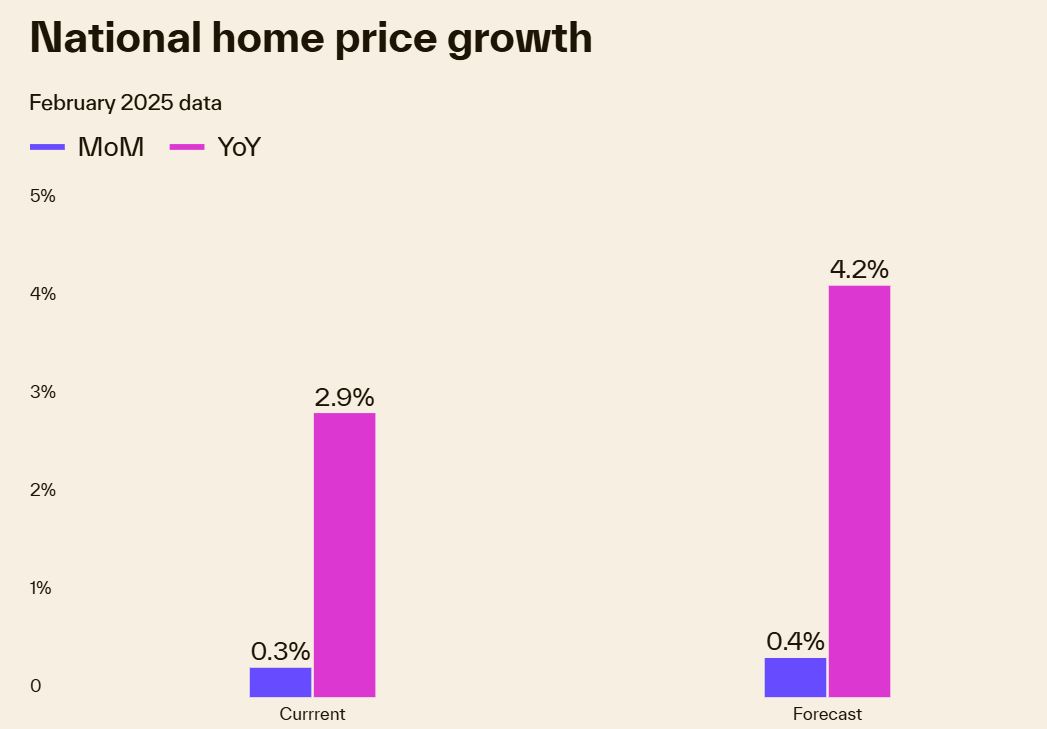

According to the latest projections from Fannie Mae, it looks like housing prices are set to increase by 4.1% in 2025. This might sound like just a number, but it has real implications for all of us. Let's dive into what this means and the factors driving this prediction.

Housing Prices Are Set to Rise by 4.1% by the End of 2025

What's Driving This Predicted Rise in Home Prices?

Now, you might be asking, “Why 4.1%? Where does that number come from?” It's not just pulled out of thin air. Fannie Mae‘s Economic and Strategic Research (ESR) Group puts together detailed forecasts based on a whole host of economic indicators and housing market trends. They've recently updated their outlook, and several key factors contribute to their prediction that housing prices are set to increase by 4.1% in 2025.

One of the main things they look at is the overall health of the economy. Their current forecast suggests a modest economic growth of 0.5% for the full year 2025 and a more robust 1.9% for 2026. While 0.5% isn't exactly booming, it still indicates some level of economic activity, which can support housing demand. As the economy gradually improves, more people might feel confident enough to make big purchases like a home.

Another crucial piece of the puzzle is the balance between the number of homes available (supply) and the number of people looking to buy (demand). For quite some time now, we've been seeing a situation where there aren't enough homes on the market to meet the demand from potential buyers. This limited supply naturally puts upward pressure on prices. While there's an expectation of approximately 964,000 new single-family homes being constructed this year, it might not be enough to fully satisfy the existing demand.

The Role of Interest Rates

Mortgage rates play a significant role in the housing market. When interest rates are high, borrowing money to buy a home becomes more expensive, which can cool down demand and potentially slow down price increases. Conversely, lower rates can make home buying more accessible. Fannie Mae currently forecasts that mortgage rates will end 2025 at 6.2 percent and 2026 at 6.0 percent, which is slightly lower than their previous predictions. While these rates aren't as low as we've seen in the past, a gradual decrease could provide some support to buyer affordability and contribute to the projected price increase.

Home Sales and Construction Outlook

Interestingly, while they predict a price increase, Fannie Mae has slightly revised their outlook for home sales in 2025 downwards, to 4.86 million units from 4.95 million. This adjustment suggests that while demand might still be there, factors like affordability (even with slightly lower mortgage rates) could still present challenges for some buyers. The fact that they saw higher-than-expected sales in the first quarter somewhat offset their downward revision for the rest of the year. This tells me that the market is still quite dynamic and can be influenced by short-term fluctuations.

Why This Matters to You

So, what does this 4.1% increase in home prices are set to increase by 4.1% in 2025 really mean for you?

- For Potential Homebuyers: If you're planning to buy a home in the near future, this forecast suggests that waiting might mean paying more. Saving up a larger down payment and getting your finances in order sooner rather than later could be beneficial. It also highlights the importance of working with a knowledgeable real estate agent who can help you navigate the market.

