If you're asking yourself “Is it a good time to buy a house in 2025?”, the answer, based on current trends and expert analysis, is it's complicated. While some factors are improving, hesitation among buyers and sellers remains, creating a mixed bag of opportunities and challenges. The decision to buy depends heavily on your individual circumstances and risk tolerance, but let's dive into the details so you can make an informed choice.

Is it a Good Time to Buy a House in 2025: 73% Say Don’t Buy Yet

First off I want to say that real estate is a very intimate decision, both financially and personally. I have bought and sold properties over the years so I can understand both sides of this.

Decoding the 2025 Housing Market: A Deep Dive

Let's unpack what's influencing the housing market as we head into 2025. Despite some positive movement in certain areas, the overall picture is still a bit fuzzy.

- Mortgage Rate Volatility: Mortgage rates are always a hot topic because they have a big impact on payments. Following a long hiatus, the Federal Reserve slightly cut policy rates in December 2024, and by September 2025 mortgage rates edged towards the lower 6% range. However, consumers still see mortgage rates going up rather than down, and this has been affecting buying decisions.

- Home Prices: Still Climbing, but Slower? The expectation is that prices continue to rise this year, but potentially at a slower pace than we’ve seen in the recent past. On average survey participants expect about 1.8% price appreciation vs close to 6% rental appreciation.

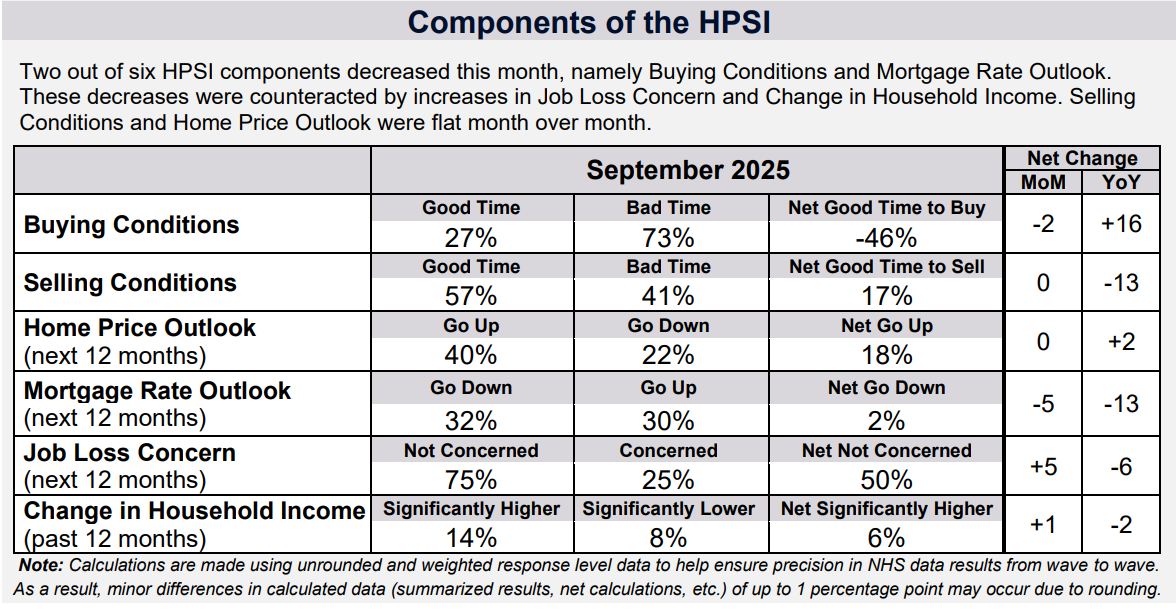

- Buyer Sentiment: A Mixed Bag The Fannie Mae Home Purchase Sentiment Index (HPSI) is essentially flat. This means people's feelings about buying a home haven't really changed much. People feel better about keeping their jobs and the income side of the equation, but are still hesitant to take the plunge. According to the most recent data, only 27% think it's a good time to buy, while a whopping 73% think it's a bad time. This difference could be attributed to the interest rate environment.

