Portland, unlike many other Pacific Northwest cities, has seen a cooling in its housing market recently. This shift comes after years of sustained growth and high competition among buyers. While Portland still offers a vibrant lifestyle and job market, those looking to buy a home should be aware of current trends, including a decrease in sale prices and an increase in available inventory.

This article will delve into the specifics of the Portland housing market, including median home values, days on market statistics, and neighborhood variations, to help you make informed decisions.

So, How is the Portland Housing Market Doing in 2024?

The Portland market is shifting in 2024, with price growth moderating and inventory increasing, creating a more balanced environment for both buyers and sellers.

Gone are the days of breakneck price escalation, replaced by a more measured pace that presents both opportunities and challenges for buyers and sellers alike. Let's delve into the data from April 2024 (PMAR) to understand this evolving market.

Price Growth: A Moderated Pace

While prices are undeniably on the rise, the blistering speed of previous years has eased. The median sales price in Portland reached $543,000 in April, reflecting a modest 2.5% increase compared to April 2023. This shift suggests a market where affordability is becoming a more prominent consideration for buyers.

The average sales price followed a similar trajectory, rising 2.1% to $618,900. This trend indicates a potential sweet spot where sellers can still expect a healthy return, and buyers have more breathing room to negotiate and find a home that fits their budget.

Market Activity Heats Up: A Sign of Balance or More Options?

The number of closed sales in April points to a more vibrant market. With a 10.3% rise compared to last year, there are more homes changing hands. This uptick could be attributed to several factors. Perhaps an increase in inventory has ignited buyer confidence, or maybe a new wave of buyers are entering the market due to lower mortgage rates or a desire to settle in Portland.

Interestingly, pending sales also saw a 6.9% increase, indicating sustained buyer interest. This suggests a market that's neither stagnant nor overly competitive, but rather one where negotiation holds more weight.

Inventory Expands: A Sigh of Relief for Buyers

One of the most significant shifts in the Portland market is the surge in new listings. In April, there was a substantial 17.6% increase compared to the same period in 2023. This growth in inventory is a welcome change for buyers who, in recent years, faced a highly competitive landscape with limited options.

The months of inventory, which sits at 2.4, also reflects this shift. While it's still a seller's market, the power dynamic is starting to subtly adjust. Buyers now have more time to browse options, compare features, and potentially negotiate a more favorable price.

Time on Market: A Balancing Act

While there's more inventory, it's important to consider the average number of days homes are staying on the market. In April, this number jumped to 83 days, a significant increase of 36 days compared to last year.

This could be due to a few reasons. Perhaps buyers are taking more time to make decisions in this new market environment, carefully weighing their options and ensuring they find the right fit.

Additionally, with more competition among sellers, properties might need to be strategically priced to attract buyers in a timely manner. This highlights the importance of consulting with a qualified real estate professional who can provide guidance on pricing strategies and ensure your home is positioned competitively within the current market landscape.

The Bottom Line: The Portland housing market in 2024 is undergoing a metamorphosis, transitioning from a seller's frenzy to a more balanced environment. Prices are still rising, but at a slower and more sustainable pace. There's more activity on both the buying and selling ends, and the rise in inventory is a positive sign for buyers seeking more options.

Portland Real Estate Appreciation Over the Years

Portland, Oregon, has become a magnet for many seeking a vibrant city with a strong connection to nature. This influx, coupled with limited housing availability, has significantly impacted the city's real estate market. Let's delve into Portland's real estate appreciation history and explore what the future might hold.

A Decade of Steady Growth

Over the past ten years, Portland's real estate market has seen impressive growth. The cumulative appreciation rate during this period stands at a remarkable 88.89%, placing it within the top half of cities nationwide. This translates to an average annual appreciation rate of 6.57%, a significant number for any homeowner (NeighborhoodScout).

A Shift in Recent Trends

While the long-term trend has been positive, there has been a shift in the market recently. The latest quarter (Q3 2023 – Q4 2023) saw a decrease of 1.91% in appreciation. This decline is even steeper when compared to the national average, which experienced a -7.41% drop during the same period.

Looking at a broader timeframe, the past year (Q4 2022 – Q4 2023) shows a minimal decline of 0.64%, similar to the national trend. However, the past two and five years still reflect moderate growth, indicating a potential for stabilization after the recent dip.

