In today's Portland housing market, rising median and average prices suggest a seller-friendly environment. However, increased inventory and longer time on the market hint at a more balanced landscape. Buyers may find greater choice and negotiation power, while sellers still enjoy strong demand.

Furthermore, the surge in pending sales and new listings indicates continued activity in the market, offering buyers a variety of options to choose from. However, the rise in inventory, coupled with the increase in the average number of days on the market, suggests a slight shift towards a more balanced market.

How is the Portland housing market doing currently?

Portland, renowned for its picturesque landscapes and vibrant culture, continues to captivate both prospective homebuyers and seasoned real estate professionals alike. In February 2024, the Portland Metropolitan Association of Realtors® (PMAR) released its comprehensive report, shedding light on the current state of the housing market in the city.

- The median sales price was $530,000 an increase from the previous year ($500,000).

- The average sales price was $576,900 an increase from the previous year ($553,300).

- No. of closed sales was 1284, a decrease from the previous year (1434).

- No. pending sales were 1742, an increase from the previous year (1703).

- New listings were 2085, an increase from the previous year (1764).

- Months of inventory equaled 2.8, an increase from the previous year (1.9).

- The average no. of days on the market was 89, an increase from the previous year (71).

Median Sales Price and Average Sales Price

The median sales price in Portland stood at $530,000 in February 2024, marking a noticeable increase from the previous year's figure of $500,000. Similarly, the average sales price witnessed an uptick, reaching $576,900, compared to $553,300 recorded in the preceding year.

Closed Sales and Pending Sales

Despite a decrease in the number of closed sales, which amounted to 1284, down from 1434 in the previous year, the Portland housing market saw a rise in pending sales. The number of pending sales surged to 1742, reflecting an increase from 1703 recorded in the same period last year.

New Listings and Inventory

One of the significant highlights of the February 2024 report is the surge in new listings. A total of 2085 new listings were reported, showcasing a substantial increase from the previous year's figure of 1764. However, this influx of listings also contributed to a rise in the months of inventory, which stood at 2.8, up from 1.9 recorded in the preceding year.

Average Days on Market

Another noteworthy metric is the average number of days properties spent on the market. In February 2024, this figure rose to 89 days, compared to 71 days in the previous year. This increase suggests a slightly slower pace in property turnover, potentially influenced by various factors such as market conditions and buyer preferences.

