Arizona's housing market has been on a rollercoaster ride in recent years. While the national market shows signs of cooling, Arizona remains a seller's market in many areas. Let's dive into the current trends to understand how things are unfolding.

How is the Arizona Housing Market Doing in 2024?

The Arizona housing market is experiencing a rise in home prices and an increase in the number of homes for sale. However, the market remains competitive, with a notable percentage of homes selling above the list price. Migration trends indicate a strong interest in moving to Arizona, reinforcing its appeal as a desirable destination. As market conditions continue to evolve, staying informed about these trends is crucial for both buyers and sellers.

One of the most pressing questions in the real estate market is whether home prices in Arizona will go down in 2024. The data and forecasts show that while there might be minor fluctuations, the overall trend appears to be positive. With an expected increase in home values in major cities like Phoenix and Tucson, it suggests a stable and potentially appreciating housing market.

Arizona Home Prices

As of May 2024, home prices in Arizona were up 3.6% compared to last year, with a median price of $451,500. However, the number of homes sold was down 6.2% year over year, with 9,838 homes sold in May this year, compared to 10,488 homes sold in May last year. The median days on the market increased by 3 days, reaching 51 days.

Arizona Housing Supply

In May 2024, there were 38,949 homes for sale in Arizona, up 21.6% year over year. The number of newly listed homes was 11,486, an increase of 15.3% year over year. The average months of supply remained steady at 3 months.

Arizona Housing Demand

In May 2024, 17.5% of homes in Arizona sold above list price, down 1.5 points year over year. The percentage of homes that had price drops increased to 33.7% from 27.0% the previous year. The sale-to-list price ratio was 98.4%, up 0.09 points year over year.

Top 10 Metros in Arizona with the Fastest Growing Sales Price

- Eloy, AZ – 34.3%

- Tanque Verde, AZ – 30.4%

- Fort Mohave, AZ – 16.5%

- Gold Canyon, AZ – 14.9%

- Paradise Valley, AZ – 13.1%

- New Kingman-Butler, AZ – 11.8%

- Fountain Hills, AZ – 11.7%

- Catalina Foothills, AZ – 9.9%

- Yuma, AZ – 9.4%

- Fortuna Foothills, AZ – 6.6%

Hence, the Arizona housing market has its ups and downs, but it remains strong and attractive to both buyers and sellers. Keeping an eye on the latest data and forecasts is crucial for making informed real estate decisions in this dynamic market.

Are Home Prices Dropping in 2024?

Home prices are not dropping in 2024; in fact, they have increased. In May 2024, home prices in Arizona rose by 3.6% year over year, reaching a median price of $451,500. This trend indicates a continued appreciation in home values rather than a decline.

Is the Arizona Housing Market Slowing Down?

The housing market shows signs of slowing down, with a 6.2% decrease in the number of homes sold year over year. Additionally, the median days on the market increased to 51 days, suggesting that homes are taking longer to sell. However, the overall demand remains strong, as indicated by the percentage of homes still selling above list price.

Arizona Housing Market Predictions for 2024

The Arizona housing market has been a topic of much discussion lately. With a median home value of $434,865 and a quick turnaround time (pending in 21 days!), it's clear there's still a strong buyer presence. But what does the future hold? Will the market experience a crash or continue to boom? Let's delve into the data and see what experts predict.

Current Market Snapshot (April 2024):

- Median sale price: $422,000

- Median list price: $480,997 (indicating a competitive market)

- Median sale-to-list ratio: 0.989 (close to asking price)

- Percent of sales over list price: 17.2% (indicates some bidding wars)

- Percent of sales under list price: 57.5% (higher than usual, possibly reflecting a market shift)

MSA Forecasts (May 2024, July 2024, April 2025):

The provided table shows predicted price increases for various MSAs (Metropolitan Statistical Areas) in Arizona. Here's a breakdown:

- Major cities like Phoenix and Tucson: These areas are expected to see modest but steady growth, with an increase of 0.3-1.2% by May 2024, reaching 0.7-1.1% by July 2024, and continuing a similar trajectory through April 2025.

- Lake Havasu City and Sierra Vista: These MSAs might see stagnation or even a slight dip (-0.2%) by April 2025.

- Yuma and Flagstaff: Yuma's forecast suggests a potential for more significant growth, reaching 1.6% by April 2025. Flagstaff shows a similar upward trend, with a projected increase of 2.8% by the same timeframe.

