Have you ever wondered how much the cost of borrowing money to buy a house has changed over the last year? It's a big question, and if you're thinking about buying a home – or even just keeping an eye on the economy – understanding the trends in mortgage interest rates is super important. Over the past year, as shown in the mortgage interest rates graph over the past year, we've seen some interesting movements that can really impact what you pay each month for your mortgage.

Let's dive into what the data tells us and what it might mean for you.

Mortgage Interest Rates Graph Over the Past One Year

What the Latest Data Shows

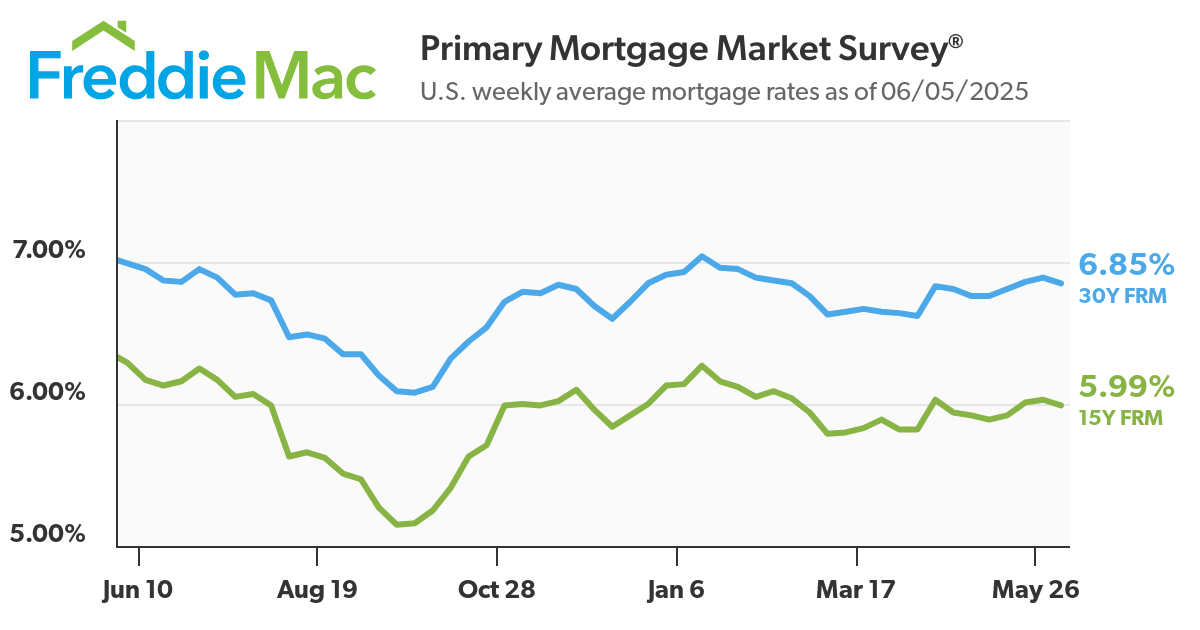

As of June 5, 2025, the average interest rate for a 30-year fixed-rate mortgage (also known as a 30-Yr FRM) stood at 6.85%. Looking back, according to Freddie Mac's data, this is a slight decrease from the previous week (-0.04%) and also a bit lower than where we were a year ago (-0.14%).

For those considering a shorter loan term, the 15-year fixed-rate mortgage (15-Yr FRM) averaged 5.99%. This also saw a decrease of 0.04% from the week before and a more significant drop of 0.3% compared to this time last year.

Here's a quick summary:

| Loan Type | Current Rate (06/05/2025) | Weekly Change | Yearly Change |

|---|---|---|---|

| 30-Yr FRM | 6.85% | -0.04% | -0.14% |

| 15-Yr FRM | 5.99% | -0.04% | -0.30% |

It's encouraging to see that rates have come down a little recently. For anyone looking to buy a home, this can make a real difference in their monthly payments and overall affordability. The fact that inventory is reportedly improving and house price growth is slowing down adds to this positive news for potential homebuyers.

A Deeper Dive into the Past Year's Trends

Looking at the mortgage interest rates graph since past one year (from June 5, 2024, to June 5, 2025), we can see the journey these rates have taken. The blue line represents the 30-year fixed rate, and the green line shows the 15-year fixed rate.

- Fluctuations are Normal: What stands out immediately is that mortgage rates don't stay still. They go up and down based on a whole bunch of economic factors. You can see periods where both the 30-year and 15-year rates were climbing, and other times where they were on a downward trend.

- Peak and Valley: The 30-year fixed rate touched a high of 7.04% within the past 52 weeks and a low of 6.08%. For the 15-year fixed rate, the range was between 6.27% and 5.15%. These are significant swings that could change your mortgage payment by a noticeable amount.

- Impact of Economic Events: While the graph itself doesn't tell us why the rates moved the way they did, I know from my experience in following the market that things like inflation reports, decisions by the Federal Reserve (the Fed) about interest rates, and the overall health of the economy play a big role. When the economy is strong, and inflation is a concern, mortgage rates tend to rise. When the economy slows down, or there are worries about a recession, rates often fall.

Thinking About the Bigger Picture

It's easy to get caught up in the week-to-week changes, but it's important to think about the broader context. Over the past year, the housing market has been navigating a period of adjustment. After the very low interest rates we saw a few years ago, rates climbed quite sharply. This naturally had an impact on home affordability and the number of people looking to buy.

Now that rates seem to be stabilizing and even coming down a bit, it could signal a more balanced market. Sellers might need to be more realistic with their prices, and buyers might find more opportunities.

My Thoughts

Having followed the housing market for a while, I can tell you that trying to perfectly time when to buy based solely on interest rates is incredibly difficult – almost like trying to catch a falling knife! There are so many factors at play.

However, understanding the trends, like the ones we see in Freddie Mac's mortgage interest rates chart, can help you make more informed decisions. For example:

- If rates are trending downward and you're in a stable financial position, it might be a good time to consider locking in a rate. Even a small decrease in the interest rate can save you thousands of dollars over the life of a 30-year loan.

- If rates are high, it might be worth exploring adjustable-rate mortgages (ARMs) or focusing on improving your credit score to qualify for a better rate. Of course, ARMs come with their own set of risks, so it's crucial to understand how they work.

It's also worth remembering that your personal financial situation – your income, debts, and credit score – will significantly influence the mortgage rate you actually qualify for.

Read More:

Dave Ramsey Predicts Mortgage Rates Will Probably Drop Soon in 2025

Looking Ahead

Predicting where mortgage rates will go next is always a challenge. Economic forecasts can change, and unexpected events can happen. However, by keeping an eye on the mortgage interest rates graph since past one year and staying informed about economic news, you can get a sense of the general direction things might be heading.

The recent decrease in rates, combined with potentially improving inventory, could create a more favorable environment for homebuyers in the coming months. Of course, this is just my take based on the current data and my understanding of the market. It's always a good idea to talk to a financial advisor or a mortgage professional for personalized advice.

Summary:

The mortgage interest rates graph over the past year provides a valuable snapshot of how the cost of borrowing for a home has fluctuated. While we've seen some decreases recently, it's a reminder that rates are dynamic and influenced by a variety of economic factors. For anyone involved in the housing market, whether as a buyer, seller, or homeowner, staying informed about these trends is key to making sound financial decisions.

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?