It's December 13, 2025, and if you're thinking about buying a home or refinancing your current one, you might be wondering if the Federal Reserve's latest move to cut interest rates has brought any good news for your wallet. Well, the short answer is: not much, at least not yet.

For today, December 13, 2025, today's mortgage rates are showing a surprising lack of reaction to the Fed’s actions, with the average 30-year fixed mortgage rate holding steady at 6.13% and the 15-year fixed rate at 5.53%, according to Zillow. It seems lenders are playing it safe, and here's a look at why that might be, and what it means for you.

Today's Mortgage Rates, December 13: Rates Remain Steady Across the Board

What's Happening with Mortgage Rates Right Now?

When the Federal Reserve makes a move, especially cutting its benchmark interest rate, everyone expects borrowing costs to go down. It’s like turning a big faucet that’s supposed to let money flow more freely and cheaply. But with mortgages, it's not quite that simple. While the Fed did lower its rate for the third time this year, mortgage lenders haven’t exactly rushed to pass those savings onto us.

My experience tells me this disconnect isn't all that unusual. Think of it this way: the Fed sets a target, but mortgage rates are influenced by a whole lot of other factors, like the bond market, what people expect inflation to do, and how risky lenders feel making loans. Right now, it seems lenders are taking a “wait and see” approach.

Here’s a look at the numbers directly from Zillow for today, December 13, 2025:

| Loan Type | Current Rate |

|---|---|

| 30-Year Fixed | 6.13% |

| 20-Year Fixed | 6.08% |

| 15-Year Fixed | 5.53% |

| 5/1 ARM | 6.24% |

| 7/1 ARM | 6.31% |

| 30-Year VA | 5.60% |

| 15-Year VA | 5.14% |

| 5/1 VA | 5.36% |

Just a reminder, these are national average rates. Your actual rate might be a bit different based on your financial situation and the lender.

What About Refinancing? Is It Any Better?

If your goal is to refinance your existing mortgage, the picture is pretty much the same: not a lot of movement. While refinancing rates are generally very close to purchase rates, there's a tiny bit of a difference if you look closely.

Here’s the breakdown for refinance rates, again from Zillow for December 13, 2025:

| Loan Type | Current Rate |

|---|---|

| 30-Year Fixed | 6.19% |

| 20-Year Fixed | 5.96% |

| 15-Year Fixed | 5.60% |

| 5/1 ARM | 6.40% |

| 7/1 ARM | 6.46% |

| 30-Year VA | 5.67% |

| 15-Year VA | 5.35% |

| 5/1 VA | 5.44% |

As you can see, the 30-year fixed refinance rate is at 6.19%. It's a little higher than the purchase rate, which can happen for various reasons, often related to how lenders price risk and manage their own portfolios.

My Take: Why the Fed Cut Isn't Like Flipping a Switch

It’s easy to think that when the “Fed cuts rates,” mortgage rates magically drop like a stone. From my perspective, this isn't how it works. The Federal Reserve controls the federal funds rate, which is the rate banks charge each other for overnight loans. Mortgage rates, especially the long-term fixed ones, are more closely tied to the 10-year Treasury yield.

Think of it like this: the Fed’s rate cut sends a signal, and that signal influences the bond market. But the bond market has its own mind, driven by all sorts of global economic factors, inflation expectations, and investor demand. So, while the Fed's move might push Treasury yields down, it doesn't guarantee a direct, immediate, or equal drop in mortgage rates. Lenders also have to consider their own costs and how much profit they need to make. If they’re uncertain about the future economy or see other risks, they’ll keep rates higher to protect themselves.

Key Things You Should Know Today

Let’s boil down what this means for you:

- Rates are Staying Put (Mostly): Despite the Fed's recent cut, don’t expect your mortgage payment to change drastically overnight. Lenders are being cautious.

- Fixed Rates Offer Predictability: The 30-year fixed rate at 6.13% and the 15-year fixed rate at 5.53% are solid numbers. They offer a good amount of stability.

