As we navigate the trends in the Colorado Springs Housing Market, it becomes evident that the region offers a balanced and stable environment for real estate activities. Buyers and sellers alike can benefit from understanding the current trends and leveraging the insights provided by median listing home prices, sale-to-list price ratios, and median days on the market.

Colorado Springs Housing Market: Prices & Trends

Colorado Springs, CO, nestled at the eastern foot of the Rocky Mountains, presents a captivating allure for homebuyers seeking a blend of urban amenities and outdoor adventure. According to realtor.com®, as of February 2024, the median listing home price in this vibrant city stands at $459,000, holding steady in comparison to the previous year. The median listing home price per square foot paints a picture of $224, while the median home sold price rests comfortably at $425,000.

Seller’s Dominance

In the realm of real estate dynamics, Colorado Springs, CO proudly boasts its status as a seller’s market in February 2024. This distinction implies a scenario where demand outweighs supply, offering sellers a favorable environment for negotiation. Homes in this picturesque locale are fetching prices close to their asking rates, with a sale-to-list price ratio standing at an impressive 100%. This metric underscores the eagerness of buyers to secure properties in this coveted locale, often resulting in competitive bidding scenarios.

Market Dynamics

Delving deeper into the intricacies of the Colorado Springs housing market unveils intriguing insights. The median days on market, a crucial indicator of demand, clocks in at 34 days on average. This figure not only reflects the brisk pace at which properties are changing hands but also signals a notable shift from previous trends. Over the past year, the trend for median days on market has exhibited a downward trajectory, showcasing the sustained appeal of Colorado Springs as a prime residential destination.

Forecast and Outlook

Looking ahead, experts anticipate continued resilience in the Colorado Springs housing market. Factors such as the city’s robust economy, scenic landscapes, and diverse array of recreational opportunities position it as a magnet for prospective homebuyers. While median listing home prices have remained relatively stable, the demand-supply dynamics favor sellers, accentuating the need for proactive strategies among buyers.

Colorado Springs – County Market Report

Colorado Springs is in El Paso County, Colorado. It is the most populous city in El Paso County, with a population of 478,961 at the 2020 United States Census. Colorado Springs is the second-most populous city and the most extensive city in the state of Colorado, and the 40th-most populous city in the United States. It is the principal city of the Colorado Springs metropolitan area and the second-most prominent city of the Front Range Urban Corridor.

The El Paso County housing market, like many others, has experienced its share of fluctuations and transformations over the years. This report (Colorado Association of REALTORS®) analyzes key metrics for both single-family homes and townhouses/condos, comparing data from 2023 to 2024, providing valuable insights into the evolving real estate market.

Single Family Homes: Continual Growth Amidst Stability

In the single-family homes segment, El Paso County has seen remarkable growth in various key metrics compared to the previous year. New listings have surged by 16.7%, indicating a healthy influx of properties onto the market. Despite this increase, the number of sold listings has also risen, albeit at a more modest rate of 6.8%, showcasing sustained demand.

One of the most notable aspects of the market is the appreciation in median sales price, which has climbed by 2.2%. This uptick reflects the desirability of properties in the region and underscores the value that homeowners are realizing. Similarly, the average sales price has seen a 4.2% increase, reaching $523,927. This rise speaks to the overall strength and stability of the housing market in El Paso County.

Buyers and sellers alike will be pleased to note the improved negotiation power, with the percent of list price received rising by 0.6%. Additionally, while days on market remain consistent at 54 days, indicating a balanced market, the inventory of homes for sale has seen a slight uptick of 0.8%. This increase, coupled with a 28.6% rise in months supply of inventory, suggests a shift towards a more buyer-friendly market, providing increased options and flexibility.

Townhouses/Condos: Diverse Opportunities Amidst Changing Dynamics

The townhouse and condo segment of the El Paso County housing market presents a slightly different picture, characterized by dynamic shifts in various metrics. While new listings have surged by a significant 33.3%, indicating a growing interest in multifamily properties, the sold listings have also experienced a healthy increase of 17.7%.

However, the median sales price for townhouses and condos has seen a slight decline of 4.0%, reflecting a more nuanced trend within this segment. This decrease, although modest, suggests opportunities for buyers seeking affordability in the region. Conversely, the average sales price has experienced a more notable decline of 5.1%, highlighting potential value propositions for investors or those looking for entry-level properties.

