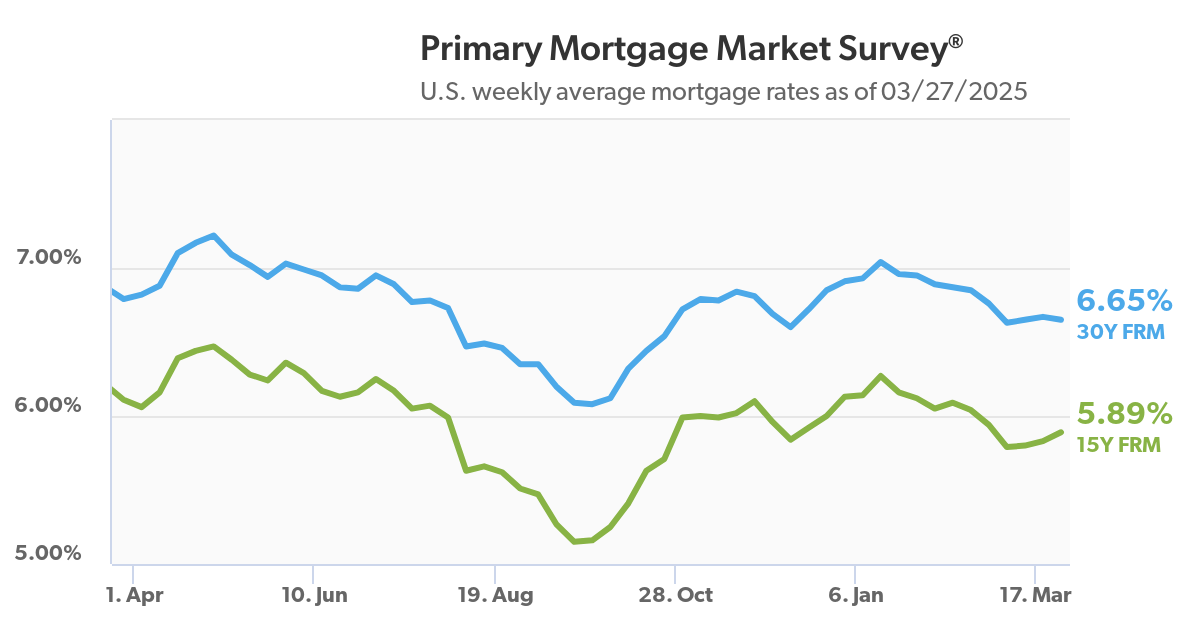

If you've been eyeing the housing market, there's a bit of good news: mortgage rates have dipped to a 2-week low. According to Freddie Mac, the average rate on a 30-year fixed home loan fell to 6.65% for the week ending March 27, 2025. While it's a small decrease from 6.67% the week before, it's a move in the right direction. But what does this mean for you, the potential homebuyer? Let’s break down what's happening, why, and what to expect in the coming months.

Mortgage Rates Drop to 2-Week Low for Week Ending March 27, 2025

What's Driving This Downtick?

Several factors play into the fluctuating nature of mortgage rates. It's not just one thing, but rather a combination of economic indicators, market sentiment, and even political factors. In this case, the drop comes despite the stock market's upward momentum and a rise in the U.S. Treasury yield. It is quite surprising, but here's the breakdown as I see it.

- Market Instability: The market is a very sensitive thing and investors are hesitant about putting money into debt markets. The 10-year Treasury yield, which is the interest rate the federal government pays to borrow money for a decade, also moved higher.

- Uncertainty in Trade Policy: Trade policies have a big impact as tariffs stoke fears about inflation and a potential economic downturn.

Expert Insights

According to Realtor.com® Senior Economist Joel Berner, the mortgage rates have been fluctuating because the recovering stock market has been pulling investors out of the debt market. Also, the uncertainty surrounding trade policy contributes to it as it stokes fears about inflation.

Why This Matters to You

For potential homebuyers, even a slight dip in mortgage rates can make a difference. It could translate to:

- Lower Monthly Payments: The most immediate impact is a reduction in your monthly mortgage payment. Over the life of a 30-year loan, even a small decrease can save you thousands of dollars.

- Increased Purchasing Power: With lower rates, you might be able to afford a slightly more expensive home.

- Renewed Hope: The psychological effect of seeing rates drop can be significant. It can encourage hesitant buyers to jump back into the market.

