Entering 2026, the big question on everyone’s mind when it comes to real estate is whether we’re headed for a dramatic upturn, a sharp downturn, or something in between. Based on the latest expert analyses, I can tell you right now: the real estate market in 2026 is not likely to boom or crash. Instead, we're looking at a period of modest stability and gradual recovery, with home prices expected to inch up slightly. This isn't the stuff of sensational headlines, but for anyone involved in buying, selling, or investing, understanding this nuanced outlook is crucial.

Will Real Estate Crash or Rebound in 2026?

My Take on the Market's Path to 2026

From where I sit, having followed real estate trends and spoken with industry professionals for years, the current situation feels like a deep breath before a measured exhale. The wild swings we saw during the pandemic – the frantic bidding wars, the unprecedented price hikes – have subsided. Now, as we move closer to 2026, the market is finding its footing, influenced by a complex mix of economic forces and demographic shifts. It's not a red alert for a crash, nor is it a green light for unchecked booming prices. It's more like Goldilocks for real estate: just right, for now.

Looking Back: What Got Us Here? Lessons from Recent Cycles

To truly grasp where we're going, we need to look at where we've been. The housing market has been on a rollercoaster. Remember the early 2020s? Fueled by super-low interest rates and the shift to remote work, home prices shot up. It felt like a gold rush, with national prices climbing over 40% in just a couple of years.

Then, reality hit. To fight inflation, the Federal Reserve started raising interest rates. Suddenly, those comfy 3% mortgages became a distant memory, and buying a home became much harder. Many homeowners who had locked in low rates found themselves “locked in” too, unwilling to sell their current homes and buy new ones at much higher rates. This created a bit of a standstill, leaving the market feeling “stuck.”

As of late 2025, this “stuck” feeling is still present. Mortgage rates are hovering around 6.5% to 6.7%, which is a lot higher than many people are used to. This, combined with affordability issues, has put a damper on sales. Home prices have been pretty flat, maybe creeping up a little year-over-year. Inventory – the number of homes available for sale – is still on the low side, with a shortage of about 4.5 million homes nationwide. However, builders are picking up the pace, adding new homes. This sets the stage for 2026, where experts believe a thaw is coming, mainly due to interest rates starting to ease.

Crucially, unlike the 2008 crisis, today's market is on much firmer ground. Lending standards are stricter, and there aren't as many people about to lose their homes. This makes a widespread crash significantly less likely.

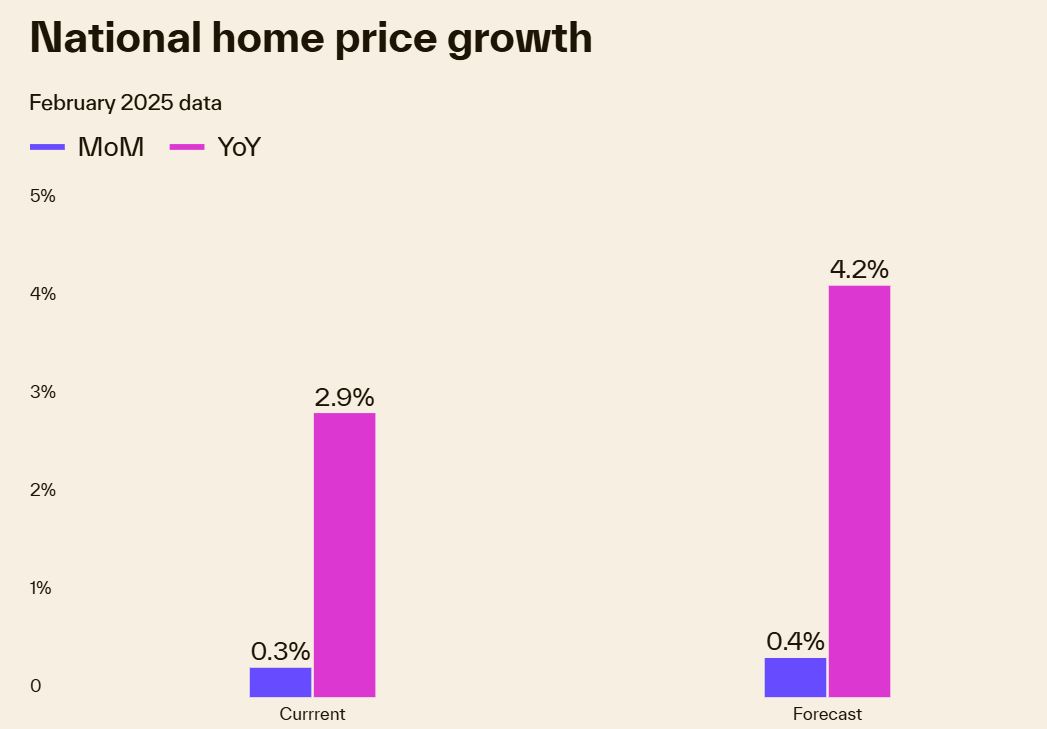

Home Price Predictions: A Gentle Rise, Not a Wild Ride

So, what about home prices in 2026? The national outlook points to modest growth, not a boom or a bust. Zillow, a major player in real estate data, predicts home values nationally will increase by a rather small 0.4% from mid-2025 to mid-2026. This is a slight upgrade from some earlier, more cautious predictions, but it still signals that prices aren't going to skyrocket. Fannie Mae, another respected institution, is a bit more optimistic, forecasting around 3.6% growth. The National Association of Realtors (NAR) also expects a bump, with median prices hitting about $420,000, a 2% increase.

