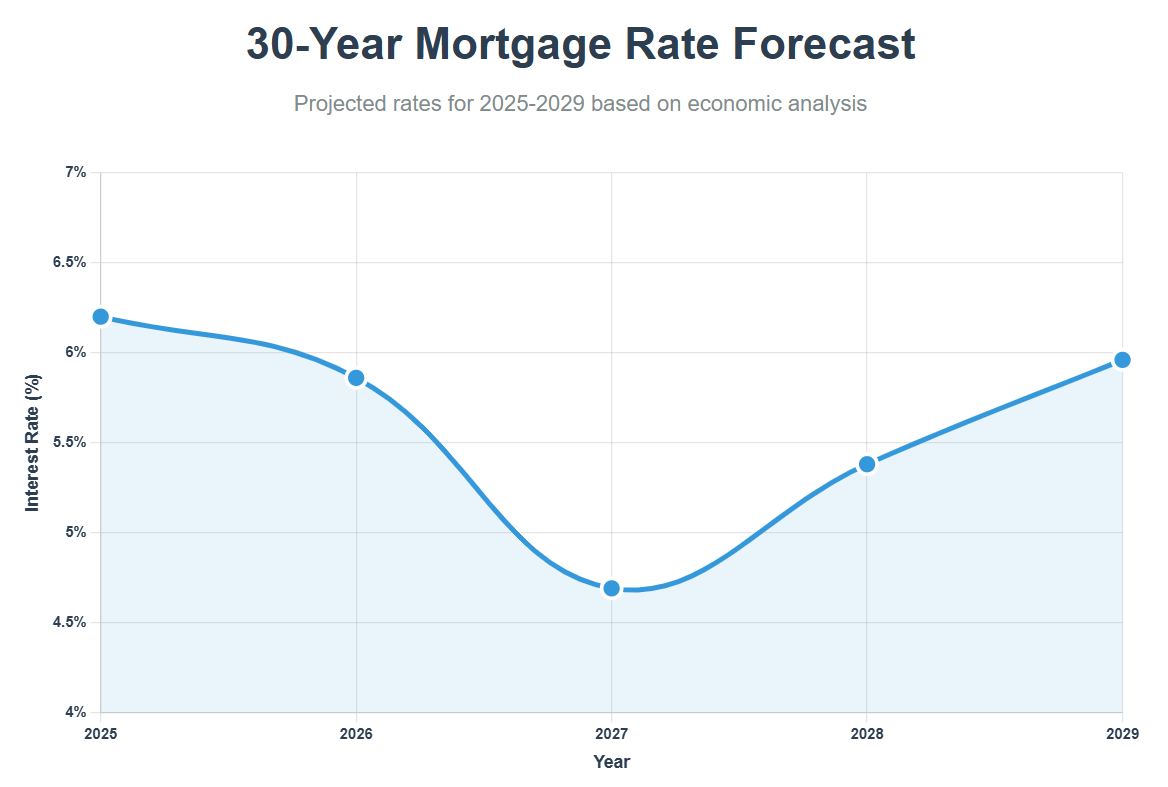

Buying a home already feels overwhelming without mortgage rates throwing curveballs. If you’re eyeing a new place or thinking about refinancing, you’re probably asking, “What’s next?” The 30-year rate forecast for the next 5 years? Think of it as a bit of a rollercoaster: experts guess we might hover around 6.2% next year, dip to ~4.7% by late 2027, then climb back toward 6% by 2029.

These numbers aren’t just abstract figures—they’re about whether that starter home feels doable, or if upgrading makes sense. Let’s unpack what this means for your wallet and how to plan.

30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

To get a clearer picture, let's look at the specific projections from sources like longforecast.com. These numbers give us a roadmap, though remember, they are forecasts, not guarantees. The economy is a complex beast, and many things can influence these predictions.

Key Takeaways:

- Peak Soon? Rates seem to be highest at the start of this forecast period, possibly peaking around the 6.20% mark by the end of 2025.