The Challenge Remains: Affordability

It's no secret that affordability is still a major hurdle for many Americans. As Berner points out, mortgage rates in the high-6% and low-7% range have slowed home sales compared to last year. He says that the first quarter of 2025 has presented more financial challenges to homebuyers than it has opportunities. People are facing growing prices across the country and increased mortgage rates.

Looking Ahead: What to Expect in the Spring Buying Season

Despite the current challenges, there's reason for optimism. Realtor.com economists are forecasting more home sales this year compared to 2024.

- Spring Surge: The expectation is that this upswing will start in the coming months as the spring buying and selling season kicks into gear.

- Increased Inventory: One of the biggest constraints on the market has been the lack of homes for sale. If more homeowners decide to list their properties, it could ease some of the pressure on prices and give buyers more options.

Understanding How Mortgage Rates Are Calculated

It's not just about the headlines; it's about understanding what drives these rates. Here’s a simplified breakdown:

- 10-Year Treasury Bond Yield: This is the key benchmark. Mortgage rates tend to follow the 10-year Treasury yield, which reflects broader market trends like economic growth and inflation expectations.

- Lender's Margin: Lenders add their own margin to cover operational costs, risks, and profit.

- Your Financial Profile: This includes your credit score, loan amount, property type, down payment size, and loan term. Lenders assess your risk based on these factors.

Essentially, lenders are trying to determine how likely you are to repay the loan. The riskier you seem, the higher the rate you'll pay.

The Impact of Your Credit Score

Your credit score is a major factor in determining the mortgage rate you'll receive. A higher credit score typically translates to a lower interest rate. Here's a quick overview:

| Credit Score Range | Rating | Impact on Mortgage Rates |

|---|---|---|

| 700+ | Excellent | Lowest Rates |

| 680-699 | Good | Competitive Rates |

| 620-679 | Fair | Higher Rates |

| Below 620 | Poor/Risky | Highest Rates, Difficulty Getting Approved |

It's worth noting that different types of loans have different minimum credit score requirements. For example, you might be able to get approved for a Federal Housing Administration (FHA) loan with a lower credit score compared to a conventional loan.

Mortgage Applications: A Mixed Bag

Recent data from the Mortgage Bankers Association (MBA) shows a mixed picture:

- Overall Dip: Mortgage applications dipped by 2% from a week ago (data ending March 21, 2025).

- Purchase Applications Up: However, purchase applications (involving the offer and agreement to buy a property) increased 1% from a week ago and 7% year-over-year.

This increase in purchase applications was driven by a surge in FHA loan applications, according to Joel Kan, MBA’s vice president and deputy chief economist.

Recommended Read:

Mortgage Rates Drop: Can You Finally Afford a $400,000 Home?

Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

Types of Mortgage Loans

When you're looking to secure a mortgage, you'll encounter different types of loans. Each has its own pros, cons, and eligibility requirements. Here's a quick rundown:

- Conventional Loans: These are not insured or guaranteed by the government. They typically require a higher credit score and a larger down payment.

- FHA Loans: Insured by the Federal Housing Administration, these loans are popular among first-time homebuyers and those with lower credit scores. They often have lower down payment requirements.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans, active-duty military personnel, and surviving spouses. They often come with no down payment and competitive interest rates.

- USDA Loans: These loans are offered by the U.S. Department of Agriculture and are designed to help people buy homes in rural areas. They often have no down payment requirements.

My Take: A Cautious Optimism

While the drop in mortgage rates is welcome news, I think it's important to remain cautiously optimistic. The housing market is complex, and many factors can influence rates. As I see it, we should be prepared for further fluctuations. However, if you're in a good financial position and have been waiting for the right moment, this small dip might be the nudge you need to start exploring your options.

Tips for Potential Homebuyers:

- Check Your Credit Score: Before you even start looking at homes, get a copy of your credit report and make sure everything is accurate.

- Get Pre-Approved: This will give you a clear idea of how much you can afford and make you a more attractive buyer to sellers.

- Shop Around for the Best Rate: Don't settle for the first offer you receive. Talk to multiple lenders and compare rates and fees.

- Be Patient: The housing market can be competitive, so don't get discouraged if you don't find the perfect home right away.

Ultimately, buying a home is a big decision, and it's important to do your research and make sure you're comfortable with the financial commitment. But with rates dipping, now might be a good time to start exploring your options.

Work With Norada, Your Trusted Source for

Real Estate Investments

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Are Ultra-Low 2% and 3% Mortgage Rates Ever Coming Back?

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?