Are you trying to buy a home in Denver? Well, here's some good news! The Denver housing market cools, and it's actually leading the nation in price reductions. That’s right, Denver tops the list with the highest percentage of homes having their price slashed in June. This shift signals a significant change, giving buyers more leverage and a chance to breathe after years of intense competition. Let’s dive into what's behind this trend and what it means for you.

Denver Housing Market Cools: Leads the Nation in Price Reductions

What's Happening in Denver?

For the past few years, Denver has been a seller's paradise. Homes were selling above asking price, bidding wars were common, and inventory was incredibly tight. But now, things are changing. According to recent data, Denver leads the nation with a whopping 38.3% of active listings having undergone a price reduction in June.

Why is this happening?

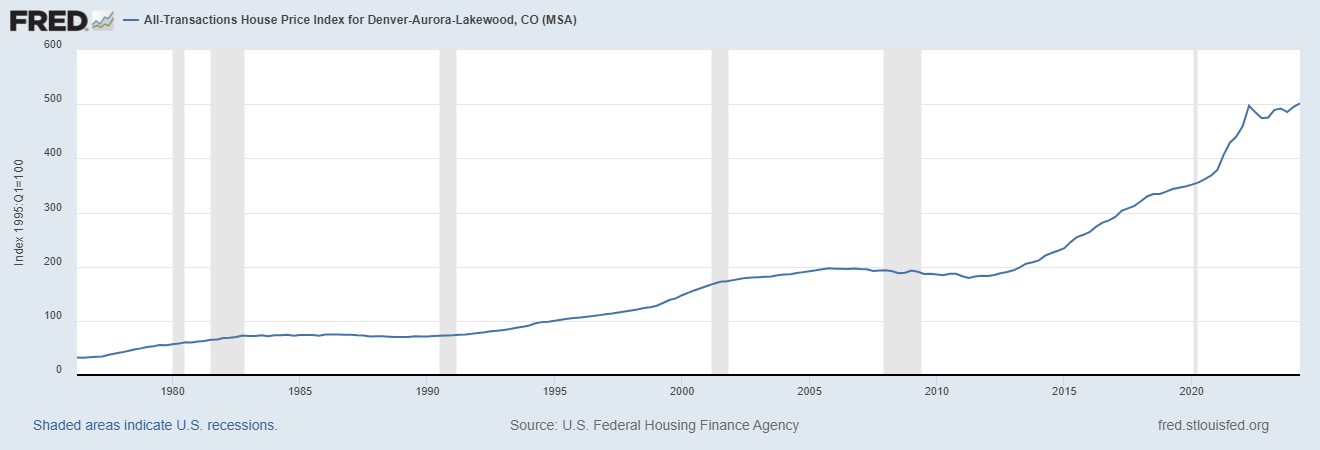

- Affordability Ceiling: Let's be real, housing prices in Denver skyrocketed during the pandemic. While Denver has always been an expensive real estate market, salaries have had a hard time keeping up, pushing many potential buyers to their limit. As mortgage rates rise, it makes it even harder for people to afford homes, leading to less demand. I think many people are now realizing they are priced out of the market.

- Slowing Population Growth: Denver saw a huge influx of people over the past decade, especially during the pandemic as remote work became more common. However, that rapid growth is slowing down. With fewer people moving in, the demand for housing decreases.

- Increased Inventory: Compared to the pre-pandemic days, Denver has more homes available on the market. More homes on the market mean more choices for buyers, and sellers need to be more competitive to attract attention. I've seen it firsthand; homes are sitting on the market longer than they used to!

Other Cities Seeing Price Cuts

Denver isn't alone. According to Zillow's data, other cities that experienced massive growth during the pandemic are also seeing a rise in price reductions. Places like:

- Raleigh (36.4%)

- Dallas (35.5%)

- Nashville (35.5%)

- Phoenix (35.5%)

These “boomtowns” are now rebalancing as the initial surge of new residents slows down and affordability becomes a bigger issue.

A National Trend?