Portland Housing Market Forecast 2024 and 2025

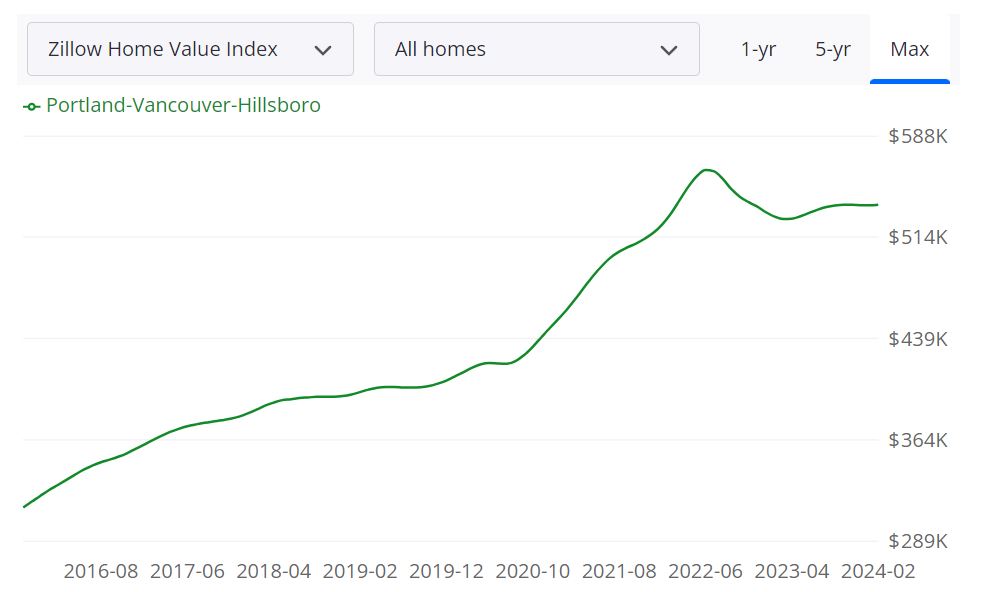

What are the Portland real estate market predictions? As the largest city in Oregon and a vibrant real estate hub, Portland's housing market has been closely monitored by both buyers and sellers. To gain insights into the current state and potential future of the market, we turn to the latest data provided by Zillow.

Market Metrics Explained:

- Home Value: The average home value in the Portland-Vancouver-Hillsboro area stands at $538,277, reflecting a modest 1.7% increase over the past year. Homes typically go pending in approximately 29 days.

- Inventory: As of February 29, 2024, there were 5,253 homes for sale in the Portland area, providing prospective buyers with a range of options to consider.

- New Listings: In February 2024, 1,372 new listings entered the market, contributing to the inventory available for potential buyers.

- Sale to List Ratio: The median sale to list ratio, which indicates how close homes are selling to their listed prices, stands at 0.994 as of January 31, 2024.

- Median Sale Price: The median sale price for homes in the Portland area was $505,417 as of January 31, 2024.

- Median List Price: Sellers listed their homes at a median price of $546,833 as of February 29, 2024.

- Sales Performance: In January 2024, 27.0% of home sales were above the list price, while 52.6% were below the list price, reflecting the dynamics of negotiations in the market.

Understanding the Portland Metropolitan Statistical Area (MSA):

The Portland-Vancouver-Hillsboro Metropolitan Statistical Area (MSA) encompasses several counties, including Multnomah, Washington, and Clackamas. This region is one of the largest urban centers in the Pacific Northwest, attracting residents with its diverse economy, vibrant culture, and scenic surroundings.

The housing market in the Portland MSA is characterized by a mix of urban and suburban neighborhoods, catering to various preferences and lifestyles. With a population of over 2.4 million residents, the demand for housing remains robust, contributing to the dynamic nature of the real estate landscape.

Forecast:

Zillow's 1-year Market Forecast for the Portland housing market, as of February 28, 2024, indicates a 0.9% increase. While this forecast provides valuable insights, it's essential to consider other economic indicators and external factors that may influence market trends.

Are Home Prices Dropping in Portland?

As of the latest data available, there is no indication of a significant drop in home prices in the Portland area. While fluctuations may occur due to various factors such as economic conditions and market dynamics, the overall trend has been one of stability or moderate increases in home prices.

Will the Portland Housing Market Crash?

While no one can predict with certainty whether a housing market will crash, several indicators suggest that the Portland market is relatively stable. Factors such as steady demand, limited inventory, and a diverse economy contribute

to the resilience of the market. However, it's essential to monitor economic trends, interest rates, and external factors that could impact the market's stability in the future.

Is Now a Good Time to Buy a House in Portland?

For prospective buyers considering purchasing a home in Portland, several factors should be taken into account. While it's currently a seller's market, low mortgage rates and the potential for future appreciation may make it an attractive time to buy. However, buyers should be prepared to act quickly, be flexible with their preferences, and work with experienced real estate agents to navigate the competitive market.

Portland Real Estate Investment: Should You Invest in Portland?

Should you consider Portland real estate investment? Many real estate investors have asked themselves if buying a property in Portland is a good investment. Portland offers a promising real estate investment landscape. Its strong economy, population growth, and rental market make it an attractive option for investors looking for potential long-term appreciation and cash flow. By carefully evaluating market conditions and working with professionals, investors can position themselves for success in the Portland real estate market.

Portland is a very ethnically diverse large city and home to around 600,000 people. However, the Portland housing market, in reality, includes more than two million people who live in the Portland Metropolitan Area or Greater Portland—comprising Clackamas, Columbia, Multnomah, Washington, and Yamhill Counties in Oregon, and Clark and Skamania Counties in Washington.