Despite these fluctuations, sellers can take solace in the fact that the percent of list price received has increased by 0.9%, indicating continued strong negotiation power. Nevertheless, the days on market until sale have seen a significant increase of 47.2%, suggesting a potentially more competitive landscape where properties may take longer to move.

The inventory of homes for sale in the townhouse and condo segment has surged by 37.2%, offering buyers a diverse range of options to explore. However, this increase has also led to a substantial rise in the months supply of inventory by 73.3%, signaling a potential shift towards a more buyer-centric market, where purchasers may have increased leverage and time to make informed decisions.

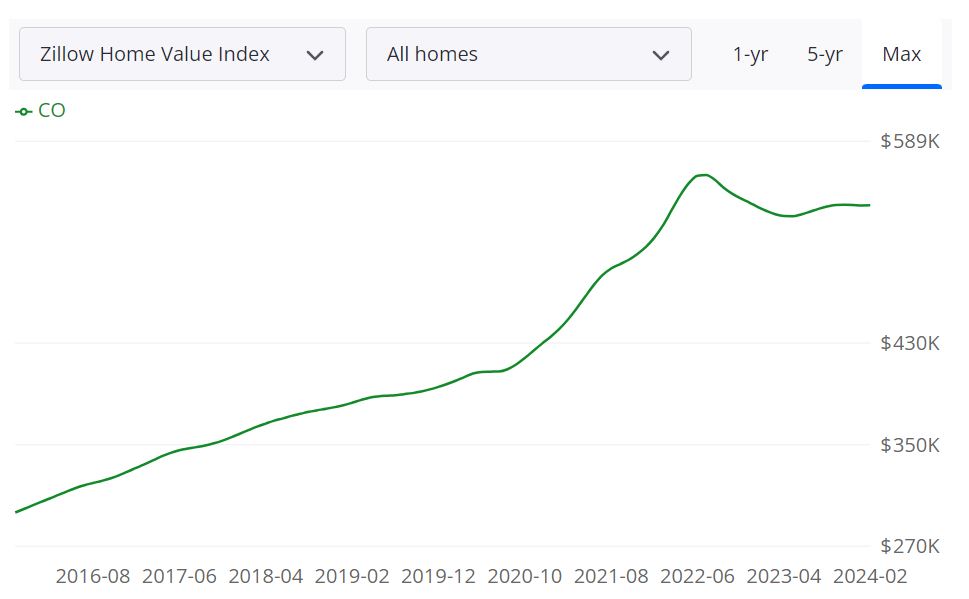

Colorado Springs Housing Market Forecast 2024 and 2025

Housing Metrics Explained

- For Sale Inventory: According to Zillow, as of February 29, 2024, the inventory of homes available for sale in Colorado Springs stands at 17,958, providing a glimpse into the supply side of the market.

- New Listings: Over the same period, there have been 4,947 new listings, indicating ongoing activity in the market and the introduction of fresh properties for prospective buyers.

- Median Sale to List Ratio: Calculated as 0.991 as of January 31, 2024, this metric showcases the relationship between listing prices and actual sale prices, offering insights into negotiation dynamics.

- Median Sale Price: The median sale price of homes in Colorado Springs as of January 31, 2024, is $497,267, reflecting the midpoint value in the spectrum of home prices within the market.

- Median List Price: At $552,300 as of February 29, 2024, the median list price provides a benchmark for sellers and an indicator of prevailing price expectations.

- Percent of Sales Over/Under List Price: These percentages, 20.8% and 55.7% respectively as of January 31, 2024, highlight the prevalence of competitive bidding and negotiation dynamics in the market.

Colorado Springs MSA Housing Market Forecast

In the context of the Metropolitan Statistical Area (MSA), the housing market forecast for Colorado Springs, CO offers a glimpse into its future trajectory. With projections extending to March 31, 2024, May 31, 2024, and February 28, 2025, stakeholders gain insights into the anticipated trends shaping the housing landscape in the coming months.

The Colorado Springs Metropolitan Statistical Area (MSA) encompasses a region characterized by its economic, social, and geographical cohesion. Comprising El Paso County as its primary constituent, the MSA extends its influence across neighboring counties, including Teller and Lincoln, among others. With a collective population exceeding 700,000 residents, this MSA represents a significant segment of Colorado’s housing market, influencing and being influenced by broader regional and national trends.

Is Colorado Springs a Buyer’s or Seller’s Housing Market?

