The Boulder housing market has been on a rollercoaster ride in recent years. Will prices continue to rise, or will we see a further decline? Let us explore the latest trends and forecasts for the Boulder housing market, providing valuable insights for both buyers and sellers.

How is the Boulder Housing Market Doing Today?

Boulder County, CO is a beautiful and thriving area located in the foothills of the Rocky Mountains. With its stunning scenery, top-rated schools, and booming economy, it's no wonder why so many people are looking to buy or sell homes in this area.

According to Realtor.com®, Boulder County, CO maintains a balanced market as of February 2024, with equilibrium between supply and demand. The median days on market for homes in the area averaged 34 days, indicating a relatively brisk pace of transactions.

Median Listing and Sold Prices

In February 2024, the median listing home price in Boulder County, CO stood at $860,000, reflecting a notable 4.8% year-over-year increase. Concurrently, the median sold price for homes settled at $723.4K, indicating a robust market performance.

Sale-to-List Price Ratio

The sale-to-list price ratio in Boulder County, CO stood at an impressive 99.2% in February 2024, suggesting that homes in the area typically sold for close to their asking prices. This statistic underscores the competitiveness of the market and the strong demand for properties.

Days on Market

Notably, the trend for median days on market has exhibited a slight decrease compared to the previous month, signaling increased efficiency in property sales. However, there has been a marginal uptick in this metric compared to the same period last year, suggesting a nuanced market dynamic influenced by various factors.

The 2024 housing market in Boulder County, CO presents an intriguing landscape characterized by rising prices, strong buyer demand, and a balanced market equilibrium. With properties typically selling close to their listing prices and a relatively swift pace of transactions, the region continues to be an attractive destination for homebuyers and investors.

Boulder Housing Market Forecast for 2024 and 2025

As prospective buyers and sellers in the Boulder, Colorado housing market, it's natural to wonder about the future trajectory of home values and market conditions. While no forecast can predict with absolute certainty, analyzing the available data can provide valuable insights into what may lie ahead.

Boulder Housing Metrics Overview

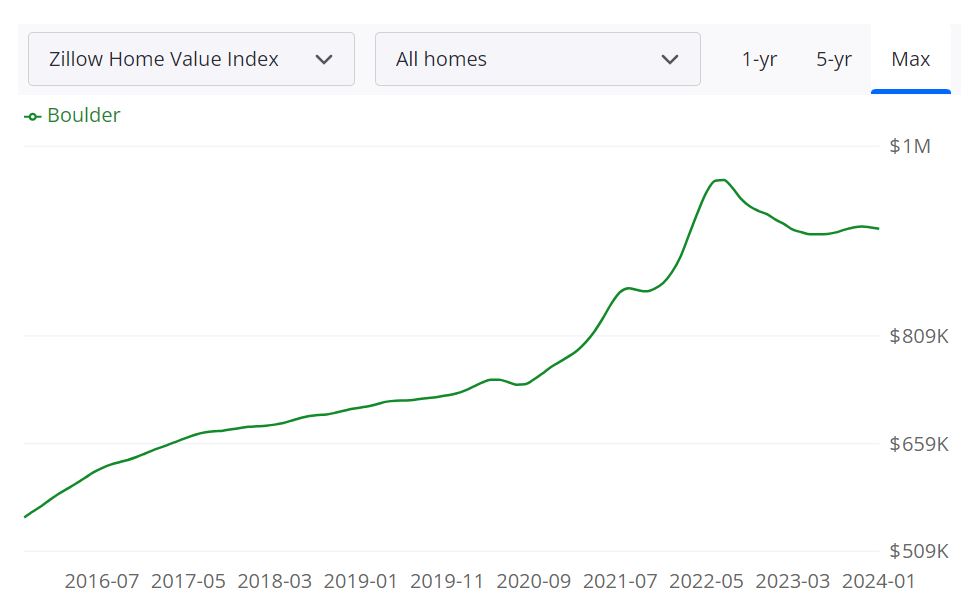

According to Zillow, the Boulder housing market is experiencing nuanced changes, reflecting a dynamic real estate landscape. As of January 31, 2024, the average home value in Boulder is $958,651, showing a modest decline of 1.3% over the past year. Homes in Boulder typically go pending in approximately 51 days, indicating a balanced market.

Housing Metrics Breakdown

- For Sale Inventory (January 31, 2024): The housing market boasts a diverse inventory with 398 properties available for sale.

- New Listings (January 31, 2024): A promising sign for potential buyers, there were 61 new listings reported at the end of January.

- Median Sale Price (December 31, 2023): The median sale price stands at $947,500 as of the end of December 2023.

- Median List Price (January 31, 2024): The current median list price for properties in Boulder is $1,199,167.

Boulder MSA Housing Market Forecast

Intriguingly, the Boulder Metropolitan Statistical Area (MSA) housing market is set for notable changes in the coming months. The forecast, sourced from Zillow and extending from February 29, 2024, to January 31, 2025, predicts a steady growth trajectory. The forecast indicates an increase of 0.9% by April 30, 2024, and a more substantial rise of 2.8% by January 31, 2025.

