Denver has secured its position as the hottest housing market in the nation, a title bestowed by the U.S. News and World Report. The analysis, based on the U.S. News Housing Market Index, meticulously examines various factors shaping the real estate landscape.

The Denver-Aurora-Lakewood Metropolitan Statistical Area (MSA) emerges as the frontrunner with a remarkable score of 74.8. This reflects a notable 7-point increase compared to the previous year, underlining the city's sustained growth and attractiveness in the real estate sector.

The report identifies several factors contributing to Denver's red-hot housing market. Noteworthy among them is the region's commendably low unemployment rate, minimal mortgage delinquencies, and a low rental vacancy rate. However, a significant challenge surfaces in the form of an insufficient housing supply, acting as a counterforce to the surging demand.

The housing market index takes into account critical metrics, including supply and demand. Denver faces a glaring issue with the supply of homes struggling to meet the burgeoning demand. This is measured by the number of months it would take to exhaust all existing listings. As of December 2023, Denver's housing supply could last only 1.9 months, trailing behind the national average of 2.6 months.

Despite the high demand, Denver experiences a nuanced scenario in its median sales prices. After reaching a peak of $595,000 in June, the median price sees a decline, settling at $550,000 by the year-end. However, this dip is marginal, marking only a 0.2% year-over-year decrease. In contrast, the national median sales price witnesses a 4.0% year-over-year increase, emphasizing Denver's premium standing with a median price approximately 36% higher than the national average.

As Denver grapples with the delicate balance between demand and supply, it is likely that prices will maintain their elevated status both locally and nationally until a substantial increase in supply becomes available for sale. The city's housing market journey remains a captivating tale, marked by challenges and successes that resonate on a broader real estate landscape.

Colorado shines on the national housing stage, with three additional cities making their mark in the top 20. Fort Collins claims the 12th spot, followed by Greeley at 15th, and Colorado Springs securing the 19th position. This collective success positions Colorado as a real estate powerhouse.

Denver Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In February 2024, the 11-county Denver Metro housing market displayed early signs of activity in the buying and selling season. According to the data by REcolorado, there's a palpable sense of optimism among households, driven by the anticipation of potential decreases in mortgage rates. This optimism has spurred an increase in inventory levels, which were 25% higher than the previous year and a remarkable 176% higher than two years ago. Sellers have been actively contributing to this trend by bringing more listings to the market.

February witnessed double-digit growth in the number of new listings for the second consecutive month, with 4,267 homes hitting the market. Additionally, both year-to-year and month-to-month increases were observed in home closings, with strong demand pushing closing prices up. The median closed price for homes in February stood at $575,000, marking a 3% increase compared to the same time last year.

How Competitive is the Denver Housing Market?

Home shoppers were particularly active during February, executing contracts on 3,454 home listings. The number of pending sale listings in February was slightly higher than the previous year, indicating sustained interest from buyers. These homes remained actively available in the market for an average of 25 days, reflecting a slight decrease compared to the previous year.

In terms of rental properties, February saw a 16% increase in leased properties compared to February 2023. Although the median leased price experienced a slight decrease compared to the previous year, single-family homes commanded the highest median leased price at $3,000 per month.

Are There Enough Homes for Sale to Meet Buyer Demand?

The Denver Metro market experienced a surge in fresh listings, with sellers bringing 4,258 new listings to the market in February. This represents a notable 21% increase compared to the previous year. The market also witnessed a second consecutive jump in new listings, which were up by 25% from January and a significant 145% increase from the beginning of the year.

Despite this increase in listings, buyer demand remained robust. Throughout the month, buyers executed contracts on 3,451 home listings. The number of pending sale listings was slightly higher than the previous year and 11% higher than the previous month.

What is the Future Market Outlook for Denver?

Looking ahead, the future market outlook appears promising, albeit with certain considerations. The price range that saw the most activity in February was $500,000 to $600,000, indicating a strong market presence within this range. Additionally, standing inventory, or the number of listings actively available for sale at the end of the month, was 25% higher than the previous February, with 5,218 homes actively available for sale in the Denver Metro area.

