As of February 19, 2025, today's mortgage rates have slightly increased, reflecting the current economic climate. The average 30-year fixed mortgage rate is sitting at 6.56%, marking a minor rise from previous figures. Meanwhile, refinance rates are also showing similar trends. Despite these small increases, many potential homebuyers still find this a good time to explore the market, especially with less competition in the winter months.

Today's Mortgage Rates – February 19, 2025: A Mix of Stability and Slight Increases

Key Takeaways

- Current 30-Year Fixed Mortgage Rate: 6.56%.

- Current 15-Year Fixed Mortgage Rate: 5.92%.

- Refinance Rates are closely following the same trend.

- A good time of year to consider buying due to lower competition.

- Rates have experienced slight increases but remain manageable.

Today's Mortgage Rates Overview

Let's take a closer look at the various mortgage rates currently available. According to Zillow's data, the following mortgage rates are noted for today:

| Loan Type | Interest Rate |

|---|---|

| 30-Year Fixed | 6.56% |

| 20-Year Fixed | 6.26% |

| 15-Year Fixed | 5.92% |

| 5/1 Adjustable-Rate Mortgage (ARM) | 6.52% |

| 7/1 ARM | 6.53% |

| 30-Year VA | 6.05% |

| 15-Year VA | 5.53% |

| 5/1 VA ARM | 6.08% |

This snapshot showcases the national averages and gives potential buyers a foundation to understand their budgeting for a mortgage.

Today's Mortgage Refinance Rates

In addition to new purchase rates, homeowners looking to refinance can also take advantage of these offerings:

| Refinance Type | Interest Rate |

|---|---|

| 30-Year Fixed | 6.55% |

| 20-Year Fixed | 6.26% |

| 15-Year Fixed | 5.92% |

| 5/1 ARM | 6.52% |

| 7/1 ARM | 6.71% |

| 30-Year VA | 6.01% |

| 15-Year VA | 5.74% |

| 30-Year FHA | 6.12% |

| 15-Year FHA | 5.70% |

These refinance rates can help homeowners determine if now is the right time to adjust their payment terms or consolidate debts.

Market Analysis and Economic Factors

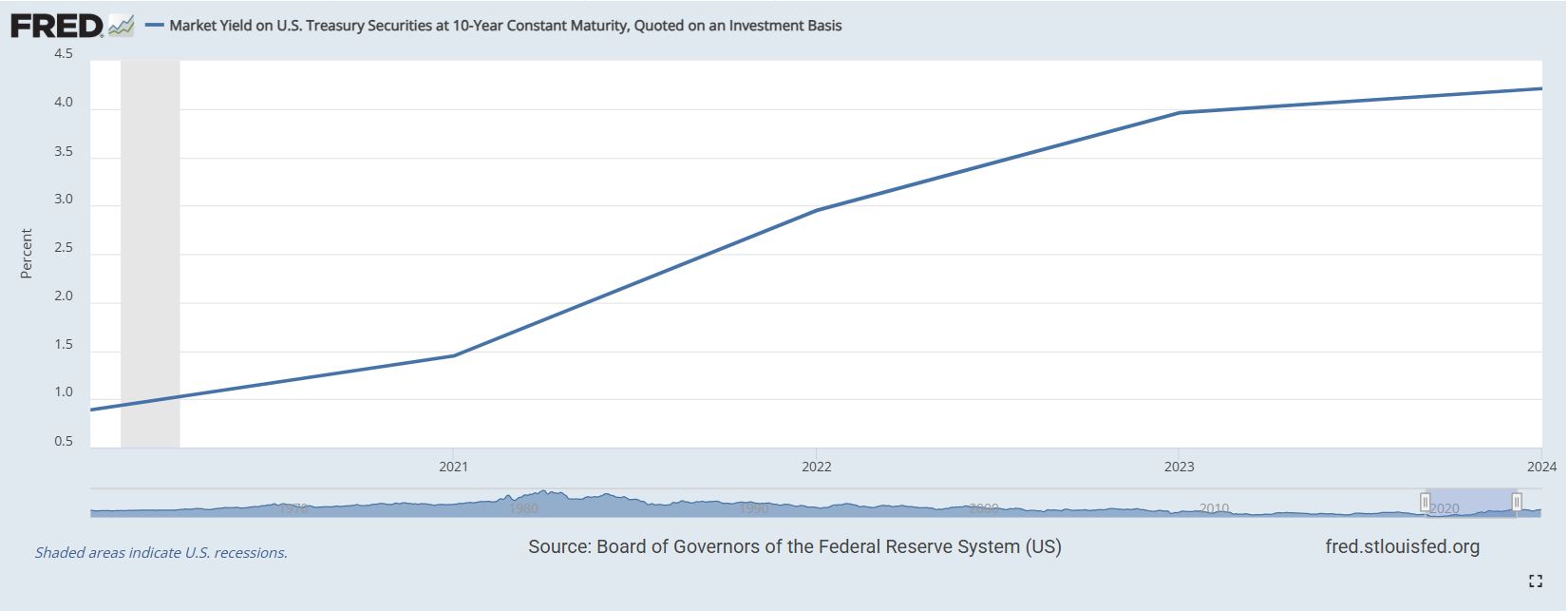

Mortgage rates are influenced by numerous economic factors, such as inflation, the performance of the economy, and federal monetary policy. The Federal Reserve has a significant impact on interest rates through its decisions on the federal funds rate. When the economy is strong, rates tend to rise, and when it is weak, they usually fall.

