Is the Los Angeles real estate market finally taking a breather, or is it still holding its breath? If you've been wondering about buying, selling, or just keeping an eye on property values in our vibrant city, you're not alone. The latest numbers for December 2025 tell us a compelling story: the Los Angeles housing market wrapped up the year with a slight cool-down in median home prices, but surprisingly robust home sales, hinting at a more inviting and stable market for 2026.

Los Angeles Housing Market Update: What's Shaking in SoCal?

The housing market in Los Angeles is always a hot topic, filled with unique challenges and opportunities. Unlike other parts of the country, our local dynamics are often influenced by a mix of high demand, limited space, and global economic currents. Let's dive into the specifics, using the recent insights from the California Association of Realtors® (C.A.R.), to understand what truly happened as 2025 came to a close.

Home Prices: A Closer Look at What You'll Pay

If you've felt like home prices in LA have been climbing relentlessly, December 2025 offered a slight pause. According to C.A.R.'s report, the median price for an existing single-family home in Los Angeles County in December 2025 was $890,910. This represents:

- A month-over-month drop of 5.5% from November 2025's $942,610.

- A year-over-year decrease of 2.4% from December 2024's $912,370.

Looking at the broader Los Angeles Metro Area, the median price was $807,540, showing a similar, though less steep, trend:

- Down 1.9% from November 2025.

- Down 1.0% from December 2024.

Now, why is this important? My immediate thought when I saw these figures was that while any dip might sound alarming, it’s actually a sign of the market adjusting. For potential buyers, this could mean less aggressive bidding wars and perhaps a moment to catch your breath. For sellers, it might signify that the peak frenzy has eased, requiring more strategic pricing.

C.A.R.'s Chief Economist, Jordan Levine, noted that “housing affordability showed some improvement in the fourth quarter.” From my perspective, this price adjustment, paired with lower interest rates (which we’ll get to), is precisely what many prospective Angelenos have been waiting for. It doesn't mean prices are crashing; it means they're finding a more sustainable level. We're stepping away from the almost unbelievable spikes we saw in recent years.

Home Sales: Buzzing or Stalling?

Despite the slight dip in prices, the number of homes changing hands in Los Angeles actually picked up speed. This is where December's report truly surprised many, especially considering it's typically a slower time of year.

For Los Angeles County, home sales saw:

- A significant 20.2% jump in December from November 2025.

- A modest 0.9% increase compared to December 2024.

And the Los Angeles Metro Area wasn't far behind, with sales up:

- 15.0% month-over-month.

- 2.2% year-over-year.

To me, these numbers highlight a crucial point: demand for living in LA is still very strong. Even with prices pulling back a little, people are still eager to make Los Angeles their home. This surge in sales, especially month-over-month, suggests that buyers who might have been sitting on the sidelines due to high interest rates or intense competition are now making their move. Tamara Suminski, C.A.R. President, put it well, saying, “As price growth eased toward the end of the year and mortgage rates fell to near-three-year lows, the stage is set for a more optimistic 2026.” I completely agree; this shows renewed buyer confidence.

Housing Supply: Are There More Homes on the Block?

The magic word in real estate often comes down to “inventory.” For Los Angeles, the housing supply paints a picture of stabilization rather than dramatic shifts.

Let's look at the Unsold Inventory Index, which tells us how long it would take to sell all currently available homes at the current sales pace:

- Los Angeles County: 2.8 months in December 2025. This is down from 3.8 months in November 2025, but just slightly up from 2.7 months in December 2024.

- Los Angeles Metro Area: 2.9 months in December 2025. This is down from 3.9 months in November 2025, and flat compared to 2.9 months in December 2024.

This tells me that while the overall statewide active listings still saw a year-over-year increase, the pace of that increase is slowing down. For us in Los Angeles, an inventory of around 2.8-2.9 months is still considered a pretty tight market, favoring sellers. However, coupled with the increase in sales, it suggests that homes aren't sitting around for too much longer.

