Selling a house is a big decision that requires careful consideration, especially in today's uncertain economic climate. Given the dramatic rise in mortgage rates over the past year, this is a question on the minds of many sellers who are considering selling their homes. The latest survey reveals that the percentage of respondents who believe it is a good time to sell a house has increased while those considering it a bad time to sell have decreased. Let's take a closer look at the factors that can influence whether it's a good time to sell your house.

Is It a Good Time to Sell a House in 2024?

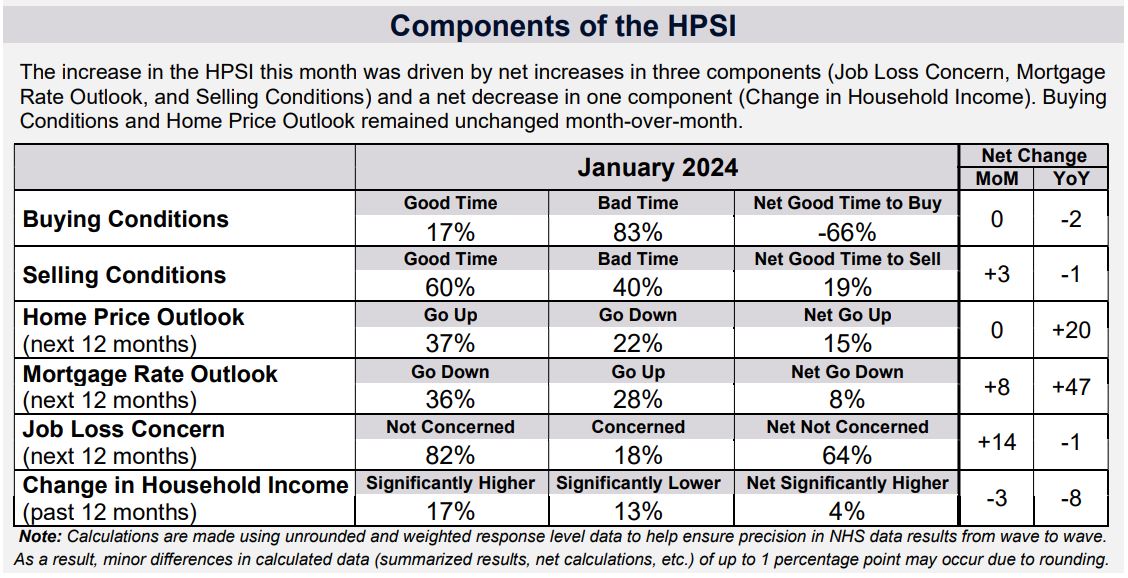

Consumer sentiment toward housing has reached its highest level in nearly two years, according to the Fannie Mae Home Purchase Sentiment Index® (HPSI). In January, the index increased by 3.5 points to 70.7, marking its highest level since March 2022. This positive trend is attributed to increased consumer confidence in job security and a significant rise in the percentage of consumers expecting mortgage rates to decrease.

Job Security and Mortgage Rate Expectations

In January, 82% of consumers expressed confidence in job security for the next 12 months, up from 75% the previous month. Additionally, a survey-high 36% of respondents anticipate mortgage rates to decrease in the next year. This optimistic outlook on job security and mortgage rates contributed to the overall positive sentiment in the housing market. However, despite these positive indicators, consumer perceptions of homebuying conditions remain predominantly pessimistic, with only 17% considering it a good time to buy a home.

Is It a Good Time to Sell?

The percentage of respondents who believe it is a good time to sell a home increased from 57% to 60%, while those considering it a bad time to sell decreased from 42% to 40%. This shift resulted in a 3-percentage point increase in the net share of those who think it is a good time to sell, signaling a growing confidence in the housing market from the seller's perspective.

On the other hand, the percentage of respondents who feel it is a good time to buy a home remained unchanged at 17%, with 83% maintaining that it's a bad time to buy. As a result, the net share of those who believe it is a good time to buy remained constant month over month.

Home Price and Mortgage Rate Expectations

Expectations regarding home prices in the next 12 months showed a slight shift. The percentage of respondents predicting an increase decreased from 39% to 37%, while those anticipating a decrease reduced from 24% to 22%. Simultaneously, the share expecting home prices to stay the same increased from 36% to 40%, resulting in a net share that remained unchanged month over month.

In terms of mortgage rate expectations, there was a notable increase in optimism. The percentage of respondents anticipating a decrease in mortgage rates over the next 12 months rose from 31% to 36%, while those expecting an increase decreased from 31% to 28%. The net share of those predicting a decline in mortgage rates increased by 8 percentage points, reflecting growing optimism in the market.

Job Loss Concern and Household Income

Concerns about job loss saw a positive shift, with the percentage of respondents not concerned about losing their job in the next 12 months increasing from 75% to 82%. In contrast, those expressing concern decreased from 24% to 18%, resulting in a net share increase of 14 percentage points month over month.

On the topic of household income, the percentage of respondents reporting significantly higher household income than 12 months ago decreased from 20% to 17%. However, the percentage indicating their income remained about the same increased from 67% to 69%. The net share of those reporting significantly higher household income decreased by 3 percentage points month over month.

