Have you ever gone to the grocery store and noticed that your favorite snacks suddenly cost a lot more? Or maybe you're thinking about buying a new TV, but the prices seem to have jumped up? These price increases, what we call inflation, can really hit our wallets hard. And lately, there's been a lot of talk about something called tariffs – taxes on goods coming into our country from other places.

So, the big question everyone's asking is: Will higher tariffs lead to inflation and higher interest rates? The short answer is yes, very likely, higher tariffs can indeed push up prices and potentially lead to higher interest rates. Let's dive into why this happens, and what it all means for you and me.

Will Higher Tariffs Lead to Inflation and Higher Interest Rates? Let's Break it Down

Understanding Tariffs: What Are They and Why Do They Matter?

Imagine you're buying a cool toy car made in another country. To get that toy car into our stores, sometimes our government puts a tax on it – that's a tariff. Think of it like a toll you have to pay to bring something into the country. Tariffs are usually put in place to try and help businesses here at home. The idea is that by making imported goods more expensive, people will buy more stuff made in our own country. Governments might also use tariffs to make money or to put pressure on other countries. But whatever the reason, tariffs change the price of things we buy, and that’s where inflation comes in.

How Tariffs Pump Up Inflation: The Price Hike Effect

So, how exactly do higher tariffs cause prices to go up – inflation? It’s actually pretty straightforward when you break it down. There are a few main ways tariffs can lead to goods inflation, which is when the prices of things we buy in stores go up:

- Direct Price Increase on Imports: This one's the most obvious. When a tariff is slapped on imported goods, it's like adding an extra cost right away. Companies that bring these goods into the country have to pay that tariff. Guess who ends up paying that extra cost? Yep, you and me. Businesses often pass that extra cost onto us as higher prices. For example, if there's a tariff on imported clothes, your favorite shirt from overseas is going to cost more at the store. According to a February 2025 NPR article, proposed US tariffs could lead to higher prices on all sorts of everyday items we get from places like Canada, Mexico, and China (NPR article on Trump tariffs and higher prices). It's simple math: higher tax = higher price.

- Domestic Companies Jack Up Prices Too: It’s not just imported stuff that gets more expensive. When tariffs make imported goods pricier, companies that make similar things here can also raise their prices! Why? Because suddenly, their stuff looks cheaper compared to the imported stuff. They know people will be more likely to buy their products now that the imported competition is more expensive. It's like when the gas station across the street raises its prices – the other stations around it might raise theirs a little too. Research from the Centre for Economic Policy Research (CEPR) supports this, suggesting tariffs give domestic producers the wiggle room to increase their prices, which adds to overall inflation (CEPR tariffs and inflation). It’s a bit sneaky, but it's just how businesses work sometimes.

- Currency Takes a Hit, Prices Go Even Higher: Here's where things get a little more complicated, but stick with me. Sometimes, when a country puts up a lot of tariffs, it can mess with how much its money is worth compared to other countries – what we call currency value. If tariffs lead to us buying less from other countries and maybe them buying less from us (that's called a trade deficit), our currency might become weaker. A weaker currency means it costs more to buy things from other countries. So, even without the tariff itself, imported goods get more expensive. It's like a double whammy! The Bank of Canada has even pointed out that tariffs can mess up supply chains and cause inflation to jump up, especially if we can't easily find things we need here at home (Bank of Canada tariffs impact). It's like everything from overseas just got more expensive across the board.

From Inflation to Interest Rates: Why Your Loans Might Cost More

Okay, so tariffs can cause inflation – prices go up. But what about interest rates? How do they fit into all of this? Well, think of interest rates as the price of borrowing money. When interest rates go up, things like car loans, home mortgages, and even credit card bills can become more expensive. And central banks, like the Federal Reserve in the US, play a big role in setting these rates.

Central banks are like the inflation firefighters of the economy. Their main job is to keep inflation under control. When inflation starts to climb too high, what do they often do? They raise interest rates. Why? Higher interest rates make it more expensive to borrow money. This means people and businesses borrow less, spend less, and save more. Less spending can cool down the economy and help bring inflation back down to a normal level.