These numbers suggest that as interest rates come down, more buyers will be able to afford homes, which will nudge prices up. However, the ongoing shortage of homes available for sale will prevent prices from soaring.

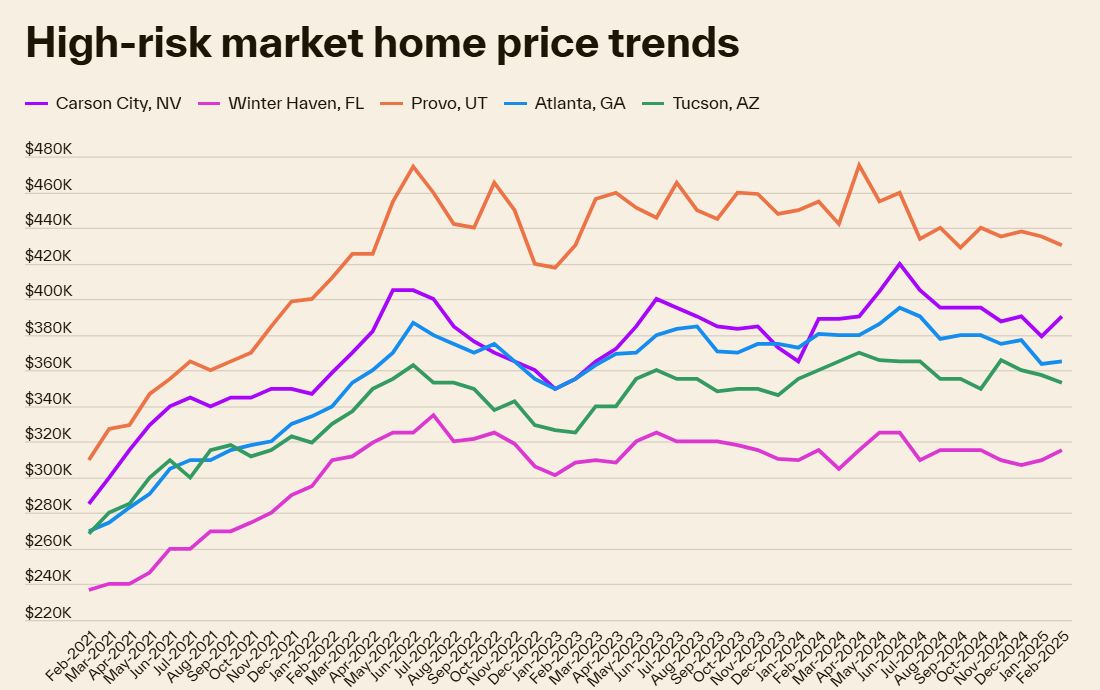

Regional Differences are Key:

It's vital to remember that real estate is local. What happens in one part of the country can be very different from another.

- Stronger Growth Areas: Markets in the Northeast and Midwest might see better price appreciation. For example, Atlantic City, New Jersey, is projected to see an increase of up to 4.3%, and Saginaw, Michigan, around 3.8%. These areas often benefit from greater affordability and job growth.

- Areas Facing Declines: On the flip side, some areas might actually see prices drop. Louisiana, for instance, faces challenges. Cities like Houma could experience declines of 5-8%, and New Orleans around 5.8%. This is often tied to local economic issues and specific supply dynamics.

- California and Florida: These typically hot markets are expected to see growth, with California’s median price climbing about 3.6% and Florida continuing its attractive growth rate of 3-5% due to population influx and investor interest.

Here’s a look at some regional forecasts from Zillow:

| Metro Area | Projected Price Change (July 2025-July 2026) |

|---|---|

| Atlantic City, NJ | +4.3% |

| Saginaw, MI | +3.8% |

| Houma, LA | -8.6% |

| New Orleans, LA | -5.8% |

(Source: Zillow via ResiClub Analytics)

Sales Volume and Inventory: A Shift Toward Balance

Get ready for more homes to be bought and sold in 2026. Experts are forecasting a noticeable increase in sales activity. NAR expects existing-home sales to jump by 11-13%, and new-home sales to rise by 5-8%. Fannie Mae also predicts an overall surge of nearly 10% if mortgage rates dip below 6%. This increase in sales is directly linked to the expected drop in interest rates.

