The real estate market in California is poised for significant changes over the next five years, driven by factors such as population growth, evolving economic conditions, and housing supply challenges.

As demand for residential properties continues to rise amidst limited inventory, experts predict a steady increase in home prices, coupled with potential shifts in buyer preferences towards suburban and rural areas.

Furthermore, the impact of remote work trends and sustainability initiatives is expected to shape the types of properties in demand. In this article, we will explore the key trends and insights that will define California's real estate landscape from 2025 to 2029.

Real Estate Forecast Next 5 Years California

California's real estate market in the next five years will likely be characterized by modest price increases, a persistent inventory shortage, and continued influence from interest rates. While predicting the exact path is difficult, staying informed about these trends will empower Californians to make informed decisions, whether they're buying, selling, or staying put. The market may be unpredictable, but with a dose of realism and adaptability, Californians can navigate the ever-evolving landscape of the Golden State's housing market.

Emerging Trends in California

The California housing market isn't just about prices. Here are some additional trends to keep an eye on:

- Rise of iBuyers: These companies offer to buy homes quickly, often below market value. While iBuyers faced struggles in 2023, they might adapt and continue to play a role in the market. They could potentially become more attractive to sellers in a softening market, impacting traditional sales.

- Shifting Demographics: Millennial and Gen Z homebuyers will continue to shape the market. Their preferences for walkable neighborhoods, proximity to amenities, and potentially smaller homes could influence development patterns. We might see a rise in multi-generational housing arrangements as well, driven by economic factors and cultural shifts.

- Technological Innovation: PropTech (property technology) is on the rise, offering new tools for buyers, sellers, and agents. Expect to see advancements in virtual tours, data analysis, and streamlined transaction processes. These innovations could increase transparency and efficiency in the market, potentially benefiting all parties involved.

The Evolving Regulatory Landscape

Policy changes can also influence the market. California has a history of enacting regulations aimed at consumer protection and increasing affordability. Potential areas of focus in the coming years include:

- Rent Control: The ongoing debate surrounding rent control measures could see further developments. While rent control can stabilize housing costs for tenants, it can also discourage investment in new rental properties. Finding a balance between affordability and a healthy rental market will be crucial.

- Short-Term Rentals: Regulations surrounding short-term rentals like Airbnb could be tightened. This could increase long-term rental inventory but might also impact the tourism industry in some areas

Recent California Real Estate Forecast for 2025

According to the recently released forecast, both home sales and prices are projected to experience an upward trajectory in 2025, fueled primarily by anticipated lower interest rates and a boost in housing inventory. This outlook offers a sense of optimism for prospective buyers and sellers alike.

Projected Increase in Home Sales and Prices

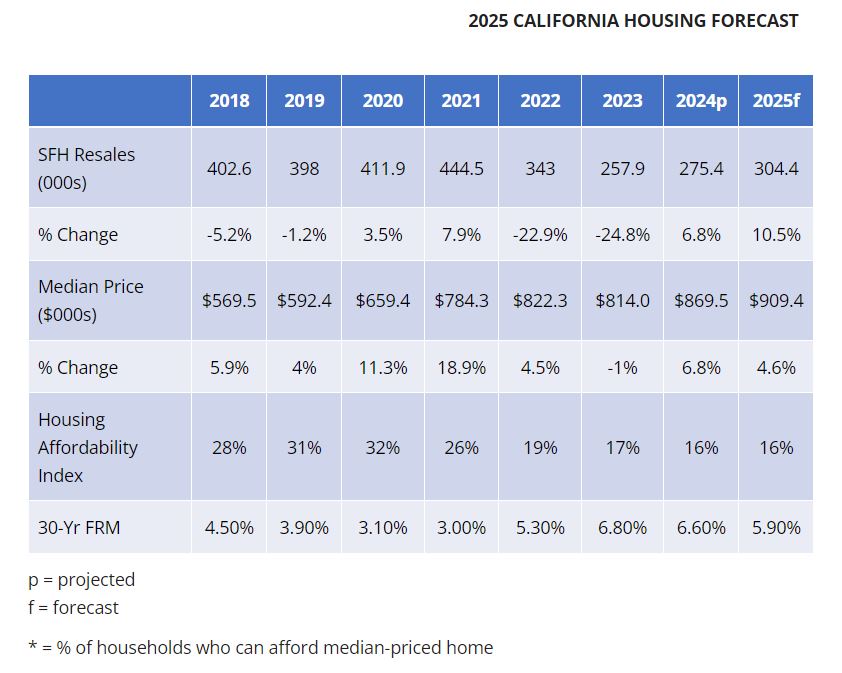

C.A.R. forecasts a notable increase in housing activity, estimating that approximately 304,400 homes will change hands in 2025. This figure reflects a substantial 10.5% increase when compared to the expected sales figures for 2024.