As of now, economic indicators suggest that the inflation rates are starting to stabilize but remain higher than desired. This reality has caused the Federal Reserve to maintain a cautious stance, avoiding significant rate cuts until there are strong signs of a consistent downtrend in inflation. Consequently, mortgage rates are expected to experience gradual movements rather than abrupt changes.

Moreover, potential homebuyers should also consider regional variations in mortgage rates. Rates can differ significantly across states and even within cities due to local markets. For instance, areas with a higher cost of living may have elevated rates compared to more affordable regions.

Monthly Payment Breakdown

When considering a mortgage, understanding how your monthly payments will look at various loan amounts can be crucial. Here’s what the monthly payments will generally be for the following amounts, based on a 6.56% interest rate for a 30-year mortgage:

Monthly Payment on a $150k Mortgage

For a $150,000 mortgage at 6.56% interest, your monthly payment will be approximately $952. This figure includes only principal and interest, and does not factor in taxes or insurance. This amount could equate to a comfortable living arrangement in many suburban areas.

Monthly Payment on a $200k Mortgage

If you increase the mortgage amount to $200,000, your estimated monthly payment rises to about $1,269. Again, this is purely for principal and interest, which can make a significant difference in financial planning.

Monthly Payment on a $300k Mortgage

For a larger loan of $300,000, expect to pay around $1,903 monthly, sticking with the same interest rate. This gives homeowners an important understanding of budget adjustments based on property value. In many urban markets, $300,000 can still afford a modest home depending on the location.

Monthly Payment on a $400k Mortgage

If you're looking at a $400,000 mortgage, the estimated monthly payment jumps to approximately $2,538. Prices can vary based on the lender and your credit profile, so these numbers serve as a broad estimate. This level of payment may be typical in sought-after neighborhoods.

Monthly Payment on a $500k Mortgage

Finally, for a mortgage amount of $500,000, your payment would typically be around $3,173 monthly. Understanding these figures can greatly assist in setting budget expectations during the house-hunting process. With more buyers entering the market, prices in many cities can escalate, making higher mortgage payments necessary.

Recommended Read:

Mortgage Rates Trends as of February 18, 2025

Will Mortgage Rates Go Up as Inflation Surges Back Up to 3%

Will Mortgage Rates Rise Back Above 7% or Go Down in 2025?

Mortgage Rate Predictions for February 2025: Will Rates Drop?

Exploring Mortgage Options

When it comes to mortgage options, understanding the types of loans available is crucial for making informed decisions. By weighing the options, prospective buyers can find solutions that best suit their financial situation.

Fixed-Rate Mortgages

A fixed-rate mortgage guarantees consistent monthly payments throughout the life of the loan. The primary benefit of this type of mortgage lies in its predictability, which can greatly assist in budgeting. Fixed-rate loans tend to work best for buyers planning to remain in their homes long-term.

Adjustable-Rate Mortgages (ARMs)

In contrast, ARMs offer lower initial rates that adjust after a set period, which can lead to substantial savings for buyers who plan to sell or refinance before the rates adjust. However, they come with risks, as payments can increase significantly when rates reset. For some, this can lead to financial strain if they are unable to plan appropriately.

As you weigh these options, consider not only your current financial situation but also your future plans. It may be worthwhile to discuss these aspects with a mortgage lender to identify the best approach tailored to your needs.

Making the Most of Your Mortgage Search

With today’s mortgage environment offering a variety of rates and options, potential buyers and homeowners should strive to be informed. Regularly checking mortgage rates can aid in making smarter financial decisions, particularly when considering purchases or refinancing options.

Outreach to multiple lenders can lead to better rates during negotiations. Doing thorough research not only on rates but on customer service, processing times, and feedback from other borrowers can make a significant difference in the mortgage experience.

Don't hesitate to leverage technology; many lenders offer online calculators that can provide instant estimates for monthly payments and show how variations in principal, interest rates, and terms can impact total cost.

Final Thoughts on Today's Mortgage Rates

With today’s mortgage rates presenting both opportunities and challenges, it's essential for potential buyers and homeowners to remain proactive. The slight increases may seem discouraging, but savvy buyers can still navigate the landscape effectively, especially with the current lower competition in the market.

The outlook for rates throughout 2025 remains cautiously optimistic. As economic conditions evolve, staying tuned to trends will be paramount for making the best purchasing or refinancing decisions.

Work with Norada in 2025, Your Trusted Source for

Real Estate Investing

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Mortgage Rates Predictions for 2025: Expert Forecast

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for 2025: Expert Forecast

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?