Historical Context

For a more comprehensive picture, it's important to consider a longer timeframe. When compared to appreciation since 2000 (205.12%), the last decade's growth appears less dramatic, with an average annual rate of 4.76%. This wider lens suggests a period of consistent, albeit slower, appreciation over the past two decades.

What Does the Future Hold?

Predicting the future of any real estate market is inherently challenging. The recent cool-down could be a temporary correction or a sign of a more significant shift. Factors like national economic trends, interest rates, and new housing construction will all play a role.

Despite the recent slowdown, Portland's long-term fundamentals remain strong. The city's continued appeal and limited housing stock could still lead to future appreciation, albeit at a more moderate pace.

Portland Housing Market Predictions (May 2024 – April 2025)

The Portland housing market has been a seller's paradise for a while. With an average home value of $542,190, up 1.1% year-over-year (Zillow), and homes going pending in a lightning-fast 11 days, it's no surprise buyers have faced fierce competition. But a recent forecast suggests a potential shift on the horizon. Let's delve into the data and see what it means for both buyers and sellers.

Market Snapshot (as of March 31, 2024):

- Median Sale Price: $500,333

- Median List Price: $531,283

- Median Sale-to-List Ratio: 0.997 (indicating a very competitive market)

- Percent of Sales Over List Price: 35.3%

- Percent of Sales Under List Price: 45.7% (interestingly high, suggesting some negotiation room)

Forecast for May 2024 – April 2025:

The forecast predicts a moderation in home prices over the next year. Here's a breakdown:

The forecast predicts a slight increase in median sale prices for May 2024, followed by a gradual decline throughout the rest of the year. By April 2025, prices could be around 2.8% lower than their March 2024 peak. This suggests a potential cooling off of the previously white-hot market. It's important to remember that even with a decrease, Portland's housing market is unlikely to see a dramatic shift. The decline is expected to be modest, and home prices are still likely to remain above historical averages.

Crash or Boom? Not Likely

While a decrease is predicted, it's important to understand the difference between a correction and a crash. A crash signifies a sudden and severe drop in prices, which this forecast doesn't suggest. It points towards a potential stabilization or correction in the market.

Here's a perspective based on typical thresholds:

- Crash: Highly unlikely based on the forecast (predicted change below -10%).

- Boom: Also unlikely (predicted change above 10%).

What This Means for You:

- Buyers: You might see some more favorable prices in the coming months, making it a potentially opportune time to enter the market. However, remember that interest rates also significantly impact affordability.

- Sellers: In a softening market, consider competitive pricing strategies to attract buyers. Leverage the still-fast turnaround time (11 days on average) to your advantage.

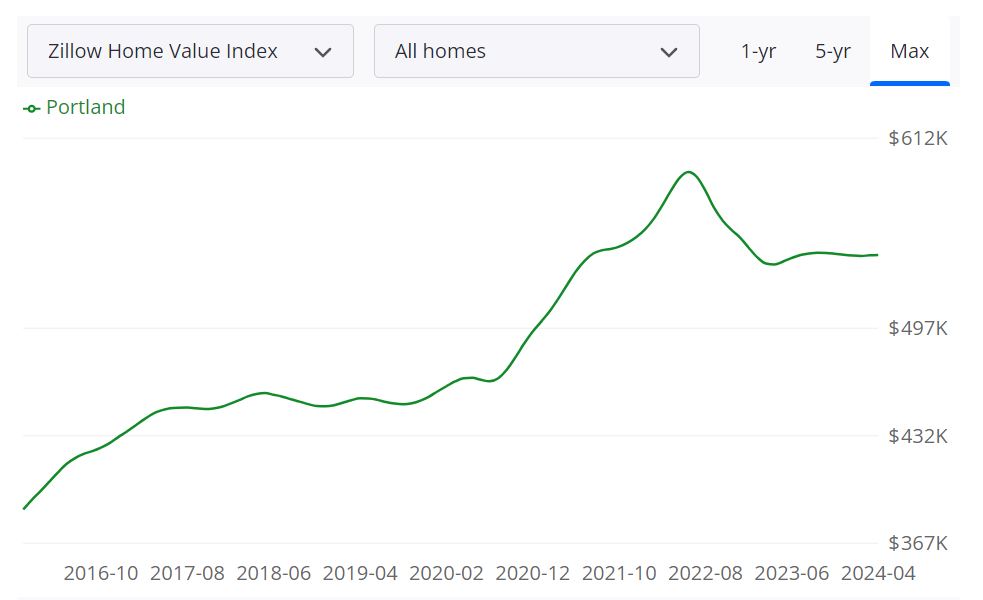

This graph (Zillow) illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

Should You Invest in the Portland Real Estate Market?