And what about the homes available? Inventory, which has been tight for so long, might finally see some improvement. A huge demographic shift is on the horizon: Baby Boomers, many of whom own homes, are starting to think about downsizing. Experts suggest this could potentially release up to 14.6 million homes into the market by 2036, with a significant portion of that starting around 2026. This could lead to more choices for buyers and might even tip the scales towards a buyer's market by mid-2026, meaning there are more homes available than buyers, giving shoppers more negotiating power. New home construction is also expected to chip in, with around 1.05 million single-family homes being built.

Here's a quick look at sales forecasts:

| Source | Existing-Home Sales Growth (2026) | Notes |

|---|---|---|

| NAR | +11-13% | Driven by lower rates and economy |

| Fannie Mae | +10% (overall surge) | Rates below 6% key driver |

| CAR (California) | +2% (to 274,400 units) | Affordability improvement expected |

Interest Rates and Affordability: The Key to Everything

The biggest factor influencing housing in 2026 will undoubtedly be interest rates. Right now, in late 2025, they're a major hurdle. But the good news is, predictions point towards a cooling trend. Fannie Mae is forecasting that the average 30-year fixed mortgage rate could drop to around 5.9% by the end of 2026. This is a significant drop from where we are now and would make a big difference in monthly payments for buyers.

When rates go down, affordability goes up. While monthly payments might still be higher than pre-pandemic levels, the slight improvement in affordability could encourage more people to enter the market, either as buyers or by moving from renting to owning. Rents are also expected to climb, which could push more people to consider buying.

Economic and External Factors: What Else Matters?

The health of the overall economy plays a huge role in real estate. For 2026, forecasts suggest the U.S. economy will grow at a steady pace, around 2.0-2.2%. Unemployment is expected to remain relatively low, holding steady at about 4.3-4.6%. This kind of stable, if not spectacular, economic environment is generally good for the housing market. It means people have jobs and are more likely to be confident about making big purchases like a home.

However, there are a few things that could throw a wrench in the works:

- Inflation: If inflation picks up again, the Federal Reserve might have to keep interest rates higher for longer, slowing down any market recovery.

- Insurance Costs: In areas prone to climate events (like Florida and California), rising home insurance costs could cool down demand and property values.

- Global Issues: Trade tensions or other international events could increase the cost of building materials, impacting new construction.

- Stock Market Volatility: If the stock market takes a big hit, it could make people feel more cautious about their finances and less inclined to invest in real state.

Some voices express concern about the market overheating due to high valuations, reminiscent of past bubbles. But the general consensus among most experts is that the underlying economic strength makes a major crash in 2026 highly unlikely.

Here's a summary of key economic projections for 2026:

| Economic Indicator | Projection Range | Key Sources |

|---|---|---|

| GDP Growth | 2.0-2.2% | Deloitte, CBO, Univ. of Michigan |

| Unemployment Rate | 4.3-4.6% | Federal Reserve, S&P Global, Philadelphia Fed |

Risks and Opportunities: Navigating 2026

Will there be a Boom? A national housing boom seems unlikely because prices are already relatively high, and while demand is increasing, it's not at the peak levels seen during the pandemic. However, we could see localized booms in certain high-demand cities driven by job growth and limited supply.

Will there be a Crash? The risk of a widespread crash is considered low. The economy is stable, unemployment is low, and lending standards are much tighter than in the past. However, specific markets that have seen rapid price increases or face economic challenges could experience corrections – a softening or decline in prices.

Opportunities for Buyers:

- Wait for Mid-2026: If you can, waiting until mid-2026 might mean more homes to choose from as inventory rises.

- Focus on Affordability: Look at metros that offer better value and potential for growth.

- Use Tools: Utilize online tools and calculators to understand your borrowing power and potential monthly payments.

Opportunities for Sellers:

- Price Competitively: In a market balancing out, pricing your home correctly from the start is crucial.

- Emphasize Strengths: Use staging and marketing to highlight your home's best features, especially if you're in a competitive area.

- Timing: The spring market often sees higher demand, so strategic timing can pay off.

Opportunities for Investors:

- Targeted Markets: Consider areas with strong rental demand, like Florida or certain Midwest cities, for rental property yields.

- Long-Term Strategy: Focus on long-term appreciation and rental income potential, rather than quick flips.

Final Thoughts: A Balanced Outlook for 2026

In my opinion, the real estate market in 2026 is shaping up to be a much more balanced and navigable environment than we've seen in recent years. It won't be a thrilling rollercoaster of booms and crashes. Instead, expect a period of steady, modest growth as interest rates ease and more homes come onto the market.

The key for everyone involved will be staying informed, doing your homework, and understanding the specific dynamics of your local market. Keep an eye on interest rate movements and economic indicators, but don't get caught up in the hype of sensational predictions. The data points towards a more stable, predictable path forward.

Invest in Real Estate in the Top U.S. Markets

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Will Real Estate Rebound in 2025: Top Predictions by Experts

- Recession in Real Estate: Smart Ways to Profit in a Down Market

- Will There Be a Real Estate Recession in 2025: A Forecast

- Will the Housing Market Crash Due to Looming Recession in 2025?

- 4 States Facing the Major Housing Market Crash or Correction

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?