- The Dip: The most significant drop appears to happen between the end of 2026 and the end of 2027, potentially reaching lows near 4.7%. This is the “sweet spot” I mentioned. For anyone actively house hunting or planning to buy, keeping an eye on this window is critical.

- The Rebound: After hitting that low point in 2027, the forecast suggests rates will start climbing again, reaching almost 6% by mid-2029. This indicates that while there might be a buying opportunity, waiting too long could mean facing higher costs again.

Breaking Down the 30-Year Mortgage Rate Forecast from 2025 to 2029

Here's a breakdown of the projected 30-year mortgage rates over the next five years, based on projections from the Economy Forecast Agency (EFA). Keep in mind that these are just forecasts, and actual rates may vary.

2025:

- The remainder of 2025 is expected to see a gradual decline in mortgage rates.

- July 2025: Forecasted close at 6.49%

- December 2025: Forecasted close at 6.20%

2026:

- The first half of 2026 sees a continuation of the downward trend.

- June 2026: Rates are expected to dip below 6%, closing at 5.83%.

- The latter half of 2026 shows a slight uptick.

- December 2026: Rates are forecasted to close at 5.86%.

2027:

- 2027 is projected to be a year of significant rate drops.

- Rates are forecasted to fall below 5% by October.

- December 2027: Rates are expected to close at 4.69%.

2028:

- The first half of 2028 continues the downward momentum, with rates bottoming out mid-year.

- June 2028: Rates are forecasted to reach a low of 3.68%.

- The second half of 2028 shows a notable rebound.

- December 2028: Rates are expected to close at 5.38%.

2029:

- 2029 sees a continuation of the upward trend that started in late 2028.

- Rates are forecasted to climb back up.

- June 2029: Rates are expected to close at 5.96%.

To summarize, here's a table that presents the year-end forecasts:

| Year | Projected 30-Year Mortgage Rate (Year-End) |

|---|---|

| 2025 | 6.20% |

| 2026 | 5.86% |

| 2027 | 4.69% |

| 2028 | 5.38% |

| 2029 | 5.96% |

Factors That Could Change the Forecast

As I mentioned before, these are just predictions! Plenty of things can throw a wrench in the works. Here are some key factors to keep an eye on:

Unexpected Inflation Spikes: If inflation suddenly surges again, the Fed might have to raise rates more aggressively, sending mortgage rates higher. The current inflation rate is 2.4% for the 12 months ending in May 2025. This rate, based on the Consumer Price Index (CPI), represents a slight increase from the 2.3% rate reported in April 2025.

Geopolitical Instability: Don't forget that what happens globally can ripple back home. Trade tensions, wars, or major economic shifts in other large economies can affect investor confidence, currency values, and ultimately, U.S. interest rates. For instance, global instability might make investors seek the perceived safety of U.S. Treasury bonds, pushing yields down and potentially lowering mortgage rates. Conversely, global supply chain disruptions could worsen inflation here, pushing rates up. These international events add another layer of unpredictability, something Business Insider often covers in its economic analysis.

Changes in Fed Policy: The Fed's decisions about interest rates are crucial. Any unexpected shifts in their policy could significantly alter the forecast. The forecast suggests the Fed might be cautious initially, holding off on rate cuts due to lingering inflation worries. This cautious stance is a big reason why rates are projected to stay relatively high in 2025 and 2026. However, as inflation potentially cools (more on that below), the Fed might start cutting rates. I always watch the Fed’s statements and meeting minutes very closely; they often give clues about their next moves.

Economic Slowdown: If the economy slows down more than expected, the Fed might cut rates to stimulate growth, potentially lowering mortgage rates. The US economy, as measured by Gross Domestic Product (GDP), experienced a contraction of 0.5% in the first quarter of 2025 (January, February, and March) compared to the previous quarter. This marks the first quarterly contraction in three years. Nonfarm payroll employment increased by 147,000 in June, surpassing economists' expectations and remaining in line with the 12-month average. The unemployment rate fell to 4.1%, down from 4.2% in May and reaching its lowest point since February.

