While the idea of a 30-year fixed mortgage rate falling into the 5% range remains appealing, current data suggests it’s unlikely to happen in a sustained way during 2026. As of mid‑January, the average rate stands at 6.06%. Recent inflation readings and Federal Reserve commentary point to slower—but not decisive—disinflation. As a result, most forecasts now expect mortgage rates to ease only into the low-to-mid 6% range unless a sharper economic slowdown emerges.

Is the 30-Year Fixed Mortgage Rate Set to Break into the 5% Range?

You know, for years, the 30-year fixed mortgage rate has been the North Star for so many of us dreaming of owning a home. It’s that steady beacon that promises predictable payments and a path to putting down roots. As we wrap up 2025, with the average rate hovering around 6%, that question keeps popping up everywhere I go: “Are we going to see those rates finally dip below 5%?” It’s a question that could unlock a whole new world for buyers and sellers.

As someone who's been following housing and finance for a while, I can tell you this isn't a simple yes or no. There are a lot of moving parts, and what affects mortgage rates is far more complex than just liking the number 5. It’s about understanding the economy, what the big financial players are doing, and even what’s happening across the globe. So, let's dive deep and see if that 5% dream is a realistic hope or just a wish.

What's the Story Right Now? A Snapshot of 2025

As of January 15, 2026, U.S. weekly mortgage rate averages show the 30‑year fixed mortgage rate at approximately 6.06% (Freddie Mac). This is a bit of a welcome relief compared to earlier in the year, but it's still quite a bit higher than the rock-bottom rates we saw before 2022. Think of it like this: the price of something might have come down a little from its highest point, but it's still not as cheap as it used to be.

We've seen some ups and downs this year. Rates even touched close to 6.9% for a bit before coming back down as the Federal Reserve started to make some moves. It reminds us that this number can be pretty jumpy, reacting to the latest news and economic reports. For someone looking to buy a $400,000 house, that difference between 6.2% and, say, 5.5% can mean paying around $150 less each month for the principal and interest. That’s money that can go towards furniture, home improvements, or just everyday life.

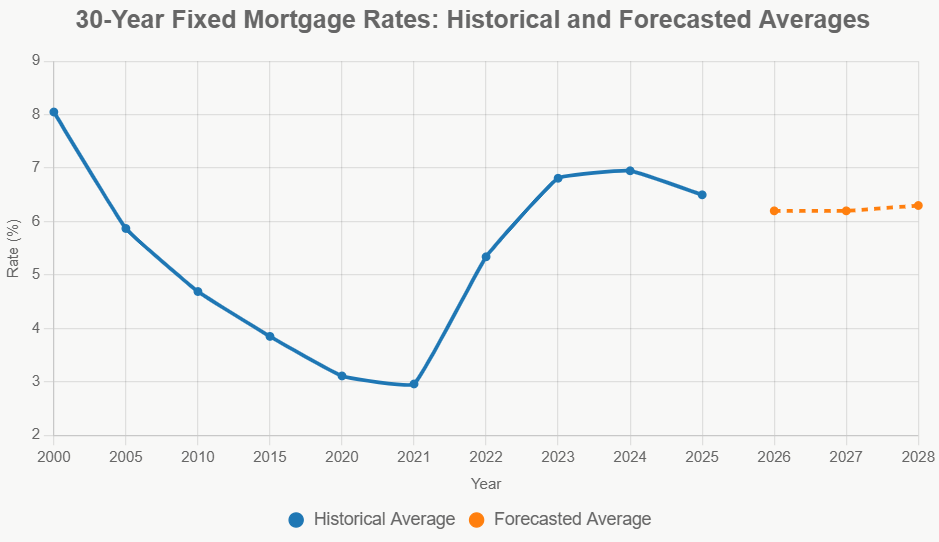

Looking Back: The Rollercoaster Ride of Mortgage Rates

To figure out if 5% is on the cards, it helps to remember where we've been. The 30-year fixed mortgage rate has averaged around 7.71% since 1971, according to data compiled by Freddie Mac and others. We even saw rates soar above 18% back in the early 1980s when inflation was a major problem.