Metropolitan Statistical Area (MSA) refers to a geographical region with a densely populated city and its surrounding communities. In the case of Boulder, CO, the MSA encompasses the broader area in Colorado, providing a comprehensive view of the regional housing market. The forecasted growth suggests a positive trend, aligning with the overall resilience and desirability of the Boulder housing market.

The Boulder MSA includes multiple counties, each contributing to the overall dynamics of the housing market. These counties, collectively shaping the real estate landscape, play a crucial role in determining market trends. The significance of the Boulder MSA lies in its diverse housing options, economic vibrancy, and the overall appeal that attracts both homebuyers and investors alike.

Is Boulder a Buyer's or Seller's Housing Market?

In the current scenario, the Boulder housing market leans slightly towards a balanced state, offering opportunities for both buyers and sellers. The average time a home spends on the market, approximately 51 days, signifies a fair equilibrium. Buyers have a reasonable inventory to explore, while sellers benefit from a market that is not overly saturated.

Are Home Prices Dropping in Boulder?

While the average home value in Boulder has experienced a modest decline of 1.3% over the past year, it does not necessarily indicate a widespread trend of dropping prices. Rather, this could be attributed to normal market fluctuations. It's crucial to consider various factors, including inventory levels, demand, and economic conditions, to gain a comprehensive understanding of the market dynamics.

Will the Boulder Housing Market Crash?

As of now, there are no imminent signs of a housing market crash in Boulder. The market exhibits stability, with the forecast indicating positive growth in the coming months. However, it's essential to remain vigilant and monitor economic indicators, interest rates, and external factors that could potentially impact the real estate landscape.

Is Now a Good Time to Buy a House in Boulder?

Considering the current state of the Boulder housing market, it appears to be a favorable time for buyers. With a balanced market, reasonable inventory, and the potential for future growth, prospective homebuyers may find opportunities that align with their preferences and budget. However, individual circumstances and long-term goals should always be taken into account when making such significant decisions.

Boulder Real Estate Investment Overview

Boulder, Colorado, is a vibrant city known for its natural beauty, cultural attractions, and thriving economy. With a population of around 100,000, it is one of the fastest-growing cities in the United States. The city's real estate market has been consistently strong over the years, with home prices increasing at a steady pace. In this overview, we will explore the Boulder real estate market and examine whether it is a good place for real estate investment.

The Boulder real estate market has a lot to offer investors. One of the primary advantages of investing in Boulder is the city's strong and diverse economy. Boulder is home to several major industries, including aerospace, biotech, and technology. The city's economy has been growing at a steady pace, which has led to a high demand for housing. This demand is expected to continue, given the city's high quality of life, natural beauty, and proximity to Denver.

Another advantage of investing in Boulder real estate is the city's excellent infrastructure. The city has an extensive network of highways, which makes it easy to travel within the region. Additionally, Boulder has a well-developed public transportation system, including buses and light rail. This infrastructure is essential for real estate investors, as it makes it easier for tenants to access their properties and increases the overall value of the real estate in the area.

Boulder is also known for its exceptional schools and universities. The University of Colorado Boulder is one of the largest employers in the city and is known for its world-class research programs. This has led to a large population of students and faculty in the area, which has increased the demand for rental properties. Additionally, the city's excellent public schools have attracted families with children to the area, which has led to an increased demand for single-family homes.

Investors should also be aware of the challenges of investing in Boulder real estate. One of the primary challenges is the high cost of living in the city. The cost of living in Boulder is 29% higher than the national average, which can make it difficult for investors to find affordable properties. Additionally, the city's stringent zoning laws and building codes can make it challenging to build new properties, which can limit the supply of available housing.

Despite these challenges, the Boulder real estate market remains a strong and attractive investment opportunity. The city's strong economy, excellent infrastructure, and high quality of life make it a desirable place to live, work, and invest. Investors who are willing to navigate the challenges of the market can find excellent opportunities to grow their real estate portfolios in Boulder.

Hence, the Boulder real estate market is an attractive investment opportunity for those looking for stable, long-term growth. While the high cost of living and stringent zoning laws can make it challenging to find affordable properties, the city's strong economy, excellent infrastructure, and high quality of life make it a desirable place to live and work. For investors willing to put in the time and effort, the Boulder real estate market offers excellent potential for growth and returns.

It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. A good cash flow means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make.

Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

References

- https://www.zillow.com/boulder-co/home-values

- https://www.redfin.com/city/2025/CO/Boulder/housing-market

- https://www.neighborhoodscout.com/co/boulder/real-estate

- https://www.zumper.com/rent-research/boulder-co

- https://www.realtor.com/realestateandhomes-search/Boulder_CO/overview

- https://www.coloradorealtors.com/market-trends/regional-and-statewide-statistics/