As of today, February 17, 2026, mortgage rates are holding remarkably steady, sitting near their lowest points in three years, offering a welcome period of calm in what can often be a turbulent housing market. It feels like just yesterday we were watching mortgage rates swing up and down with every economic report. But right now, something really interesting is happening.

According to Zillow's latest data, the average 30-year fixed mortgage rate is sitting comfortably at 5.85%, and the 15-year fixed rate is a very attractive 5.36%. This stability is a direct result of the Federal Reserve's decisions to lower rates in late 2025. Even though they didn't change rates at their first meeting of 2026, the groundwork has been laid for this calm. It's a rare chance for us to get a good deal on a home loan.

Today’s Mortgage Rates, February 17: Rates See Persistent Stability Near 3-Year Lows

A Snapshot of Current Mortgage Rates

To give you a clear picture, here’s what the numbers look like today:

| Loan Type | Average Rate |

|---|---|

| 30-year fixed | 5.85% |

| 20-year fixed | 5.64% |

| 15-year fixed | 5.36% |

| 5/1 ARM | 5.81% |

| 7/1 ARM | 5.71% |

| 30-year VA | 5.36% |

| 15-year VA | 5.15% |

| 5/1 VA | 4.99% |

What's Making These Rates So Stable?

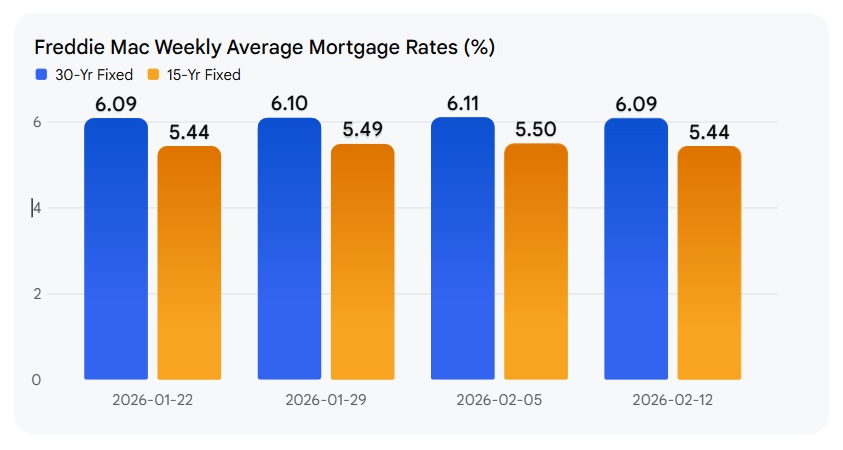

What’s truly remarkable about February 17, 2026, isn't just that the rates are low, but that they've stayed put. We haven't seen the wild swings that usually happen when economic news comes out or when Treasury yields jump around. It's like the market has found its happy place, at least for now.

Let's break down some of the key options:

- The 30-year fixed at 5.85%: This is still the go-to for many people who want predictable monthly payments and the security of knowing their rate won't change over the lifespan of the loan. It's a solid choice, especially with this rate.

- The 15-year fixed at 5.36%: If you want to build equity faster and pay less interest overall, this is a fantastic option. You'll have higher monthly payments than a 30-year loan, but you'll be mortgage-free sooner.

- VA Loans: I have to give a special shout-out to VA loans. With the 5/1 VA ARM coming in at a stunning 4.99%, these are incredibly competitive. If you're a veteran or active-duty service member, this is a golden opportunity to refinance or buy your dream home.

The Bigger Economic Picture

So, why are rates behaving so nicely? A few things are at play. Inflation has been cooling down – the Consumer Price Index (CPI) in January dropped to 2.4%, which is great news. Plus, the Federal Reserve wrapped up its plan to shrink its balance sheet (quantitative tightening) back in December 2025. These two factors have put downward pressure on mortgage rates. However, the job market is still pretty strong, which might be preventing rates from dropping even further.

Because of these lower rates, we're seeing a big jump in people wanting to refinance. Zillow reports that refinance applications are up by over 100% compared to last year! Many homeowners who took out loans at rates above 7% in early 2025 are now jumping at the chance to lower their monthly bills.