Then things changed. After the 2008 financial crisis, we entered a period of really low rates. But the real wild ride arguably started with the COVID-19 pandemic:

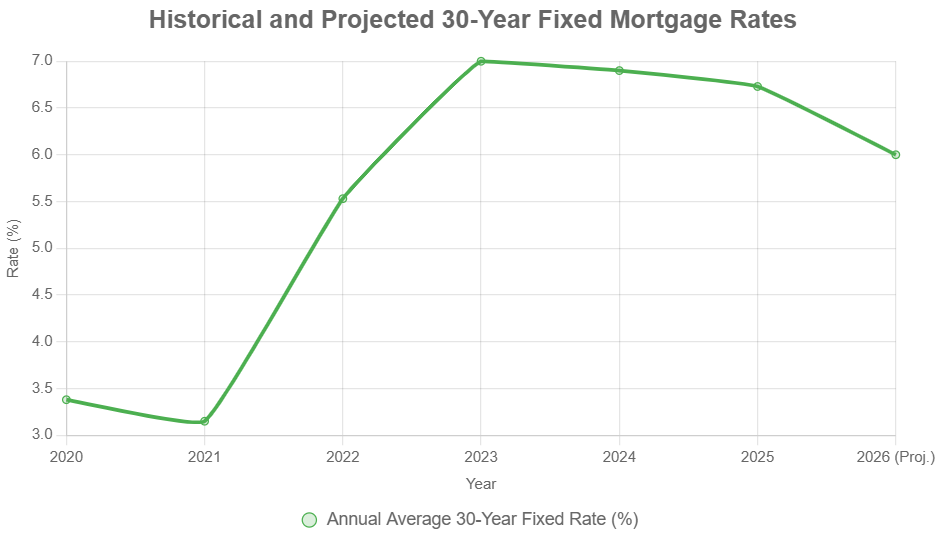

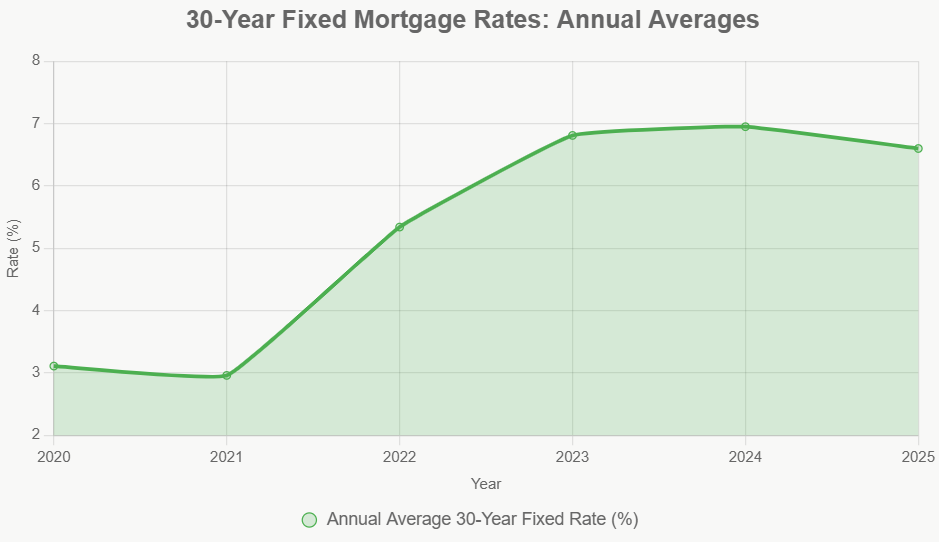

- 2020: Stimulus money flowed like water, and mortgage rates dropped to a yearly average of 3.11%. This sent people scrambling to buy homes, and sales shot up by 16%.

- 2021: This was the golden year for low rates, averaging 2.96%. Homeownership felt within reach for more people, but the lack of houses on the market led to bidding wars.

- 2022: Inflation started biting hard. Rates climbed to an average of 5.34% for the year, hitting a peak of over 7% by October as the Federal Reserve started hiking its key interest rate to fight rising prices.

- 2023: This year was tough, with an average rate of 6.81%. Many potential buyers were priced out, and home sales dropped by about 19%.

- 2024: Rates sort of bounced around, ending up at an average of 6.95%. Some rate cuts late in the year gave a little glimmer of hope.

- 2025: So far, rates have generally been in the mid-6% range, settling to an estimated annual average of 6.60% by year-end.

This history shows us that mortgage rates are super sensitive to what's happening in the economy. Dropping to 5% or below usually happens when the economy is pretty weak or when the Federal Reserve is making big efforts to boost things. Since the economy seems to be holding up fairly well, a dramatic drop might be capped.

What's Really Moving the Needle on Mortgage Rates?

It’s easy to think mortgage rates just magically appear, but they're actually tied to a bunch of bigger financial factors. The most important is the 10-year Treasury yield, which is basically what the government pays to borrow money for 10 years. Lenders then add a bit extra to that yield to cover their costs and make a profit, often around 1.8% to 2.3%.

Here are the main forces at play:

- The Federal Reserve's Moves: The Fed controls a short-term interest rate called the federal funds rate. When they cut this rate, it tends to push longer-term rates, including mortgage rates, lower. In 2025, the Fed made about three cuts, totaling 0.75%, bringing their target rate down. This helped ease pressure on mortgages. However, even with these cuts, mortgage rates didn't drop as much as folks hoped because inflation was still a bit stubborn. If the Fed cuts rates two more times in 2026, and inflation keeps cooling, we could see mortgage rates drop by another 0.25% to 0.50%.

