The San Diego housing market shimmers with the same star power as its beaches. A booming tech sector, stunning scenery, and a vibrant lifestyle fuel demand and push prices higher than the national average. This haven for retirees and young professionals alike presents a competitive landscape for buyers.

While the sunshine may be plentiful, affordability can be a challenge. Before diving into this market, understanding its unique characteristics and current trends is crucial for making informed investment decisions. This article will equip you with the knowledge you need to navigate the San Diego real estate market, from home values and current trends to strategies for securing your dream property.

How is the San Diego Housing Market Doing in 2024?

The surge in home prices coupled with robust sales activity suggests that the San Diego housing market is among the hottest in the nation. San Diego recorded the third month of double-digit annual increases in March and led the 20-city index. Home prices were up 11.1% year over year, according to the latest S&P/Case-Shiller Home Price Index.

Home Sales in San Diego

In June 2024, San Diego's real estate landscape witnessed notable shifts in home sales. The total number of homes sold dropped by 9.0% compared to May 2024 and 1.9% year-over-year (C.A.R.). This decline indicates a cooling trend that many experts believe is a natural consequence of rising interest rates and an ongoing adjustment to market dynamics.

For a broader perspective, the Southern California region experienced a similar downturn in sales, with a drop of 11.5% both month-over-month and year-over-year. This collective slowdown suggests that buyers may be facing affordability challenges and are becoming more cautious in their purchasing decisions.

Home Prices in San Diego

One of the most striking aspects of the San Diego housing market in June 2024 is the median sold price of existing single-family homes, which reached an impressive $1,054,180. This figure marked a 2.8% increase from the previous month and a noteworthy 10.0% rise from June 2023. The consistent upward trajectory in home prices highlights the enduring demand for properties in the area, despite the decline in sales.

In contrast, the Southern California region's median home price dipped slightly to $875,000, reflecting a 0.6% decrease month-over-month. Yet, it still signifies a 7.4% increase year-over-year, indicating that while prices may be stabilizing, the overall trend remains positive.

Market Trends in San Diego

The current market trends in San Diego reveal a complex interplay between supply and demand. Inventory levels have tightened, as many homeowners opt to stay put in their current homes due to low interest rates secured in previous years. This reluctance to sell has contributed to the stability in home prices, even amidst declining sales figures.

Moreover, buyer sentiment appears to be shifting. With rising interest rates and an uncertain economic climate, prospective homebuyers are exhibiting caution. Many are opting to wait and see how the market develops over the next few months, preferring to avoid the financial strain of higher mortgage payments.

In addition, the luxury segment of the housing market in San Diego has shown resilience, with high-end properties still commanding significant prices. This trend suggests that while entry-level buyers may be struggling, the affluent demographic remains active and confident in their purchasing decisions.