Portland, Oregon, has consistently captured the hearts of investors with its unique blend of urban living, natural beauty, and a thriving cultural scene. But is it still a wise investment in 2024? Let's delve into the key factors to consider before making your decision.

Portland's Strong Fundamentals

Population Growth and Trends:

- Portland boasts steady population growth, attracting young professionals and families seeking a high quality of life. This consistent growth creates a reliable demand for housing, a positive sign for rental property investors.

- The influx of new residents is driven by several factors. Portland's reputation for environmental consciousness and abundance of green spaces attracts those seeking a connection with nature. The city's entrepreneurial spirit fosters a dynamic startup scene, while established corporations like Nike and Intel provide stable job opportunities.

Economy and Jobs:

- Portland's economy is diverse, with a strong presence in tech, healthcare, manufacturing, and tourism. This diversification helps insulate the city from economic downturns in any one sector.

- According to the Portland Metro Chamber, the Portland metro area's job growth in 2023 was 1.3%. The report also noted that three out of the four metro counties, excluding Multnomah County, exceeded their 2019 job totals, indicating a completed pandemic recovery and potential for growth after 2023. The technology sector's continued growth also helped bolster the region's GDP recovery.

- Major corporations like Nike, Intel, and Columbia Sportswear call Portland home, alongside a flourishing startup scene. This economic strength translates to a stable job market, which in turn fuels housing demand. A strong job market not only increases the pool of potential renters but also fosters a sense of economic security, encouraging residents to stay and invest in the community.

Livability and Other Factors:

- Portland consistently ranks high in livability surveys, offering residents access to green spaces, a vibrant arts scene, and a walkable downtown core. The city boasts a renowned coffee culture, a plethora of microbreweries, and a thriving farmers' market scene, catering to a young, progressive demographic.

- This desirability attracts renters seeking a well-rounded lifestyle, potentially increasing your rental income and the long-term value of your property. As more people discover the unique charm of Portland, the demand for housing is likely to remain strong.

The Allure of the Portland Rental Market

Rental Property Market Size and Growth:

- Portland boasts a robust rental market with a historically low vacancy rate. This high occupancy rate signifies a strong demand for rental properties, making it easier to find tenants and minimize vacancy periods.

- The rental market in Portland has grown alongside the population, creating a favorable environment for investors. With a steady influx of new residents seeking housing options, investors can capitalize on the consistent demand for rentals.

Potential for Rental Income and Appreciation:

- Portland's rental market allows investors to generate a steady stream of income through rent payments. Rental income can help offset mortgage payments, property taxes, and maintenance costs. In a healthy rental market like Portland's, investors have the potential to achieve positive cash flow, meaning the property generates income that exceeds its ongoing expenses.

- While the forecast predicts a slight decrease in home prices in the short term, Portland has a history of steady appreciation in the long run. This means your property could gain value over time, offering an additional return on your investment. Appreciation can be a significant factor in building wealth through real estate ownership.

Other Factors to Consider

Competition:

- Portland's popularity also means there's competition among investors for available properties. Be prepared to act quickly and strategically when making offers. Research the local market trends and partner with a qualified real estate agent to gain an edge over other investors.

Regulations and Taxes:

- Research local rental regulations and property taxes to understand your ongoing costs and responsibilities as a landlord. Familiarize yourself with tenant rights and laws regarding repairs and maintenance. Understanding these regulations will help you avoid potential pitfalls and ensure a smooth rental experience.

Management Considerations:

- Decide whether you'll manage the property yourself or hire a property management company. Factor in the associated costs and time commitment. Managing a property requires time and effort, including tenant screening, rent collection, and maintenance coordination. Hiring a property management company can free up your time but comes with additional fees.

Market Fluctuations:

- The real estate market is dynamic. Stay informed about economic trends and potential shifts in the market to make informed investment decisions. Diversifying your portfolio across different geographic locations and property types can help mitigate risk.

Exit Strategy:

- Consider your long-term goals for the property. Will you hold onto it for long-term appreciation and rental income, or do you plan to sell it in the future? Having a clear exit strategy will help you make informed decisions about property selection and renovations.