Investing in Portland real estate can be a lucrative opportunity for those seeking to grow their wealth and portfolio. With its strong economy, diverse job market, and desirable quality of life, Portland has become an attractive destination for real estate investors.

One of the key factors that make Portland an enticing investment option is its steady population growth. The city's population has been consistently increasing, driving demand for housing and rental properties. This demand creates opportunities for investors to generate rental income and capitalize on the appreciation.

Another advantage of investing in Portland is the city's thriving job market. Portland is home to a diverse range of industries, including technology, healthcare, education, and manufacturing. The presence of major employers and a growing entrepreneurial ecosystem contribute to a stable economy, ensuring a steady stream of potential tenants and buyers for investment properties.

Additionally, Portland's strong rental market offers investors a reliable income stream. With a high percentage of renters in the city, there is a constant demand for rental properties. Rental rates have been steadily increasing, providing investors with the potential for consistent cash flow and attractive returns on their investments.

Furthermore, Portland's commitment to sustainability and green initiatives has made it a leader in eco-friendly practices. This focus on sustainability has attracted environmentally conscious tenants and buyers, enhancing the long-term value of real estate investments in the city.

However, like any investment, there are considerations and risks to keep in mind. The Portland real estate market has experienced price fluctuations and can be competitive, especially in desirable neighborhoods. Conducting thorough market research, analyzing property values, and working with experienced local professionals are essential steps to mitigate risks and make informed investment decisions.

Portland is a “Hot” Real Estate Market for Millennials

One of the major factors driving the Portland real estate market is the city is hot with Millennials. Nor is it just students coming to Portland driving up prices in the Portland housing market. They want to buy homes in a family-friendly, cultural city, something many cannot afford to do in California.

When a city sees people move there for work, this could include everyone from 25-year-old grads to 50-year-old mid-career professionals. The fact that the Portland real estate market is especially attractive to young adults trying to buy houses, means there will be a strong demographic momentum into the future as they start families, increasing the local population and the odds they’ll stay.

Portland Lacks Room to Grow Which Drives The Home Prices Up

One of the beautiful things about Portland is its proximity to the ocean and the mountains, while much of the area is covered in protected forests. The downside of this is that the city lacks room to grow the way many inland real estate markets do. Developers could tear down older buildings and build skyscrapers, but that’s expensive compared to going five miles down the highway and building a new suburban neighborhood.

Relative to the strong migration and income-driven demand, the supply is lagging in the entire Portland MSA. New housing permits have been among the slowest recovering economic indicators in the Portland MSA after bottoming out in 2012. Not only is the Portland MSA producing new buildings at a relatively slow rate, but also fewer homes are

available for sale than ever before.

The relative lack of room to grow keeps rents high in the Portland real estate market for both residents and commercial firms. While Portland residents complain about the rent, Silicon Valley’s insane rents are pricing firms out of San Francisco Bay Area, and enough have moved north to get the area called Silicon Forest. Google’s moved both people and jobs here.

Other tech firms followed suit, opening offices here, or simply relocating. Increased demand for housing guarantees higher rental rates and property values. Considering the affordability problems in San Francisco and Seattle, Portland’s relative cheapness is leading people to migrate from those cities—which has contributed to the population growth of Portland MSA.

Portland’s Relatively Affordable Housing Market

Portland's relatively affordable housing market is a significant draw for both residents and prospective homebuyers. Compared to other major cities on the West Coast, such as Seattle and San Francisco, Portland offers a more accessible and affordable housing market.

One of the factors contributing to Portland's affordability is its lower median home prices. While housing prices have seen an increase in recent years, they still remain relatively affordable compared to other metropolitan areas. This affordability opens up opportunities for individuals and families to become homeowners without facing exorbitant costs.

Another aspect of Portland's affordability is the presence of diverse housing options. The city offers a range of housing types, including single-family homes, townhouses, condominiums, and apartments. This variety allows individuals to find housing that aligns with their budget and preferences.