- Refinancing Isn't a Steal Right Now: The refinance rates are only slightly higher, but they aren’t dramatically lower than purchase rates, meaning the savings might not be as huge as some hoped.

- Adjustable-Rate Mortgages (ARMs) are Still Pricier: ARMs are looking more expensive than fixed rates, especially for refinancing. This makes sense when lenders are unsure about the future direction of interest rates.

The Bigger Picture: Affordability and Future Forecasts

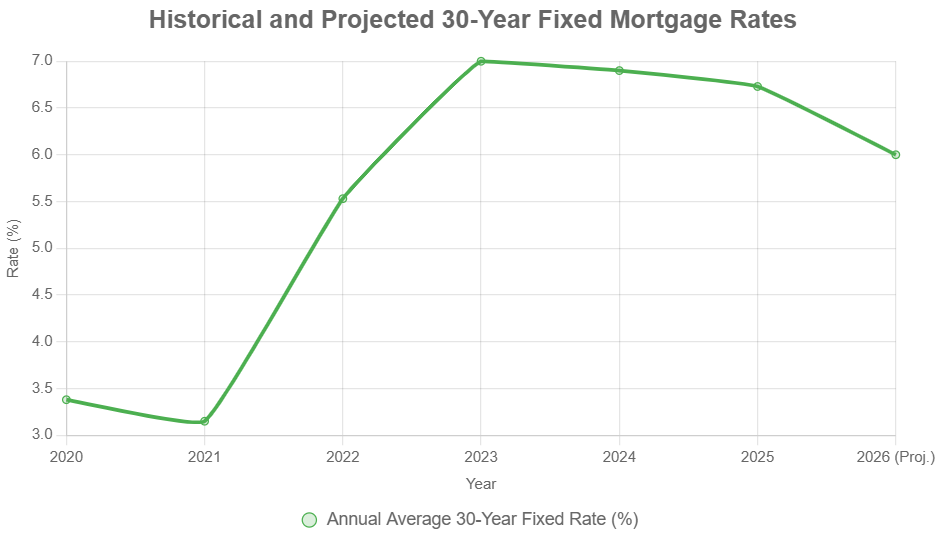

We’re still in a market where home prices are high, and while rates are much lower than they were a couple of years ago, they’re certainly not at the historic lows we saw back in 2020 or 2021. This combination continues to make buying a home a challenge for many.

