Getting the best deal on your mortgage rate isn't just about good luck; it's about smart planning and proactive steps you start taking today. To get a lower mortgage rate in 2026, you absolutely must focus on building a strong financial foundation now and becoming a savvy shopper for the best loan terms, because lenders reward preparedness and smart comparison with significantly better rates.

I’ve had a front-row seat to the ever-shifting world of mortgages for years, and one thing remains consistently true: the power lies with the borrower who prepares. While no one has a crystal ball for interest rates, the factors that qualify you for the best rates are largely within your control. Think of it like training for a marathon: you don't just show up on race day. You train, you prepare, and you build strength. Getting a killer mortgage rate in 2026 demands the same dedication. Let's dig into the strategies that can put more money in your pocket over the life of your loan.

Smart Ways to Secure a Lower Mortgage Rate in 2026

Building Your Financial Fort Knox: The Credit Score Command Center

This is, without a doubt, your starting point. Your credit score is essentially your financial report card, and lenders rely on it heavily to gauge how risky you are to lend money to. A higher score tells them you're responsible and likely to pay back your loan.

From my experience, many homebuyers underestimate just how much impact those three little digits have. We’re talking about potentially hundreds of dollars saved each month, which adds up to tens of thousands over the life of a loan. My friends often ask me, “What's the magic number?” While there's no single perfect score, aiming for a FICO score of 760 to 780 or higher is your golden ticket for securing the best conventional mortgage rates out there. I've personally seen clients with scores in this range consistently get more favorable terms than those even a few points lower.

So, how do you get there?

- Pay Your Bills on Time, Every Time: This is the most crucial factor. Even one late payment can ding your score. Set up automatic payments if you need to, or use reminders. Consistency is key.

- Keep Your Credit Utilization Low: This fancy term just means don't max out your credit cards. Lenders like to see you using less than 30% of your available credit, but even lower – like under 10% – is even better. If you have a credit card with a $10,000 limit, try to keep your balance below $1,000.

- Don't Open (Or Close) Too Many Accounts Too Quickly: A long credit history is a good credit history. Avoid opening a bunch of new accounts just before applying for a mortgage, as this can make you look risky. Similarly, closing old accounts can actually hurt your score by reducing your overall available credit and shortening your credit history.

- Check Your Credit Report Regularly: Mistakes happen! Get your free credit report from AnnualCreditReport.com at least once a year. Dispute any errors you find – I've seen simple errors corrected that have jumped a score by 20 points almost overnight. This small step can make a huge difference.

The Power of the Down Payment: Show Them the Money

If your credit score is about trust, your down payment is about commitment. A larger down payment significantly reduces the lender's risk. Why? Because you have more “skin in the game.” If you had to walk away from the loan, the lender would lose less money because of the equity you already have in the home.

My personal belief is that, if possible, striving for a 20% down payment or more is one of the smartest financial moves you can make when buying a home. Not only does it often secure you a lower interest rate, but it also helps you avoid private mortgage insurance (PMI). PMI is an extra monthly fee added to your mortgage payment that protects the lender, not you, if you default. Avoiding PMI can save you hundreds of dollars each month, which is money you can use for other things, like home improvements or just building up your savings.

Think about it:

- Less Risk for Lenders = Better Rates for You: It's that simple.

- Avoid PMI: This is a huge win. That 20% mark is your magic number to sidestep this extra cost.

- Lower Monthly Payments: A larger down payment means you're borrowing less money, which directly translates to a smaller monthly mortgage payment.

Even if 20% feels out of reach, every extra dollar you put down helps. Don't underestimate the power of going from, say, 5% to 10% down. It still makes a difference to lenders and to your borrowing costs.

The Debt-to-Income (DTI) Ratio: Your Financial Balancing Act

This is another huge one that lenders scrutinize. Your debt-to-income (DTI) ratio tells lenders how much of your monthly gross income goes towards paying off debts each month. It’s a snapshot of your financial health and your ability to take on new debt.

Lenders prefer to see a DTI of 36% or less, with the lowest rates often reserved for borrowers who can keep their DTI at 25% or less. I often tell clients this is like looking at your monthly budget from the lender's perspective. They want to see that you have plenty of room to comfortably make your mortgage payments.

How can you improve your DTI?

- Pay Down Existing Debts: Focus on credit cards, car loans, student loans, or any other recurring monthly payments. Even paying off a small personal loan can make a difference. Prioritize high-interest debts first.