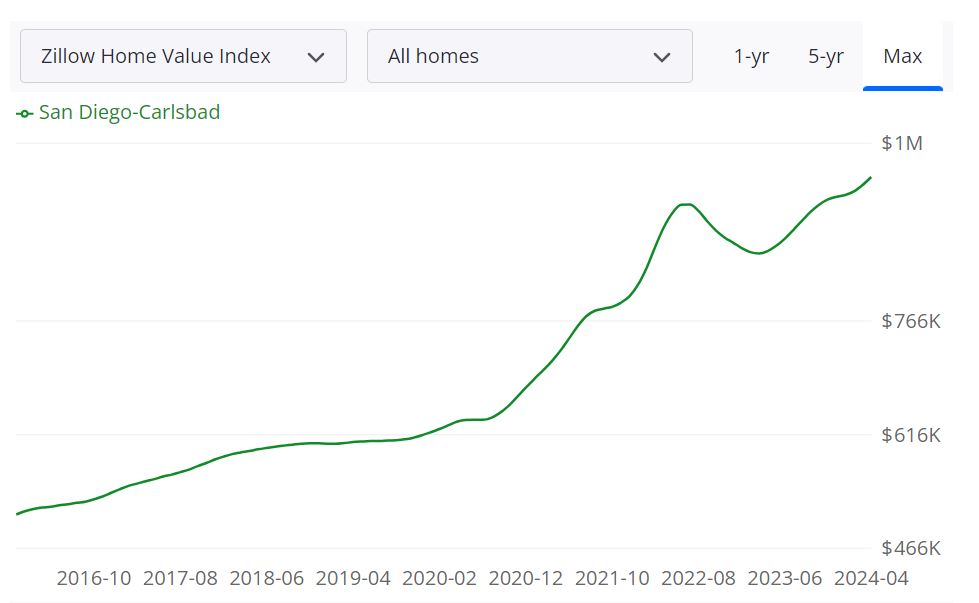

San Diego Real Estate Appreciation Trends

San Diego's allure as a coastal paradise translates into a thriving real estate market. Home values have consistently risen over the past decade, making it an attractive location for homeowners and investors. Let's explore the data and the trends that have fueled San Diego's real estate appreciation.

A Decade of Strong Growth

San Diego's housing market has outpaced national averages for ten years. The impressive cumulative appreciation rate of 100.78% places San Diego within the top 30% nationwide. This translates to a healthy annual average appreciation rate of 7.22% (NeighborhoodScout).

Breaking Down the Numbers

While the latest quarter (Q3 2023- Q4 2023) saw a slight dip (-0.44%), it's important to consider this within a broader context. Looking at the last year (Q4 2022- Q4 2023), appreciation remains positive at 4.46%. Over the past five and ten years, the growth trajectory has strengthened considerably, with appreciation rates of 43.91% and 100.78% respectively.

San Diego vs. the National Stage

San Diego's performance is impressive not just in isolation, but also when compared to the state and national averages. Consistently ranking within the top 10 for appreciation rates over various timeframes showcases San Diego's market resilience.

What's Driving the Appreciation?

Several factors contribute to San Diego's strong real estate market:

- Desirable Location: San Diego boasts beautiful weather, stunning beaches, and a vibrant culture, making it a highly sought-after place to live.

- Strong Job Market: The presence of major industries and a thriving tech sector fuel steady job growth, attracting professionals and bolstering housing demand.

- Limited Inventory: The supply of available housing often struggles to keep pace with demand, putting upward pressure on prices.

Looking Ahead

While the real estate market is dynamic and future trends can't be guaranteed, San Diego's strong fundamentals suggest continued appreciation. The combination of a desirable location, a robust economy, and limited inventory positions San Diego's real estate market for ongoing growth.

San Diego Housing Market Predictions 2024

It Will be a Competitive Market with Continued Growth!

The San Diego housing market is forecast to remain a competitive seller's market in 2024, with continued growth in home prices. Here's a detailed look at the current market trends, a one-year forecast based on available data (as of April 30, 2024), and what to expect in the coming months.

Current Market Stats

- Median Sale Price: $855,000 (March 31, 2024) (Zillow)

- Median List Price: $954,300 (April 30, 2024)

- Average Home Value: $957,094 – up 11.4% year-over-year

- Homes Sell Above List Price: 46.2% (March 31, 2024)

- Homes Sell Below List Price: 39.8% (March 31, 2024)

One-Year Market Forecast (April 30, 2024)

- Growth Projection: Analysts predict a positive 1.1% growth in the overall market value within the next year. This suggests a potential increase in the median sale price to around $864,000 by April 2025.

- Continued Seller's Market: With high demand and a limited number of homes available, sellers are likely to continue to have the upper hand in negotiations. Homes are selling quickly, often receiving multiple offers.

- Rising Prices: The median sale price is expected to continue to rise throughout 2024, albeit at a potentially slower pace compared to the previous year due to the forecasted 1.1% growth.

- Inventory Levels: Inventory levels may increase slightly, but demand is likely to remain high. This could create a more balanced market over time, but competition for desirable properties is likely to persist.

- Interest Rates: Interest rates are a factor to watch, as they can impact affordability. While not a major deterrent currently, a significant rise in interest rates could dampen buyer enthusiasm.

Here's the graph showing the San Diego home price appreciation and forecast for the next twelve months.

Can You Afford to Buy a House in San Diego in 2024?

San Diego, with its stunning beaches, vibrant culture, and robust economy, is a desirable place to live. However, the question remains: can you afford to buy a house in this beautiful city in 2024? This data will help you understand the current housing market, interest rates, and affordability for different types of homes in San Diego.