Furthermore, Portland's affordable housing market is complemented by the city's strong job market. The region boasts a robust economy with opportunities in various industries, including technology, healthcare, education, and manufacturing. The availability of well-paying jobs enables residents to afford housing options in the city.

Additionally, the city's transportation infrastructure, including public transit systems and bike-friendly initiatives, provides residents with convenient access to different neighborhoods and reduces commuting costs. This accessibility contributes to the overall affordability of living in Portland.

Portland's Massive Student Market For Rental Property Investment

There are more than three dozen private and public universities within 150 miles of Portland. The University of Oregon and Oregon Institute of Technology both have massive campuses here. Student enrollment for the STEM and IT programs is exploding because graduates are entering the hot tech market created by Silicon Valley refugee firms. This means there is a strong Portland housing market for students in the vicinity of multiple campuses. Compare that to places like College Station, Texas – your property values and rents depend on the attractiveness of the one main school to students.

Portland Rental Market Statistics: The average size of a Portland, OR apartment is 765 square feet. Studio apartments are the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage. The average rent for an apartment in Portland is $1,763, according to RENTCafé.

More than 32% of the apartments can be rented for $1,500 or less while about 40% fall in the range of $1,500 to $2,000. 47% of the households in Portland, OR are renter-occupied while 53% are owner-occupied. That makes a huge population of renters. The most expensive Portland neighborhoods to rent apartments are Arnold Creek ($1,999), Old Town Portland – Chinatown ($1,999), and The Pearl ($2,006).

As of March 2024, the median rent for all bedroom counts and property types in Portland, OR is $1,550. This is -22% lower than the national average. Rent prices for all bedroom counts and property types in Portland, OR have decreased by 1% in the last month and have decreased by 9% in the last year.

The monthly rent for an apartment in Portland, OR is $1,450. A 1-bedroom apartment in Portland, OR costs about $1,490 on average, while a 2-bedroom apartment is $1,855. Houses for rent in Portland, OR are more expensive, with an average monthly cost of $2,495.

Portland's Better Business Climate

If you ask people and businesses why they relocated to Portland, one answer is the lower cost of living. Oregon is one of only five states in the nation that levies no sales or use tax. State government receipts of personal income and corporate excise taxes are contributed to the State's General Fund budget, the growth of which is controlled by State law. Oregon has property tax rates that are nearly in line with national averages. The effective property tax rate in Oregon is 1.04%, while the U.S. average currently stands at 1.08%.

Oregon is ranked number fifteen out of the fifty states, in order of the average amount of property taxes collected. It is ranked 16th of the 50 states for property taxes as a percentage of median income. Oregon's median income is $73,097 per year. The average home price in Portland Oregon is much lower than the average house cost in nearby cities like Seattle. The median property tax in Oregon is $2,241.00 per year for a home worth the median value of $257,400.00. Counties in Oregon collect an average of 0.87% of a property's assessed fair market value as property tax per year.

The exact property tax levied depends on the county in Oregon the property is located. Oregon's Multnomah County, which encompasses most of the city of Portland, has property taxes near the state average. The county's average effective tax rate is 1.07%. To understand why Portland property taxes go up every year nearly regardless of real estate values, let’s take a quick look at how taxes are usually calculated. The standard way is to multiply the value of your home by the property tax rate for your area of the county—which is estimated by county assessors through in-person inspections and comparisons to similar, recently sold homes.

But Oregon’s system of property taxes was modified by a 1997 bill that uncoupled property taxes from the actual value of homes. Now, Oregon pegs the taxable value of a property to its 1995 property values, plus 3 percent a year thereafter. In 2019, we had a cooling real estate market but now the market conditions are neutral amid the pandemic. That means that your home’s value may stay the same this year, or even go down a little bit, as per the Oregon property taxation system, the value is still going up 3%.

In many areas, real home values have risen much faster but the assessed property value still has a long way to go to catch up to them. The caps have succeeded in keeping property taxes relatively predictable and far lower than if they rose in sync with their home value — the price homeowners could fetch for their house. According to Metro, the current average assessed value of a Portland home is just $231,000.