- Seller Hesitation: The “Locked-In” Effect: This is a big one that doesn’t get talked about enough. Many homeowners are locked in to really low mortgage rates (below 6%) from previous years. This makes them less inclined to sell, because upgrading to a new house would also mean paying a much higher rate. In fact over 80% of mortgage holders are locked in this position. This greatly impacts the number of houses on the market (inventory).

- Financial Confidence: Still Shaky. While job security concerns have eased a bit recently, household income growth remains subdued. People don't see wage increases. Only 14% of folks report higher income than the previous year. Optimism about personal finances is also slightly down. Without stronger income and financial confidence, buyer sentiment simply won't climb.

Key Factors to Consider Before Taking the Plunge

Okay, enough with the high-level stuff. Let's get real about what you NEED to think about before you sign on the dotted line:

- Your Personal Finances: Can you comfortably afford a monthly mortgage payment, property taxes, insurance, AND ongoing maintenance? Don't stretch yourself too thin! Make sure you also consider future repair costs and unexpected events.

- Interest Rates and Affordability: Even a slight change in interest rates can drastically affect your borrowing power and monthly payment. Use online calculators like the one listed below to run different scenarios.

- Your Long-Term Goals: Buying a house is a major decision. Do you plan to stay in the area for at least 5-7 years? Is this the right type of property for your current AND future needs?

- Local Market Conditions: All real estate is local! What's happening nationally might not be what's happening in your specific city or neighborhood. Talk to a local real estate agent who understands the area. They can provide invaluable insights.

A general benchmark based on your income:

| Income Bracket | Home Affordability |

|---|---|

| Low Income ( < $50,000) | Consider renting or smaller homes |

| Mid Income ($50k – $100k) | Starter Homes, Townhouses |

| High Income (> $100,000) | Luxury Homes, Investment Proprty |

Potential Opportunities in 2025

Despite the challenges, there are potential advantages for buyers in 2025:

- Less Competition: With buyer sentiment still low, you might face less competition, translating to more negotiating power.

- Slight Rate Relief: If mortgage rates edge down further, affordability could improve slightly.

- Motivated Sellers: Some sellers may be more willing to negotiate on price or offer concessions if their homes have been on the market for a while.

My Take: Proceed with Caution, But Don't Dismiss the Idea

Look, I'm not going to sugarcoat it. Buying a house is a big deal, and the market right now isn't exactly screaming “BUY NOW!”.

However, the “perfect” time to buy rarely exists. If you're financially ready, have a long-term plan, and find a property that truly meets your needs, 2025 could be your year. Just be cautious, do your research, and don't let FOMO (fear of missing out) drive your decisions.

Instead focus your decision on your personal situation.

Resources to Know!

- Fannie Mae: Stay updated with their monthly Home Purchase Sentiment Index releases for ongoing data tracking.

- Local Real Estate Agents: They are your eyes and ears on the ground.

Work With Norada – Buy Smart, Invest Smarter

Wondering if it’s the right time to buy a house in 2025? Don’t wait on perfect timing — focus on profitable markets and cash-flowing rentals. Norada helps you invest in high-demand, low-risk cities so you can build wealth confidently, regardless of market swings.

🔥 Exclusive Investment Deals Available Now! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Recommended Read:

- Top 10 Best and Worst Days to Sell Your Home in 2025

- Is It Harder to Buy a House Now Than 50 Years Ago?

- Is It a Good Time to Buy During a Housing Market Crash?

- Is Now a Good Time to Buy a House with Cash in 2025?

- Is It a Good Time to Sell a House in 2025?

- Should I Sell My House Now or Wait Until 2026?

- Best Time to Buy a House in the US: Timing Your Purchase

- Is Now a Good Time to Buy a House? Should You Wait?

- The 2025 Housing Market Forecast for Buyers & Sellers

- Why Did More People Decide To Sell Their Homes in Fall?

- When is the Best Time to Sell a House?

- Is It a Buyers or Sellers Market?

- Don't Panic Sell! Homeowners Hold Strong in Housing Market