As of May 2024, the housing market in San Diego County continues to be competitive. The market dynamics, including the number of homes for sale, median prices, and monthly payments, vary significantly depending on the size of the home you are looking to purchase.

Interest Rates

The current interest rates have a substantial impact on your mortgage payments. As of May 2024, the interest rates are as follows:

- Current Interest Rate: 7.06%

- Last Year’s Interest Rate: 6.99%

- Last Month’s Interest Rate: 6.43%

The slight increase in interest rates from last year and last month means higher monthly payments for homebuyers.

Affordability by Home Size

1-Bedroom Homes

- Number of Homes for Sale: 271

- Median Price: $515,000

- Monthly Payment (with 20% down): $3,350

- Monthly Payment (with 3% down): $3,936

- Down Payment (20%): $103,000

- Down Payment (3%): $15,000

2-Bedroom Homes

- Number of Homes for Sale: 823

- Median Price: $712,000

- Monthly Payment (with 20% down): $4,630

- Monthly Payment (with 3% down): $5,440

- Down Payment (20%): $142,000

- Down Payment (3%): $21,000

3-Bedroom Homes

- Number of Homes for Sale: 1,166

- Median Price: $940,000

- Monthly Payment (with 20% down): $6,114

- Monthly Payment (with 3% down): $7,184

- Down Payment (20%): $188,000

- Down Payment (3%): $28,000

4+ Bedroom Homes

- Number of Homes for Sale: 1,555

- Median Price: $1.59 million

- Monthly Payment (with 20% down): $10,336

- Monthly Payment (with 3% down): $12,144

- Down Payment (20%): $318,000

- Down Payment (3%): $48,000

Can You Afford to Buy?

Affording a home in San Diego depends on several factors, including your income, savings, and ability to secure a mortgage at the current interest rate. Here are a few considerations:

- Income: Ensure your monthly mortgage payments are no more than 30% of your monthly income.

- Savings: A larger down payment can reduce your monthly payments and overall interest paid.

- Credit Score: A higher credit score can help you secure a lower interest rate.

Given the current median prices and interest rates, buying a home in San Diego requires substantial financial planning and resources.

In 2024, purchasing a home in San Diego is a significant financial commitment. With high median prices and rising interest rates, prospective buyers need to evaluate their financial situation carefully. Whether you're looking for a 1-bedroom starter home or a spacious 4+ bedroom property, understanding the costs and planning accordingly will be crucial in making your homeownership dreams a reality.

Why is Housing So Expensive in San Diego?

San Diego's allure is undeniable. Pristine beaches, perfect weather, and a vibrant city life make it a dream destination for many. But this paradise comes at a price, particularly when it comes to real estate. Let's delve into the factors driving San Diego's expensive housing market:

Limited Supply, High Demand

- Geography: Nestled between the Pacific Ocean and mountains, San Diego has limited developable land. This scarcity creates a competitive seller's market, pushing prices upwards.

- Desirable Location: San Diego's climate, job opportunities, and outdoor activities attract residents and retirees alike, placing constant pressure on a finite housing stock.

Economic Factors

- Strong Local Economy: San Diego boasts a diverse and thriving economy, fueled by a strong tourism industry, a growing tech sector, and a robust military presence. The economy grew in 2021, adding over $11 billion to its gross regional product (GRP) compared to pre-pandemic levels. In 2022, the San Diego metro area's real gross domestic product (GDP) was $257.34 billion, a significant increase from the previous year's $250.06 billion. According to the UCLA Anderson March Economic Outlook, San Diego County is expected to grow 2.7% in 2023. This economic strength translates to job growth and attracts professionals with higher salaries who can afford premium housing.

- Low Interest Rates (Historically): Over the past decade, interest rates have hovered near historic lows. This has significantly reduced the monthly mortgage payment for a fixed-rate loan, making homeownership more affordable for many buyers. For example, in 2016, the average 30-year fixed mortgage rate was around 3.5%. By 2 2021, that number had dipped below 3%, making it significantly cheaper to finance a home purchase. This easy access to cheap credit fueled a surge in buyer demand, which in turn drove up housing prices. While interest rates have risen in 2024, they remain historically affordable compared to long-term averages. However, even with slightly higher rates, the overall impact on affordability is mitigated by wage growth and a strong local economy.