In 2019, Oregonlive.com ranked Oregon counties by their effective tax rates — the amount of tax imposed per $1,000 of real market value across the entire county. This is an average, and individual homeowners within those counties might have dramatically different rates. Also, These numbers reflect the previous tax year (2018), the most recent for which figures were available from the Oregon Department of Revenue.

Portland metropolitan area comprises Clackamas, Columbia, Multnomah, Washington, Yamhill Counties in Oregon, and Clark and Skamania Counties in Washington.

In Multnomah County, the average tax rate is $20.12 per $1,000 of assessed value, but the average homeowner is taxed $9.87 per $1,000 of real market value.

In Clackamas County, the average tax rate is $16.00 per $1,000 of assessed value, but the average homeowner is taxed $10.60 per $1,000 of real market value.

In Columbia County, the average tax rate is $13.32 per $1,000 of assessed value, but the average homeowner is taxed $9.40 per $1,000 of real market value.

In Washington County, the average tax rate is $17.07 per $1,000 of assessed value, but the average homeowner is taxed $10.88 per $1,000 of real market value.

In Yamhill County, the average tax rate is $15.21 per $1,000 of assessed value, but the average homeowner is taxed $10.52 per $1,000 of real market value.

Caveat: On Nov. 6, 2018, voters approved a million-dollar general obligation bond to create affordable housing for approximately 12,000 people in the greater Portland region. The total amount to be raised through property taxes is nearly $653 million over 30 years. Due to this property owners in the tri-county Portland area would pay the bond back through higher property taxes over the next 30 years.

In 2019, property taxes to pay for this bond went up by 24 cents per $1,000 in assessed value for Portland homes in each of the three counties. That comes out to about $60 for a home with an assessed value of $250,000. Although the region's average home market value is far higher than $250,000, the average home's assessed value was $231,000 in 2018.

Now coming to its business friendliness, various national surveys put Oregon in the middle of the pack. However, business friendliness is relative. Forbes Magazine came out with an article in mid-2018 describing how California is unsustainable. Infrastructure is crumbling, and they build trains to nowhere instead of roads and dams people need.

It is hard to run a water-dependent industry when they’re rationing water for homeowners soon. We already addressed taxes, but regulations are insane. The new California rule mandating that businesses have at least one woman on the board by the end of 2019 is merely the camel’s nose under the tent; they could start mandating ethnicity-based board membership, union, or employee representation on boards and board membership based on sexuality.

A business could try to solve this by going private, or they can move their headquarters to Oregon. It is certainly easier to move a business and team north to Portland where their salaries go further since the Portland real estate market is so much more affordable.

Portland is Relatively Landlord Friendly – For Small Landlords

There’s an interesting situation in the Portland real estate market. If you own a large apartment building, you’ll find the Portland area difficult to manage because it is so tenant-friendly. A small landlord with a single home for rent, though, is in a different category. People buying and renting out a single home in the Portland housing market will have a much easier time.

They don’t have to follow the same rules on renter protection like rental assistance payments if you evict someone without cause (like you’re going to rehab or sell the property). Rental rates for smaller landlords can go up more in accord with market rates instead of being capped at around 5%. Regardless of how many properties you own, Portland has only discussed rent control – and seen significant opposition to it.

Portland Investment Properties: Where To Invest?

In any property investment, cash flow is gold. The Portland real estate market is booming because the economy is doing well on its own and the area is head and shoulders above California’s deteriorating situation. The Portland housing market has experienced double-digit annual price growth in recent years. Home values rose 11.4% in 2016 alone, according to a report from the real estate data company Clear Capital. The home prices in the Portland, Oregon housing market have slowed considerably over the last few months. And that’s a good thing, from a sustainability standpoint.

Good cash flow from Portland investment property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in Portland in a growing neighborhood would be key to your success. If you invest wisely in Portland's real estate, you could secure your future.

The less expensive the Portland investment property is, the lower your ongoing expenses will be. When looking for the best real estate investments in Portland, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing.

