The Fort Collins housing market in 2024 presents an interesting scenario for buyers and sellers alike. February 2024 saw a surge in new listings, particularly in single-family homes (up 23.6%) and townhouse-condo properties (up 41.7%). Despite this increase in inventory, pending sales remained robust, indicating sustained demand.

Median sales prices fluctuated slightly, with single-family homes experiencing a 0.7% decrease and townhouse-condo properties seeing a 1.3% increase. Notably, days on market decreased for both property types, suggesting a quicker sales process. Overall, the market appears balanced, offering opportunities for both buyers and sellers to achieve their goals.

Fort Collins Housing Market Trends in 2024

How is the Housing Market Doing Today?

Fort Collins, Colorado is a picturesque city located at the foothills of the Rocky Mountains. Known for its scenic beauty, vibrant downtown, and top-rated schools, Fort Collins has become a popular destination for homebuyers. The data revealed by the Fort Collins Board of REALTORS® shows that in February 2024, the market experienced a surge in new listings, with single-family homes witnessing a **23.6 percent increase** and townhouse-condo properties soaring by **41.7 percent**.

This influx of new properties entering the market signals a potentially favorable environment for buyers, providing them with more options to choose from. Despite the increase in new listings, pending sales remained robust. Single-family homes recorded **160 pending sales**, while townhouse-condo properties saw **53 pending sales**. This indicates sustained demand in the market, as buyers continue to show interest in purchasing properties in Fort Collins.

The median sales price for single-family homes experienced a slight decline of **0.7 percent**, settling at **$586,000**. Conversely, townhouse-condo properties witnessed a **1.3 percent increase** in median sales price, reaching **$422,655**. These fluctuations in prices suggest a market that is adjusting to various factors such as supply and demand dynamics, economic conditions, and buyer preferences.

One of the notable changes in the Fort Collins housing market is the decrease in days on market for both single-family homes and townhouse-condo properties. Single-family homes saw a **4.0 percent decrease**, while townhouse-condo properties experienced a significant **19.2 percent decrease**. This reduction in days on market indicates that properties are selling at a faster pace, reflecting the active nature of the market.

Fort Collins Housing Market Forecast for 2024 and 2025

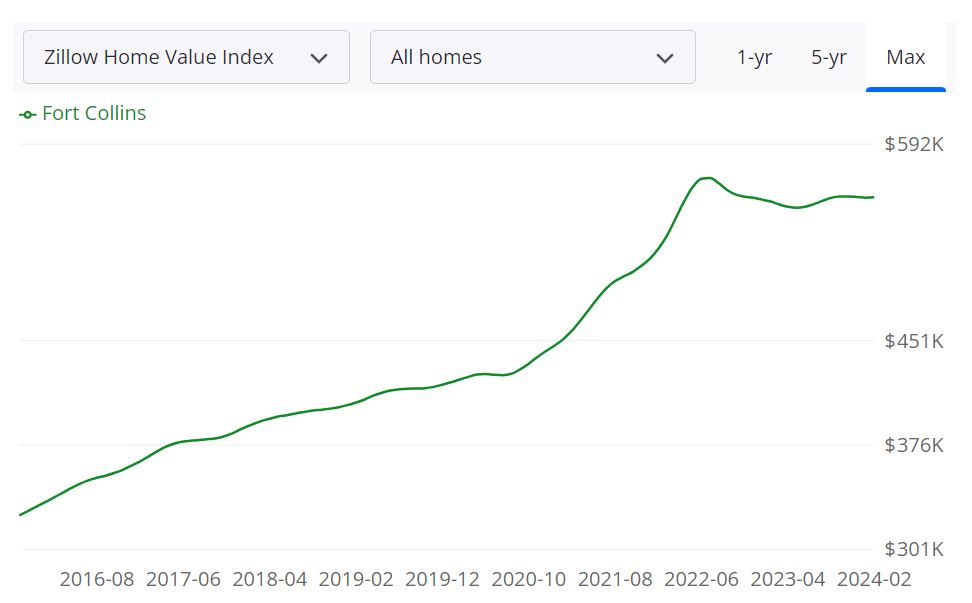

Fort Collins, a city nestled in the northern part of Colorado, boasts a vibrant housing market that has been steadily growing in recent years. According to Zillow, the average home value in Fort Collins stands at $554,647, marking a 0.6% increase over the past year. Homes in this area typically go pending within an efficient 29 days, showcasing the brisk pace of transactions within the region.

Explaining Housing Metrics

Delving into the intricacies of the housing metrics provides valuable insights into the Fort Collins market. As of February 29, 2024, the inventory of homes for sale stood at 418, indicating a healthy supply for prospective buyers. Moreover, 108 new listings entered the market on the same date, further diversifying the options available to potential homeowners.

The median sale to list ratio, a key indicator of market competitiveness, registered at 0.991 as of January 31, 2024, highlighting the balanced nature of transactions. In terms of pricing, the median sale price was $507,083, while the median list price stood slightly higher at $586,333 as of February 29, 2024. Noteworthy percentages of 14.5% and 58.1% denote the proportion of sales over and under the list price, respectively, underscoring the diverse negotiation dynamics prevalent in the Fort Collins housing market.

Fort Collins MSA Housing Market Forecast

Zooming out to examine the broader market trends, the Fort Collins Metropolitan Statistical Area (MSA) presents a promising outlook for the coming months. This MSA encompasses various counties in Colorado and serves as a significant economic and residential hub within the state.