The gross sales volume in February also experienced a healthy increase of 10.5% compared to the same period last year, further underlining the market's resilience and potential for growth.

Is It a Buyer's or Seller's Housing Market?

Considering the current state of the Denver housing market, it's fair to say that it leans towards being a seller's market. With inventory levels on the rise but still unable to fully meet the robust demand from buyers, sellers continue to enjoy favorable conditions. However, buyers are also active in the market, capitalizing on opportunities and driving competition. As mortgage rates potentially decrease, this dynamic could further influence the balance between buyers and sellers in the coming months.

Denver Rental Market Insights for February 2024

In February 2024, the rental market in the Denver area witnessed notable activity and trends. Here are the key statistics and insights:

– Leased Properties: A total of 305 properties were leased using the REcolorado MLS platform, representing a significant increase of 16% compared to February 2023. This uptick in leased properties indicates sustained demand for rental housing in the region.

– Median Leased Price: Despite the increase in leased properties, the median leased price experienced a slight decrease compared to the previous year. However, it's worth noting that the median leased price per square foot actually saw a 3% increase, suggesting that while overall prices may have dipped slightly, there may have been a shift towards smaller, more cost-effective rental units.

– Single-Family Homes: Single-family homes continued to command the highest leased prices in February, with a median monthly rent of $3,000. This indicates that demand for standalone rental properties remains strong, likely driven by factors such as space requirements and lifestyle preferences.

– New Rental Listings: Throughout February, 326 new rental listings were added to the REcolorado MLS platform, indicating ongoing activity in the rental market and a willingness among landlords to bring their properties to market to capitalize on demand.

– Active Rental Properties: At the close of February, there were 553 active rental properties listed on the REcolorado MLS platform. This inventory of available rental units provides options for prospective tenants and contributes to the overall vibrancy of the rental market.

Overall, the rental market in the Denver area demonstrated resilience and activity in February 2024, with increased leasing activity, a diverse range of rental properties available, and a continued preference for single-family homes among renters.

ALSO READ: Colorado housing market forecast & trends

Denver Housing Market Forecast 2024 and 2025

What are the Denver real estate market predictions for the next twelve months? Denver has a track record of being one of the best long-term real estate investments in the U.S. Denver's strong economy gives buyers the ability to spend more on housing, consequently increasing real estate prices. Home values have risen so much over the past six or seven years that affordability has become an issue for a person earning the median income in this area.

According to Zillow, the average home value in the Denver-Aurora-Lakewood Metropolitan Statistical Area (MSA) stands at $581,367, reflecting a modest 1.2% increase over the past year. Homes in this region typically go pending within an average of 21 days.

Market Forecast

The one-year market forecast, as of February 28, 2024, indicates a slight -0.3% change. While this forecast hints at stability, it's essential to examine additional metrics to gauge the overall market health.

Key Metrics Defined

- For Sale Inventory: As of February 29, 2024, Denver boasts 6,862 properties listed for sale.

- New Listings: In February 2024, 2,381 new listings entered the market, contributing to inventory diversity.

- Median Sale to List Ratio: This ratio, recorded as 0.995 in January 2024, indicates a balance between listing prices and actual sale prices.

- Median Sale Price: As of January 2024, the median sale price in Denver stood at $539,000.

- Median List Price: The median list price for homes in Denver, reported on February 29, 2024, is $590,000.

- Percent of Sales Over/Under List Price: In January 2024, 23.2% of sales were recorded above list price, while 52.7% were below list price, highlighting the variance in pricing dynamics.

The Denver-Aurora-Lakewood MSA encompasses several counties, including Denver County, Arapahoe County, and Jefferson County, among others. With its diverse urban and suburban landscapes, the housing market caters to a wide range of preferences and needs.

Are Home Prices Dropping in Denver?

