Dreaming of owning your own home? Or maybe you're already a homeowner wondering if you should refinance? Well, pay attention because today's mortgage rates, specifically for February 22, 2025, have just gotten a little bit better! We're seeing a slight but significant dip, with the average 30-year fixed mortgage rate now sitting at 6.50%.

That's a drop of four basis points, and honestly, it's the most encouraging news I've seen in a while for folks trying to navigate the housing market. This small shift could be exactly what you've been waiting for to make your move. Let's dive into what this means for you and why paying attention to these rates right now could really pay off.

Today’s Mortgage Rates February 22, 2025: Rates Drop To Lowest Since Dec.

Okay, so “four basis points” might sound like mumbo jumbo, right? Let me break it down. Think of a basis point as just a tiny fraction of a percentage – 0.01% to be exact. So, a drop of four basis points means mortgage rates went down by 0.04%. It doesn't sound like a lot, but in the world of home loans, even small changes can make a big difference in your monthly payment and how much interest you pay over the life of the loan.

And trust me, after watching rates climb and stay stubbornly high for what feels like forever, any downward movement is worth celebrating. This is the lowest we’ve seen rates since way back in December of last year, according to the latest data from Zillow. It’s like a little ray of sunshine peeking through the clouds for potential homebuyers and those wanting to refinance.

Here’s a quick snapshot of what’s happening right now:

- Key Mortgage Rate Today: 30-year fixed rate at 6.50%

- Refinance Rate (30-year fixed): 6.53%

- Across the Board Drops: It’s not just the 30-year fixed rate that’s down. We're seeing lower rates for shorter-term loans and even those adjustable-rate mortgages (ARMs).

- Market Momentum: This decrease could be the nudge some hesitant buyers needed to jump into the market. More buyers means more activity, which can be good for everyone involved.

- Your Homework: Now, more than ever, it pays to shop around! Different lenders offer different rates, so doing your homework could save you some serious cash.

Breaking Down Today's Mortgage Rate Numbers

Let's get into the nitty-gritty and look at the actual rates being offered today. Zillow, a reputable source for real estate data, has compiled the current average rates across various loan types. Keep in mind, these are averages, and the rate you personally qualify for will depend on your credit score, down payment, and other financial factors. But this table gives you a solid overview of where things stand:

| Loan Type | Current Rate |

|---|---|

| 30-year Fixed | 6.50% |

| 20-year Fixed | 6.25% |

| 15-year Fixed | 5.83% |

| 5/1 ARM | 6.50% |

| 7/1 ARM | 6.45% |

| 30-year VA | 5.98% |

| 15-year VA | 5.48% |

| 30-year FHA | 6.09% |

| 15-year FHA | 5.55% |

As you can see, the 30-year fixed is sitting at 6.50%. If you're looking for something shorter, a 15-year fixed is significantly lower at 5.83%. For our veterans, VA loans are looking particularly attractive with rates under 6%. And FHA loans, often popular with first-time buyers, are also offering competitive rates.

Refinancing? Here's What Today's Rates Mean for You

Refinancing can be a smart move for homeowners looking to lower their monthly payments, shorten their loan term, or even tap into their home equity. So, what do today's rates mean if you're thinking about refinancing? Let's take a look at the average refinance rates:

| Refinance Type | Current Rate |

|---|---|

| 30-year Fixed | 6.53% |

| 20-year Fixed | 6.25% |

| 15-year Fixed | 5.88% |

| 5/1 ARM | 6.56% |

| 7/1 ARM | 6.36% |

| 30-year VA | 5.98% |

| 15-year VA | 5.56% |

| 30-year FHA | 6.09% |

| 15-year FHA | 5.55% |

Notice that refinance rates are generally slightly higher than purchase rates for fixed-rate loans. For instance, the 30-year fixed refinance is at 6.53% compared to 6.50% for a new purchase. It’s a small difference, but it’s there. However, for ARMs, the opposite is true in some cases! It’s a bit of a mixed bag, and that's why digging into the details and talking to a loan officer is crucial.

If you locked in a mortgage when rates were higher, say even just a few months ago, refinancing at these lower rates could potentially save you a chunk of money over the long haul. But, and this is important, you need to crunch the numbers to make sure refinancing makes sense for your specific situation. Factor in closing costs and how long you plan to stay in your home to see if the savings outweigh the expenses.

What Do These Rates Translate to in Monthly Payments? Let's Get Real.

Numbers are great, but what we really want to know is: how much will I actually pay each month? Let's break down some examples to see what these 6.50% rates mean for different loan amounts on a 30-year fixed mortgage. Remember, these are just estimates for principal and interest and don't include property taxes, homeowners insurance, or potentially private mortgage insurance (PMI).

Monthly Payment Scenarios (30-Year Fixed Rate at 6.50%)

- $150,000 Mortgage: Around $948.10 per month

- $200,000 Mortgage: Roughly $1,264.13 per month

- $300,000 Mortgage: Approximately $1,896.20 per month

- $400,000 Mortgage: About $2,528.27 per month

- $500,000 Mortgage: Around $3,160.35 per month

Looking at these figures, you can start to see how even a small change in the loan amount or interest rate can impact your monthly budget. If you were on the fence about whether you could afford a certain price range, this slight rate decrease might just make homeownership more attainable.