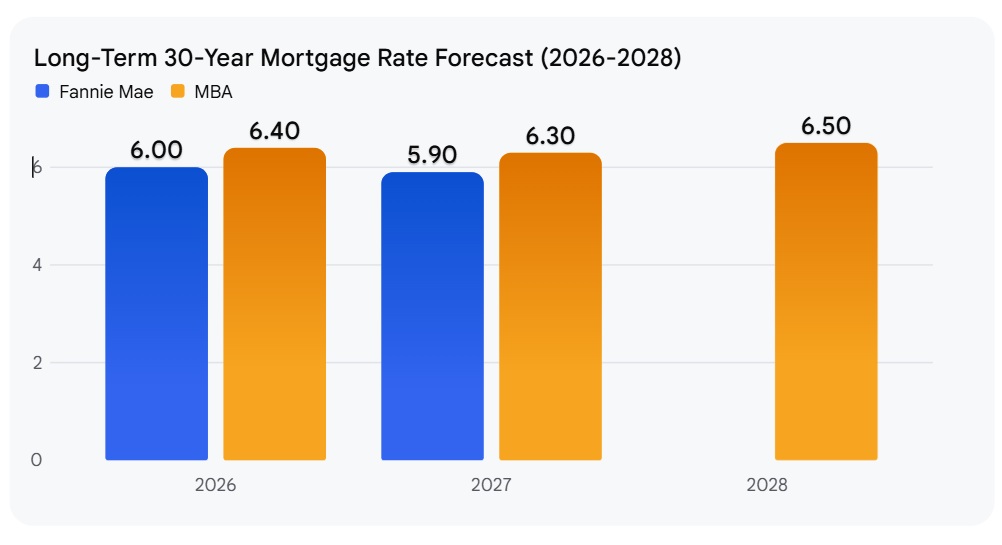

Looking ahead, most of the smart people at places like Fannie Mae and the Mortgage Bankers Association believe that 30-year mortgage rates will likely stay pretty consistent through the rest of 2026, probably hovering somewhere between 5.9% and 6.3%. This prediction is based on the current economic conditions and the Fed's likely path.

Why This Environment is a Win for Borrowers

This steady, lower-rate environment is a real game-changer for anyone looking to get into a home or improve their current mortgage situation.

- For Homebuyers: When rates are lower, it means you can afford more house for your money, or you can keep your monthly payments more manageable. This improves affordability significantly.

- For Refinancers: If you have a mortgage from a year or two ago with a higher interest rate, now is the time to seriously consider refinancing. You could be saving a good chunk of money every month.

- For Our Veterans and Service Members: As I mentioned, VA loans are offering some of the absolute best rates out there. It’s definitely worth exploring if you qualify.

It's Not Just About the National Average: What Affects YOUR Rate

While these national averages are fantastic, it’s important to remember that the rate you actually get will depend on several personal factors. Think of the national average as the starting point for the conversation.

Here’s what lenders will look at:

- Your Credit Score: Generally, if you have a credit score of 740 or higher, you’ll be in the best position to grab the lowest advertised rates. A good credit score shows lenders you're a reliable borrower.

- Loan-to-Value (LTV) Ratio: This is the ratio of how much you owe on the loan compared to the value of the home. If you can put down a larger down payment – say, 20% or more, which means a lower LTV – lenders often see that as less risk and can offer you a better interest rate.

- Shopping Around is Key: This is a tip I can't emphasize enough! Freddie Mac research has shown that by getting quotes from multiple lenders, you could potentially save between $600 and $1,200 per year on your mortgage payments. Don't just go with the first lender you talk to. Compare offers from banks, credit unions, and online lenders.

Key Takeaways on Today's Market and Rates

As someone who follows the housing market closely, I find this period on February 17, 2026, quite refreshing. We've moved past the steep rate hikes, and rather than seeing rates bounce wildly, they've settled into a much more predictable and borrower-friendly range. The 30-year fixed at 5.85% and the 15-year fixed at 5.36% are rates that many people only dreamed of a few years ago.

Whether you're aiming to buy your first home or looking to make your current mortgage work better for you, today's stable and relatively low rates present a wonderful opportunity. It’s a reminder that sometimes, patience in the market pays off, and when those good times arrive, it’s smart to act strategically to make the most of them.

VS

Texas’s A‑rated rental with stability vs Ohio’s affordable property with higher cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to Our Investment Counselor (No Obligation):

(800) 611-3060

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?