The median number of days a single-family home took to sell in Los Angeles County was 33 days in December 2025, which is the same as November 2025 but up from 29 days in December 2024. For the Los Angeles Metro Area, it was 36 days, up from 33 days a year prior. Properties are taking a little longer to sell than a year ago, but not excessively so. This slight stretch is healthier, allowing buyers a bit more time to make a thoughtful decision rather than having to jump immediately.

Market Trends: What's Driving the Numbers?

So, what's really fueling these shifts? For me, a few key factors stand out:

- Mortgage Rates: This is a big one. The 30-year fixed-mortgage interest rate averaged 6.19 percent in December, a noticeable drop from 6.72 percent in December 2024. Lower rates bring down monthly payments, opening the door for more qualified buyers. This shift in mortgage rates is a huge sigh of relief for many, and I’ve seen this personally reflected in the renewed energy from clients.

- Seasonality: December is usually a slower month, so the jump in sales is particularly telling. It shows that even with holidays, motivated buyers were out there.

- Affordability Gains: C.A.R.'s report directly mentions improved affordability in Q4. This isn't just about lower prices but also the combined effect of slightly more inventory and lower interest rates. While LA will always be a pricy market, any improvement helps.

- Sales-Price-to-List-Price Ratio: Statewide, this ratio was 97.9 percent in December 2025. This means sellers are, on average, getting about 97.9% of their last asking price. This figure is slightly down from 98.7% in December 2024, implying that buyers have a bit more room to negotiate than before. In my conversations with agents, this is exactly what we're seeing on the ground in Los Angeles – fewer bidding wars and more consideration given to offers below asking.

My Takeaway: The Los Angeles market, specifically in December 2025, appears to be settling into a more balanced state. We're seeing less aggressive price growth, more buyers stepping in because of attractive rates, and a manageable level of inventory. This isn't the wild west of two years ago, nor is it a market in freefall. It feels like a mature market finding its rhythm.

Looking Ahead: What Does 2026 Hold?

Based on these trends and C.A.R.'s optimistic outlook, I believe Los Angeles is headed for a year with more stability and perhaps slightly more opportunity for buyers. While the glamour and appeal of LA won't ever truly make it a “buyers' market” in the traditional sense, the current climate suggests that carefully planned moves, whether selling or buying, could be more successful.

If you’re a buyer, paying close attention to interest rate fluctuations could give you an edge. If you’re considering selling, realistic pricing and a well-prepared home will be more important than ever. The key, as always in real estate, is to stay informed and work with someone who understands the nuances of our unique Los Angeles market.

Los Angeles Housing Market Forecast: Will Prices Rise or Fall?

You're probably wondering what's going to happen with prices. The Los Angeles housing market forecast suggests a slight decrease over the next year. While the national real estate market may pick up, Los Angeles specifically will likely see some downward pressure on home values. Let's dig into the details and see what factors are shaping the future of housing in LA.

Currently, the average home value in the Los Angeles-Long Beach-Anaheim area is $972,837. That's up about 1.1% from last year, which isn't a huge jump. Homes are going pending pretty quickly, in about 20 days. But, is this trend expected to continue?

According to Zillow's latest projections, here's what they see happening in the Los Angeles housing market over the next year:

| Timeframe | Predicted Home Value Change |

|---|---|

| July 2025 | -0.4% |

| September 2025 | -0.9% |

| June 2025 to June 2026 | -1.3% |

Basically, Zillow anticipates a gradual cooling off. While it's not a crash, they believe values will edge down a bit.

How Does L.A. Compare To Other California Markets?

Okay, Los Angeles might see a slight dip. But what about other parts of California? Here's a quick look at how the forecast compares to other major metro areas using the same forecast data:

| Region | Predicted Home Value Change (June 2025 – June 2026) |

|---|---|

| San Francisco, CA | -6.1% |

| San Diego, CA | -1.5% |

| Riverside, CA | -0.9% |

| Sacramento, CA | -3.7% |

| San Jose, CA | -4.0% |

| Fresno, CA | -1.2% |

| Bakersfield, CA | -0.1% |

| Los Angeles, CA | -1.3% |

As you can see, Los Angeles' forecasted decline is less than some other California cities, but still a bit downward.

