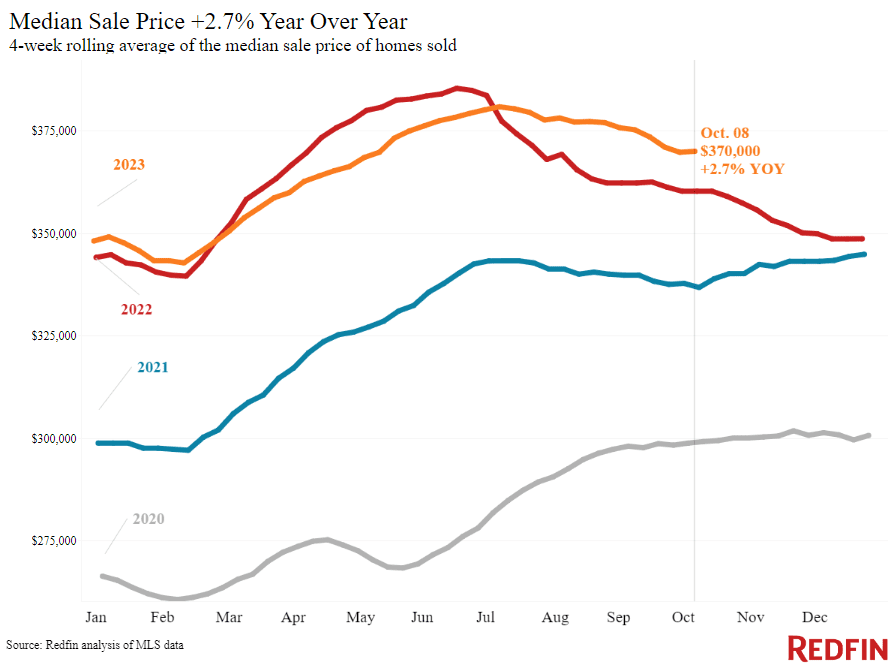

The housing market is experiencing a significant slowdown, with economists predicting that 2023 will be the slowest year for home sales since the 2008 housing bubble burst. According to a recent report by Fox Business, the housing market is facing several challenges, including persistently high mortgage rates and low inventory, which are discouraging potential buyers.

Redfin, a leading real estate brokerage, has estimated that there will be only around 4.1 million sales of existing homes in the United States by the end of 2023. One of the major factors contributing to this decline is the soaring mortgage rates, which currently stand at a staggering 7.63%. These high rates are dissuading many potential homebuyers from entering the market, making 2023 one of the toughest years for real estate sales.

According to Redfin's economic research lead, Chen Zhao, “Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low.

The current mortgage rates are the highest they've been in over two decades, which is causing a growing number of buyers to hesitate about entering the market. Recent data from the Mortgage Bankers Association reveals that mortgage applications have dropped to their lowest level since 1995, further confirming the challenges the housing market is facing.

A Stark Comparison to 2008

The situation in 2023 draws a striking comparison to the housing market crash in 2008, which was triggered by a combination of factors, including the subprime mortgage crisis, high debt levels, and a lack of financial regulation. As reported by Fox Business, this crash led to a severe economic recession that affected millions of Americans, with many finding themselves in homes worth less than their mortgages.

However, one notable difference is that during the Great Recession, plummeting home prices created opportunities for first-time homebuyers to enter the market and purchase starter homes. In contrast, the current high mortgage rates are discouraging potential buyers, leading to a stagnant market and further worsening inventory issues.

Impact on Homebuyer Demand

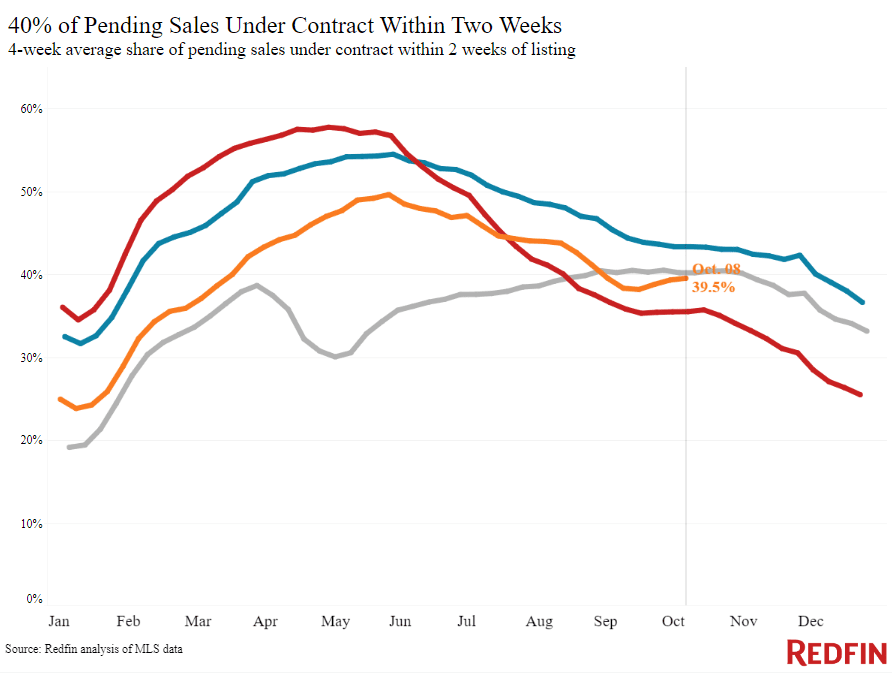

Redfin's Homebuyer Demand Index, which measures early-stage demand indicators such as home tours, has fallen to its lowest level in a year. This decline reflects the reduced enthusiasm among homebuyers, who are waiting for better market conditions.

Furthermore, during the four weeks ending on October 15, the housing market saw a nearly 14% decrease in available homes, as homeowners opted to hold onto their lower borrowing rates. While there has been a slight increase in new listings this fall, potential buyers may find better opportunities in the new construction market.

New Construction Offers Hope

Amid the challenging conditions in the existing home market, new construction is emerging as a more attractive option for homebuyers. According to Redfin, sales of newly built homes are holding up better than existing home sales. This is partly because builders are not constrained by low mortgage rates, and they are often more motivated than homeowners to close a deal.

In the United States, sales of new construction homes increased by 1.5% year over year last month. This comes as prices for new construction homes dropped by approximately 4%. These statistics indicate that buyers might find more favorable conditions in the new construction sector, where builders are adapting to the changing market dynamics.

In summary, the 2023 housing market is facing unprecedented challenges, with high mortgage rates and low inventory discouraging potential homebuyers. These conditions have led economists to project that 2023 will witness the fewest home sales since the 2008 housing market crash. This situation is a stark contrast to the opportunities that emerged during the Great Recession, as today's high rates are keeping more homebuyers on the sidelines.

However, amidst these challenges, new construction homes are offering hope to buyers, with sales in this sector holding up better and prices dropping. As we navigate these uncertain times, potential homebuyers may find new opportunities in the evolving real estate market.