- Inflation's Grip: As of late 2025, the core inflation rate (which measures price increases excluding food and energy) is around 2.7%. That's better than it was, but it's still higher than the Fed's target of 2%. If inflation continues to fall steadily, dipping below, say, 2.5%, that could help push mortgage rates closer to 5.5%. But if prices start creeping up again, maybe because of supply chain problems or rising wages, then those rate drops will stall.

- The Economy's Health: Things like job growth and the overall growth of the economy (GDP) play a big role. When the economy is strong, with unemployment low (around 4.1% as of late 2025) and GDP growing at a decent clip (like 2.5% annualized), it tends to keep interest rates higher. Consumers spending money and people wanting to buy homes also add to this demand for borrowing, which can keep rates from falling too low.

- What's Happening Globally: Big events happening worldwide can also affect things. For example, if there's a lot of fear or instability in the world, investors often move their money into safer investments like U.S. Treasury bonds, which can actually push their yields (and therefore mortgage rates) up. Also, in 2025, there were times when the market for mortgage-backed securities was a bit uncertain, causing lenders to widen the gap between their borrowing costs and the rates they offered to borrowers.

So, while the Fed cutting rates is a helpful nudge in the right direction, inflation's tendency to stick around is like a brake on how fast rates can fall. To really see rates dive below 5%, we'd probably need to see inflation come down consistently and the Fed feel confident enough to make more aggressive cuts.

What the Experts Are Saying About 2026

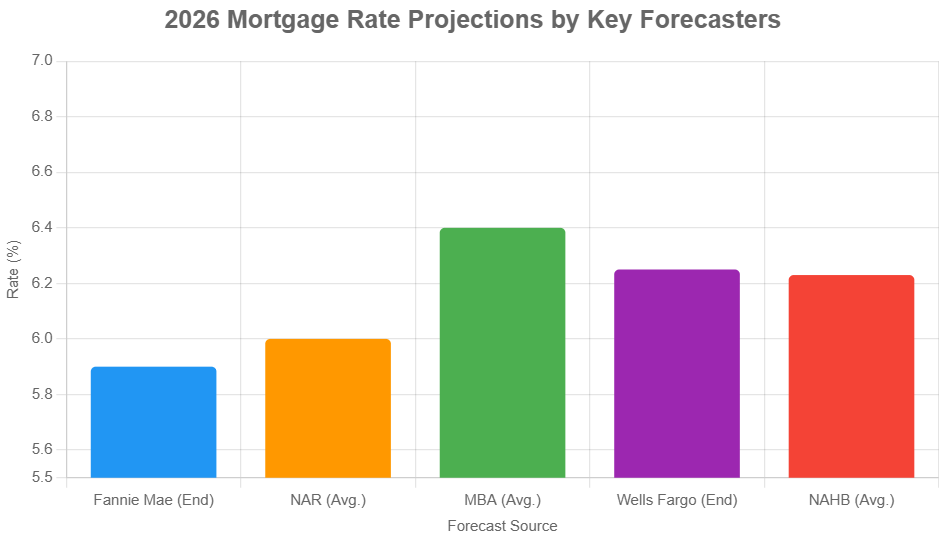

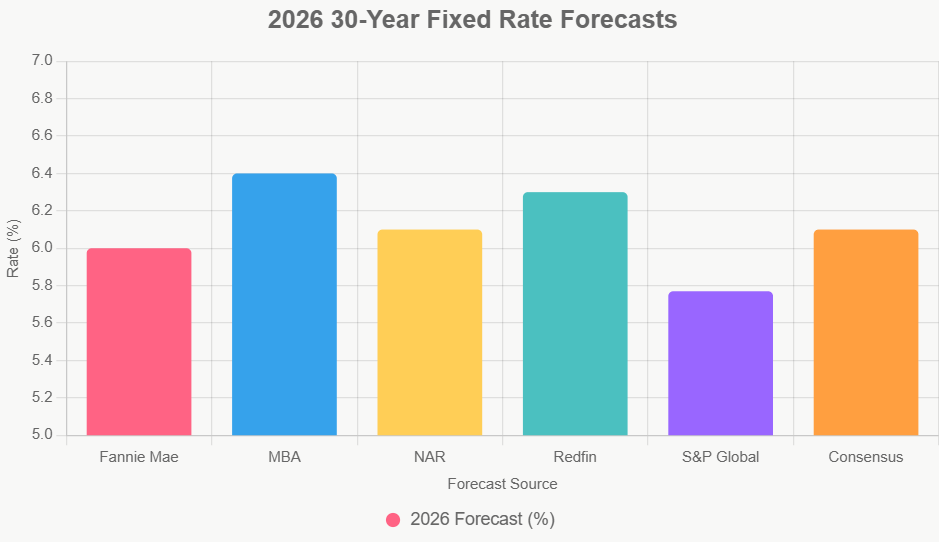

When I look at what the big financial institutions and real estate groups are predicting for 2026, there's a general feeling of some easing, but nobody is boldly shouting “5%!” here we come. The general consensus seems to be that rates will likely settle in the mid-6% range.