While the housing market in Denver has shown resilience with a modest 1.2% increase in average home values over the past year, there is no indication of a significant drop in prices. However, market conditions can evolve rapidly, influenced by various economic and societal factors. Continuous monitoring of key metrics and trends is essential to stay informed about any shifts in pricing dynamics.

Will the Denver Housing Market Crash?

Predicting a housing market crash with absolute certainty is challenging due to the multitude of factors influencing market behavior. While Denver's housing market has demonstrated stability with a forecasted -0.3% change over the next year (as of February 28, 2024), it's crucial to remain vigilant and consider potential risk factors such as economic downturns, interest rate fluctuations, and geopolitical events. Employing sound financial practices and consulting with real estate professionals can help mitigate risks and navigate market uncertainties.

Is Now a Good Time to Buy a House in Denver?

Deciding whether it's an opportune time to purchase a home depends on individual circumstances, financial readiness, and long-term goals. Despite competitive pricing and seller-friendly conditions in Denver's housing market, favorable mortgage rates and a diverse inventory may present favorable opportunities for buyers. Conducting thorough research, assessing personal financial capabilities, and consulting with real estate experts can help determine whether now is the right time to embark on homeownership.

Is Denver a Good Place to Invest in Real Estate?

Should you consider Denver real estate investment? You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers. Denver is ranked as the country's 16th-most walkable city, with 600,158 residents. It has some public transportation and is very bikeable. Downtown is the most walkable neighborhood in Denver with a Walk Score of 93.

As per Neigborhoodscout.com, a real estate data provider, one and two-bedroom single-family detached are the most common housing units in Denver. Other types of housing that are prevalent in Denver include large apartment complexes, duplexes, rowhouses, and homes converted to apartments. Single-family homes account for about 40-45% of Denver's housing units.

Denver ranked 13th for overall real estate investment and development, according to some 3,000 industry professionals surveyed and interviewed by the Urban Land Institute and PwC. Survey respondents viewed Denver's housing market even more favorably, collectively ranking it ninth overall.

Of greater importance to real estate investors in Denver is that the area is growing in population. The jobs are increasing and so are the number of renters. It is the largest and capital city of Colorado, home to roughly 700,000 people. The Denver metropolitan area is home to around 2.7 million people. The population has increased by 1.33% since 2019. The Denver-Aurora, Colorado statistical area is home to about three and a half million people.

It has a low unemployment rate of 3% unchanged from 3.30 last month and down from 6.70% one year ago, according to the U.S. Bureau of Labor Statistics. A third of the population of the Denver metro area rents. All these are excellent signs of investors looking to buy a rental property in Denver. Despite the recent cooling off, there are several reasons to consider a long-term investment in the Denver real estate market.

Shortage of housing for a growing population, a strong economy & increasing jobs have been fueling the demand in the Denver housing market for the past many years. Denver is a key trade point for the country, and home to several large corporations in the central United States. It was named 6th on Forbes Magazine’s “Best Places for Business and Careers.” Denver South is home to 7 Fortune 500 companies. It is also home to mining and energy companies such as Halliburton, Smith International, Newmont Mining, and Noble Energy.

Let’s take a look at the number of positive things going on in the Denver real estate market which can help investors who are keen to buy an investment property in this city. We’ll address the biggest factor pulling people to the Denver housing market next.

Is Denver a Good Market For Rental Property Investment?

A third of the Denver metro area rents. Since housing inventory is scarce, prices are going up much faster than wages, and the younger population is more comfortable renting than owning, the Denver housing market is seeing a rapid rise in its rental market. The sheer demand for housing stock is making it profitable to break up large homes into multiple apartments.

Denver remains more expensive than other Colorado cities, including Fort Collins and Colorado Springs, and other major metro areas such as Phoenix and Charlotte, but considerably below California-based rent leaders and more. If Forbes could recommend this as a Denver real estate market investment strategy in 2016, it can be seriously considered today.

