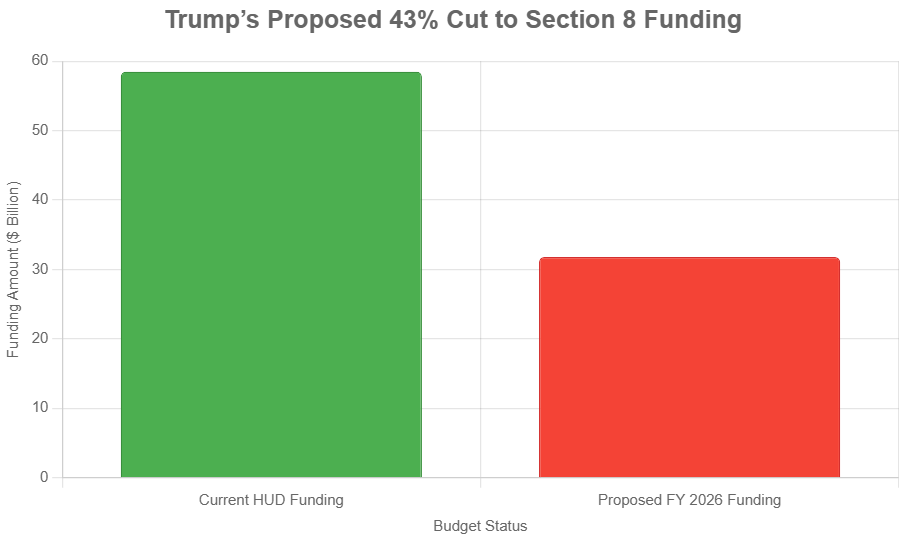

Get ready, because the numbers being tossed around for the Fiscal Year 2026 Department of Housing and Urban Development (HUD) budget are, frankly, eye-opening and a little bit scary. At a glance, we're talking about a proposed cut of around $33 billion, which is a massive 44% reduction from what we’re looking at for FY2025.

Proposed FY2026 HUD Budget Cuts Could Reduce Housing Assistance for Millions

This isn’t just trimming around the edges; it signals a potential fundamental shift in how the federal government helps people find and keep a safe place to live. For anyone who relies on or works within housing assistance programs, this is a conversation we absolutely need to have, and the initial proposals suggest a move away from our current federal “Housing First” model towards a system where states would have more control through block grants.

This isn't just about numbers on a ledger. It’s about real people, families struggling to make ends meet, seniors on fixed incomes, individuals with disabilities, and those battling homelessness. The proposed changes, if enacted as presented by some in Congress, could reshape the entire landscape of federal housing aid, and not necessarily for the better.

The Sharp End of the Stick: Rental Assistance

Perhaps the most significant and immediate impact will be felt in rental assistance programs. The proposals are looking to slash funding for these vital services by a staggering $26.7 billion. This isn't just about reducing the number of vouchers; it's about a complete overhaul. Major programs like Section 8 (the Housing Choice Voucher program), Public Housing, and assistance for the elderly (Section 202) and disabled (Section 811) could be bundled into something new: a State Rental Assistance Block Grant.

What does this mean in plain English? Well, if we look at estimates from the House version of the proposal, it could mean 181,900 fewer households getting the help they need to pay rent. The Senate’s version, while less severe, still projects 107,800 fewer households served. This is a huge number of people who could lose their housing altogether.

And it’s not just about the sheer number of people affected. The proposals suggest introducing a two-year cap on assistance for non-elderly, able-bodied adults. Right now, many people rely on this assistance long-term to stabilize their lives, find jobs, or get an education. Imagine having that lifeline cut off after just two years. It could force people back into unstable situations, making it even harder to get ahead.

For those already on waiting lists for housing assistance, this spells more bad news. With reduced funding, these lists are expected to get even longer, and it’s not out of the realm of possibility that many housing agencies could simply stop issuing new vouchers altogether. The dream of affordable housing, already a struggle for many, could become an even more distant reality.

Rethinking Homelessness Services: A Shift in Priorities?

The proposals also aim to restructure how we address homelessness. Programs like the Continuum of Care (CoC) and HOPWA (Housing Opportunities for Persons with AIDS) are being looked at to be combined into the Emergency Solutions Grants (ESG) program.

This is where things get particularly concerning for those in permanent supportive housing. The proposal includes a new cap, limiting spending on permanent housing to just 30%. Right now, programs are often spending much more on permanent housing solutions, typically averaging around 87-88%. This means a significant shift in resources, pushing more money towards shorter-term emergency shelters and transitional housing.