In tandem with sales growth, the median home price in California is set to rise to $909,400 in 2025. This represents a 4.6% increase from an estimated $869,500 in 2024. Although prices are continuing to climb, the rate of growth appears to be moderating, which should be welcome news for buyers contending with affordability constraints.

Understanding the Driving Factors: Interest Rates and the “Lock-In” Effect

The so-called “lock-in” effect is pivotal in understanding the housing market's current state. Many homeowners are sitting on loans with incredibly low interest rates and are consequently hesitant to sell and repurchase homes at significantly higher rates. This phenomenon has contributed to a tight supply of homes available on the market.

However, optimistic projections indicate that interest rates are likely to decrease slightly in 2025, potentially alleviating the lock-in effect. C.A.R. anticipates the average 30-year fixed mortgage rate will fall from 6.6% in 2024 to 5.9% in 2025. While these rates continue to exceed pre-pandemic levels, this downtrend could encourage more homeowners to enter the market, thus increasing available inventory. The easing of interest rates also enhances affordability for buyers, stimulating the housing market.

Assessing Affordability Amidst Rising Prices

While the prospect of more homes for sale and lower interest rates is promising, questions regarding affordability remain critical. C.A.R.'s projections suggest that the housing affordability index will stabilize around 16% for both 2024 and 2025. This statistic implies that only about 16% of California households will be in a position to afford a median-priced home, resulting in challenges for many potential buyers. While the situation is not deteriorating, it certainly underscores the ongoing struggle for affordability in the state's housing market.

A Closer Look at the Numbers: Key Metrics for the California Housing Market

For a deeper understanding of the projected trends, here is a detailed overview of key metrics as outlined in C.A.R.'s forecast:

| Metric | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (Projected) | 2025 (Forecast) |

|---|---|---|---|---|---|---|---|---|

| Single-Family Home Sales | 402.6 | 398 | 411.9 | 444.5 | 343 | 257.9 | 275.4 | 304.4 |

| % Change | -5.2% | -1.2% | 3.5% | 7.9% | -22.9% | -24.8% | 6.8% | 10.5% |

| Median Price ($) | 569.5 | 592.4 | 659.4 | 784.3 | 822.3 | 814.0 | 869.5 | 909.4 |

| % Change | 5.9% | 4% | 11.3% | 18.9% | 4.5% | -1% | 6.8% | 4.6% |

| Housing Affordability Index | 28% | 31% | 32% | 26% | 19% | 17% | 16% | 16% |

| 30-Year Fixed Mortgage Rate | 4.50% | 3.90% | 3.10% | 3.00% | 5.30% | 6.80% | 6.60% | 5.90% |

This table reflects the anticipated changes in the housing market, showing a recovery from previous declines and an overall more favorable environment for buyers and sellers in 2025.

Implications for Buyers and Sellers: What This Forecast Means

For those contemplating a home purchase in California, the housing market forecast for 2025 suggests potential advantages over the previous year. With anticipated lower interest rates and an increase in inventory, there might be more opportunities to explore within the market.

Conversely, sellers may also benefit from heightened buyer activity and slightly elevated home prices. This dual optimism encourages engagement in the market, whether you are buying or selling.

However, it is essential to remain cognizant that these predictions are merely suggestions and are subject to change. Monitoring economic trends and interest rates is crucial in making informed decisions. Engaging with a local real estate professional can provide invaluable insights tailored to individual circumstances.

Final Thoughts

In summary, the outlook for the California housing market in 2025 reveals a cautious but optimistic scenario. Despite inherent uncertainties and challenges, particularly regarding affordability, the trends suggest a turnaround that could stimulate both sales and market activity in the coming year. As we navigate this evolving landscape, staying informed will be critical to making strategic real estate decisions.

Recommended Read:

- California Housing Market Predictions 2025

- Will Housing Prices Drop in 2025 in California?

- California Housing Market 2024: Trends and Predictions

- California Housing Market Sizzles: Median Home Price Tops $900,000

- California Housing Market Booms: Investor Purchases Are Soaring

- The Great Recession and California's Housing Market Crash: A Retrospective