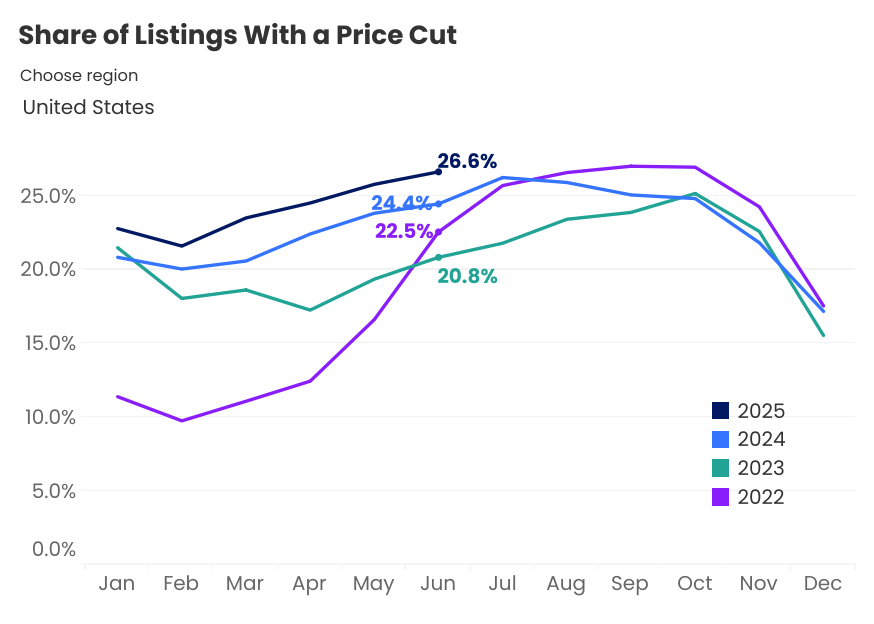

Absolutely! Nationally, over one in four listings saw a price cut in June, hitting 26.6%. Looking at the graph, we can see that the trend of price cuts is on the rise. That’s the highest ever for June in Zillow data.

Here's a little summary of data:

National Trend In price Cuts

| Month | Percentage of listings |

|---|---|

| June, latest reporting | 26.6% |

Cities Seeing Biggest Jumps in Price Cuts (May to June)

Some cities are seeing a rapid increase in the number of price cuts. Here's a list:

- Kansas City (+5 percentage points)

- Buffalo (+3.9 pts)

- Indianapolis (+3.8 pts)

- Columbus (+3.3 pts)

- Minneapolis (+3.2 pts)

This rapid increase often suggests a rapidly cooling market.

Who Still Has the Upper Hand?

Of course, not every market is experiencing the same trend. According to the data I see, there are still some areas where sellers are in control due to tight inventory:

- Milwaukee (13.9% of listings with a price cut)

- New York (15.6%)

- Hartford (16.0%)

- Buffalo (18.3%)

- San Jose (22.1%)

What This Means for Buyers

So, what does all this mean if you're looking to buy a home? Here’s my take:

- More Negotiating Power: Gone are the days of automatically offering over asking price. You might actually be able to negotiate with sellers and get a better deal.

- Fewer Bidding Wars: With fewer buyers competing for each home, you're less likely to get caught up in crazy bidding wars. Thank goodness!

- More Time to Decide: You won't feel as rushed to make a decision. You can take your time to inspect homes and consider your options.

- Potential for Seller Concessions: In some markets, you might even be able to ask sellers to cover some of your closing costs or offer other incentives. This is definitely something to discuss with your realtor.

Tips for Buyers in a Cooling Market

Here's my advice as a real estate professional:

- Get Pre-Approved: Knowing your budget and getting pre-approved for a mortgage puts you in a stronger position when you do find the right home.

- Work with a Good Real Estate Agent: A local agent can offer valuable insights into the market and help you negotiate effectively. I can help you find one.

- Do Your Research: Don't just jump at the first home you see. Take your time to research different neighborhoods and find a place that fits your needs and budget.

- Don't Be Afraid to Make an Offer: With prices coming down, now is the time to make a reasonable offer on a home you love.

What This Means for Sellers

For sellers, however, the times are changing a little bit:

- Pricing is Key: You can't just throw a high price on your home and expect it to sell quickly. You need to price it competitively based on comparable sales in your area.

- Presentation Matters: Make sure your home is in top condition before you list it. Clean, declutter, and make any necessary repairs.

- Marketing is Important: Work with your agent to create a strong marketing plan that will attract potential buyers to your home. I believe that having a good plan is critical.

- Be Open to Negotiation: Be prepared to negotiate with buyers. You might not get the full asking price, but you can still get a fair price for your home.

My Prediction

I think we'll see more price cuts in the months ahead. While mortgage rates and home prices aren't expected to drastically improve, the market will continue to rebalance, giving buyers more opportunities.

The Bottom Line: The Denver housing market cools, offering a much-needed break for buyers. While it's not a fire sale just yet, the shift in the market is undeniable. If you're a buyer, now is the time to get prepared and start your search. If you're a seller, adjust your expectations and be ready to compete. The market is changing, and those who adapt will be the most successful.

Invest in Real Estate in the Top U.S. Markets in 2025

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Denver Housing Market: Trends and Forecast 2025-2026

- Denver Housing Market Trends: Sellers Still Have the Upper Hand

- Denver Housing Market Heats Up Again: Can You Afford?

- Where to Buy Denver Investment Properties in 2025?

- Colorado housing market forecast & trends

- Is Buying a House in Denver a Wise Investment

- Buying a House in Denver in 2025: Comprehensive Guide