Housing Market Dynamics: Changes in housing supply and demand can also influence mortgage rates. For example, a surge in housing construction could put downward pressure on rates.

Bond Yields: The Market's Whisper: This is a technical point, but super important. Mortgage rates, particularly the 30-year fixed, are heavily influenced by the yields on long-term bonds, especially the 10-year Treasury note. Mortgage lenders often bundle mortgages into securities and sell them to investors. These investors want a certain return, and that return is linked to what they can get from safer investments like Treasury bonds.

When demand for Treasury bonds goes up, their prices rise, and their yields (the interest rate they pay) tend to fall. When yields fall, mortgage lenders can offer lower rates. Conversely, if investors get nervous about the economy or inflation, they might sell bonds, pushing yields up, forcing mortgage rates higher. Keep an eye on the 10-year yield; it’s often a leading indicator for mortgage rates. Freddie Mac and other financial institutions frequently highlight this connection.

Implications for You, the Homebuyer

Okay, we have the numbers and the reasons behind them. Now, what does this 30-Year Mortgage Rate Forecast for the Next 5 Years mean for your home-buying plans?

The Opportunities: Timing Your Purchase

- The 2027 Window: As highlighted, the forecast suggests a potential dip in rates around 2027, possibly falling below 5%. This could be a fantastic time to buy. Lower rates mean lower monthly payments. Let's do a quick example:

- On a $400,000 loan:

- At 7% interest, your principal and interest payment is ~$2,661/month.

- At 5% interest, that payment drops to ~$2,147/month.

- That’s a difference of over $500 per month! Over 30 years, that’s significant savings ($180,000+). Waiting until 2027 might make a huge difference in what you can afford or simply save you a fortune.

- On a $400,000 loan:

- Refinancing Power: If you bought a home in the last couple of years when rates were higher (say, 7% or 8%), and you can refinance when rates hit that projected 2027 low, you could potentially lower your monthly payment or switch from an adjustable-rate mortgage (ARM) to a fixed-rate loan, giving you long-term payment stability.

The Challenges: The Near-Term Hurdles

- 2025-2026 Affordability: With rates predicted to be in the 5.8% to 6.2% range, buying might still feel expensive, especially if home prices don't cool down significantly. High prices combined with these rates can make affordability a real struggle. Many buyers might feel priced out or forced to make compromises on location or home size.

- The Waiting Game Risk: While waiting for that 2027 low seems appealing, it’s not without risk.

- Home Prices: What if home prices continue to rise faster than rates fall? You might save on the mortgage rate but pay significantly more for the house itself, potentially canceling out the savings.

- Economic Shocks: Unexpected economic events could change the forecast entirely. A sudden recession might push rates down faster but could also lead to job instability for buyers. Conversely, a stronger-than-expected economy could keep rates higher for longer.

- Personal Circumstances: Life happens! Your personal situation (job change, family growth) might necessitate buying sooner rather than later, regardless of the rate forecast.

Final Thoughts:

Let’s cut to the chase—these next five years? It’s a bit of a rollercoaster ride. Rates might hit their peak soon, then dip enough by 2027 to make house hunting feel less stressful… before edging up again. Why? Blame (or thank) the usual suspects: inflation throwing tantrums, job growth doing its thing, and the Fed playing musical chairs with interest rates.

What does this mean for you? If you’re dreaming of buying a home, think of it like catching waves. Lower rates later sound great for your wallet, but don’t get stuck waiting for “perfect” conditions. Pulling the trigger when you find the right home and rate combo usually beats playing the guessing game. Stay sharp, lean on folks you trust (like your mortgage pro), and remember: homeownership’s not a race against the market—it’s about making moves that work for your life.

“Invest in Rental Income Properties”

With today's mortgage rates on the rise, investing in turnkey real estate can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Fed Funds Rate Forecast 2025-2026: What to Expect?

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?