Regulations and Taxes

- Development Restrictions: San Diego, like many coastal cities in California, faces challenges in balancing growth with environmental protection. Strict zoning regulations, lengthy permitting processes, and environmental impact reviews can significantly slow down or even halt new housing developments. This can stifle the ability to increase housing supply to meet the growing demand, putting upward pressure on prices. Additionally, citizen groups and environmental concerns can further complicate the development process. While these regulations are important for safeguarding the natural beauty and character of San Diego, they can also contribute to the limited housing inventory and high costs.

- Property Taxes: California has relatively high property taxes, with an average effective rate of 0.73% in 2023 according to the California Tax Foundation. This means that for a home valued at $1 million, the annual property tax bill would be around $7,300. High property taxes can impact affordability, particularly for first-time homebuyers or those on fixed incomes. However, these taxes also contribute to the overall perceived value of San Diego real estate. Property taxes are a major source of revenue for local governments, which use these funds to finance essential services like schools, roads, and public safety. Additionally, high property taxes can discourage speculation and absentee ownership, potentially leading to a more stable housing market.

National Trends

Nationwide Housing Market: While San Diego stands out, it's part of a larger national trend of rising housing costs. Investor activity and a national shortage of affordable housing contribute to the overall market dynamic.

The “Sunshine Tax”

San Diegans often jokingly refer to the high cost of living as the “sunshine tax.” While it might be a sardonic term, it reflects the reality that many people are willing to pay a premium to live in such a desirable location with a high quality of life.

Greater San Diego Real Estate Market Trends

The housing market in Greater San Diego region continues to be a dynamic force in 2024, with some interesting trends emerging in April. Here's a breakdown of the key data points and what they might signal for the coming months.

Sales Activity:

- Detached Homes: Closed sales for detached homes saw a positive increase of 5.8%, indicating continued buyer interest in single-family residences. However, pending sales for detached homes only rose by a modest 0.5%, suggesting a potential slowdown in buyer activity.

- Attached Homes: Sales of attached homes (condos, townhomes) paint a slightly different picture. Closed sales dipped slightly by 1.1%, while pending sales grew by a more significant 2.6%. This could indicate a shift in buyer preference towards detached homes or a potential price correction in the attached home market.

Inventory Levels:

- Overall Growth: Inventory levels are a welcome sight for both buyers and sellers. There was a significant increase in inventory across the board, with detached homes experiencing an 18.7% rise and attached homes a substantial 65.2% increase. This suggests a potential shift towards a more balanced market.

Price Trends:

- Detached Homes: The median sales price for detached homes remains high, surging by 15.8% to $1.1 million. This reinforces the strong seller's market for single-family residences.

- Attached Homes: The median sales price for attached homes saw a more moderate increase of 6.6% to $685,000. This could be due to a combination of factors, including increased inventory or a shift in buyer preferences.

Market Speed:

- Faster Sales: Homes are selling quickly, with days on market decreasing by 10.3% for detached homes and 9.7% for attached homes. This indicates continued seller leverage, especially for desirable properties.

Market Analysis:

The San Diego housing market appears to be in a state of transition. While detached homes continue to see strong demand and rising prices, the attached home market might be experiencing a slight adjustment. The significant increase in inventory across both categories suggests a potential softening of the seller's market, particularly for attached homes. However, with detached home prices still climbing and days on market remaining low, the overall market favors sellers, albeit with a less intense pace compared to the previous year.

What to Expect:

The coming months will likely see a more balanced market with increased inventory options for buyers. This could lead to a stabilization of prices, particularly for attached homes. However, detached homes in desirable locations are likely to remain in high demand, potentially with continued price increases.

The San Diego real estate market has been ranked among the ten most expensive real estate markets in the country, though it ranks below several other West Coast cities. This creates massive demand for San Diego rental properties by those who simply cannot afford to buy homes.