With a forecasted growth rate of 0.2% by March 31, 2024, followed by a further increase to 0.4% by May 31, 2024, the region is poised for continued expansion. Looking ahead to February 28, 2025, a marginal decline of -0.9% is anticipated, reflective of the nuanced fluctuations inherent in real estate markets.

Understanding the scale of the Fort Collins MSA entails recognizing its geographic and economic reach. Comprising multiple counties in Colorado, including Larimer and Weld, this MSA encapsulates a diverse array of communities and housing markets. Its significance extends beyond mere size, as the Fort Collins MSA serves as a focal point for residential, commercial, and industrial activities, underpinning its pivotal role in the state's economy.

Are Home Prices Dropping in Fort Collins?

While the Fort Collins housing market has experienced steady growth, there are no indications of imminent price drops. The average home value has seen a modest increase over the past year, signaling stability rather than decline. However, market conditions can shift rapidly, and it is essential for buyers and sellers alike to stay informed and adapt to evolving trends.

Will the Fort Collins Housing Market Crash?

Forecasting a housing market crash involves meticulous analysis of numerous economic and demographic factors, making it challenging to predict with certainty. Currently, there are no imminent signs of a crash in the Fort Collins market. However, market conditions can fluctuate, influenced by external factors such as interest rates, employment trends, and geopolitical events. It is advisable for stakeholders to remain vigilant and seek guidance from real estate professionals to navigate potential risks.

Is Now a Good Time to Buy a House in Fort Collins?

Deciding whether it is a good time to buy a house in Fort Collins hinges on individual circumstances and preferences. With favorable mortgage rates as compared to last year and a diverse inventory of homes, many prospective buyers may find the current market conducive to their needs. However, it's essential to conduct thorough research, consider long-term financial implications, and assess personal readiness before making a significant investment in real estate.

Fort Collins Real Estate Investment Overview

Northern Colorado city Fort Collins is regarded as one of the most desirable places to reside in Colorado. Fort Collins, with a population of over 170,000, has a thriving economy, exceptional schools, and a thriving culture. Colorado State University is located in the city, which contributes to its vibrant and educated population. All of these factors have made Fort Collins an attractive real estate investment location.

The city's robust rental market is one of the primary reasons why Fort Collins is an excellent real estate investment opportunity. Consistently robust, due to the high demand for housing from students, families, and young professionals. In addition, the city's stringent zoning regulations restrict the number of rental properties, resulting in a limited supply of rental units. This circumstance leads to high rental costs and low vacancy rates.

Fort Collins's housing market has also experienced consistent growth over the years, making it an ideal location for real estate investors. Fort Collins's real estate market is diverse and offers a variety of investment opportunities. Investors have the option of purchasing single-family residences, condominiums, townhomes, and even commercial properties. In addition, the city's robust economy has led to a growing demand for commercial real estate, providing investors with an excellent investment opportunity.

Additionally, investors in Fort Collins benefit from the city's tax policies, making it a low-cost investment option. Colorado has no estate or inheritance tax, and its property tax rates are among the lowest in the nation.

Overall, Fort Collins presents a unique opportunity for real estate investors. With a robust rental market, a thriving economy, and a diverse real estate market, investors can find opportunities that align with their specific objectives.

Top Reasons to Invest in Fort Collins Real Estate

There are several compelling reasons why investing in Fort Collins real estate can be a smart decision. Here are some of the top reasons to consider:

- Strong Market Fundamentals: Fort Collins has a thriving economy, a stable employment market, and a consistently high standard of living. These factors make the area appealing to both renters and homebuyers, thereby assuring a steady demand for real estate.

- Diverse Housing Options: Fort Collins provides a variety of housing options, ranging from affordable apartments to luxury residences, making it an attractive market for investors with varying budgets.

- Proximity to Denver: Fort Collins is a little more than an hour's journey from Denver, one of the fastest-growing cities in the United States. This makes Fort Collins an attractive option for people who work in Denver but prefer a smaller, tranquil community.

- Strong Rental Market: Fort Collins has a robust rental market due to its large student population, as well as its growing number of young professionals and families. This affords investors opportunities to generate consistent rental income.

- Appreciation Potential: Fort Collins real estate has historically appreciated at a consistent rate, and with the city's expanding population and robust economy, there is the potential for future appreciation.

- Favorable Regulatory Environment: Fort Collins has a favorable regulatory environment, with minimal taxes and a streamlined regulatory procedure. This facilitates the acquisition and management of the real estate in the area by investors.

- Outdoor Recreation: Fort Collins is surrounded by stunning natural scenery, including the Rocky Mountains and Horsetooth Reservoir, ideal for outdoor recreation. This makes it a desirable destination for outdoor enthusiasts, which can increase demand for vacation rentals.

Thus, Fort Collins is an attractive location for real estate investors due to its combination of robust market fundamentals, diverse housing options, and lenient regulations.

Buying an investment property is different from buying an owner-occupied home. Whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success as a Real Estate Investor in Fort Collins, CO is your ability to find great real estate investments in that area.

According to real estate experts, buying in a market with increasing prices, low interest, and low availability requires a different approach than buying in a cooler market. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you may fill up the form given here.

Sources:

- https://fcbr.org/monthly-housing-statistics/

- https://www.zillow.com/fort-collins-co/home-values/

- https://www.redfin.com/city/7006/CO/Fort-Collins/housing-market

- https://www.neighborhoodscout.com/co/fort-collins/real-estate

- https://www.realtor.com/realestateandhomes-search/Fort-Collins_CO/overview

- https://www.zumper.com/rent-research/fort-collins-co