The warning from advocates is stark: this change could potentially force over 170,000 people currently living in permanent supportive housing back onto the streets or into crowded shelters. This feels like a step backward from a “Housing First” philosophy, which prioritizes getting people into stable housing as quickly as possible, recognizing that it’s the foundation from which they can address other challenges like employment, health, and recovery. Moving away from permanent housing solutions and towards temporary measures could create a revolving door for homelessness, rather than breaking the cycle.

Cutting the Foundations: Community Development Programs

Beyond direct rental and homelessness assistance, the proposed budget also targets essential community development programs for elimination. These aren't just abstract government programs; they are concrete tools that communities use to build and maintain affordable housing and revitalize neighborhoods.

- HOME Investment Partnerships: This has been a crucial source of funding for building new affordable housing units and preserving existing ones. Its elimination would leave a significant gap for developers and non-profits working to create more affordable options.

- Community Development Block Grants (CDBG): These grants are incredibly versatile and vital for local communities. They fund everything from fixing up public spaces and infrastructure to supporting local businesses and providing essential public services. Losing CDBG funding would mean towns and cities have less flexibility to address their unique needs, which often includes housing initiatives.

- Self-Help Homeownership (SHOP) & Native Hawaiian Housing: The proposal aims to completely zero out funding for these programs, which help specific populations achieve homeownership through dedicated support and resources.

Losing these programs means losing the tools communities need to build a stronger, more affordable future. It’s like taking away the bricks and mortar that house development.

Protecting Rights and Ensuring Compliance: Fair Housing and Staffing

The proposals also cast a shadow over our nation's commitment to fair housing. Funding for initiatives designed to combat housing discrimination would be slashed by more than half. Specifically, the Fair Housing Initiatives Program (FHIP), which plays a critical role in handling about 75% of housing discrimination complaints, is slated for complete elimination.

This is deeply troubling. FHIP funds local organizations that actively investigate discrimination and conduct testing to uncover illegal housing practices. Without them, where will people go when they face discrimination? The budget also proposes zeroing out funding for the National Fair Housing Training Academy, which provides vital education for fair housing professionals. Furthermore, the Limited English Proficiency (LEP) Initiative, ensuring equal access for those with language barriers, is also marked for elimination.

This signals a potential shift in enforcement, moving away from proactive efforts to prevent discrimination towards a more reactive approach. The Office of Fair Housing and Equal Opportunity (FHEO) itself would see significant cuts, leading to a reduction in federal staff dedicated to enforcing civil rights laws. This could mean slower investigations and less accountability for those who violate fair housing laws.

On top of all this, the proposal includes a substantial 26% reduction in HUD staff. From around 8,600 full-time employees down to approximately 6,340. This would likely slow down everything from processing applications and distributing funds to carrying out necessary inspections, impacting the overall efficiency of critical housing programs.

The Path Forward: Negotiations and Uncertainty

It’s important to remember that these are proposed budgets. The final outcome will depend on intense negotiations between the House and the Senate. As of late 2025, the House version leans towards deeper cuts, while the Senate’s approach is more moderate, suggesting an increase to keep pace with inflation rather than the deep reductions proposed elsewhere. Congress will ultimately vote on these measures.

From my perspective, these proposed cuts represent a significant threat to the progress we’ve made in addressing housing insecurity and homelessness. They seem to prioritize austerity over the fundamental human need for safe and affordable housing. While fiscal responsibility is important, especially in these economic times, gutting programs that serve our most vulnerable populations feels short-sighted and potentially more costly in the long run, both in human suffering and in increased demand on other social services.

The shift towards state-run block grants could lead to a patchwork of support across the country, with some states potentially offering more robust assistance than others, creating new inequities. The potential reversal of gains in permanent supportive housing for the homeless is particularly alarming, representing a step away from proven solutions.

I truly hope that our lawmakers will consider the real-world consequences of these proposals and seek a more balanced approach that protects and strengthens our vital housing assistance programs. Affordable housing isn't a luxury; it's a foundation for individual well-being and community stability.

Want Stronger Returns? Invest Where the Housing Market’s Growing

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Housing Market Predictions 2026: No Crash, No Boom, Just Rebalancing

- Will Real Estate Rebound in 2026: Top Predictions by Experts

- Housing Market Predictions for the Next 4 Years: 2026, 2027, 2028, 2029

- Housing Market Predictions for 2026 Show a Modest Price Rise of 1.2%

- Housing Market Predictions 2026 for Buyers, Sellers, and Renters

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025