Is my money safe in the bank in 2024? In recent times, people have become increasingly concerned about the safety of their money, especially after the collapse of financial institutions such as the Silicon Valley Bank (SVB). If you are one of those people, you may be wondering if your money is safe after the SVB collapse. This article aims to address your concerns by providing a comprehensive analysis of the situation.

The Silicon Valley Bank was a financial institution that provided banking services to tech companies and startups. The collapse of the Silicon Valley Bank in 2023 was a harsh reminder that even the most reputable financial institutions can experience difficulties. The Silicon Valley Bank was known for providing banking services to tech companies and startups and was considered a key player in the industry.

The fallout from the bank's collapse was significant, with many customers losing their savings and investments. This event underscores the importance of selecting a bank that is reputable and trustworthy. Customers must conduct thorough research on the bank's history, financial health, and regulatory compliance. It's crucial to ensure that the bank is FDIC insured, which provides an added layer of protection for deposit accounts.

Is My Money Safe in the Bank: FDIC Insurance Coverage?

The Federal Deposit Insurance Corporation (FDIC) is a government agency that provides insurance coverage to depositors in case of bank failures. FDIC insurance coverage guarantees up to $250,000 per depositor, per insured bank, for each account ownership category. This means that if you have multiple accounts with the same bank, each account is insured separately up to $250,000.

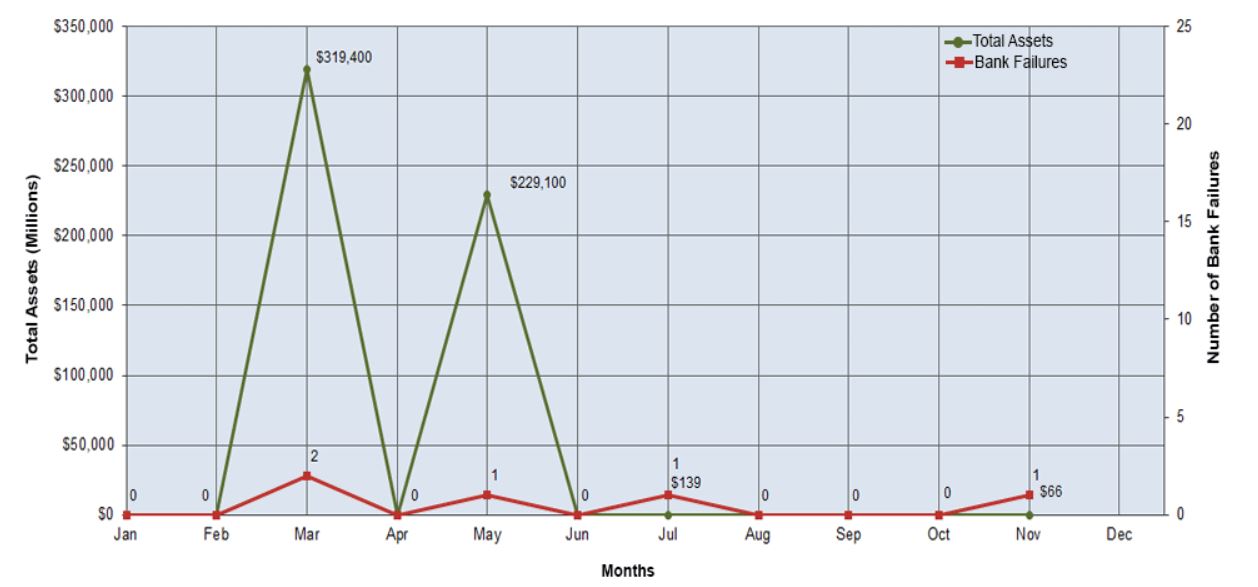

If you had deposits in the SVB, you may be wondering if your money is covered by FDIC insurance. The Federal Deposit Insurance Corporation (FDIC) has taken action to protect all depositors of the former Silicon Valley Bank in Santa Clara, California, which was closed by the California Department of Financial Protection and Innovation on March 10, 2023, and the FDIC was appointed receiver.

ALSO READ: Which Banks Are in Danger of Failing or Collapse 2023

The FDIC transferred all deposits – both insured and uninsured – and substantially all assets of the bank to a newly created, full-service FDIC-operated ‘bridge bank' to protect all depositors of Silicon Valley Bank. Depositors will have full access to their money beginning this morning when Silicon Valley Bridge Bank, N.A. opens, and borrowers will automatically become customers of the bridge bank.