The rental market will continue to grow as the city grows an estimated 500,000 population by 2050, adding tens of thousands each year. The median rent in San Diego is $2700. The rent you’d receive on single-family San Diego rental properties would, of course, be much higher.

Renters vs. Owners in San Diego

San Diego's property rental market is influenced by several factors, including the local economy, job opportunities, and the overall demand for housing. It's a city known for its mix of urban and suburban neighborhoods, each with its own rental and ownership dynamics.

San Diego had a diverse housing landscape with a mix of renters and property owners.

- Renters: San Diego has a significant population of renters, comprising individuals and families who lease residential properties. This includes apartments, condominiums, townhouses, and single-family homes. The exact percentage of renters relative to property owners can vary by neighborhood and demographic factors.

- Owners: San Diego also has a substantial number of property owners. These are individuals or entities who own residential properties and may either live in their properties or lease them out to renters. Property owners contribute to the diversity of the city's housing options.

Size of the Rental Market

The size of the San Diego property rental market is substantial, with a wide range of rental properties available to residents. This market includes apartments, houses, and various types of housing units. The exact size of the rental market can fluctuate based on factors like population growth, economic conditions, and housing development trends.

Real estate agencies, rental platforms, and government agencies often track and report on the status of the rental market, offering detailed insights into its size and dynamics.

For the most up-to-date and specific information regarding the current state of the San Diego property rental market, including the number of renters and property owners, it's recommended to refer to the latest reports and data from sources like local real estate associations, government housing agencies, and real estate websites.

San Diego's property rental market is an essential component of the city's real estate landscape, offering a wide range of housing options to its diverse population.

San Diego County shows it has a Median Gross Rent of $1,842 which is the third most of all other counties in the greater region. Comparing rental rates to the United States average of $1,163, San Diego County is 58.4% larger. Also, measured against the state of California, rental rates of $1,698, San Diego County is 8.5% larger.

San Diego Apartment Rent Prices

As of May 2024, the median rent for all bedroom counts and property types in San Diego, CA is $2,895. This is +50% higher than the national average. Rent prices for all bedroom counts and property types in San Diego, CA have decreased by 2% in the last month and have decreased by 2% in the last year.

The monthly rent for an apartment in San Diego, CA is $2,615. A 1-bedroom apartment in San Diego, CA costs about $2,414 on average, while a 2-bedroom apartment is $3,262. Houses for rent in San Diego, CA are more expensive, with an average monthly cost of $3,995.

Housing Units and Occupancy

In terms of occupied housing units, San Diego has the following distribution:

- Renter-occupied Households: Renter-occupied households make up 53% of the housing units in San Diego, indicating a significant presence of renters in the city.

- Owner-occupied Households: Owner-occupied households account for 48% of the housing units, highlighting a balanced mix of homeowners in the area.

Affordable and Expensive Neighborhoods

San Diego's neighborhoods offer a range of rental prices, making it accessible for various budgets:

The Most Affordable Neighborhoods:

- Bay Park: The average rent in Bay Park is $2,135 per month.

- University Heights: In University Heights, the average rent is around $2,200 per month.

- North Park: North Park offers an average rent of approximately $2,273 per month.

The Most Expensive Neighborhoods:

- Carmel Valley: Carmel Valley is one of the more expensive neighborhoods, with an average rent of $2,942 per month.

- Mission Valley East: In Mission Valley East, the average rent can go for $2,894 per month.

- Mission Beach: Mission Beach has an average rent of $2,850 per month.

Popular Neighborhoods

Some neighborhoods in San Diego are particularly popular among renters:

- Mission Beach: Mission Beach tops the list with 1,115 listings, making it a sought-after area for renters.

- Pacific Beach: Pacific Beach is also a popular choice, offering 760 listings for prospective renters.

- Ocean Beach: Ocean Beach features 295 places for rent, making it a vibrant neighborhood for renters.

These insights provide a snapshot of the current rental market in San Diego. Rental prices have seen some fluctuations in recent months, with variations in different apartment types. The city offers a range of neighborhoods to suit different budgets and preferences, with a balanced mix of renters and homeowners.

ALSO READ:

Is San Diego’s Housing Getting Very Expensive: Experts Predict

San Diego Housing Market Booms With 9.4% Growth: Expert Predictions