Florida's recent housing boom has been nothing short of spectacular. Fueled by low interest rates, remote work opportunities, and an influx of retirees, home prices skyrocketed, with some coastal havens experiencing double-digit growth year after year. However, the winds of change are blowing. Rising mortgage rates, inflation, and economic headwinds have cast a shadow over the once-sizzling market.

The Florida housing market is currently in a state of moderation and slight growth, with different indicators presenting a nuanced picture.

Prices:

- Slowly rising: Median home prices in Florida are seeing gradual increases.

- Regional variations: While the statewide trend is upward, price changes vary within the state. Some areas, like Miami and Tampa Bay, experienced higher price jumps, while others saw slower growth or even slight declines.

Sales:

- Holding steady: The number of homes sold isn't experiencing dramatic swings, remaining relatively stable compared to the previous year.

- Days on the market: Homes are spending a bit longer on the market compared to the peak of the seller's market, indicating a shift towards buyer equilibrium.

When Will the Housing Market Crash in Florida?

No crash coming in Florida. Instead, the market is exhibiting signs of stabilization with slower but continued growth. A chorus of voices suggests a slowdown rather than a dramatic crash.

Here's why:

- Demand Still Outpaces Supply: Florida's inventory remains tight, with more buyers chasing fewer homes. This imbalance, while easing slightly, prevents a glut that could trigger a freefall.

- Stronger Financial Footing: Unlike the 2008 crisis, homeowners today boast better credit scores and equity built from years of appreciation. This reduces the risk of mass defaults and forced sales.

- No “Subprime” Specters: Stricter lending regulations have choked out the risky subprime mortgages that fueled the last crash. Most Florida mortgages are secured by solid borrowers.

- More balanced market: Buyers are gaining slightly more leverage compared to the previous strong seller's market, with less competition and slightly reduced sale-to-list ratios.

However, clouds on the horizon cannot be ignored:

- Affordability Squeeze: Higher interest rates have made homes significantly more expensive. This could price out first-time buyers and eventually dampen demand.

- Economic Downturn Looms: Recessionary fears might lead to job losses and decreased consumer confidence, impacting the housing market indirectly.

- Local Variations: While the statewide picture might be stable, specific regions, particularly luxury segments, could experience sharper corrections.