They said that any single-family home in the Denver housing market could be considered a good rental property due to the rapid rise in home prices. Denver Has A Large Student Population For Rental Homes. The college market presents a unique opportunity for landlords. There is a constant stream of people who will only rent unless they choose to stay after graduation. They may rent a while longer before feeling secure enough to buy a house.

Buying investment real estate in a college town is high risk. After all, when a college like Evergreen State scares off students or simply fails to attract them like many classics, private liberal arts schools that found themselves rendered redundant after brand-name schools opened their doors, there’s less demand for the rental of the house as a permanent residence.

You don’t have that problem in Denver since there are so many colleges in the Denver area. Schools range from the massive community college network to the 400-student Bel-Rea Institute of Animal Technology. American Sentinel University in Aurora is home to 2600 students, while the Metropolitan State College of Denver has more than 20,000 students.

The Colorado School of Healing Arts has only 100 students, while Colorado Christian University has more than 7000. Yes, the Denver real estate market for those who want to cater to students is diverse. You could invest in rental real estate near any of these colleges, knowing you could rent or sell to people that simply want to live in the area if student demand slacks off.

Denver Rent Prices Are Going Up

Dense urban areas are seeing weaker rental prices and drops in average rents, while some suburban sunbelt areas project small increases in rents. The main reason is working people relocating to less expensive and less dense areas.

