The US Dollar, long a cornerstone of global financial stability, has recently fallen to its lowest level in three years, sparking widespread concern and discussion. As of June 27, 2025, the US Dollar Index (DXY) has dropped to around 97, a level not seen since March 2022, representing a decline of over 10% this year alone.

This significant event has captured the attention of investors, policymakers, and consumers, raising questions about its causes and consequences. Let's explore the reasons behind the dollar’s decline, its implications for Americans and the global economy, and what the future might hold for the world’s reserve currency.

US Dollar Plummets to Three-Year Low: Causes of the Decline

The US Dollar’s fall is driven by a combination of economic, political, and market factors:

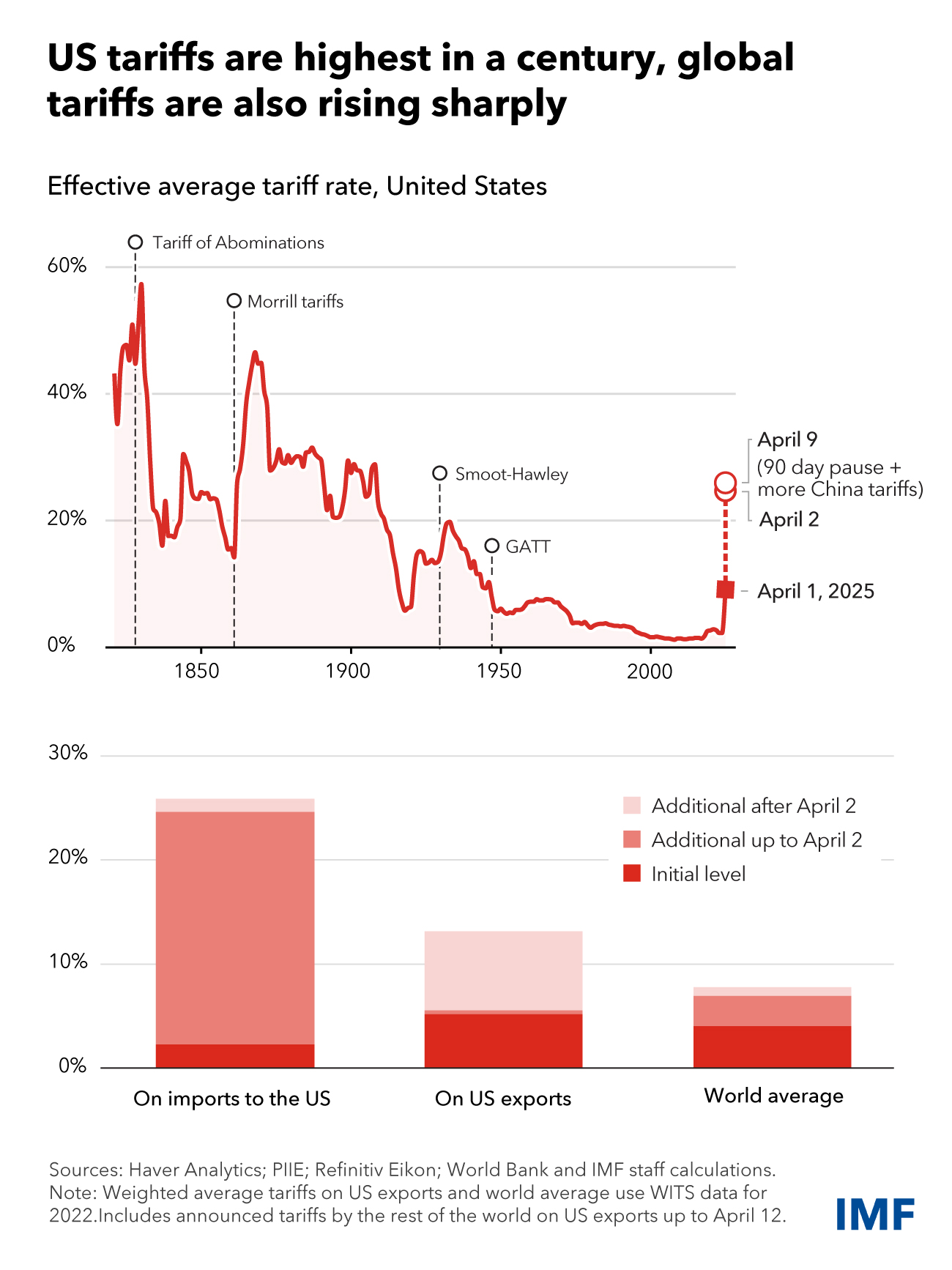

Economic Uncertainty and Tariffs

President Donald Trump’s economic policies, including the “Liberation Day” tariffs and the proposed “Big, Beautiful Bill,” have introduced significant uncertainty. These measures, aimed at protecting US industries, have raised fears of trade wars and economic slowdowns. An X post from @nexta_tv noted, “Due to U.S. tariffs, investors are losing trust in the currency as a ‘safe haven’ and are effectively pulling out” X Post. The “Big, Beautiful Bill” could add over $2.5 trillion to the federal debt, further eroding investor confidence (TIME).

Federal Reserve Independence Concerns

Speculation about changes in Federal Reserve leadership has significantly impacted the dollar. Reports indicate that President Trump is considering announcing a new Federal Reserve Chair before Jerome Powell’s term ends in May 2026. The prospect of a dovish chair who might cut interest rates has led to a decline in US bond yields, weakening the dollar. Kathleen Brooks, research director at XTB, stated, “This could undermine Powell’s final months as chair. The consensus is that Trump will pick a dovish chair, who is likely to cut interest rates. This triggered a decline in U.S. bond yields, which has weighed on the dollar” (MarketWatch).

Global Economic Shifts

