Will the housing market be better in 2026? This question has sparked much discussion and debate amongst homeowners, potential buyers, and investors. As we navigate financial uncertainties, it becomes crucial to understand various trends and predictions that could shape the housing market landscape over the coming years.

In this comprehensive analysis, we will delve deep into whether the housing market is stuck until 2026, if housing prices are likely to drop, whether 2026 will be a favorable year to buy a house, and what mortgage rates might look like.

Will the Housing Market Be Better in 2026: What to Expect?

Key Takeaways

- High Prices Expected: Housing prices are projected to remain high until at least 2026, with only minor dips anticipated.

- Mortgage Rates Trends: Mortgage rates may see a decline by the end of 2026 but are expected to remain elevated early in the year.

- Market Dynamics: Ongoing supply issues and high demand will significantly influence market changes leading up to 2026.

- Buyer's Market Risk: While 2026 may not be the best year for bargain hunting, it might provide some opportunities for discerning home buyers.

Understanding the Current Housing Market Dynamics

The housing market today is navigating a challenging environment. Many experts agree that it is somewhat stuck. Reports suggest that the housing market won't rebound until at least 2026, primarily due to a persistent housing shortage that continues to put upward pressure on prices.

According to analysts at Bank of America, the current conditions indicate that high prices will likely stay consistent, preventing many families from entering the market. This prolonged period of expensive real estate can lead to potential buyers feeling frustrated, prompting them to delay purchases or remain in their existing living situations longer than planned.