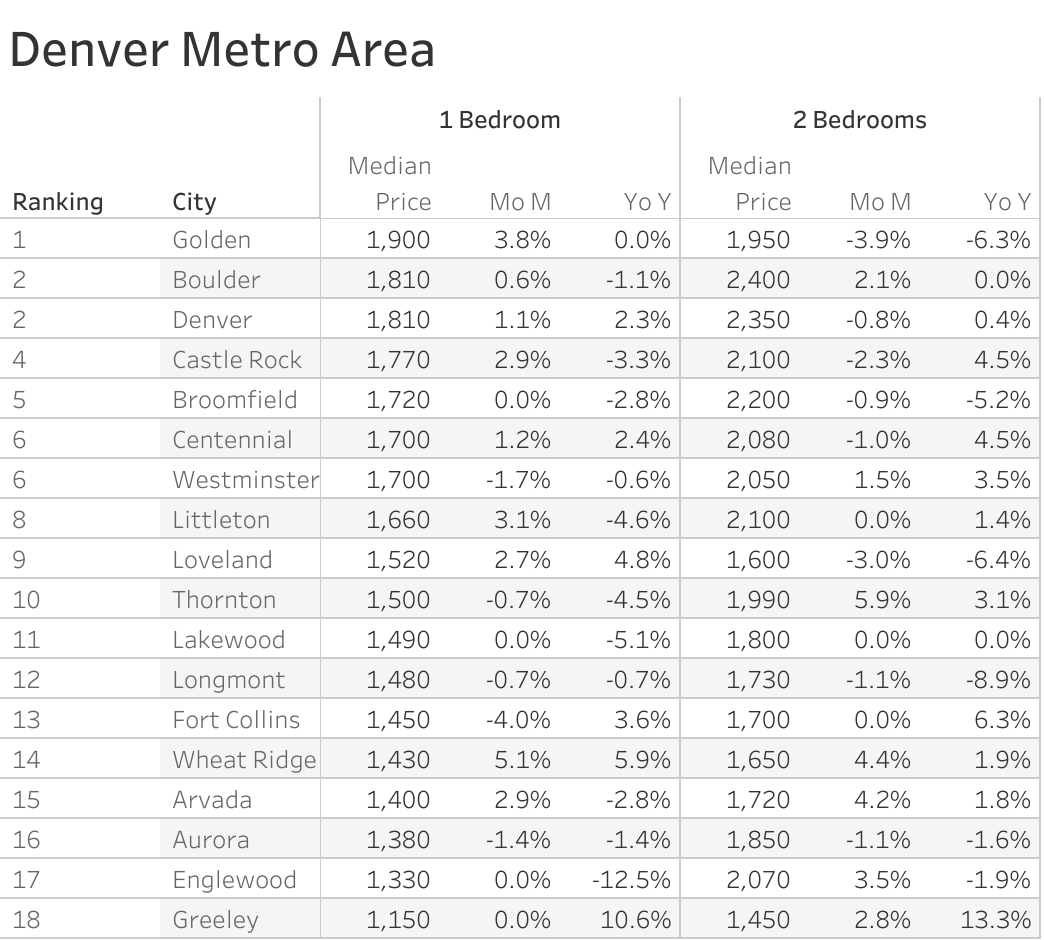

The “Zumper Denver Metro Area Report” analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Colorado one bedroom median rent was $1,502 last month. Golden was the most expensive city with rent priced at $1,900 whereas Greeley was the most affordable city with one bedrooms priced at $1,150.

These cities look good for rental property investment this year as rents are growing over there.

The Fastest Growing Cities For Rents in the Denver Metro Area (Y/Y%)

- Greeley had the fastest growing rent, up 10.6% since this time last year.

- Wheat Ridge saw rent climb 5.9%, making it second.

- Loveland ranked as third with rent increasing 4.8%.

The Fastest Growing Cities For Rents in the Denver Metro Area (M/M%)

- Wheat Ridge had the largest monthly growth rate, up 5.1%.

- Golden rent climbed 3.8% last month, making it the second fastest growing.

- Littleton was third with rent increasing 3.1%.

Denver Is Relatively Landlord-Friendly

Colorado is relatively landlord-friendly; compare it to the West coast, and it is a landlord’s dream. You don’t have to give tenants notice that you’re entering a property. You can quickly begin evictions if they haven’t paid the rent. That protects your investment in the Denver housing market. There’s no limit on late fees.

There are no state laws that prevent you from rekeying the locks after evicting them. If they violate the lease, give them formal notice. The tenants then have 72 hours to correct the issue or move out. If they don’t comply with notices, then you can go to court. If the court agrees with you, the sheriff gives the tenants 48 hours to move out before forcing them out.

Denver's Limited Room to Grow Keeps Housing Supply Tight

Many of the fastest-growing markets in the US are along the Front Range, a part of the Southern Rocky Mountains. While there are houses in the hills, it is a lot harder to build on the mountainous landscape than on flat plains. In Denver’s case, the massive national forests and Rocky Mountain Park to the west of Denver and its suburbs prevent the expansion of the Denver housing market in that direction. This keeps home prices higher than they’d be in places like Dallas.

The residential median home price in Denver hovers around $530K. That’s a steal for the migrants from California, but the sheer numbers of them coming in is pricing locals out of the housing market. The median monthly rent here – and that includes one-bedroom apartments – is around $1100 a month. Note that you could get much more for a spacious single-family home for rent or a large condo. With a 3 bedroom detached single-family home, you could receive well over $2000 per month in rent. You’ll find strong ROI numbers for the Denver real estate market.

Denver's Quality of Life

We can joke about the people who moved to Colorado decades ago, inspired by the movie “Rocky Mountain High”. We’re not going to joke about the overhyped medical marijuana industry there today. U.S. News & World Report published its list of the “150 Best Places to Live in the U.S.,” and four of the top five cities are right here in Colorado: Boulder (1), Denver (2), Colorado Springs (4), and Fort Collins (5). Denver was the second-best city to live on that list.

The area was a little lower in value than many like, but it ranked high on jobs, quality of life, and desirability. It is a beautiful city to live near the mountains – located on the western edge of the exquisitely beautiful High Plains. It is exactly one mile high above sea level and has the largest city park system in the nation, with 14,000 acres of mountain parks and 2,500 acres of natural areas.

That isn’t enough on its own to draw huge numbers of people to the Denver real estate market, but it is a factor. It has become the 19th most populous city in the nation. The metro area population of Denver (as of 2020) is 2,827,000, a 1.33% increase from 2019 (Macrotrends.net).