The transfer of all deposits was completed under the systemic risk exception approved on March 28, 2023, and all depositors of the institution will be made whole, but shareholders and certain unsecured debt holders will not be protected, and senior management has been removed.

The receiver for Silicon Valley Bank has also transferred all Qualified Financial Contracts of the failed bank to the bridge bank. The bridge bank structure is designed to bridge the gap between the failure of a bank and the time when the FDIC can stabilize the institution and implement an orderly resolution. The FDIC named Tim Mayopoulos as CEO of Silicon Valley Bridge Bank, N.A.

What Types of Bank Accounts Are Protected?

The FDIC (Federal Deposit Insurance Corporation) insures certain types of bank accounts in the United States to protect depositors in case of bank failures or financial problems. FDIC insurance is automatically provided to depositors at FDIC-insured banks and savings institutions, meaning depositors don't have to take any additional steps to receive this protection.

The types of accounts that are covered by FDIC insurance include checking accounts, Negotiable Order of Withdrawal (NOW) accounts, savings accounts, money market deposit accounts (MMDA), time deposits such as certificates of deposit (CDs), cashier’s checks, money orders, and other official items issued by a bank. These accounts are insured up to $250,000 per depositor, per bank, for each account ownership category.

Additionally, there is also coverage for certain types of retirement accounts and benefit plans, including single accounts, certain retirement accounts like IRAs, self-directed defined contribution plans, and self-directed 401(k) plans, as well as revocable and irrevocable trust accounts, employee benefit plan accounts, corporation/partnership/unincorporated association accounts, and government accounts.

However, not all types of investments are insured by the FDIC. For example, stock investments, bond investments, mutual funds, crypto assets, life insurance policies, annuities, municipal securities, safe deposit boxes, or their contents, and Treasury bills, bonds, or notes are not covered by FDIC insurance. It's important for depositors to be aware of what types of accounts and investments are covered by FDIC insurance and what types are not, so they can make informed decisions about where to put their money.

How to Ensure Your Money is Safe From Bank Failure?

Bank failure can be a daunting thought for anyone who has money in a bank. It is important to take steps to protect your money in case of a bank failure. The good news is that there are several ways to protect your money from bank failure.

First and foremost, it is essential to choose a bank that is insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC insures deposits up to $250,000 per depositor, per insured bank. This means that if your bank fails, you can still get your money back up to the insured amount. It is important to note that not all banks are insured by the FDIC, so it is important to verify the insurance status of your bank before opening an account.

ALSO READ: List of Failed Banks in the United States

In addition to choosing an FDIC-insured bank, it is also important to keep your deposits within the insurance limit. Deposits that exceed the FDIC insurance limit are not insured and will not be returned in the event of a bank failure. If you have more than $250,000 to deposit, you may consider spreading your money across multiple banks to stay within the insurance limit.

Another way to protect your money from bank failure is to diversify your deposits. Rather than keeping all your money in one account, you can consider opening multiple accounts with different banks. This can help you spread your risk and ensure that you are not putting all your eggs in one basket. By diversifying your deposits, you can also take advantage of higher interest rates or better account terms offered by different banks.