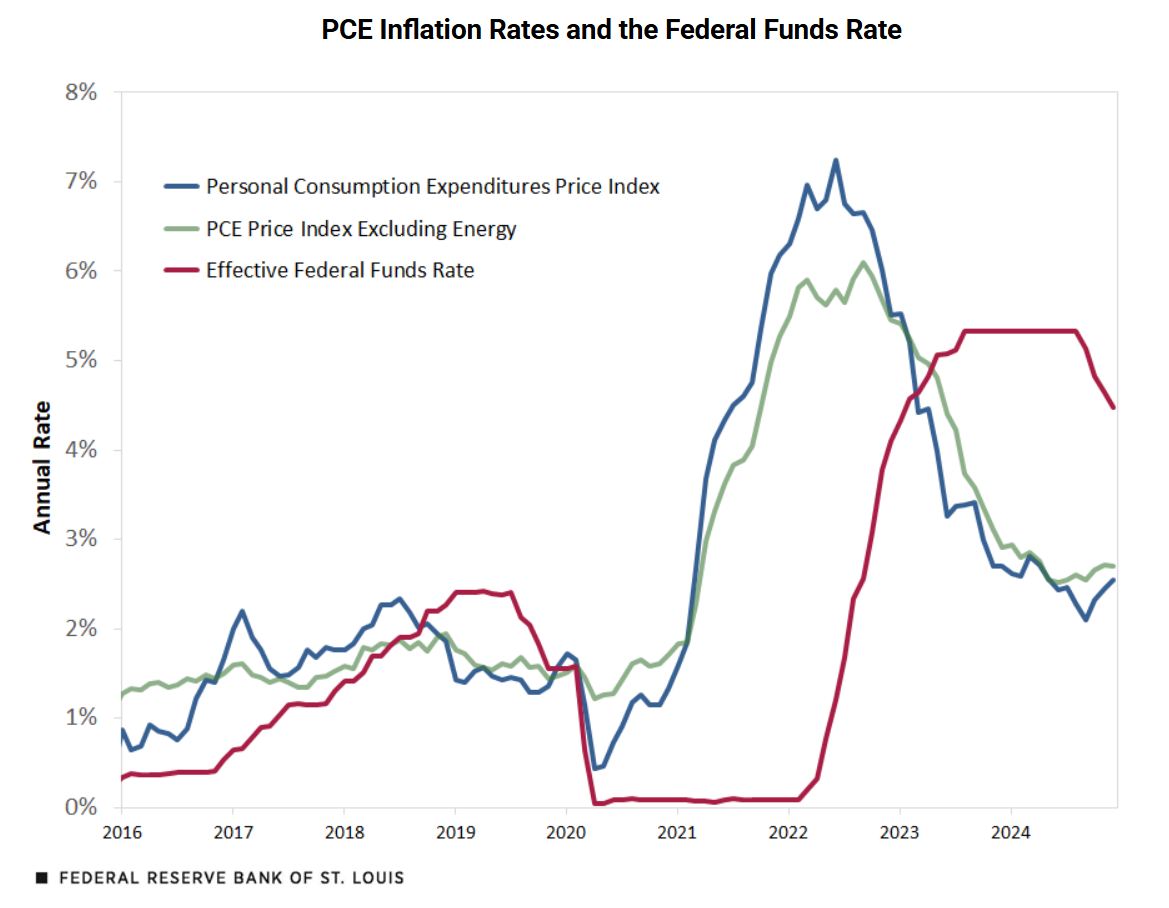

So, if higher tariffs cause a significant jump in goods inflation, it's pretty likely that central banks will think about raising interest rates to fight that inflation. The Federal Reserve Bank of Boston, for example, estimated that some proposed tariffs could add almost a whole percentage point to inflation! That's a big jump, and it could definitely push the Fed to consider raising rates to keep things in check (Boston Fed tariffs on inflation).

But here's the tricky part: raising interest rates can also slow down the economy. It can make it harder for businesses to grow and create jobs. So, central banks are in a tough spot. They have to balance fighting inflation with keeping the economy healthy and growing. If tariffs not only cause inflation but also hurt economic growth, central banks have a really complicated decision to make. Do they raise rates to fight inflation, even if it slows down the economy more? Or do they hold off on raising rates to support growth, even if inflation stays a bit higher? Economists at CEPR point out this exact dilemma – it's a balancing act between controlling prices and keeping the economy moving forward (CEPR monetary policy response). It's not as simple as just raising rates whenever prices go up.

Real-World Examples: Tariffs in Action

To see how this all works in real life, we can look back at when the US put tariffs on steel, aluminum, and goods from China in 2018. Studies estimate that these tariffs added a bit to inflation – somewhere between 0.1 and 0.2 percentage points to what's called core inflation (that's inflation without food and energy prices, which can jump around a lot).

At that time, inflation was already around 2.2% to 2.5%. During this period, the Federal Reserve did raise interest rates several times. Now, it's hard to say exactly how much of those rate hikes were because of the tariffs, since there were other things happening in the economy too, like strong economic growth.

But it's definitely something that economists were watching closely, and it shows how tariffs can play into the inflation and interest rate picture. You can even see the inflation data from that time from the Bureau of Labor Statistics (BLS CPI data).

Looking ahead, some experts think that new tariffs being talked about, like those proposed in 2025, could push inflation even higher – maybe up to 3% or 4%! Capital Economics, for instance, suggests tariffs could really complicate things for the Federal Reserve, making it harder for them to lower interest rates in the future because of the added inflation pressure (Capital Economics inflationary impact of tariffs).

