If you’re curious about Sunnyvale home prices, you’re not alone. This vibrant city in Silicon Valley has been a buzzing topic among homebuyers, real estate enthusiasts, and residents alike. The Sunnyvale home prices have drawn a lot of attention recently, and it’s essential to understand why. With scenic parks, excellent schools, and a booming tech industry nearby, it’s no surprise that many people are looking to settle in this charming city.

Sunnyvale Housing Market Update

Sunnyvale home prices have demonstrated remarkable resilience, showing an impressive 11.8% increase from the previous year. This strong growth highlights the city's ongoing desirability and continued demand for housing in the market.

Sunnyvale Home Prices: A Deep Dive into the Housing Market

Key Takeaways

- Average Home Value: The current average home price in Sunnyvale is approximately $2.01 million.

- Median Home Price: As of August 2024, the median sold price for homes was $1.8 million, reflecting a 4.9% increase from the previous year.

- Market Trends: Home prices are on the rise, up 11% over the past year.

- Competitive Market: The Sunnyvale housing market scored 94 out of 100 on competitiveness.

- Cost of Living: The cost of living in Sunnyvale is approximately 125% higher than the national average.

Average Home Value in Sunnyvale, CA, by Home Size

| Home Size | Number of Homes | Average Home Value |

|---|---|---|

| 1 bedroom | 9 | $670,643 |

| 2 bedrooms | 45 | $1,126,243 |

| 3 bedrooms | 66 | $1,892,695 |

| 4 bedrooms | 23 | $2,687,691 |

Source: [Trulia]

The State of Sunnyvale Home Prices

In recent months, Sunnyvale home prices have shown remarkable resilience and growth. According to Zillow, the average home value is currently $2,014,550, reflecting an impressive 11.8% increase from the previous year. This surge signifies the city's desirability and the ongoing demand for housing.

A closer look reveals that the homes in Sunnyvale are often sold faster than in many other cities. For instance, homes are typically listed for days rather than weeks, with properties spending an average of just 9 days on the market before going pending. This quick turnaround reflects the intense competition among buyers eager to seize opportunities as soon as they arise.

Looking at the trends over the last few months, we see consistent upward momentum in home prices. For instance, data from Redfin shows that the median house price stood at $1.8 million in August 2024, which has increased by 4.9% compared to the previous quarter. This continued growth paints a picture of a highly competitive real estate market, making it essential for prospective buyers to act swiftly and decisively.

Recommended Read:

$2 Million Homes: San Jose’s Housing Market Reaches New Height

Factors Influencing Sunnyvale Home Prices

The rising Sunnyvale home prices can be attributed to several key factors:

1. High Demand for Housing

Sunnyvale, located in the heart of Silicon Valley, is surrounded by the tech giants of the world, from Google to Apple. The city's strategic location, featuring a blend of work-life balance and access to major tech employers, drives high demand for housing. This area is not just appealing to tech workers, but it attracts professionals from various industries looking for a suburban lifestyle close to urban job markets. With many people wanting to live in this sought-after area, it’s no surprise that prices continue to rise.

2. Limited Inventory

A significant challenge in the Sunnyvale real estate market is the limited housing inventory. With fewer homes on the market compared to the number of prospective buyers, the imbalance leads to increased competition. As of September 2024, there were only 70 homes listed for sale, as reported by Rocket Homes. This scarcity fuels competition, where buyers often find themselves in bidding wars, further driving home prices upward and making it challenging for many to enter the market.

3. Quality of Life

Sunnyvale offers a fantastic quality of life, thanks to its well-kept parks, family-friendly neighborhoods, and an assortment of dining and shopping options. The city prides itself on having excellent schools, like Sunnyvale Middle School and Fremont High School, which consistently rank among the best in the area. The combination of a safe environment, community facilities, and a culturally rich atmosphere makes Sunnyvale an attractive spot for families and individuals alike, further justifying the high home prices.