- Other MSAs: Show Low, Payson, Nogales, and Safford are all expected to experience moderate growth, ranging from 0.6% to 1.6% by April 2025.

Will it Crash or Boom?

The data suggests a stabilization rather than a dramatic boom or crash for the Arizona housing market. Here's why:

- Price growth: While prices are still rising, the forecast indicates a slower and more controlled increase compared to the rapid escalation seen in previous years.

- Inventory: There might be a shift in the seller-dominated market. The higher percentage of sales under list price could indicate a slight rise in inventory, giving buyers more negotiating power.

- Interest rates: Rising interest rates can impact affordability and potentially dampen buyer enthusiasm.

Overall, Arizona's housing market appears to be transitioning from a white-hot seller's market to a more balanced one. This provides opportunities for both buyers and sellers to navigate the market with a more realistic perspective.

The takeaway? Arizona's housing market is likely to experience continued growth, but at a more measured pace. While a dramatic crash is unlikely, it's wise to stay informed about market trends and local economic conditions before making any real estate decisions.

If mortgage rates go on a decreasing trajectory in 2024, prospective buyers may return to the market to increase the demand. The important thing to take away from the shortage of housing units is that economists anticipate that the price of homes may continue to rise slowly in the AZ housing market in 2024.

On the supply side, it favors the property sellers. The bottom line here is that a stark imbalance between supply and demand continues to put upward pressure on AZ home prices. This partly accounts for the somewhat bold Arizona real estate market forecast for coming years. The other factors are that the economy of Arizona is robust, but the state is struggling with elevated levels of inflation and housing price growth. In 17 different states, the unemployment rate is at an all-time low.

As of April 2024, Arizona has a 3.6 percent unemployment rate, a 0% change from a year ago. The pace of population increase in Arizona is the fourth fastest in the country. A significant number of states saw a loss in population as a consequence of COVID-19, low birth rates, and migration to neighboring states. Florida, Texas, and Arizona are the three states with the most rapid population increases. Years of underbuilding are a key contributor to the low inventory.

According to a study conducted by the Weldon Cooper Center for Public Service at the University of Virginia, Arizona's population is projected to expand by 26.1% between 2020 and 2040 – an increase of 1,897,585 people. As the population is expected to rise yet there are only a few available homes on the market.

This also raises a bit of a concern that in Arizona wages are not keeping up with the rising costs of housing. When prices go up, some buyers can no longer afford to buy and drop out. The faster that pricing goes up, the more buyers tend to drop out, at least in a healthy market. Mortgage rates also play an impact here. In the past few years, interest rates have remained at historically low levels.

This is one of the causes that contributed to a countrywide increase in home-buying activity. However, rates have increased somewhat during the previous several months in 2022. If rates continue to rise, the Arizona real estate market might experience a general cooling trend. However, the persistent supply deficit is projected to “outweigh” this effect, guaranteeing that the AZ housing market will stay competitive long into 2023.

Of course, there is also a great deal of uncertainty in the air. From escalating inflation to the conflict in Ukraine, several elements might affect the economy in the future. Consequently, it is difficult to make reliable projections for the Arizona real estate market or any other market in the United States.

Here's the median price of a home in some of the counties of Arizona

The data shows the median listing home price and listing price per square foot for various counties in Arizona. Maricopa County has the highest number of homes for sale and rent, with a median listing home price of $549K and a listing price per square foot of $286. Coconino County has the highest median listing home price of $725K, while Cochise County has the lowest median listing home price of $296K. The data indicate that the housing market in Arizona is diverse and offers options for buyers with different budgets.