With a median sale to list ratio nearing parity and a significant portion of sales occurring below list price, buyers may find opportunities for negotiation and potentially favorable terms. However, the relatively low inventory levels and competitive bidding for certain properties suggest a seller-friendly environment in segments of the market. Ultimately, the characterization of the market as favoring buyers or sellers may vary depending on specific factors such as neighborhood, property type, and prevailing economic conditions.

Are Home Prices Dropping in Colorado Springs?

As of the most recent data available, there is no indication of widespread or significant drops in home prices in the Colorado Springs housing market. While real estate markets are subject to fluctuations and localized trends, the median sale price and median list price have remained relatively stable, with modest increases noted over recent periods. Factors such as supply-demand dynamics, economic conditions, and interest rates can influence pricing trends, but at present, there is no evidence to suggest a pronounced downward trajectory in home prices.

Will the Colorado Springs Housing Market Crash?

Predicting a housing market crash with certainty is challenging due to the multitude of factors at play and the inherent complexity of real estate markets. While there may be fluctuations and localized corrections within specific segments or neighborhoods, broader market crashes are typically precipitated by systemic economic factors such as widespread job losses, economic recession, or financial instability.

Currently, the Colorado Springs housing market exhibits resilience, supported by steady demand, relatively low inventory levels, and favorable economic indicators. However, vigilance and prudent decision-making remain essential for stakeholders to navigate potential risks and uncertainties in the market.

Is Now a Good Time to Buy a House in Colorado Springs?

Determining whether now is a favorable time to buy a house in Colorado Springs depends on individual circumstances, financial considerations, and long-term objectives. For prospective homebuyers with stable incomes, favorable credit profiles, and a readiness to commit to homeownership, current conditions may present opportunities for favorable pricing, competitive interest rates, and a diverse selection of properties.

However, it’s crucial to conduct thorough research, assess affordability, and consider factors such as job stability and personal preferences before making a decision. Consulting with real estate professionals and financial advisors can provide valuable insights and guidance tailored to individual needs and goals.

Colorado Springs Real Estate Investment: Should You Invest?

Is Colorado Springs a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Colorado Springs is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers. Let’s talk a bit about the Colorado Springs area before we discuss what lies ahead for investors and homebuyers. The Colorado Springs real estate market gets overlooked in favor of bigger markets like Denver.

However, Colorado Springs has several things in its favor for residents and real estate investors alike. Colorado Springs sits on the eastern side of the Rocky Mountains. Colorado Springs contains nearly half a million people. The Colorado Springs metropolitan area is home to around seven hundred thousand people. The Colorado Springs area is seeing continual, rather fast growth. Colorado Springs real estate has continued to appreciate faster than most of the markets in the US.

Conditions in the Colorado Springs real estate market seem to be in a sustainable, upward direction and show no signs of slowing down. Inventory is low and prices are increasing at a steady pace. The local economy is strong and mortgage rates remain low. Colorado Springs’s real estate appreciation rate in the latest quarter was around 3.02%, which equates to an annual appreciation rate of 12.63%. You can either choose to invest in your future or market your home to potential buyers.

If you are looking to make a profit, you don’t want to buy the most expensive property on the Colorado Springs real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Colorado Springs that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider. Let’s take a look at the number of positive things going on in the Colorado Springs real estate market which can help investors who are keen to buy an investment property in this city.

Colorado Springs is a Rental Market

Many people know that the Air Force Academy is located in Colorado Springs. However, the student market in Colorado Springs is both larger and more diversified than the military student population. The University of Colorado Springs hosts over twelve thousand students. Colorado College, Colorado Technical College, Remington College, Colorado Christian University, and the University of the Rockies are also located here. This provides a large, diverse student market that rents properties across the Colorado Springs real estate market.

U.S. News and World Report magazine discusses the large retiree community in Colorado Springs. The area’s abundant recreational opportunities and proximity to military services like commissaries and VA facilities explain why more than 10% of the population is retired – many of them military veterans and their families. Peterson Air Force Base sits on the eastern edge of town.

For Airbnb’s attractability and business building, there are two huge military bases with Air Force, Naval Academy. Fort Carson, an Army base, is located within the city limits. The infamous Cheyenne Mountain is located just to the west of town. A side benefit of this diverse military market is that the Colorado Springs real estate market enjoys a large, permanent population of renters but without the wild swings that come with the rise and fall of a single military base’s fortunes.