Insights from Fannie Mae's Chief Economist

Doug Duncan, Fannie Mae's Senior Vice President and Chief Economist, noted that mortgage rate optimism reached a new high in January. A greater percentage of consumers believe mortgage rates will decrease over the next year rather than increase. Despite this optimism, challenges persist in the housing market, such as low affordability, stagnant perceptions of home prices, and a historically low sentiment regarding the opportune time to buy a home.

Duncan emphasized that a lower mortgage rate trajectory supports the forecast for increased housing demand and sales activity in 2024. However, until there is a meaningful increase in housing supply, affordability is expected to remain a significant barrier to homeownership for many households.

Should I Sell My House Now or Wait?

So, the question remains, should you sell your house in 2024 or wait until 2025? The answer is not straightforward, as it depends on a number of factors specific to your personal situation. Some of the key considerations are discussed below. Selling a house is a major decision that requires careful consideration of various factors, including market conditions, personal circumstances, and financial goals.

Assess Current Market Conditions

The first step in deciding whether to sell your house now or wait is to evaluate the current state of the real estate market in your area. Consider the following:

- Local Housing Market: Research recent sales data for homes similar to yours in your neighborhood. Are properties selling quickly or languishing on the market? A seller's market, characterized by high demand and low inventory, might be favorable for selling now.

- Home Prices: Monitor trends in home prices in your area. If prices have been steadily increasing, it could be an advantageous time to sell.

- Interest Rates: Keep an eye on mortgage interest rates. Lower rates might attract more buyers to the market, potentially leading to a quicker sale.

Evaluate Your Financial Goals

Your personal financial goals and needs play a significant role in the decision-making process:

- Profit Margin: Consider how much equity you have in your current home. If you've built substantial equity and can sell at a profit, it might be a good time to capitalize on your investment.

- Downsizing or Upsizing: Are you planning to downsize or upsize? Your plans for your next home can influence the timing of your sale. If you're downsizing, the current market conditions might align well with your goals.

Life Circumstances

Your personal circumstances should also be factored in:

- Job Relocation: If you're moving for a new job or career opportunity, the timing of your move might be determined by external factors.

- Family Changes: Life events like marriage, divorce, or growing families can impact your housing needs. Consider how your changing family circumstances play into your decision.

Market Trends and Projections

While it's impossible to predict the future with certainty, researching market trends and projections can provide insights into potential market shifts. Consult with real estate professionals who can offer expert opinions on where the market might be headed.

Real estate professionals, including real estate agents and financial advisors, can offer invaluable guidance. An experienced real estate agent can provide a Comparative Market Analysis (CMA) to help you understand your home's value in the current market. Financial advisors can help you evaluate the financial implications of selling now versus waiting.

Examining the current housing market trends and data provided by Realtor.com, it's essential to evaluate whether it's an opportune moment to sell a house or if waiting might be a strategic move. Let's delve into the key findings to make an informed decision:

Recent Surge in Newly Listed Homes

The past week witnessed a significant surge in newly listed homes, indicating that sellers are closely monitoring mortgage rates and adjusting their strategies accordingly. The active for-sale inventory continued to rise, exerting downward pressure on prices. However, the acceleration in price growth after a recent decline suggests that housing demand remains robust. The decline in mortgage rates has enticed more buyers into the market, offsetting improvements on the supply side and propelling price growth.

Despite the encouraging boost in listing activities, further data points are necessary to confirm whether sellers are responding promptly and to assess the sustainability of this improvement. If supply-side improvements do not align with increasing buyer demand, there is the potential for prices to continue rising, contributing to the persistence of elevated home prices.

Median Listing Price and Price Growth

The median listing price experienced a 0.9% growth compared to the same week last year. Although home price growth eased from 2.2% to 0.2% in January, it ticked up again in the first week of February. Home prices have been in a holding pattern since May 2023, deviating from prior year levels by a range of -0.9% to +2.2%. This suggests a more stable market compared to the intense price growth observed in 2021 to 2023.

New Listings and Regional Variations

Newly listed homes, a measure of sellers putting homes up for sale, saw a significant increase of 12.8% from one year ago. This marks the 15th consecutive week with levels above those of the previous year. The biggest jumps were observed in Denver (+21.3%), Seattle (+20.6%), and Miami (+20.2%). However, the sustainability of this improvement requires further assessment, as highlighted in Realtor.com's January Housing Trends Report.

Active Inventory and Home Options

Active inventory increased, with for-sale homes standing 12.2% above year-ago levels. This marks the 13th consecutive week with active listings surpassing the previous year's numbers, providing today's home shoppers with more choices. Despite the improvement, overall inventory remains low, down nearly 40% below 2017 to 2019 levels for the month of January.

Time on Market Dynamics

Homes spent three days less on the market compared to the same time last year, continuing a trend observed for 18 consecutive weeks. However, the gaps are more modest than the significant drops seen in late 2020 through 2022. January's overall time on the market was 69 days, down 4 days from 2023 but up 10 days from 2022's record low.

Conclusion: A Balancing Act for Home Sellers

Considering the current trends in the housing market, the decision to sell a house now or wait involves a delicate balancing act. Sellers must weigh the increased options for home shoppers, the potential for rising prices, and the stability observed in the median listing prices. As the market continues to evolve, staying informed and assessing the dynamic interplay between supply and demand is paramount for making a well-informed decision.

Sources

- https://www.fanniemae.com/research-and-insights/surveys-indices/national-housing-survey

- https://www.realtor.com/research/articles/