|

Counties

|

Median listing

home price |

Listing

$/SqFt |

For sale

|

For rent

|

|---|---|---|---|---|

|

Maricopa County

|

$559K

|

$287

|

23,704

|

16,545

|

|

Pima County

|

$395K

|

$229

|

4,839

|

938

|

|

Yavapai County

|

$659K

|

$327

|

4,173

|

219

|

|

Pinal County

|

$396K

|

$213

|

5,582

|

665

|

|

Mohave County

|

$410K

|

$247

|

3,938

|

223

|

|

Coconino County

|

$749K

|

$389

|

1,461

|

136

|

|

Navajo County

|

$489K

|

$289

|

1,811

|

53

|

|

Gila County

|

$525K

|

$314

|

853

|

40

|

|

Yuma County

|

$341.5K

|

$215

|

842

|

122

|

|

Cochise County

|

$315K

|

$179

|

1,632

|

77

|

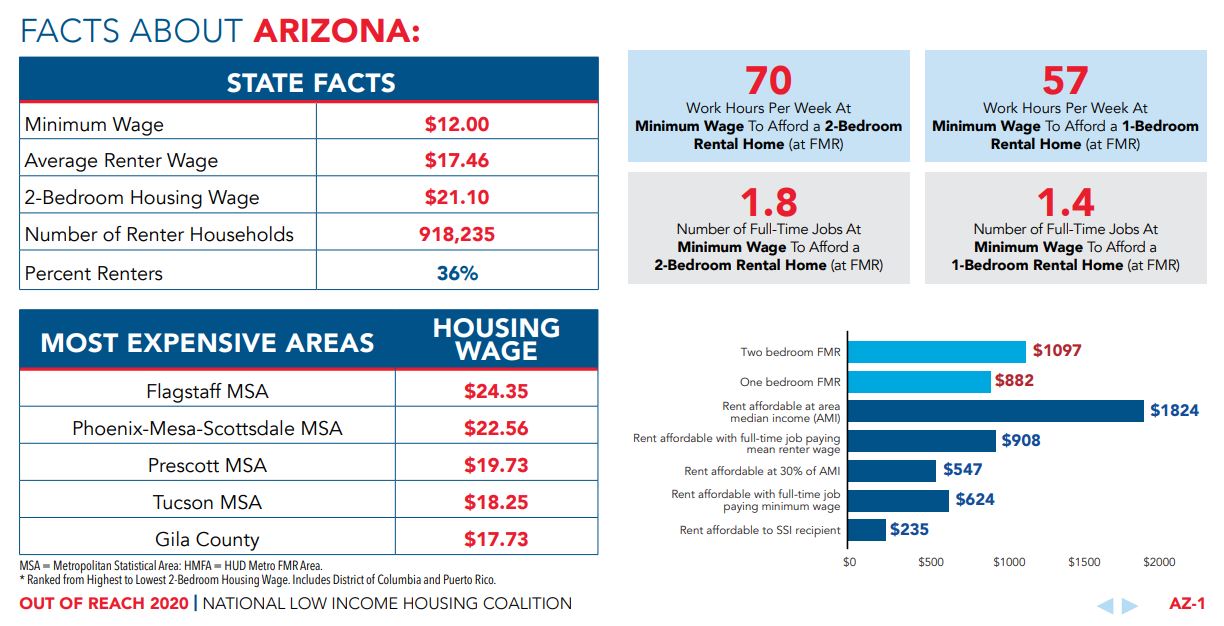

Arizona's housing market has over 900,000 renter households, accounting for 36% of the total number of households. According to a report from the National Low Income Housing Coalition (NLIHC), rental prices in Arizona have become out of reach for many residents. For too many low-income workers, wages have not kept pace with rising rents and home prices. Workers need to make $21.10 an hour to afford a 2-bedroom rental at a fair-market rate.

In Arizona, the Fair Market Rent (FMR) for a two-bedroom apartment is $1,097. To afford this level of rent and utilities — without paying more than 30% of income on housing — a household must earn $3,658 monthly or $43,892 annually. Assuming a 40-hour workweek, 52 weeks per year, this level of income translates into an hourly Housing Wage of $21.10.

The minimum wage in Arizona is $12.00/hr and the Average Renter Wage is $17.46. Cost-burdened is defined as spending more than 30% of one’s monthly income on housing and utilities. Neighborhoods in west and South Phoenix are the most cost-burdened. In some cases, more than 50% of households are paying 30% or more of their income on housing costs, while less than 29% of renting households are housing cost-burdened in the north.

Flagstaff MSA is the most expensive MSA where you need an hourly wage of $24.35 to afford a 2-bedroom rental. The second most expensive MSA is Phoenix-Mesa-Scottsdale, where you need an hourly wage of $22.56 to afford a 2-bedroom rental.

Between 2010 and 2018, the City of Phoenix’s median income increased by only 10%, median rent increased by over 28%, and the median home price increased by over 57% during this time. In 2018, half of Phoenix renters were considered housing-cost burdened, 25% of homeowners were housing-cost burdened and altogether 36% of the entire population is housing-cost burdened. According to a report by Phoenix.gov, 65 % of households that fall within or below the moderate-income range would require some amount of subsidy to achieve housing that is considered affordable at their income level.