Latest Rental Trends in Colorado Springs, CO

As of March 2024, the median rent for all bedroom counts and property types in Colorado Springs, CO is $1,774. This is -10% lower than the national average. Rent prices for all bedroom counts and property types in Colorado Springs, CO have decreased by 9% in the last month and have decreased by 11% in the last year.

The monthly rent for an apartment in Colorado Springs, CO is $1,295. A 1-bedroom apartment in Colorado Springs, CO costs about $1,278 on average, while a 2-bedroom apartment is $1,457. Houses for rent in Colorado Springs, CO are more expensive, with an average monthly cost of $2,195.

Occupancy Status

The occupancy distribution in Colorado Springs is as follows:

- Renter-occupied Households: 40%

- Owner-occupied Households: 60%

This distribution provides an insight into the housing landscape and the prevalent occupancy preferences in the city.

According to RENTCafe, 36% of the households in Colorado Springs, CO are renter-occupied. The average size for a Colorado Springs, CO apartment is 837 square feet with studio apartments being the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage. 48% of the apartment can be rented in the price range of $1,001-$1,500 while 36% fall in the price range of $701-$1,000.

The most expensive Colorado Springs neighborhoods to rent apartments in are Briargate, Northgate, and Central Colorado City. The cheapest Colorado Springs neighborhoods to rent apartments in are East Colorado Springs, Southeast Colorado Springs, and Northeast Colorado Springs.

The Landlord Friendly Market Compared to the Rest of the West

Colorado is almost as landlord-friendly as Arizona and Texas, but it is far more landlord-friendly than Nebraska, Kansas, or any West Coast state. Colorado allows you to quickly evict tenants who don’t pay their rent. Once you give them a demand for compliance, they have 72 hours to either pay up or move out. If that 3 day period expires and you go to court, the courts typically side with the landlord. After that ruling, the tenants have 48 hours to leave, and then local law enforcement will enforce the eviction order. Another major point in its favor is that you’re not required to get tenants a 24-hour notice before you visit the property.

Short-Term Rental Investment Opportunities

A city that’s within a stone’s throw of Pike’s Peak and the rest of the Rocky Mountains is going to attract tourists. Garden of the Gods is a very famous public park located in Colorado Springs. It was designated as a National Natural Landmark in 1971. It features stunning geological formations, rock climbing, nature trails, and the Garden of the Gods Visitor & Nature Center. Another major attraction is the US Olympic Training Center, located in Colorado Springs. Colorado Springs allows properties to be rented out on a short-term basis, but you must have a short-term rental permit and collect the appropriate taxes.

Colorado Springs’ regulations on short-term rentals are not as stringent, though, as those in nearby “tourist” towns like Breckenridge. Colorado Springs is a very Airbnb-friendly city. You can convert your property into an Airbnb vacation rental and rent it out to vacationers and tourists on a short-term rental basis. Owning a house near the Gardens of the Gods Park can prove to be a goldmine in building up your Airbnb rental business. For setting up an Airbnb business, there are lots of outdoor attractions, 3 hospitals, the Broadmoor hotel (historic hotel on a lake), 2 cute downtown streets with restaurants (downtown and colorado city), 90mins from Denver, and 2 hours from skiing in Breckenridge.

Their airport offers direct flights to many cities via Frontier & United. You can also co-host clients in Colorado Springs through profit sharing with landlords. You can charge landlords a start-up fee and 20% commission for co-hosting (finding clients and getting the property Airbnb ready). The controversial Airbnb ordinance was passed in November 2018 by the Colorado Springs City Council. Under the ordinance, property owners must apply for a license, pay taxes, and obey neighborhood rules. This came into effect on January 1st, 2019.

Colorado Springs’ Strong Job Growth & Demographics Momentum

The Colorado Springs area boasted an unemployment rate of around 3% in 2018, more than a full percentage point less than the national average. People move here for work and the lower cost of living compared to more expensive Front Range cities. Industry sectors hiring people include hospitality and professional and technical services. The latter category is driven by defense contractors in the area.

Despite the very large population over the age of 65, Colorado Springs managed to have a median age of 34, several years below the national average. The tight labor market is drawing people to the area and keeping college graduates in the vicinity. This guarantees demographic momentum as young people stay here to buy homes and raise their own families, fueling demand for the Colorado Springs real estate market.