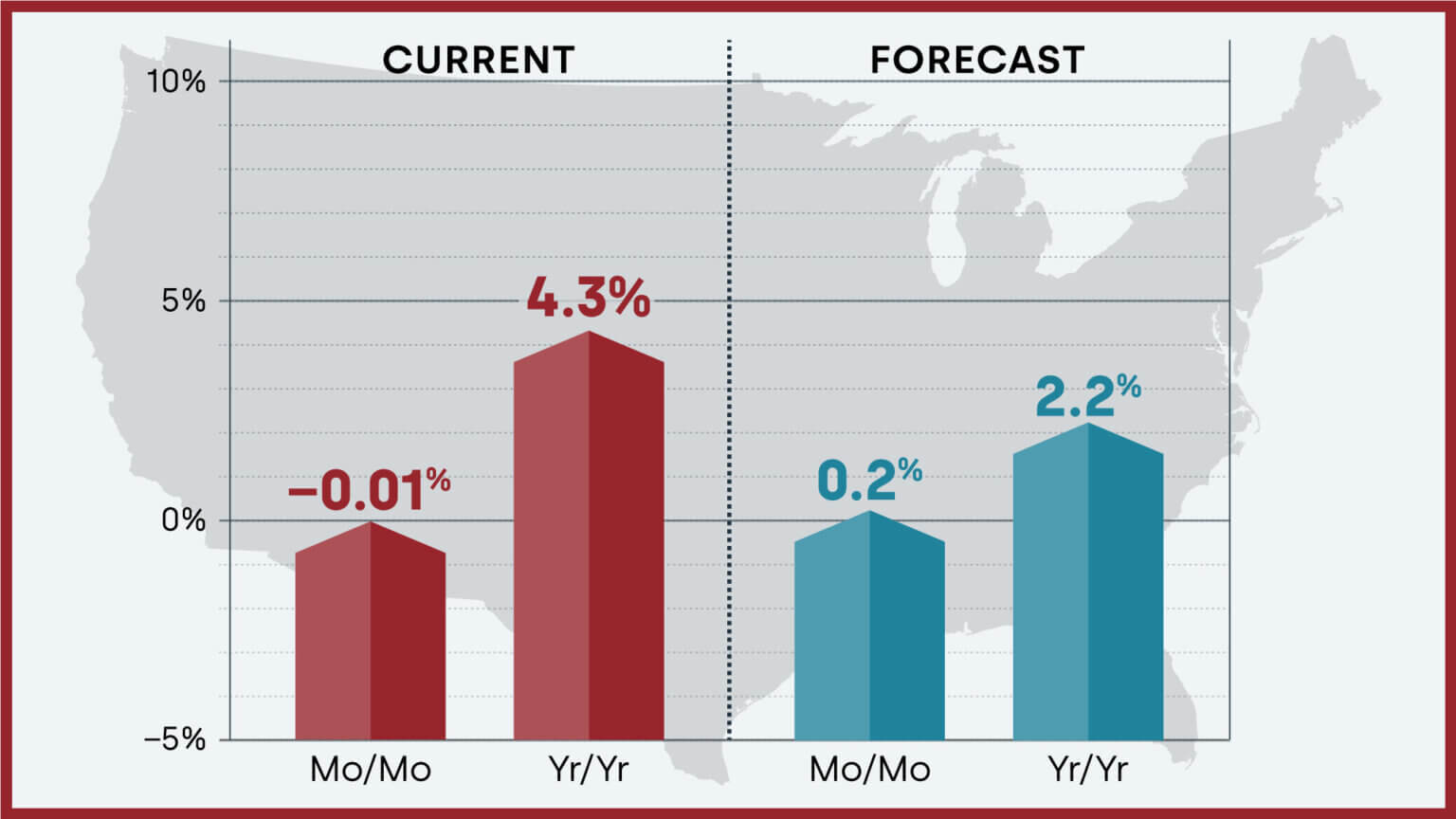

Recent data provides insight into the current pricing trends. Home prices have remained elevated, and analysts predict that they could continue to increase by approximately 4.5% this year and another 5% next year before experiencing a slight dip of about 0.5% in 2026 (CNN). This trend towards consistently high prices leaves many buyers feeling priced out of the market while existing homeowners take solace in their increasing equity.

Will Housing Prices Drop in 2026?

As we ponder whether housing prices will drop in 2026, it's essential to look at the broader economic context. Although there may be local variations, experts generally believe that significant home price drops are unlikely. Some regions may experience limited declines, but the overarching trend looks to remain on a steady upward path.

For instance, Goldman Sachs forecasts a mild increase in home prices due to ongoing demand and the limited availability of housing options in many desired areas. In urban centers and regions experiencing population growth, prices are expected to continue rising. The simple truth is that where there's a high demand for homes but not enough supply, prices will often stay higher than desired (Forbes).

Is 2026 Going to Be a Good Year to Buy a House?

Addressing the question of whether 2026 will be a good year to buy a house requires buyers to reflect on their personal circumstances. While it may not present the lowest prices compared to prior years, 2026 could still be a relatively favorable time to purchase. Housing availability is predicted to rise, which could lead to more options for buyers—this implies increased competition among sellers, potentially providing buyers with better negotiating power.

According to multiple forecasts, including insights from credible sources, the housing supply might increase by 7% in 2026. This increase signifies the arrival of more inventory to the market, a necessary condition to balance the current high demand. As per reports from U.S. News, regions with improved housing stock could see changes in pricing dynamics as new listings become available (U.S. News).

Recommended Read:

Housing Market Predictions for the Next 4 Years: 2024 to 2028

What Will Be Mortgage Rates in 2026?

Understanding mortgage rates is critical for anyone considering entering the housing market. Current predictions suggest that mortgage rates, particularly for the average 30-year fixed mortgage, could see a significant drop by late 2026, with estimates falling to around 3.96% (Long Forecast). However, experts caution that rates may remain relatively high at the beginning of 2026 as the market adjusts to ongoing economic factors and potential inflation scenarios.

Mortgage rates have a direct impact on overall affordability for buyers. An increase in available housing may help mitigate some of these rates, providing opportunities for more buyers to enter the market. Therefore, potential buyers should keep an eye on rate forecasts and be prepared to act when conditions align.

My Opinion on the Housing Market Forecast for 2026

In my view, the current housing market reflects a unique combination of challenges and opportunities. The housing supply constraints are genuine, leading to high prices that frustrate many would-be buyers. However, anticipated changes in supply dynamics and potential mortgage rate declines could make 2026 a year to watch. While it may not be the best time to buy in recent history, astute buyers who do their homework could find advantageous offers in select markets.

Predicting the perfect time to enter the housing market is fraught with uncertainty. Still, as the market rebalances in 2026, there could be solid opportunities for buyers ready to navigate the changing landscape.

Conclusion

As you think about your own plans within the housing market, keep these dynamics in mind. The conditions of today are influenced by past trends and will inevitably impact the future. While the housing market might not experience a drastic improvement until 2026, mounting pressure on supply could provide openings for buyers willing to take the plunge.

The interplay between supply, demand, and mortgage rates will continue to create fluctuations in market conditions. Those who remain informed and adaptable will be best positioned to identify potential opportunities in the housing market as it edges closer to 2026.

Also Read:

- Housing Market Predictions for the Next 4 Years: 2024 to 2028

- Real Estate Market Predictions 2025: What to Expect

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Housing Market Predictions for the Next 2 Years

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions 2024: Will Real Estate Crash?

- Housing Market Predictions: 8 of Next 10 Years Poised for Gains

- Trump vs Harris: Which Candidate Holds the Key to the Housing Market (Prediction)