Here’s a quick rundown of some of those forecasts:

| Source | 2026 Average Rate | Q4 2026 Projection | Notes |

|---|---|---|---|

| Fannie Mae | 6.0% | 5.9% | Predicts a steady drop each quarter, betting on Fed cuts. |

| Mortgage Bankers Assoc. (MBA) | 6.4% | 6.4% | Expects rates to stay pretty much flat throughout the year. |

| National Assoc. of Realtors (NAR) | 6.1% | 6.0% | Believes rates will hang out in the mid-6% range. |

| Redfin | 6.3% | N/A | Suggests a slight easing compared to 2025. |

| S&P Global | 5.77% | N/A | The most optimistic forecast, banking on significant Fed action. |

Note: Some projections are based on specific scenarios and economic assumptions.

Fannie Mae has the most optimistic outlook, suggesting rates could end the year just shy of 5.9%. This scenario relies on the Fed making more cuts and inflation really cooperating. On the other hand, the MBA sees rates staying pretty much where they are. NAR and others are clustering in the low- to mid-6% zone. S&P Global's forecast of 5.77% is quite bullish and hinges on inflation cooling down faster than most expect.

Looking even further out, towards 2030, many forecasts suggest rates will hover in the 6.0% to 6.4% range, barring any major economic surprises. This suggests that the days of ultra-low rates might be behind us for a good while, at least without some significant economic upheaval.

If Rates Did Drop to 5%, What Would That Mean?

Now, let's imagine, just for a moment, that those rates did manage to dip into the 5% range. The impact would be pretty significant.

- More Buyers Could Enter the Market: This is the big one. Affordability would jump dramatically. Using data from the National Association of Home Builders (NAHB), when rates are around 7.25%, only about 20% of households can afford the average new home. But if rates dropped to 6.25%, that number jumps to around 26% – a nice boost. If we got down to 5%, even more people would be able to afford starter homes or upgrade. Redfin estimates this could bring 5.5 million more potential buyers into the game.

- Home Sales Could Get a Kickstart: With more buyers able to qualify for mortgages, we'd likely see a bump in overall home sales. We could be looking at a 10% to 15% increase in sales compared to what we're seeing now. The National Association of Realtors is already forecasting around 4 million existing-home sales in 2026, and a drop in rates could push that higher.

- Prices Might Start Climbing Again: While lower rates make homes more affordable on a monthly basis, they can also lead to more demand. In areas where homes are already scarce, this increased competition could push prices up by 2% to 3% nationally, though some regions might see bigger jumps than others.

- A Refinancing Frenzy: Homeowners who have higher-rate mortgages might rush to refinance, potentially freeing up tens of billions of dollars in household cash that could be spent elsewhere in the economy, giving GDP a little boost.

However, it's not all sunshine. If demand surges too quickly, it could put pressure on the limited supply of homes available. This could create bidding wars all over again and potentially push the Federal Reserve to rethink cutting rates further, or even raise them again if inflation starts to reheat.

My Take: Hope for Relief, But Keep Expectations in Check

From where I stand, looking at all the data and expert opinions, I feel there's good reason to expect some relief in mortgage rates during 2026. We’ll likely see those 30-year fixed rates move into the low- to mid-6% range. It’s not quite the 5% dream many are hoping for, but it’s still a step in the right direction and will make homeownership more attainable for a larger number of people.

Breaking into the 5% range is a much bigger ask. It would need inflation to cool off much faster and more consistently than it has been, and for the Federal Reserve to be very bold with their interest rate cuts. While it’s not entirely impossible, it seems like more of a long shot for 2026.

For anyone thinking about buying a home, my advice is to keep a close eye on the weekly mortgage rate reports from Freddie Mac and keep an eye on what’s happening with those Treasury yields. Think about your financial goals. If you see a rate that makes sense for you and locks in a payment you can comfortably afford, it might be worth considering. Waiting for 5% could mean missing out on a good opportunity if rates level off in the 6% range. In this market, being ready financially and making a strategic decision based on your own circumstances is key.

Invest Smartly in Turnkey Rental Properties

With rates dipping to their lowest levels, investors are locking in financing to maximize cash flow and long-term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?