Denver was ranked as a Beta world city by the Globalization and World Cities Research Network. It has been one of the fastest-growing major cities in the United States, and real estate investments provide a direct way to participate in the strong growth of these economies. The strength of the overall economy significantly impacts the real estate market.

Denver's Strong Economy & Jobs Boost Its Housing Market

Job growth directly affects the real estate market. Demand for all types of real estate increases with the number of local jobs, as during periods of economic development or boom. Jobs are a major reason why people move to Denver in the first place. Denver’s unemployment rate has been well below the national average for years.

The BLS reported that the unemployment rate for Denver rose 0.1 percentage points in September 2022 to 3.3%. For the same month, the metro unemployment rate was 0.1 percentage points lower than the Colorado rate. The unemployment rate in Denver peaked in May 2020 at 12.6% and is now 9.3 percentage points lower. From a post-peak low of 3.2% in August 2022, the unemployment rate has now grown by 0.1 percentage points

Forbes ranked Denver as the number one Best Place for Business and Careers in 2015. Additionally, the magazine placed Denver 16th for employment growth and 20th for education. When one considers the huge oil and government sectors, as well as the rapidly expanding aerospace and technology businesses, it's no surprise that Denver is seeing such a big job boom.

The National Renewable Energy Laboratory contracts for research and development while companies such as Halliburton profit from a profitable oil play. Aerospace and technology positions are available at Ball Aerospace, Raytheon, and Lockheed-Martin, whilst software engineers are in demand at Rocket Software, StorageTek, and Sun Microsystems.

That explains why Denver is one of the top cities for in-migration, attracting people from all over the state as well as the country. Due to its proximity to the mineral-rich Rocky Mountains, Denver has long been a home for mining and energy companies such as Halliburton, Smith International, Newmont Mining, and Noble Energy. The top 25 employers in Metro Denver include government and municipal organizations, and corporations.

Denver Technological Center, better known as The Denver Tech Center or DTC, is a business and economic trading center located in Colorado in the southeastern portion of the Denver Metropolitan Area, within portions of the cities of Denver and Greenwood Village. It is home to several major businesses and corporations.

The U.S. Government is the largest employer in Metro Denver. The Department of the Interior includes such agencies as the Bureau of Land Management, Office of Surface Mining and Reclamation, and Bureau of Reclamation, and all have offices in or near the Denver Metro area. Another top employer in the Denver Metro Area is the State of Colorado.

It employs nearly 30,000 people in the Denver Metro area. As the capital and largest city in the state, Denver hosts the State of Colorado in multiple locations. Centura Health is one of the top 25 employers in the metro Denver area. Its massive healthcare network includes 15 hospitals, eight affiliate hospitals, health neighborhoods, health at home, urgent care centers, emergency centers, mountain clinics, 100-plus physician practices, clinics, and Flight for Life Colorado.

Denver is well known for its proximity to the Rockies. Other attractions in the area include but are not limited to the Denver Zoo and the Denver Botanic Gardens. Many of those 30 million tourists would love to have rented a house or apartment for their visit instead of a hotel. Then there’s the business traveler. Denver hosts around 80 conventions a year, too.

Whether someone is staying for a week for a convention or working a contract job in the tourism industry, this drives demand for short-term rentals that can be incredibly profitable. Renting on sites like Airbnb is legal if you have a business license, though around half of the Airbnb rentals are thought to be violating that rule. Denver is particularly progressive in allowing people to rent out their homes and apartments on Airbnb, though landlords may not agree with it.

Known Areas of Redevelopment

You don’t want to invest in the Denver housing market and end up losing money because the neighborhood is going downhill. Conversely, areas slated for redevelopment will almost certainly go up. And Denver has known and planned for areas of redevelopment. Downtown Denver saw multiple infill projects downtown ten years ago. Redevelopment is planned around Elitch Gardens today.