4. Economic Stability

California's economy, especially Silicon Valley’s tech-driven ecosystem, continues to thrive. The aftermath of recent economic challenges has solidified tech's position as a cornerstone of financial stability in the region, with companies expanding and new startups emerging. This economic backdrop assures homeowners and investors of the viability of their real estate investments. Consequently, this stability provides assurance to homeowners and investors, keeping Sunnyvale home prices buoyant.

Current Market Conditions

As we analyze the Sunnyvale home prices today, it’s essential to understand the current market conditions. The housing market has a 94 out of 100 score in competitiveness, indicating that homes rarely linger on the market for long. This high competitiveness means that homes in Sunnyvale often attract multiple bidders, leading to bidding wars where prices can escalate quickly. Buyers should be prepared to act quickly, as homes frequently go under contract shortly after listing.

In recent reports, the median home listing price in Sunnyvale is approximately $1.7M million, indicating that while the prices have increased, there are signs of slight stabilization in some neighborhoods.

As buyers weigh their options, those interested in purchasing property are often encouraged to negotiate rather than settle for asking prices, thanks to a growing number of listings in the current market. This slight increase in inventory can provide some relief for buyers, but the competitive nature of the market remains prevalent.

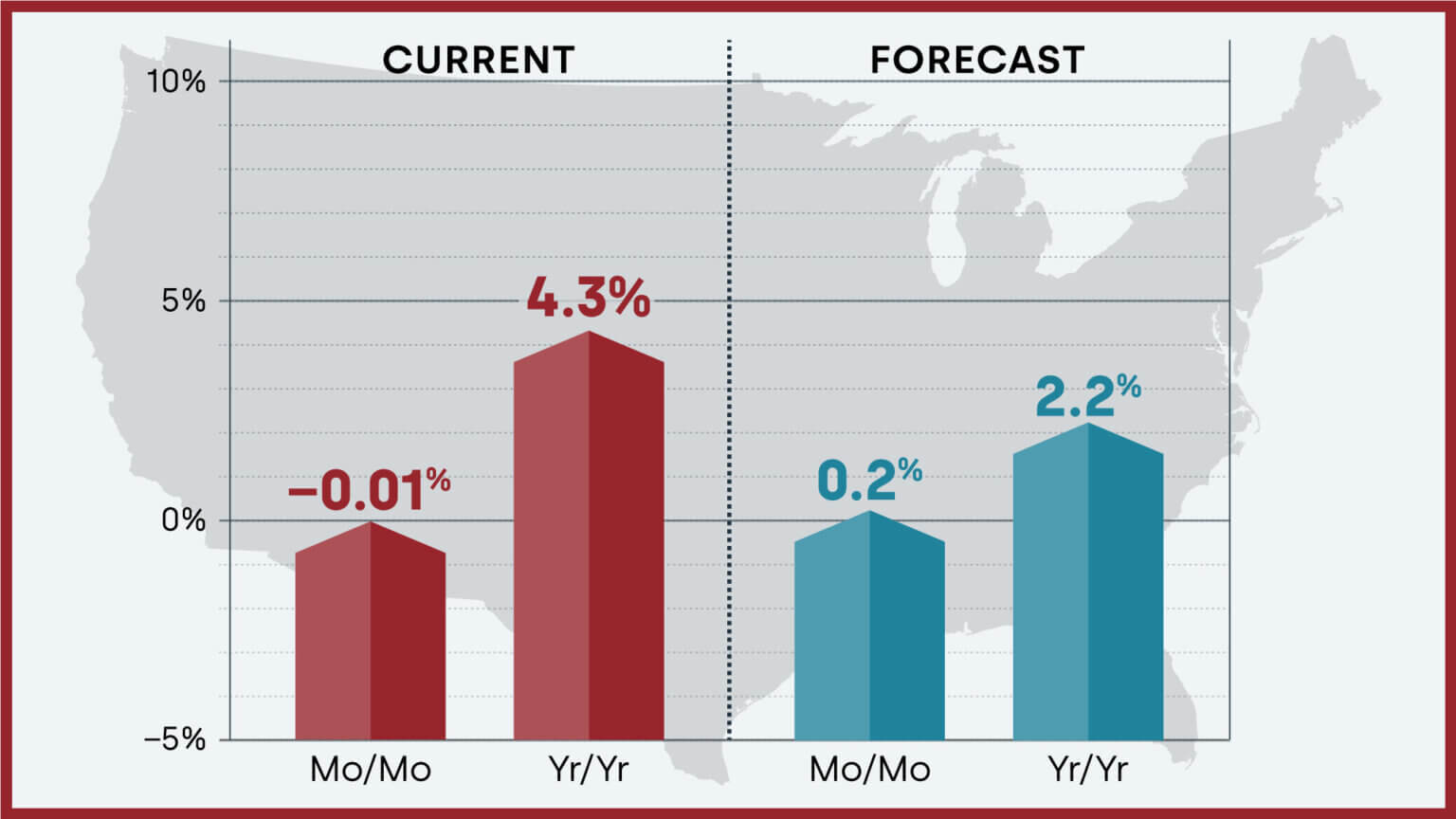

Sunnyvale Housing Market Forecast 2025

In considering the housing market forecast in Sunnyvale, experts predict that while prices may continue to rise in the short term, the pace could slow due to potential economic shifts and interest rate changes.

Analysts highlight that inflationary pressures and Federal Reserve policies may influence interest rates, prompting a change in buyer sentiment. Should these rates increase, some buyers might delay their purchasing decisions, temporarily slowing the upward trajectory of home prices.

However, Sunnyvale's strong demand fundamentals, combined with limited inventory, suggest that substantial price drops are unlikely. Buyers are encouraged to stay vigilant about these factors, as they could significantly impact purchasing power and real estate investment decisions.

Sunnyvale Home Appreciation

Sunnyvale has seen impressive home appreciation levels over the years. Many properties have maintained their value even amid broader economic fluctuations. On average, homes in Sunnyvale have appreciated at a rate of around 8% annually, making it one of the more stable markets in Silicon Valley. This consistent appreciation is reflective of the high demand for housing as families and professionals look for homes in a coveted area.