- Increase Your Verifiable Income: This could mean picking up a side gig, getting a raise, or increasing hours at your current job. Just make sure it’s income you can prove with pay stubs and tax returns. Lenders want to see consistent income.

- Avoid Taking on New Debt: This goes hand-in-hand with improving your DTI. Applying for new credit cards or financing a new car right before applying for a mortgage will inflate your DTI and could jeopardize your chances of getting the best rate.

The Savvy Shopper's Secret: Shop Around and Negotiate

Once you've polished up your financial profile, this is where you become the astute consumer. Mortgage rates can vary significantly between lenders, even on the same day. Think of it like comparing prices for a big-ticket item; you wouldn't just buy the first one you see, right? The same applies to one of the biggest purchases of your life.

My firm belief, backed by years of watching this market, is that you must obtain quotes from at least three to five lenders on the same day. Why the same day? Because rates can fluctuate daily, and comparing quotes from different days wouldn't give you an accurate picture. This allows for a true “apples-to-apples” comparison.

Once you have these competing offers, use them! Don't be shy about negotiating. If Lender A offers you 6.5% and Lender B offers 6.3%, go back to Lender A (or C, or D) and ask if they can beat or match Lender B's offer. You'd be surprised how often they'll adjust their rate or fees to earn your business. This isn't being pushy; it's being smart with your money.

Consider different types of lenders as well:

- Big banks: Often have competitive rates but can be slower.

- Credit unions: Known for personalized service and sometimes better rates if you're a member.

- Online lenders: Can offer very competitive rates due to lower overhead but may lack personal touch.

- Mortgage brokers: They work with multiple lenders to find you the best deal.

Strategic Loan Options: Tailoring Your Mortgage

Not all mortgages are created equal, and choosing the right structure can significantly impact your rate.