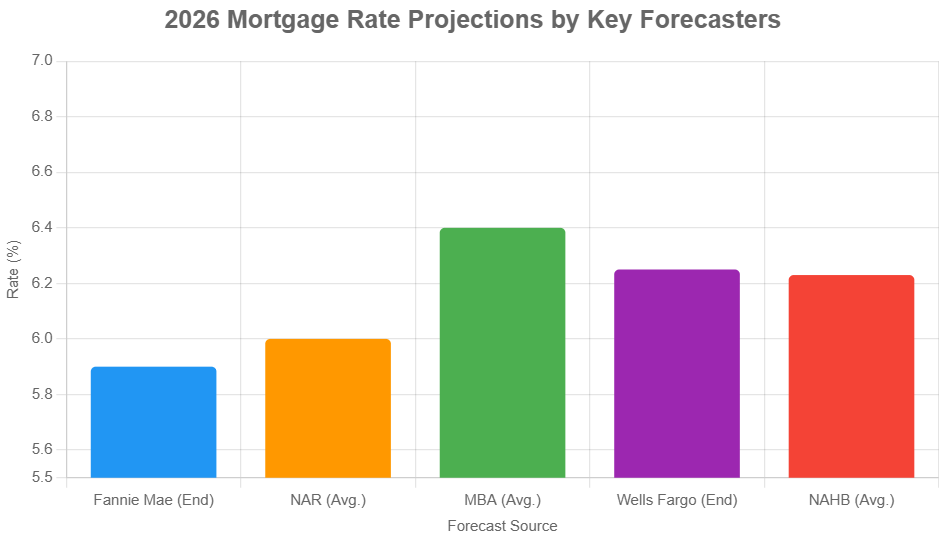

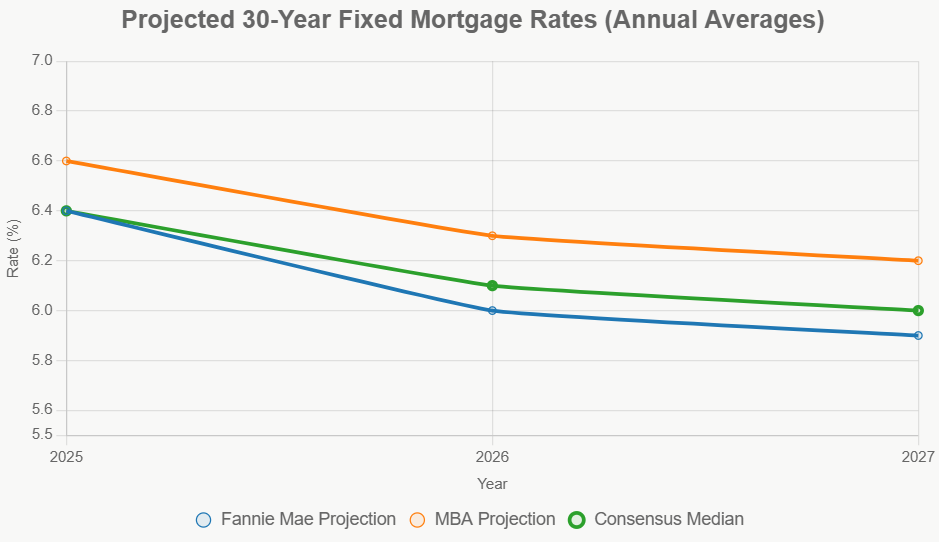

Looking ahead, what can we expect? Experts are forecasting that rates will likely hover in the low to mid-6% range for a while. Some believe we might see them dip below 6% by the end of 2026, with forecasts from Fannie Mae suggesting an average of 5.9% for the year. However, the Mortgage Bankers Association is more conservative, predicting rates to stay around 6.4% throughout 2026.

Here’s a bit of seasoned advice: waiting for rates to drop significantly is a gamble. If rates do start to fall, it's very likely that more buyers will jump into the market, which could push home prices back up. It’s a bit of a balancing act.

15-Year Fixed vs. 30-Year Fixed: A Quick Refresher

This is a classic decision point for homebuyers.

- 15-Year Fixed:

- Generally comes with a lower interest rate.

- You pay off your loan much faster, building equity quicker.

- Your monthly payments are higher.

- You save a significant amount on total interest paid over the life of the loan.

- 30-Year Fixed:

- Has lower monthly payments, offering more budget flexibility.

- You pay more total interest over the loan term.

- Gives you more wiggle room if your finances are tighter or you want to prioritize other savings or investments.

Which One Should You Choose?

Honestly, there's no single “right” answer. It’s deeply personal and depends on your financial situation and what you want to achieve.

- If you have a solid, stable income and can comfortably afford the higher monthly payments of a 15-year loan, and your goal is to own your home free and clear as quickly as possible while saving on interest – it’s a fantastic option.

- If you need the breathing room of lower monthly payments, perhaps to manage other expenses, save for retirement, or if you’re just starting out as a homeowner, a 30-year loan might be a better fit. Many people choose the 30-year for its flexibility and then make extra payments whenever they can to chip away at the principal faster.

The Bottom Line for December 13, 2025

For today, December 13, 2025, the mortgage and refinance rates are holding steady. The 30-year fixed mortgage is at 6.13%, and the 30-year fixed refinance is at 6.19%. The Federal Reserve’s latest rate cut hasn’t translated into lower mortgage rates for borrowers just yet. Instead, lenders seem to be in a cautious mode. Understanding these dynamics is key as you navigate your homeownership journey.

Invest in Turnkey Rentals for Smarter Wealth Building

With mortgage rates dipping to their lowest levels in months, savvy investors are seizing the opportunity to lock in financing. By securing favorable terms now, they’re maximizing immediate cash flow while positioning themselves for stronger long‑term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?