Such appreciation not only secures a reliable investment for homeowners but also creates a sense of pride and community as neighborhoods grow and develop. Additionally, increased demand for housing leads to further developments, making Sunnyvale an even more attractive place to live.

Sunnyvale Real Estate Listings

With numerous options available, prospective buyers can explore the current Sunnyvale real estate listings. Websites like Realtor.com showcase an extensive array of homes, often with features appealing to a wide range of buyers. The median listing price is around $1.4 million, and options range from single-family homes to condominiums, accommodating varying budgets and lifestyles.

Notably, the average time for homes to sell currently sits at 17 days, underscoring the competitiveness of the market. This swift turnover highlights how urgent the current market dynamics are, suggesting that interested buyers need to be prepared for quick decision-making when they find a property that fits their criteria.

Cost of Living in Sunnyvale

Another crucial aspect to consider when discussing Sunnyvale home prices is the cost of living, which is significantly higher than the national average—approximately 125% more. This increase in living expenses is influenced by rising housing costs, which dominate everyone’s budgeting concerns.

Factors contributing to this cost include housing, groceries, transportation, and health expenses. Rent and mortgage payments take up a significant portion of residents' income. For instance, the average rent can be as high as $3,200 per month, depending on the neighborhood and type of property. While residents enjoy a high standard of living, the trade-off comes in the form of increased financial commitment, leading many to discuss and evaluate whether living in Sunnyvale balances out their financial goals.

Why Are Sunnyvale Home Prices So High?

A question frequently asked by potential buyers and investors is why are Sunnyvale home prices so high? The answer lies in the interplay of demand, local economic stability, and limited housing stock. Sunnyvale's appeal stems from its high-quality living conditions, access to excellent schools, and proximity to major employment centers within Silicon Valley.

Moreover, the influx of technology workers seeking proximity to their jobs means that more people than ever want to live in Sunnyvale, driving prices up further. This dynamic makes it less likely that property prices will experience significant drops, creating concern among buyers about potential future affordability.