The perception of the US as a safe haven for investments is waning. Investors are diversifying away from US assets, reflecting a broader shift in global economic power. Bilge Erten, an economist at Northeastern University, observed, “The US is no longer seen as a safe haven for investments. The dollar’s decline reflects a broader shift in global economic power” (TIME). This shift is evident in the dollar’s performance against other currencies, with the euro reaching its strongest level since September 2021 and the dollar hitting a decade-and-a-half low against the Swiss franc (Reuters).

Market Dynamics

The dollar has weakened against major currencies, including the euro, Swiss franc, and Japanese yen. The US Dollar Index fell to 97, with the euro up 0.33% at $1.1697 and the British pound trading above $1.3750 for the first time since 2021. An X post from @Investingcom reported, “U.S. DOLLAR INDEX FALLS TO THREE-YEAR LOW OF 97.68” X Post.

| Currency Pair | Performance | Details |

|---|---|---|

| USD/EUR | Down 0.33% | Euro at $1.1697, strongest since September 2021 |

| USD/CHF | Decade-and-a-half low | Swiss franc at 0.80030 |

| USD/JPY | Down 0.57% | Japanese yen at 144.415 |

| USD/GBP | Weakened | British pound above $1.3750, first time since 2021 |

Implications of the Dollar’s Fall

The dollar’s decline has significant consequences for both the US and the global economy:

For Americans

A weaker dollar increases the cost of imported goods and international travel, potentially raising the cost of living. TIME reported, “Americans’ wallets could be set to take a hit as the U.S. dollar has tumbled to a three-year low amid concerns about the stability and strength of the US economy.” However, it also makes US exports more competitive, benefiting domestic businesses. For example, industries like manufacturing and agriculture could see increased demand for their products abroad.

For the Global Economy

A weaker dollar can lead to higher inflation in countries reliant on US imports, as goods become more expensive. It also affects the value of dollar-denominated assets held by foreign investors, potentially prompting capital flight from the US. Additionally, the cost of servicing US debt held by foreign entities rises, complicating fiscal management.

For Financial Markets

The dollar’s decline has contributed to record highs in stock markets, as a weaker currency boosts corporate earnings when repatriated. However, it also introduces volatility, particularly for investors holding dollar-denominated assets. Michael Metcalfe from State Street noted, “The dollar is in a structural decline. Investors are the most negative on the dollar since the COVID pandemic.”