Decoding Mortgage Types: Fixed vs. Adjustable, and Loan Terms

Navigating the world of mortgages can feel like learning a new language. Let's break down some of the most common types of mortgages to help you make sense of it all:

30-Year Fixed Mortgage: The Classic Choice

- The Good: Predictability is king here. With a 30-year fixed mortgage, your interest rate stays the same for the entire 30-year loan term. This means your principal and interest payment will be consistent month after month, making budgeting much easier. This stability is a huge draw, especially for first-time homebuyers or those who value financial certainty.

- The Not-So-Good: You'll typically pay more interest over the life of the loan compared to shorter-term mortgages. And, because you're spreading payments out over a longer time, you'll build equity in your home more slowly initially.

- My Take: For most people, especially those planning to stay in their home for a while, the 30-year fixed is a solid, dependable choice. The peace of mind that comes with knowing your payment won't change is invaluable.

15-Year Fixed Mortgage: Payoff Powerhouse

- The Good: Faster payoff and lower overall interest costs are the big wins here. Because you're paying the loan off in half the time, you'll save a significant amount of money on interest. Plus, you build equity much faster. And often, 15-year fixed rates are lower than 30-year rates, which is a double bonus!

- The Not-So-Good: Your monthly payments will be higher compared to a 30-year loan. This can stretch your budget and might make it harder to qualify for the loan in the first place.

- My Take: If you can comfortably afford the higher payments, a 15-year fixed is a fantastic way to build wealth and own your home free and clear sooner. It’s a great option if you’re focused on long-term financial goals and have the income to support it.

Adjustable-Rate Mortgages (ARMs): The Rate Rollercoaster?

- The Good: Lower initial interest rates are the main appeal of ARMs. For a set period (like 5 or 7 years in the case of 5/1 and 7/1 ARMs), your rate is fixed, and often lower than a comparable fixed-rate mortgage. This can mean lower payments in the early years of the loan.

- The Not-So-Good: Rate adjustments are the big risk. After the initial fixed period, your interest rate can change – and potentially increase – based on market conditions. This can lead to payment shock and uncertainty.

- My Take: ARMs can be a gamble. They might make sense if you know you'll be moving or refinancing before the rate adjusts, or if you strongly believe rates will go down in the future (which is hard to predict!). However, for most people, especially in a market where rates could be volatile, the predictability of a fixed-rate mortgage is generally safer and less stressful.

Recommended Read:

Mortgage Rates Trends as of February 21, 2025

Mortgage Rates Forecast March 2025: Will Rates Finally Drop?

Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

Will Mortgage Rates Go Up as Inflation Surges Back Up to 3%

The Bigger Picture: Housing Market Context

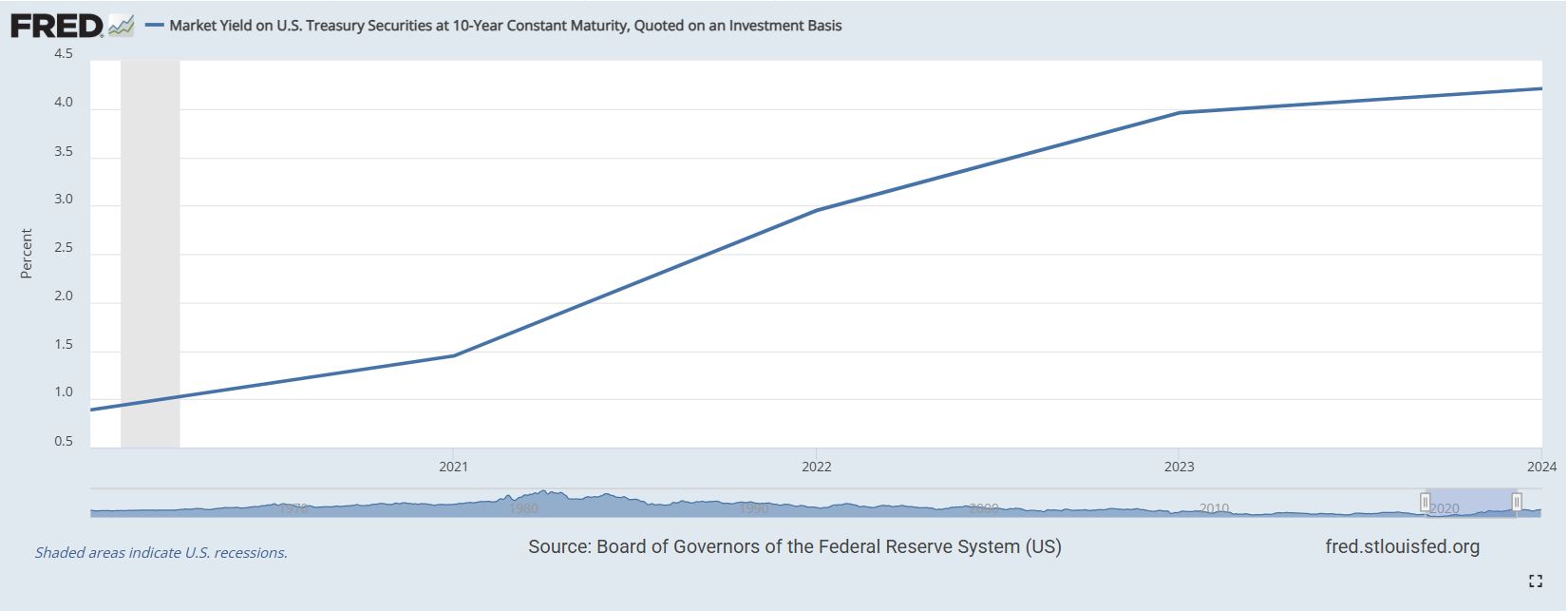

Mortgage rates don’t exist in a vacuum. They’re influenced by a whole host of economic factors – inflation, economic growth, and the actions of the Federal Reserve, to name a few. Right now, the housing market is still navigating some choppy waters. We've seen home prices moderate in many areas after the frenzy of the past few years, but affordability is still a major concern for many.

This slight dip in mortgage rates could be a welcome sign for the housing market. Lower rates can make homes more affordable, potentially bringing more buyers back into the market. It might also ease some of the pressure on sellers, as there could be more demand.

However, it’s important to be realistic. We're not suddenly back to the rock-bottom rates we saw a few years ago. 6.50% is still historically higher than what many people have become accustomed to. And, as experts predict, we could still see some fluctuations and potentially a slight upward trend in rates later this year.

Seizing the Opportunity: What Should You Do Now?

So, where does this leave you? If you’re thinking about buying a home or refinancing, here’s my advice:

- Don't Wait Indefinitely: While nobody has a crystal ball, waiting for rates to magically plummet back to historic lows might be a long shot. This slight decrease we're seeing today is encouraging, and it's worth taking seriously.

- Shop Around, Shop Around, Shop Around! I can’t stress this enough. Don't just settle for the first rate you see. Get quotes from multiple lenders – banks, credit unions, mortgage brokers. Rates can vary significantly from lender to lender, and doing your homework can save you thousands of dollars over the life of your loan.

- Get Pre-Approved: If you're serious about buying, getting pre-approved for a mortgage is a crucial step. It shows sellers you’re a serious buyer and gives you a clear picture of what you can actually afford. Plus, the pre-approval process will give you a good indication of the interest rate you’re likely to qualify for.

- Talk to a Mortgage Professional: Mortgages are complex! A good loan officer can answer your questions, help you understand your options, and guide you through the application process. They can also help you decide if refinancing is right for you.

- Consider Your Long-Term Goals: Think about how long you plan to stay in the home, your financial situation, and your risk tolerance when choosing a mortgage. What works for one person might not be right for another.

Frequently Asked Questions About Today's Mortgage Rates

Let’s tackle some common questions you might have about today’s mortgage rate environment:

- Q: What are the current average mortgage rates right now?

- A: As of February 22, 2025, the average 30-year fixed mortgage rate is around 6.50%. Rates for other loan types vary – check the tables above for a detailed breakdown.

- Q: Are mortgage rates expected to go up or down in the near future?

- A: It's tough to say for sure. Experts predict we might see some fluctuations, and a potential slight upward trend later in the year is possible. However, economic conditions are constantly evolving, so things can change.

- Q: What can I do to get the lowest possible mortgage rate?

- A: Boosting your credit score is key! Also, reducing your debt-to-income ratio (the amount of debt you owe compared to your income) can help. Putting down a larger down payment can sometimes also get you a better rate. And of course, shopping around for lenders is essential.

- Q: Is now a good time to buy a house with these rates?

- A: “Good time” is relative and depends on your personal situation. But, with rates dipping slightly, and potentially before they climb again, it could be an opportune moment for those who are financially ready. The market is showing some signs of becoming a bit more balanced, which could be good for buyers.

The Bottom Line: A Glimmer of Hope for Homebuyers

Today's slight decrease in mortgage rates is a positive development. While 6.50% for a 30-year fixed mortgage isn't “low” in the historical sense, it's a step in the right direction and the lowest we've seen in a couple of months. For those who have been patiently waiting on the sidelines, this could be the signal to start exploring your options.

Don’t delay in taking action! Get informed, get pre-approved, and talk to a mortgage professional. The dream of homeownership might just be a little bit closer to reality today. And for current homeowners, it's definitely worth looking into whether refinancing could save you money. The housing market is always changing, so staying informed and being proactive is your best strategy.

Work with Norada in 2025, Your Trusted Source for

Real Estate Investing

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Mortgage Rates Predictions for 2025: Expert Forecast

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for 2025: Expert Forecast

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?