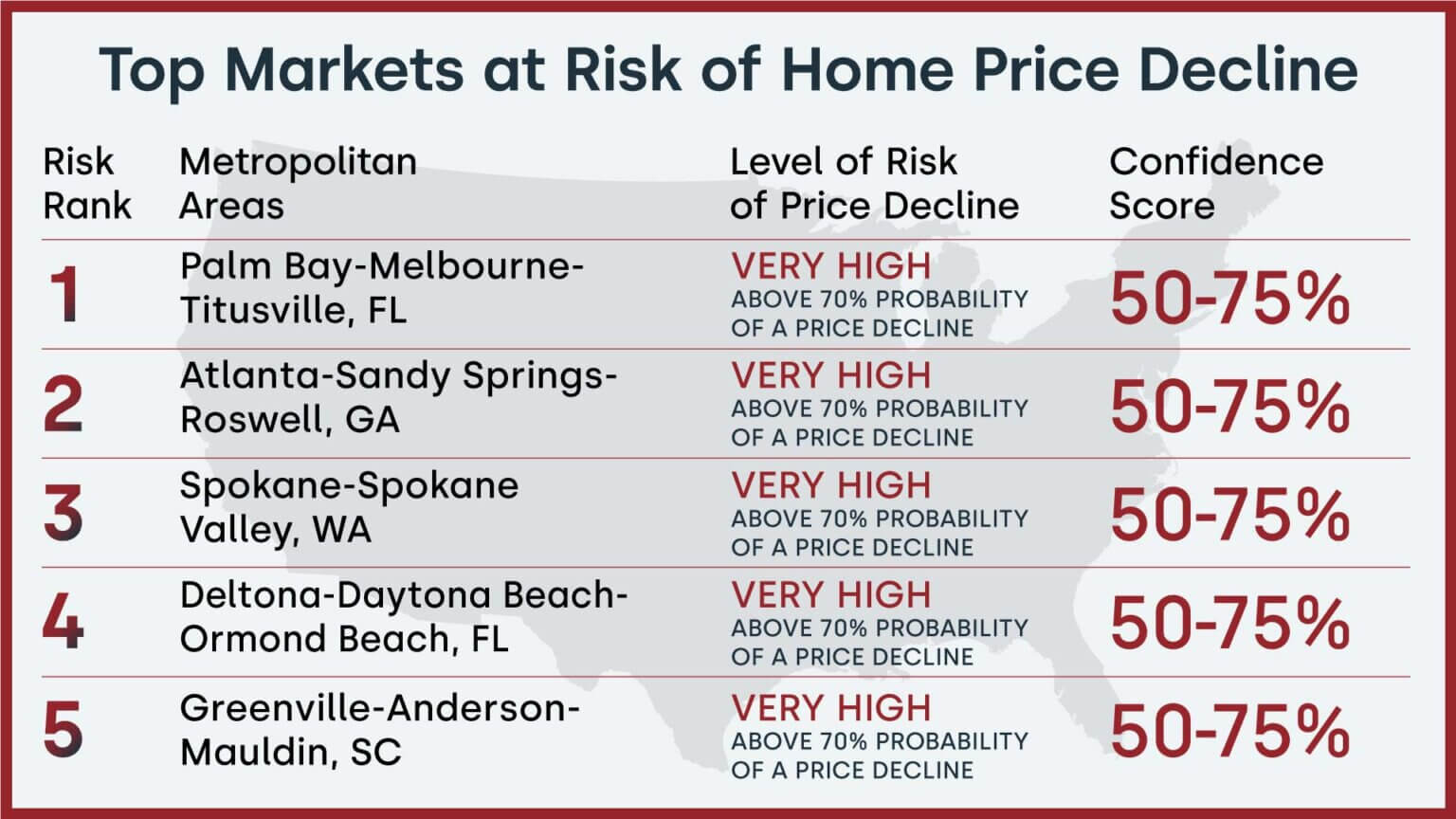

Riskiest Florida Markets to Avoid in 2025

With interest rates rising and economic uncertainty looming, the riskiest Florida markets to avoid in 2025 are starting to emerge. Based on recent data, West Palm Beach-Boca Raton-Delray Beach, FL is at a very high risk of home price declines in the coming year. This market is showing signs that might lead to slower growth in home values or even a price drop in the near future.

Understanding the CoreLogic Market Risk Indicator (MRI)

The CoreLogic Market Risk Indicator (MRI) is a monthly report that gives insights into the overall health of housing markets across the country. It looks at a range of factors, including job growth, home price trends, inventory levels, and affordability. When the MRI shows a high risk of price declines, it suggests that those markets could be facing some challenges in the coming months.

As a real estate professional, I understand that these indicators don't guarantee a decline. However, they flag specific markets that deserve careful consideration, especially for people planning to buy a property. It's always a good idea to do your own thorough research before making any big real estate decisions.

Florida Market Facing Potential Price Declines

According to recent data, the following Florida market is at a very high risk of a price decline over the next 12 months:

- West Palm Beach-Boca Raton-Delray Beach, FL: This area in South Florida is now flagged as one of the riskiest Florida markets to avoid in 2025. The risk factors include affordability challenges and a potential slowdown in economic growth.

My Take on the Situation

This is a good reminder that real estate is not always a one-way bet. While Florida remains a popular place to live, potential home buyers need to be mindful of the risks that certain markets are facing. It's always wise to be cautious in the face of a cooling market and uncertainty.

Navigating the Uncertain Shores:

So, what does this mean for sellers, buyers, and investors?

- Sellers: Be prepared for longer listing times and potentially revised price expectations. Adapting to a buyers' market might be necessary.

- Buyers: Patience is key. Bargains might emerge, but don't rush into impulsive purchases. Wait for the right fit and ensure financial stability.

- Investors: Diversification is crucial. Research thoroughly and consider long-term holding strategies to weather potential fluctuations.

It's important to remember that “crash” might be an overblown term. A Florida housing market correction, characterized by slower growth or even minor price dips, is a more likely scenario. The Sunshine State's allure remains potent, fueled by its natural beauty, favorable tax climate, and growing job market.

The Final Thought:

Overall, it's still too early to predict the exact trajectory of the market in 2025 and beyond. Factors like rising interest rates and economic fluctuations could impact future trends. Florida's housing market might not face a devastating crash, but a period of readjustment is inevitable. Adaptability, caution, and a long-term perspective will be the anchors during this voyage.

Recommended Read:

- Florida Real Estate: 9 Housing Markets Predicted to Rise in 2025

- Florida Housing Market Forecast for Next 2 Years: 2025-2026

- 3 Florida Housing Markets Are Again on the Brink of a Crash

- Florida Housing Market Predictions 2025: Insights Across All Cities

- Florida Housing Market Trends: Rent Growth Falls Behind Nation

- South Florida Housing Market: Will it Crash in 2025?

- South Florida Housing Market: A Crossroads for Homebuyers