Expert Opinions and Market Reactions

The financial community has been vocal about the dollar’s decline:

- Bilge Erten, Northeastern University: “The US is no longer seen as a safe haven for investments. The dollar’s decline reflects a broader shift in global economic power” (TIME).

- Michael Metcalfe, State Street: “The dollar is in a structural decline. Investors are the most negative on the dollar since the COVID pandemic” (Reuters).

- Kathleen Brooks, XTB: “The talk of an early Fed Chair nomination has undermined Powell’s final months as chair. The market expects a dovish replacement, which has triggered a decline in US bond yields and weighed on the dollar” (MarketWatch).

On X, the topic is trending, with users expressing concern and analyzing implications. For instance, @Han_Akamatsu posted, “The dollar is taking a serious hit right now… The Fed is cornered right now. Can’t hike, can’t cut. The world is rejecting the U.S. debt, and the dollar is…” X Post. Another post from @MarioNawfal stated, “U.S. DOLLAR HITS 3-YEAR LOW AS TRUMP RATTLES THE FED — AND MARKETS PANIC” X Post.

Historical Context

The US Dollar has experienced fluctuations in the past. It spiked in value around 2015, deteriorated during the COVID-19 pandemic, and rose again in subsequent years. Historically, the dollar was notably high in 2002 and 1985 before experiencing sharp declines. The current drop, if sustained, could mark the largest first-half-year decline since the early 1970s, when currencies began free-floating.

Future Outlook

The future of the US Dollar is uncertain and depends on several factors:

- Federal Reserve Decisions: The outcome of the Fed Chair nomination and subsequent monetary policy will be critical. A dovish chair could lead to further rate cuts, potentially weakening the dollar further.

- US Economic Policies: The impact of tariffs and fiscal policies, such as the “Big, Beautiful Bill,” will influence investor confidence and economic stability.

- Global Economic Trends: Continued diversification away from US assets could sustain downward pressure on the dollar.

The coming months will provide more clarity, but for now, the dollar’s decline highlights the interconnectedness of global economies and the fragility of financial stability.

Bottom Line:

The US Dollar’s fall to a three-year low is a complex issue driven by economic policies, Federal Reserve uncertainties, and global economic shifts. While it poses challenges for Americans through higher costs, it also offers opportunities for exporters. Globally, the decline could reshape investment patterns and economic relationships. As policymakers, businesses, and investors navigate this evolving landscape, the dollar’s trajectory will remain a critical focus for the global economy.

Protect Your Wealth as the Dollar Weakens

With the U.S. Dollar hitting a three‑year low, savvy investors are turning to tangible assets that hold value.

Norada offers turnkey rental properties in resilient U.S. markets—providing passive income and serving as a hedge against currency depreciation.

HOT NEW LISTINGS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- US-Iran War: A New Threat to America's Shaky Economy

- Bond Market Today and Outlook for 2025 by Morgan Stanley

- The Risk of New Tariffs: Will They Crash the Stock Market and Economy?

- Stagflation Alert: Economist Survey Predicts Weak Q1 GDP Due to Tariffs

- Goldman Sachs Significantly Raises Recession Probability by 35%

- 2008 Crash Forecaster Warns of DOGE Triggering Economic Downturn

- Stock Market Predictions 2025: Will the Bull Run Continue?

- Stock Market Crash: Nasdaq 100 Tanks 3.5% Amid AI Concerns

- Stock Market Crash Prediction With Huge Discounts on Bitcoin, Gold, Houses

- S&P 500 Forecast for the Next Year: What to Expect in 2025?

- Stock Market Predictions for the Next 5 Years

- Echoes of 1987: Is Today’s Stock Market Crash Leading to a Recession?

- Is the Bull Market Over? What History Says About the Stock Market Crash

- Wall Street Bear Predicts a Historic Stock Market Crash Like 1929

- Economist Predicts Stock Market Crash Worse Than 2008 Crisis

- Next Stock Market Crash Prediction: Is a Crash Coming Soon?

- Stock Market Crash: 30% Correction Predicted by Top Forecaster