Rental Vacancy Rates on the Rise

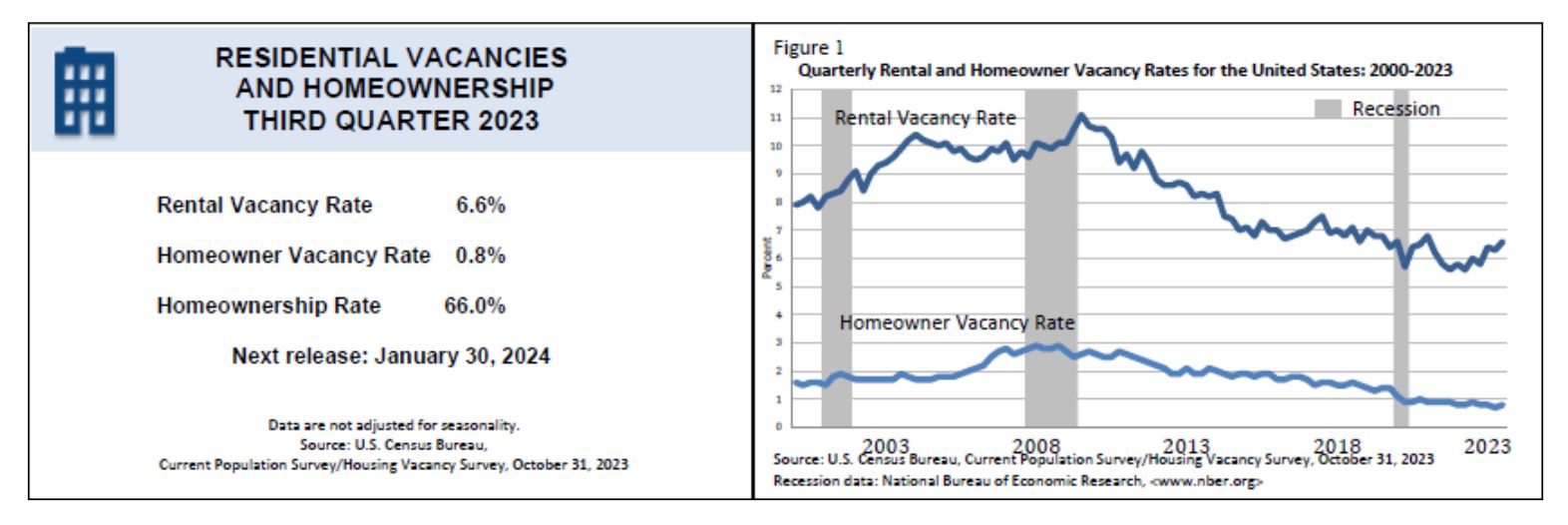

The rental vacancy rate in the United States ticked up in the third quarter of 2023, according to data from the U.S. Census Bureau. The rate climbed to 6.6%, up from 6.3% in the second quarter.

This increase could be due to a number of factors, including rising rents, a slowing economy, or a shift in renter preferences. Whatever the cause, the higher vacancy rate could mean more options for renters, but it could also put pressure on landlords to offer lower rents or concessions.

It will be interesting to see how the rental market evolves in the coming months. If the vacancy rate continues to rise, it could put downward pressure on rents. However, if the economy picks up, the vacancy rate could start to decline again.

In the meantime, renters should be aware of their options and negotiate with their landlords if they can. Landlords, on the other hand, may need to be more flexible with their pricing and terms in order to attract and retain tenants.

- The vacancy rate is not the same in all parts of the country. Some areas, such as coastal cities, have much lower vacancy rates than others.

- The vacancy rate for different types of rental units also varies. For example, the vacancy rate for apartments is typically lower than the vacancy rate for houses.

- The vacancy rate is just one indicator of the health of the rental market. Other factors, such as rents and apartment turnover, also need to be considered.

Homeownership Vacancy Rate

The homeowner vacancy rate held steady at 0.8% in the third quarter of 2023. This is not statistically different from the rate in the third quarter of 2022 (0.9%) and higher than the rate in the second quarter of 2023 (0.7%).

The homeownership rate of 66.0% was virtually the same as the rate in the third quarter of 2022 (66.0%) and not statistically different from the rate in the second quarter of 2023 (65.9%).

Analysis of Rental and Homeowner Vacancy Rates (2020-2023)

The data provided by the U.S. Census Bureau shows the rental and homeowner vacancy rates for the United States from 2020 to 2023.

Here are some key observations:

Rental vacancy rates:

- The rental vacancy rate has been steadily increasing since 2020, reaching 6.6% in the third quarter of 2023.

- The highest rental vacancy rate was in the first quarter of 2021 (6.8%), while the lowest was in the second quarter of 2022 (5.6%).

Homeowner vacancy rates:

- The homeowner vacancy rate has been relatively stable over the past four years, fluctuating between 0.7% and 0.9%.

- The highest homeowner vacancy rate was in the first quarter of 2020 (1.1%), while the lowest was in the second quarter of 2023 (0.7%).

These trends suggest that the rental market may be softening, while the homeowner market remains tight. This could be due to a number of factors, such as rising rents, a slowing economy, or changes in renter preferences.

It is important to note that these are just national trends, and vacancy rates can vary significantly depending on the location. For example, vacancy rates tend to be higher in urban areas than in rural areas.

Additional insights:

- The average rental vacancy rate in 2023 was 6.4%, which is higher than the average rate in 2020 (6.2%) and 2021 (6.2%).

- The average homeowner vacancy rate in 2023 was 0.8%, which is lower than the average rate in 2020 (0.9%) and 2021 (0.9%).

- The rental vacancy rate peaked in the first quarter of 2021 and has been declining since then.

- The homeowner vacancy rate peaked in the first quarter of 2020 and has been relatively stable since then.