What About the National Picture?

While the Los Angeles housing market faces a slight correction, the national outlook, according to the National Association of Realtors (NAR), is more positive. Their Chief Economist, Lawrence Yun, thinks “brighter days may be on the horizon.” Here's what he's predicting:

- Existing home sales are expected to rise by 6% in 2025 and 11% in 2026.

- New home sales are projected to climb by 10% in 2025 and another 5% in 2026.

- Median home prices are forecasted to continue increasing modestly, with a rise of 3% in 2025 and 4% in 2026.

- Mortgage rates are anticipated to average 6.4% in the second half of 2025 and dip further to 6.1% in 2026.

He considers lower mortgage rates the “magic bullet” for boosting the market.

Will Home Prices Crash in Los Angeles?

Based on these forecasts, a crash seems unlikely. While there seems to be a real estate market slowdown and a price correction, a significant crash seems unlikely. The Los Angeles market is still competitive, and demand remains relatively strong. A slight dip in prices could even be a good thing, making homes more affordable for potential buyers.

Looking Ahead to 2026

Predicting beyond a year is always tricky, but if the NAR's predictions hold true, the Los Angeles housing market could see a slight recovery in 2026. With potentially lower mortgage rates and a growing national market, LA could mirror this trend, evening out back around where it is now. However, local economic conditions and housing supply will play a significant role. It's best to keep an eye on the data and consult with a real estate professional for the most up-to-date advice.

Should You Invest in the Los Angeles Real Estate Market in 2025?

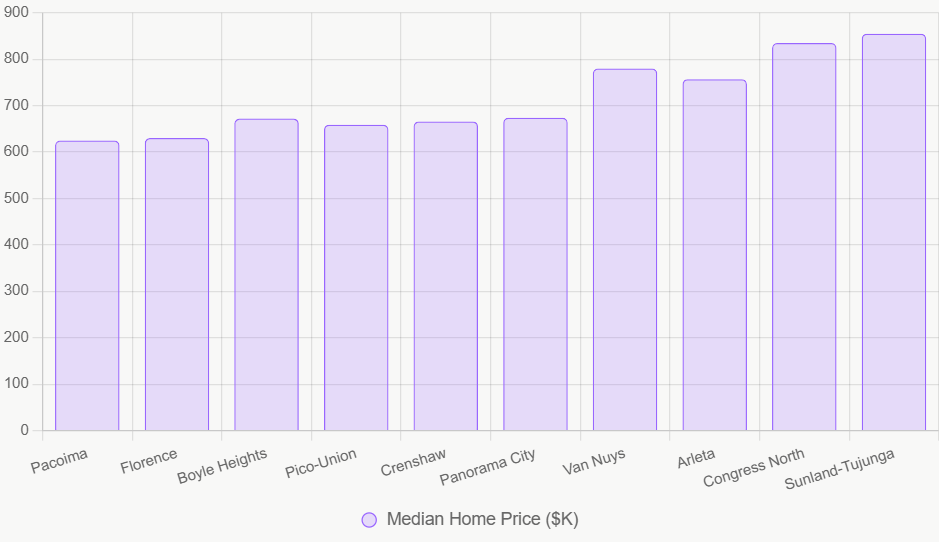

Los Angeles has historically been a sought-after real estate market due to its desirable location, diverse economy, and strong demand for housing. Here are some key points to consider:

Market Stability

Los Angeles has a relatively stable real estate market with a history of consistent, long-term appreciation in property values. This stability is driven by factors such as the city's status as an economic hub, its thriving job market, and the limited supply of land for new construction. However, it's essential to note that like any market, there can be fluctuations, and past performance is not indicative of future results.

Property Appreciation

Over the long term, Los Angeles properties have typically appreciated in value. While there can be short-term fluctuations, investing with a long-term perspective can allow you to benefit from the city's overall property value growth.