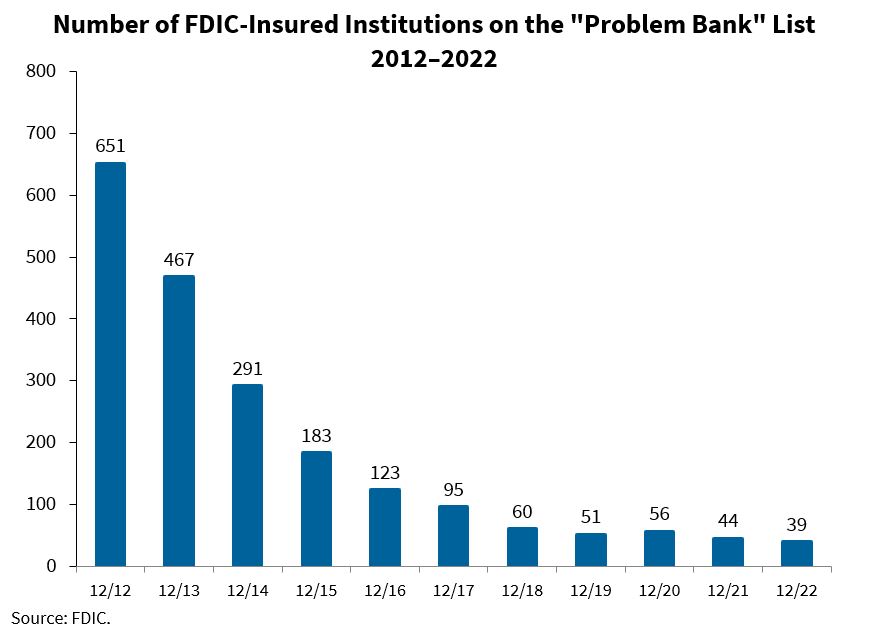

It is also important to monitor the health of your bank. Banks are required to provide quarterly financial reports to the FDIC, which are publicly available. You can review these reports to get a sense of the financial health of your bank. If you see any red flags or warning signs, you may want to consider moving your money to a more stable bank.

Another way to protect your money is to maintain accurate records of your deposits. This can include keeping track of your account balances, interest rates, and transaction history. By doing so, you can quickly identify any discrepancies or errors in your account and take action to correct them.

In the event of a bank failure, it is important to stay informed and take action quickly. The FDIC will typically step in to take over the failed bank and transfer deposits to a new bank. However, this process can take time, and there may be a period when you do not have access to your funds. It is important to have alternative sources of funds available, such as cash or credit cards, to cover your expenses during this time.

How to Tell if Your Money is Safe in the Bank?

Checking the health of your bank is an important step in protecting your money. By doing so, you can ensure that your bank is financially stable and able to safeguard your deposits. One way to check the health of your bank is by utilizing the data and statistics provided by the Federal Deposit Insurance Corporation (FDIC).

The FDIC provides a wealth of information on the financial health of banks across the United States. This includes data on a bank's assets, deposits, loans, and other financial metrics. By reviewing this data, you can get a clear picture of your bank's financial standing and assess its ability to keep your money safe.

In addition to utilizing the FDIC's data and statistics, there are other indicators you can look at to determine the health of any bank. These include factors such as the bank's capitalization, liquidity, and profitability. Here are all the indicators that can be used to determine the health of a bank.

- Capital adequacy ratio: This ratio measures a bank's ability to absorb losses. A bank with a high capital adequacy ratio is considered to be financially strong and able to withstand economic downturns.

- Asset quality: This refers to the quality of a bank's loan portfolio. A bank with a high percentage of non-performing loans is considered to be at risk of failure.

- Liquidity: A bank's ability to meet its short-term obligations is an important indicator of its health. If a bank is unable to meet its obligations, it may be forced to borrow funds at a high cost or sell assets at a loss.

- Profitability: A bank's profitability is a key indicator of its long-term viability. A bank that consistently generates profits is more likely to be financially stable.

- Efficiency: A bank's efficiency ratio measures its expenses as a percentage of its revenue. A bank with a high-efficiency ratio may be less profitable and less efficient in its operations.

- Management quality: The quality of a bank's management team can also be a good indicator of its health. A bank with experienced and knowledgeable managers is more likely to make sound decisions and avoid risky investments.

- Market share: A bank's market share can also provide some indication of its health. Banks with a large market share are often more stable and able to weather economic storms.

- Regulatory compliance: A bank's compliance with regulatory requirements is also important. Banks that consistently violate regulations may be at risk of being shut down or facing legal action.

In conclusion, the collapse of the Silicon Valley Bank has left many customers wondering if their money is safe. While bank failures are a rare occurrence, it is always better to be safe than sorry. It is important to understand how banks work and how to protect your money in case of a bank failure. By checking the health of your bank and staying informed of any changes in its financial status, you can ensure that your money is safe.

Remember, the FDIC offers a wealth of information on banks, including data and statistics that can help you determine the health of your bank. It is always a good idea to periodically review your bank's financial information and compare it to industry benchmarks to ensure that it is operating in a safe and sound manner.

By taking a few simple steps, you can protect your money from bank failure and ensure that it remains safe and secure. Don't wait until it's too late – start taking proactive steps today to safeguard your hard-earned money.

References:

- https://www.fdic.gov/news/press-releases/2023/pr23019.html

- https://www.fdic.gov/analysis/quarterly-banking-profile/statistics-at-a-glance/

- https://www.fdic.gov/resources/deposit-insurance/financial-products-insured/index.html