Colorado prides itself on cultivating high-tech jobs like California without the over-crowding or insane housing prices. Yet this has made the Denver housing market unaffordable for many people who work there. One solution for many is living in Colorado Springs and commuting an hour or more each way to work. Another solution that’s more readily available in Colorado than elsewhere is telecommuting.

Realtors in the Colorado Springs housing market are finding people buying houses even on the south side so they can find a property they can afford, then driving in one or two days a week to Denver. Conversely, the high price of a property in Denver is driving many businesses to move or expand south into the Front Range, bringing Denver’s jobs closer to the Colorado Springs housing market.

Steady Property Appreciation Forecast

Population growth in Colorado Springs has been just ahead of new home construction; housing permits in the Colorado Springs real estate market, for example, are not yet back at 2005 levels. This helps to explain why home prices have risen more than 40% in the past five years, though it is one of the most active housing markets in the country. This is partial because Millennials are the biggest group buying houses today, and the Colorado Springs real estate market is already loaded with them.

Millennials prioritize homes in walkable areas with access to public transit, but they value practical, usable homes oversize. This means well-designed condos and duplexes in the right areas are as attractive to them as a large house in the suburbs. However, the limited supply of homes on the market in Colorado Springs is keeping prices increasing faster than the rate of inflation. Ironically, the near-total lack of homes with negative equity in the Colorado Springs housing market has been considered one reason why prices are going up so fast.

Colorado Real Estate Investment Opportunities

Maybe you have done a bit of real estate investing in Colorado but want to take things further and make it into more than a hobby on the side. The Colorado Springs real estate market contains several large populations of renters, many practical reasons for people to move here from the surrounding area and across the country, and long-term factors that will drive growth for years to come. Forget the Mile High City and invest in the Colorado Springs real estate market.

Good cash flow from Colorado Springs investment properties means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Colorado Springs real estate investment opportunity would be key to your success.

The three most important factors when buying real estate anywhere are location, location, and location. The location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Colorado Springs investment real estate and you should be able to flip it for a lump sum profit.

The neighborhoods in Colorado Springs must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. As with any real estate purchase, act wisely. Evaluate the specifics of the Colorado Springs housing market at the time you intend to purchase.

Some of the popular neighborhoods in Colorado Springs are Broadmoor, Old Farm, Colorado Centre, Kissing Camels, Downtown Colorado Springs, Falcon Heights, Cordera, Wolf Ranch, Rockrimmon, Old Colorado City, Fountain Valley, Old North End, Pikes Peak Park, Briargate and Flying Horse Ranch.

Here are the ten neighborhoods in Colorado Springs having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Fort Carson Southwest

- Fort Carson

- Fort Carson South

- Fort Carson West

- Fort Carson Northwest

- Spring Creek

- Old Colorado City

- Lowell

- Patty Jewett South

- Southeast Colorado Springs

REFERENCES

Market Prices, Trends & Forecasts

https://www.coloradorealtors.com/

https://www.coloradorealtors.com/market-trends/regional-and-statewide-statistics/

https://www.zillow.com/ColoradoSprings-co/home-values

https://www.neighborhoodscout.com/co/colorado-springs/real-estate/

https://www.realtor.com/research/hottest-zip-codes-2021/

https://www.realtor.com/realestateandhomes-search/Colorado-Springs_CO/overview

https://greatcoloradohomes.com/colorado-springs-real-estate-market-statistics.php

https://www.propertymanagementincoloradosprings.com/colorado-springs-local-market-statistics

Rental Statistics

https://www.rentcafe.com/blog/renting/states-best-worst-laws-renters

https://morrisinvest.com/blog/2016/12/21/5-most-landlord-friendly-states

http://www.landlordstation.com/blog/top-landlord-friendly-states

https://www.zumper.com/rent-research/colorado-springs-co

Reasons to Invest in Colorado Springs

https://www.uccs.edu

https://en.wikipedia.org/wiki/Colorado_Springs,_Colorado

https://realestate.usnews.com/places/colorado/colorado-springs

https://www.military.com/base-guide/colorado-springs-military-bases

https://www.zeonamcintyre.com/blog/2018/1/26/airbnb-investing-trip-colorado-springs-edition

https://www.krdo.com/news/top-stories/airbnb-ordinance-passes-2nd-vote-by-colorado-springs-city-council/862178044

https://www.avalara.com/mylodgetax/en/blog/2018/10/colorado-springs-passes-new-airbnb-rules.html

http://www.cpr.org/news/story/move-over-denver-colorado-springs-might-have-the-hottest-housing-market