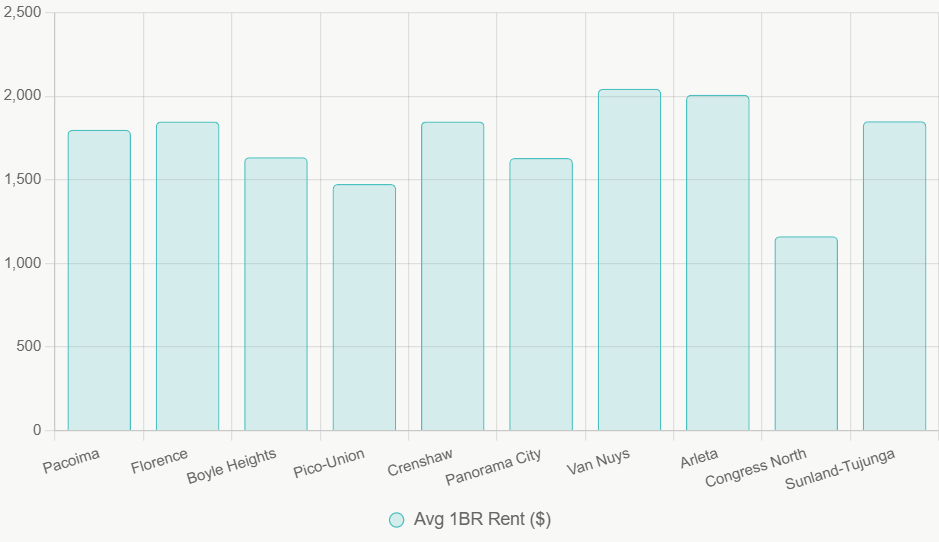

Rental Income Potential

Los Angeles has a strong rental market, with a high demand for both single-family and multi-family rentals. This presents an opportunity for investors to generate rental income. However, rental income potential can vary depending on the neighborhood and property type.

Consideration for Property Type

Investors in Los Angeles can choose between single-family and multi-family properties. Single-family homes often provide more predictable rental income and potential for appreciation, while multi-family properties can offer multiple income streams but come with added management responsibilities.

The Housing Shortage Dilemma

Los Angeles is no stranger to the housing shortage dilemma. As its population continues to grow, driven by a robust job market and desirable lifestyle, the housing market struggles to keep pace. The consequences are multifold, affecting both renters and potential homeowners. High demand has led to escalating rental costs and home prices, making housing less affordable for many.

Investor's Paradise: The Demand-Supply Gap

For real estate investors, this gap between demand and supply represents a significant opportunity. The housing shortage has created a strong demand for rental properties, offering the potential for attractive rental income and return on investment. Here's why Los Angeles is an investor's paradise:

- Rental Income: High demand for housing has driven up rental rates, providing investors with the prospect of steady rental income.

- Property Appreciation: Despite the challenges, Los Angeles properties have shown a history of appreciating in value over the long term.

- Population Growth: Los Angeles continues to attract new residents due to its economic opportunities and lifestyle. This demographic growth fuels the demand for housing.

- Construction Gap: Construction in Los Angeles hasn't kept pace with population growth, intensifying the supply-demand imbalance.

Economic Diversity

Los Angeles is renowned for its economic diversity. The region's economy spans various sectors, including entertainment, technology, aerospace, healthcare, and tourism. The presence of major corporations, such as those in the entertainment and tech industries, has been a key driver of job creation and economic growth. The city's thriving tourism industry, centered around attractions like Hollywood and Disneyland, also plays a significant role in generating revenue and job opportunities.

Job Growth

Los Angeles has consistently experienced job growth, making it an attractive destination for job seekers. The city's diverse economic landscape provides opportunities in various fields. It is a hub for creative industries, with Hollywood serving as the epicenter of the global entertainment industry. Additionally, the tech sector has witnessed substantial growth in Silicon Beach, an area on the west side of Los Angeles, home to numerous tech startups and established companies.

The presence of educational institutions, including the University of California, Los Angeles (UCLA) and the California State University, Northridge, contributes to research, development, and a well-educated workforce. The healthcare sector, with renowned institutions like the Cedars-Sinai Medical Center, further drives job opportunities.