Is Sunnyvale Real Estate Overpriced?

Some buyers might wonder if Sunnyvale real estate is overpriced. While opinions may vary, many believe that the high prices reflect the city's desirability and robust local economy. It's not unusual for new buyers to feel concerned about affordability when faced with high home prices; however, the consistent demand for housing in Sunnyvale coupled with a lack of inventory suggests that while prices are high, they remain rooted in demand rather than speculative bubbles.

Overall, pricing reflects the market's ability to sustain these values over time. Potential homeowners and investors should consider their long-term financial strategy and the unique factors driving Sunnyvale's market when evaluating whether or not they are comfortable with current pricing.

Best Time to Buy a Home in Sunnyvale

Considering market trends, some buyers may ponder the best time to buy a home in Sunnyvale. Homes typically sell quickly, especially in the warmer months, with spring and early summer being the most active periods for listings and sales. In these months, buyers have a larger inventory to choose from, but they also face intense competition.

Potential homeowners may find advantageous opportunities during quieter months—like fall and winter—when fewer homes are on the market. This could lead to reduced competition, allowing buyers to negotiate better terms or find deals on properties that may have been overlooked. However, entering the market at any time requires careful consideration and planning.

Are Home Prices Dropping in Sunnyvale?

Amid ongoing discussions about rising prices, many are curious if home prices are dropping in Sunnyvale. As of now, prices continue to trend upwards, although the rate of increase could slow. Recent data shows a cautious yet optimistic sentiment in the market, suggesting that while there might be fluctuations, a dramatic decline in prices is unlikely at this moment.

Factors like interest rates, economic outlook, and overall demand will weigh heavily on future pricing trends. Buyers should stay informed and monitor market conditions closely to leverage any fluctuations that may benefit their shopping experience.

Sunnyvale Home Price Growth

Long-term projections show continued Sunnyvale home price growth, with many industry experts expecting the upward trajectory to persist, albeit at a slower pace than we’ve observed in recent years. As Silicon Valley maintains its status as a tech hub, favorable economic conditions promise to keep demand robust.

With ongoing developments and the ever-present tech industry, it is likely that home values will keep climbing steadily. Buyers who invest in Sunnyvale today may benefit significantly from this trend in the future, especially as the Bay Area demographic tide continues to rise.

In summary, the Sunnyvale home prices reflect the city's extraordinary appeal, characterized by high demand, a thriving economy, and a vibrant community. As nature and technology coexist, making Sunnyvale a unique place to call home, it will continue to attract individuals and families alike. The housing market is competitive, but for many, the benefits of living in Sunnyvale outweigh the rising costs.

FAQs

What is the average home price in Sunnyvale?

The average home value in Sunnyvale is approximately $2.01 million, with recent trends highlighting significant appreciation over the past year.

Is Sunnyvale a good place to invest in real estate?

Given its strong economic foundation and consistent demand for housing, Sunnyvale is often considered a good investment option for real estate.

How have Sunnyvale home prices changed over the years?

Sunnyvale home prices have consistently increased, with notable appreciation rates reflecting the city's desirability and limited housing supply.

What are the future predictions for Sunnyvale home prices?

While prices are expected to continue growing, the pace may slow down due to various economic factors. Buyers should remain informed about market shifts.

Are there affordable homes in Sunnyvale?

The current market presents challenges for affordability, but options may exist, particularly in less central neighborhoods or through local homebuyer assistance programs.

Also Read:

- San Jose Housing Market: Prices, Trends, Forecast 2024

- Average Home Price in San Jose

- $2 Million Homes: San Jose's Housing Market Reaches New Height

- Real Estate Forecast Next 5 Years California: Crash or Boom?

- California Housing Market: Price, Trends, Forecast 2024-2025

- Bay Area Housing Market: Prices, Trends, Forecast 2024-2025

- Bay Area Housing Market: What Can You Buy for Half a Million?

- The Great Recession and California's Housing Market Crash: A Retrospective

- Where Can I Buy a House for 300k in California?