The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. A cheaper neighborhood in Portland might not be the best place to live in. A cheaper neighborhood should be determined by these factors – Overall Cost Of Living, Rent To Income Ratio, and Median Home Value To Income Ratio. It depends on how much you are looking to spend and if you are wanting smaller investment properties or larger deals in Class A neighborhoods.

Portland home prices are some of the most expensive in all of the United States. According to Realtor.com, there are 90 neighborhoods in Portland. Southwest Hills has a median listing home price of $1.2M, making it the most expensive neighborhood. Lents is the most affordable neighborhood, with a median listing home price of $380K.

Some of the most popular neighborhoods in Portland are Bethany, Southwest Hills, Hazelwood, Multnomah Village, Raleigh Hills, St. Johns, Eastmoreland, Lake Oswego, Laurelhurst, Downtown Portland, Tigard, Alameda, Cedar Hills, Montavilla, Hillsdale, Lents, Woodstock, and Kenton.

We recommend taking the help of the local real estate agents to find neighborhoods with an affordable entry prices of homes, high appreciation forecasts, and growing rent prices so that as an investor you can enjoy positive cash flow and nice profits. If the housing supply meets housing demand, investors should not miss the opportunity since entry prices of homes remain affordable. Find neighborhoods that are most popular among renters.

Here are the ten neighborhoods in Portland having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Downtown North

- Downtown East

- Arbor Lodge

- Overlook

- Overlook North

- Humboldt

- Concordia

- Kenton East

- King

- Humboldt North

References

Market Data, Reports & Forecasts

https://pmar.org/shareables/

https://www.oregonlive.com/

https://realestateagentpdx.com/category/portland-real-estate-market-news

https://www.littlebighomes.com/real-estate-portland-or.html

https://www.realtor.com/realestateandhomes-search/Portland_OR/overview

Impact of Covid-19 & Recovery

https://realestateagentpdx.com/portland-real-estate-market-spring-2020-covid-19-update/17320

https://www.oregonlive.com/realestate/2020/06/portland-area-housing-market-pending-sales-new-listings-surge-in-may.html

Rental Statistics for apartments

https://www.rentcafe.com/average-rent-market-trends/us/or/portland/

https://www.rentjungle.com/average-rent-in-portland-or-rent-trends/

Best Neighborhoods

https://www.neighborhoodscout.com/or/portland/real-estate

https://www.rentjungle.com/portland-or-apartments-and-houses-for-rent/

https://www.rentcafe.com/blog/apartment-search-2/neighborhood-guides/portlands-best-neighborhoods-for-renters/

Foreclosures

https://www.realtytrac.com/statsandtrends/or/multnomah-county/portland

Oregon Tax Rates & Way of Computing

http://www.tax-rates.org/oregon/property-tax

https://smartasset.com/taxes/oregon-property-tax-calculator

https://realestateagentpdx.com/portland-property-taxes-to-rise-in-2020/16247

https://www.oregonlive.com/news/erry-2018/10/7273fa75401636/property-tax-rates-in-oregons.html

Top Reasons to Invest in Portland

https://www.entrepreneur.com/article/273822

https://www.oregonbusiness.com/article/item/16045-is-oregon-good-for-business

https://www.cnbc.com/2015/05/14/water-millennials-drive-portland-oregon-housing.html

https://www.oregonlive.com/politics/index.ssf/2017/02/portlands_tina_kotek_explains.html

https://www.oregonlive.com/portland/index.ssf/2014/07/how_friendly_is_oregon_portlan.html

https://www.pdx.edu/nerc/sites/www.pdx.edu.nerc/files/The%20State%20of%20the%20Portland%20Housing%20Market.pdf

https://www.business2community.com/brandviews/upwork/why-silicon-valley-techies-are-rushing-to-the-pacific-northwest-02076366

https://www.forbes.com/sites/thomasdelbeccaro/2018/04/19/the-top-four-reasons-california-is-unsustainable/#6f1366cd3a23

https://www.portlandmercury.com/news/2018/01/24/19626335/portlands-small-time-landlords-dont-have-to-follow-renter-protections