Population Growth

The Los Angeles Metropolitan Area's strong economy and job market have attracted a steady influx of residents. The population of the Los Angeles metro area is projected to be 12,598,000 in 2024, which is a 0.51% increase from 2023. However, the population of Los Angeles County is estimated to be 9,606,925 in 2024, which is a 0.58% decrease from the previous year.

The allure of the city's lifestyle, cultural diversity, and range of amenities has made it a magnet for people from various backgrounds. The region's population growth can be attributed to factors such as:

- Job Opportunities: People move to Los Angeles in search of better job prospects and career growth.

- Education: The presence of top-tier universities and educational institutions attracts students and faculty from around the world.

- Cultural Attractions: The city's vibrant cultural scene, including theaters, museums, and art galleries, appeals to those seeking a rich cultural experience.

- Quality of Life: Los Angeles offers a pleasant climate, beautiful landscapes, and recreational opportunities that enhance the quality of life.

- Entertainment Industry: The allure of the entertainment industry draws aspiring actors, musicians, and filmmakers to Los Angeles.

As the population continues to grow, the demand for housing and services surges, creating a dynamic environment for real estate investors.

How to Invest in Real Estate in Los Angeles?

Investing in real estate in Los Angeles involves several steps:

1. Research the Market: Begin by thoroughly researching the Los Angeles real estate market. Analyze historical property values, rental trends, and the performance of different neighborhoods.

2. Financial Preparation: Ensure your financial situation is in order. This may include saving for a down payment, understanding your credit score, and securing financing.

3. Property Selection: Choose the type of property you want to invest in, whether it's a single-family home, multi-family building, or another type. Consider your investment goals and budget.

4. Location Matters: Location is critical in Los Angeles. Research neighborhoods and select areas with potential for growth and strong rental demand.

5. Property Management: Decide whether you'll manage the property yourself or hire a property management company. This choice may depend on the number of units and your experience.

6. Legal and Tax Considerations: Understand the legal and tax implications of real estate investing in Los Angeles. Consult with professionals if needed.

Single-Family Rental vs. Multi-Family Investment

When considering whether to invest in single-family or multi-family properties, it's essential to weigh the pros and cons of each:

Single-Family Rental:

- Typically lower initial investment.

- Easier property management.

- Predictable rental income.

Multi-Family Investment:

- Multiple income streams.

- Potential for higher overall rental income.

- More management responsibilities.

The choice between the two depends on your investment goals, budget, and willingness to manage the property. Both can be viable options in the Los Angeles market.

Maximizing Return on Investment

Investors looking to maximize their return on investment (ROI) in Los Angeles should consider the following strategies:

- Location Selection: Carefully choose neighborhoods with strong rental demand and potential for property appreciation.

- Property Type: Evaluate whether single-family or multi-family properties align with your investment goals and budget.

- Property Management: Efficient property management can enhance ROI by reducing vacancies and maintenance costs.

- Market Timing: Keep an eye on market trends and consider timing your investment to take advantage of favorable conditions.

- Legal and Tax Considerations: Consult with legal and financial experts to ensure you're optimizing your investment from a legal and tax perspective.

Turnkey real estate delivers immediate cash flow from day one and builds wealth for decades ahead.

Norada Real Estate helps you secure turnkey rental properties designed for consistent cash flow, appreciation, and long‑term wealth—so your investment pays today and continues to grow for years to come.

Recommended Read:

- Los Angeles Housing Market Booms With Double-Digit Sales Growth

- Los Angeles Housing Market Cools as Buyers Pullback in 2025

- Top 5 Richest Cities in the Los Angeles County

- Minimum Qualifying Income to Buy a House in Los Angeles is $219,200

- Top 5 Richest Cities in the Los Angeles County

- 20 Wealthy Neighborhoods in Los Angeles

- Average Home Price in Los Angeles

- Minimum Qualifying Income to Buy a House in Los Angeles is $219,200