And globally, the Bank of Canada in early 2025 even cut interest rates, but warned that a tariff war could be “very damaging” and cause persistent inflation, potentially forcing them to raise rates later on (Bank of Canada rate cuts). These examples show that tariffs aren't just abstract ideas – they have real effects on prices and interest rates in the real world.

When Tariffs Might Not Cause Big Inflation Hikes (The Exceptions)

Now, it's important to remember that the economy is complicated. It’s not always a straight line from tariffs to inflation to higher interest rates. There are times when tariffs might not lead to big jumps in inflation or interest rate hikes. Here are a few situations to keep in mind:

- If We Don't Rely Heavily on Imports: If a country makes a lot of its own stuff, and doesn't import too much of a certain product, tariffs on those imports might not cause a huge price shock. For example, if the US puts tariffs on imported steel but already makes a lot of steel domestically, the price increase might be smaller because we can just buy more American-made steel instead. CEPR's analysis points out that how much tariffs affect inflation really depends on how much a country relies on trade in the first place (CEPR tariffs and inflation). If we can easily switch to buying local, the tariff impact is less.

- If Our Money Gets Stronger: Sometimes, other things happen in the world that can make a country's money stronger. If a country's currency becomes more valuable, it can actually offset some of the price increases from tariffs. A stronger currency makes imports cheaper, which can help keep inflation in check, even with tariffs. The Boston Fed mentioned that currency changes can be a factor when looking at the impact of tariffs on inflation (Boston Fed tariffs on inflation). So, currency strength can act as a buffer against tariff-driven inflation.

- If Central Banks Decide Not To Raise Rates: Even if tariffs cause some inflation, central banks might choose not to raise interest rates if they think the inflation is only temporary or if the economy is already weak. Remember the Bank of Canada example? They actually cut rates even with tariff risks, because they were more worried about economic growth than inflation at that moment (Bank of Canada rate cuts). Central banks have to make tough calls, and sometimes fighting inflation isn't their top priority, especially if the economy is struggling.

Who Feels the Pinch? Sector-by-Sector Impacts

It’s also worth noting that tariffs don't affect every part of the economy equally. If tariffs are placed on a wide range of goods – like a broad-based tariff on everything coming into the country – the impact on inflation can be much bigger. The Budget Lab at Yale University estimates that a 10% tariff on all imports could raise consumer prices quite a bit, anywhere from 1.4% to a whopping 5.1%! (Yale Budget Lab tariffs). That's a significant jump that would be felt by pretty much everyone.

On the other hand, if tariffs are only put on specific goods, like just steel or just certain electronics, the impact might be more limited to those specific industries. For example, tariffs on steel might mainly affect companies that use a lot of steel, like car manufacturers or construction companies. The price of cars and buildings might go up a bit, but the price of other things might not change much. So, the breadth and scope of the tariffs really matter in determining how widespread the inflationary effects will be.

Wrapping It Up: Tariffs, Inflation, and Your Wallet

So, to bring it all together: will higher tariffs lead to inflation and higher interest rates? Based on what we know from economic research and real-world examples, the answer is likely yes. Higher tariffs can definitely contribute to goods inflation by making imported goods more expensive, giving domestic companies room to raise prices, and potentially weakening our currency, which makes imports even pricier. This inflation, in turn, can push central banks to raise interest rates as they try to keep prices under control.

However, it's not a guaranteed outcome every time. The actual effect of tariffs on inflation and interest rates depends on lots of things – how much we rely on imports, how strong our currency is, and how central banks decide to respond. But the general trend is clear: tariffs tend to push prices up, and that can have ripple effects throughout the economy, potentially making borrowing more expensive for all of us.

As someone trying to understand what's happening in the economy, I think it's crucial to see how policies like tariffs, which might seem simple on the surface, can have complex and sometimes unexpected consequences for our everyday lives. It's not just about trade numbers and economic theories – it's about the prices we pay at the store, the interest rates on our loans, and the overall health of our economy. Keeping an eye on these connections helps us all be more informed and make better decisions in our own financial lives.

Navigate Economic Uncertainty with

Norada Real Estate Investments

Whether it's recession or inflation, turnkey real estate offers stability and consistent returns.

Diversify your portfolio with ready-to-rent properties designed to withstand economic fluctuations.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Read More:

- Will the Fed Achieve Its 2% Inflation Target in 2025: The Road Ahead

- Are We in a Recession or Inflation: Forecast for 2025

- Inflation's Impact on Home Prices & Mortgages: What to Expect in 2025

- Interest Rates vs. Inflation: Is the Fed Winning the Fight?

- Is Fed Taming Inflation or Triggering a Housing Crisis?

- Will Inflation Go Down Below 2% in 2025: Economic Forecast

- How To Invest in Real Estate During a Recession?

- Will There Be a Recession in 2025?

- When Will This Recession End?

- Should I Buy a House Now or Wait for Recession?