- For Current Homeowners: If you already own a home, this projected price increase could mean an increase in your home's equity. This can be good news if you're thinking about selling in the future or leveraging your equity for other financial goals. However, it's also important to remember that real estate is local, and price changes can vary significantly depending on your specific area.

- For the Overall Economy: The housing market is a significant part of the overall economy. Increases in home prices can contribute to wealth creation for homeowners but can also create affordability challenges for those trying to enter the market. It's a delicate balance that policymakers and economists closely watch.

My Take on the Housing Market Forecast

Having followed the housing market for a while, I think Fannie Mae‘s forecast of a 4.1% increase in home prices are set to increase by 4.1% in 2025 is a reasonable one, given the current economic conditions and the persistent supply-demand imbalance. While the slight downward revision in home sales suggests some caution, the projected decrease in mortgage rates could provide some offsetting support.

However, it's crucial to remember that forecasts are just that – predictions based on the best available data at a specific point in time. Unexpected economic shifts, changes in government policies, or even regional factors could influence the actual outcome. For instance, if the economy weakens more than anticipated, or if interest rates don't decline as predicted, the rate of home price appreciation could be lower. Conversely, if we see a sudden surge in demand or a more significant constriction in supply, prices could rise even faster.

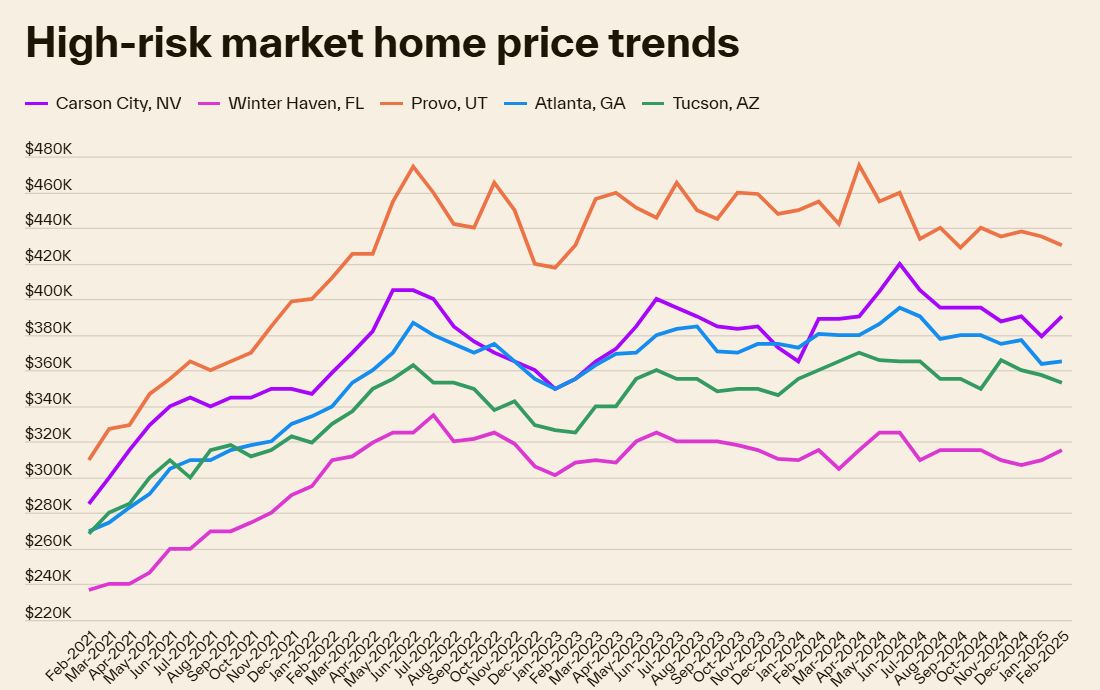

In my opinion, while a nationwide average increase of 4.1% is projected, the experience will likely vary quite a bit from one housing market to another. Areas with strong job growth and limited housing inventory are likely to see more significant price increases, while other areas might experience slower growth or even price stabilization.

What Should You Do Next?

If you're actively involved in the housing market, whether as a buyer, seller, or homeowner, it's essential to stay informed. Here are a few things I recommend:

- Talk to a Real Estate Professional: A local real estate agent can provide valuable insights into your specific market and help you understand the current trends.

- Monitor Economic Indicators: Keep an eye on reports related to economic growth, employment, and inflation, as these can indirectly impact the housing market.

- Assess Your Personal Financial Situation: Understand your affordability and make informed decisions based on your individual circumstances.

- Don't Panic: Real estate is a long-term investment. Avoid making rash decisions based solely on short-term forecasts.

Looking Ahead

The housing market is constantly evolving, and while Fannie Mae‘s prediction that home prices are set to increase by 4.1% in 2025 provides a useful outlook, it's just one piece of the puzzle. By staying informed and understanding the underlying factors, you can make more confident decisions about your housing future.

Work with Norada, Your Trusted Source for

Real Estate Investment in the Top U.S. Markets

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Will Real Estate Rebound in 2025: Top Predictions by Experts

- Recession in Real Estate: Smart Ways to Profit in a Down Market

- Will There Be a Real Estate Recession in 2025: A Forecast

- Will the Housing Market Crash Due to Looming Recession in 2025?

- 4 States Facing the Major Housing Market Crash or Correction

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?