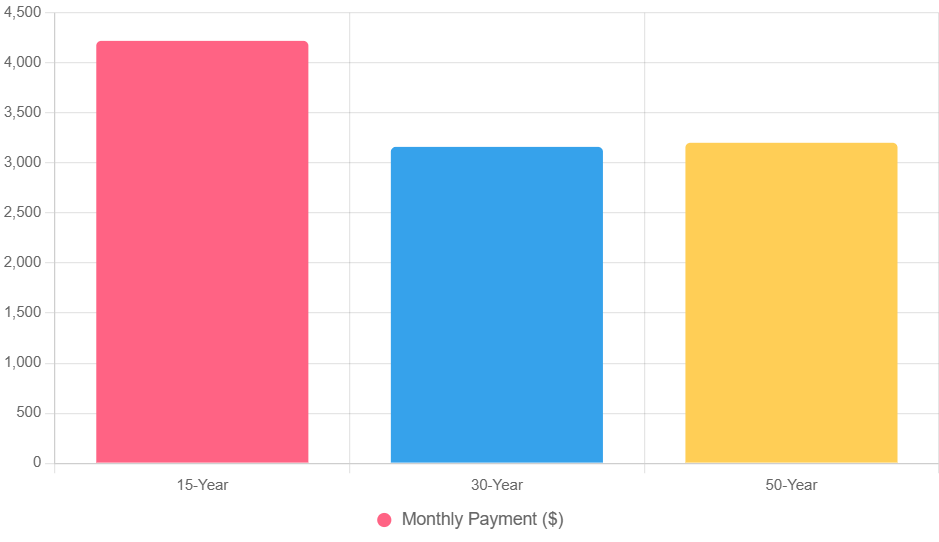

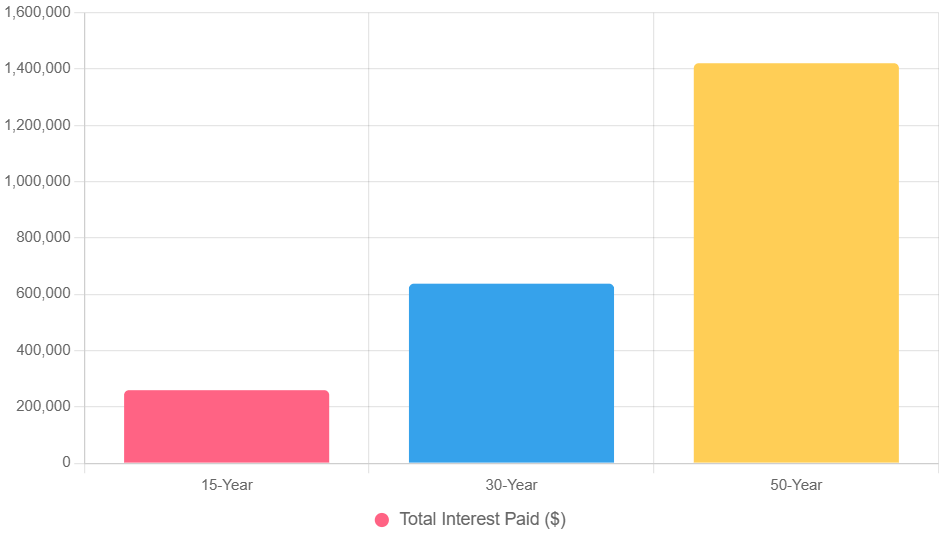

Consider a Shorter Loan Term

This is a strategy often overlooked but can lead to substantial savings. Mortgages with shorter terms, such as 15-year or 20-year fixed-rate loans, generally offer lower interest rates than a standard 30-year term. While your monthly payments will be higher because you're paying off the loan quicker, the total interest you pay over the life of the loan can be dramatically lower.

For example, a 15-year mortgage rate could be a full percentage point lower than a 30-year mortgage. If you can comfortably afford the higher monthly payment, this option is worth serious consideration. It's not for everyone, but if your budget allows, it's a powerful way to accelerate equity building and save a lot on interest.

Buy Discount Points

This strategy involves paying a bit extra upfront to reduce your interest rate for the entire life of the loan. You can prepay interest at closing in exchange for a permanently lower interest rate. Typically, one “point” costs 1% of the total loan amount and usually reduces the interest rate by about a quarter of a percentage point (0.25%).

For a $300,000 loan, one point would cost $3,000 at closing. In return, your interest rate might drop from, say, 6.5% to 6.25%. This is a math problem you need to solve based on how long you plan to stay in the home. If you plan to live in the house for many years, paying points can definitely save you money in the long run. If you think you might move in a few years, it might not be worth the upfront cost. I always advise doing the break-even calculation before going this route.

Explore Different Loan Types

Don't assume a conventional loan is your only option. Depending on your situation, government-backed loans can offer more favorable terms, especially if you have a lower down payment or specific circumstances.

- FHA Loans: Great for first-time homebuyers or those with lower credit scores and smaller down payments (as low as 3.5%).

- VA Loans: An incredible benefit for eligible veterans, active-duty service members, and some surviving spouses. These often require no down payment and have very competitive rates.

- USDA Loans: Designed for low-to-moderate-income borrowers in eligible rural areas. These also often require no down payment.

It’s crucial to research these options because they might open doors to homeownership with terms you didn't think were possible, potentially including lower rates.

The Future-Proofing Strategy: Refinance Later

Getting a great rate in 2026 is the goal, but the housing market is always in motion. What if rates drop further down the road? If you buy a home now and mortgage rates drop significantly in the future, you may be able to refinance your loan to secure an even lower rate.

Think of refinancing as a chance to hit the reset button on your mortgage. This is a smart contingency plan. I've guided many clients through refinancing when market conditions shifted in their favor, allowing them to significantly reduce their monthly payments and total interest paid. Keep an eye on economic indicators and be prepared to act if a golden opportunity arises.

In Conclusion: Your Journey to a Lower Rate

Getting a lower mortgage rate in 2026 isn't just a wish; it's a plan you can execute. It requires discipline, research, and a willingness to negotiate. By focusing on boosting your credit score, maximizing your down payment, optimizing your DTI, shopping around fiercely, considering different loan types and terms, and keeping an eye on future refinance opportunities, you'll be well-positioned to unlock the best possible rate. Start today, and you'll thank yourself for years to come.

Smart ways to secure a lower mortgage rate in 2026 aren’t just about saving on financing—they’re about maximizing returns. As rates fluctuate, investors who lock in favorable terms can amplify cash flow and long‑term wealth through rental property investing.

Norada Real Estate helps you take advantage of these opportunities with turnkey rental properties designed to deliver passive income and appreciation—positioning you to thrive even as mortgage markets shift.

Also Read:

- Mortgage Rates Predictions for 2026 Backed by Top Housing Experts

- Mortgage Rate Predictions for the Next 5 Years: What’s Ahead 2026–2030

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?