Key trade point for the country – Denver is home to several large corporations in the central United States. Denver South is home to 7 Fortune 500 companies. Denver was named 6th on Forbes Magazine’s “Best Places for Business and Careers.” Home for mining and energy companies such as Halliburton, Smith International, Newmont Mining, and Noble Energy.

Denver's Demographic Momentum

At first glance, the average age of 36 for residents versus 40 for the national average doesn’t sound too promising. However, this long-established city has already been noted as a great place to retire. That pulls the average age up. The coolness factor and job market attract equal numbers of young adults. That is why Millennials make up about 22% of Denver’s population. And given the job market and quality of life, they’ll probably stay here to raise families, generating more demand for the Denver housing market.

Generation X made that decision, too, which is why roughly a quarter of residents are under the age of 20. Additions to the local labor force tend to drive rents and prices up on properties in the vicinity and result in the local construction of homes and apartments. That will propel the Denver real estate market for decades to come.

Denver Colorado Real Estate Investment Markets

Investing in Denver's real estate can be a worthy investment due to a steady rate of appreciation. There are many reasons why the Denver real estate market is going strong today and is certain to remain strong for years to come. You cannot afford to miss out on this growing and appreciating real estate market. Good cash flow from Denver investment properties means the investment is, needless to say, profitable.

On the other hand, a bad cash flow means you won’t have money on hand to repay your debt. Therefore, finding a good Denver real estate investment opportunity would be key to your success. Even as Denver home prices have reached new heights, the market remains attractive to residential real estate investors in the $300,000 to $399,000 price range. As they continue to compete for potential investment properties at the lower end of the market, the challenges for first-time homebuyers will remain.

The homebuyers won’t be able to outbid real estate investors and would end up renting. The high prices combined with the lack of higher gains have slowed down fixing and flipping investment properties in Denver. The best investment is now looking for a rental property that will generate good cash flow. Your best tenants would be the retirees who intend to relocate to Denver and want to purchase property to rent out. The three most important factors when buying real estate anywhere are location, location, and location.

The location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Denver investment property and you should be able to flip it for a lump sum profit. The neighborhoods in Denver must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls.

Some of the popular neighborhoods for buying a house or an investment property in Denver are Jefferson Park, Berkeley, Park Hill, Cheesman Park, Congress Park, Hilltop, Sunnyside, Capitol Hill, Highland, Platte Park, Stapleton, Reunion, Cherry Creek, Aspen, and Washington Park.

Denver housing prices are not only among the most expensive in Colorado but they are also some of the most expensive in all of the United States. It depends on how much you are looking to spend and if you are wanting smaller investment properties or larger deals such as duplex and triplex in Class A neighborhoods. As with any real estate purchase, act wisely. Evaluate the specifics of the Denver housing market at the time you intend to purchase. Hiring a local property management company can help in finding tenants for your investment property in Denver.

The inventory is low, but opportunities are there. According to Realtor.com, there are 69 neighborhoods in Denver, where properties are available for sale. If you think of investing in Denver, you have decided on a long-term investment property. Here are the ten neighborhoods in Denver having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Victory Crossing

- Stapleton

- Stapleton South

- Stapleton East

- Stapleton North

- Stapleton Southeast

- CBD

- Ballpark

- City Center

- W 14th Ave / Quitman St

REFERENCES

- https://www.recolorado.com

- https://www.dmarealtors.com

- https://www.zillow.com/denver-co/home-values

- https://www.zumper.com/blog/denver-metro-report/

- https://realestate.usnews.com/places/colorado/denver

- https://denverrelocationguide.com/largest-employers-in-denver

- http://www.landlordstation.com/blog/top-landlord-friendly-states

- https://www.avail.co/education/laws/colorado-landlord-tenant-law

- https://crej.com/news/airbnb-31-billion-gorilla-room

- https://denverinfill.com/home-old.htm

- https://businessden.com/2018/08/27/50-of-airbnb-landlords-ignore-denver-rules-taxes-in-booming-100m-industry

- https://www.collegesimply.com/colleges-near/colorado/denver