Are you looking for the next big real estate opportunity? Colorado Springs is predicted to be the hottest housing market in 2025, according to a recent forecast by Realtor.com. This vibrant city in the heart of Colorado is projected to experience significant growth in both home sales and prices, making it a prime location for buyers and investors. Let's delve deeper into the reasons behind this prediction and explore what makes Colorado Springs such a desirable place to live.

Colorado Springs Housing Market to Boom in 2025

I've been following the real estate industry for a while now and the forecasts from reliable sources like Realtor.com are always interesting. For their 2025 National Housing Forecast, they ranked the 100 largest metropolitan areas based on their predicted growth in both home sales and prices. They identified several key factors influencing their predictions, and these factors seem to be especially favorable for Colorado Springs and other cities in the South and West.

Based on their study, these are some of the key factors that suggest a strong housing market in 2025:

- Stronger Sales and Price Growth: Some areas in the country, particularly in the Sun Belt, are expected to experience far stronger growth than the national average.

- Improved Housing Inventory: With mortgage rates potentially stabilizing and homebuilders increasing production, the housing inventory situation is gradually improving.

- Regional Concentration: The top 10 markets for 2025 are clustered in the South and West, highlighting a growing demand in these areas.

- Younger Populations: These markets tend to have a larger share of young families and individuals, boosting demand for housing.

- Military and International Connections: In several top markets, there's a significant presence of military families and international residents, further impacting the real estate dynamics.

- Government-Backed Loan Programs: The availability of programs like VA and FHA loans makes it easier for certain populations to buy homes in these markets, leading to increased homeownership.

- Relative Affordability: Many of these markets, while not necessarily ultra-cheap, are more affordable compared to other parts of the country.

- Flexible Work Arrangements: The shift towards remote and hybrid work has made these markets more attractive for those seeking a better work-life balance and lower living costs.

Why Colorado Springs Stands Out

While the Sun Belt in general is projected to experience significant growth in 2025, Colorado Springs is particularly noteworthy. I find it fascinating that it's predicted to be the hottest of all the markets. The factors that drive this prediction include:

- Stronger Growth in Sales and Prices: Realtor.com forecasts a 27.1% year-over-year increase in existing home sales in Colorado Springs for 2025. Moreover, the median sale price is predicted to rise by 12.7%. These numbers are quite substantial and indicate a very robust market.

- Military Presence: Colorado Springs has a significant presence of military personnel and veterans, with the share of households connected to the military being around 31.4%. This translates to a strong demand for housing due to frequent relocations and the presence of VA loan benefits.

- Relatively Affordable Housing: Colorado Springs, compared to other areas in the state, like Denver, offers more affordable housing, which attracts a wider range of buyers, especially those seeking a good value for their money. This factor is further highlighted by the relative affordability when combined with government-backed loans that offer lower down payment requirements.

- Outdoor Recreation and Lifestyle: Colorado Springs is renowned for its stunning natural beauty, surrounded by mountains and offering ample opportunities for hiking, biking, and outdoor activities. This lifestyle aspect is incredibly attractive to those who want a healthy and adventurous lifestyle.

- Growing Economy: Colorado Springs is experiencing economic growth in sectors like aerospace, healthcare, and tourism. The stable and growing job market plays a crucial role in drawing in both residents and businesses, which in turn drives up housing demand.

- Stronger Inventory: The forecast suggests that Colorado Springs may be nearing its pre-pandemic inventory levels, which implies that buyers may have more options compared to the recent past. New construction also plays a role in adding more inventory, creating a healthy market dynamic.

- Good Schools: The quality of education is important to many families, and Colorado Springs boasts a strong educational system with highly rated schools. This is a crucial element for families with school-aged children.

The Impact of Government-Backed Mortgages

The availability of government-backed loan programs like VA loans is a significant factor contributing to Colorado Springs’ projected success. I've personally interacted with many homebuyers who have benefited from these programs. I see that they are especially helpful for:

- Military Families: VA loans are a lifeline for many service members and veterans, especially those who are transitioning out of the military and looking to establish a new life.

- First-Time Homebuyers: For those without substantial savings for a down payment, VA and FHA loans can be incredibly helpful in achieving homeownership.

- Lower-Income Households: Government-backed mortgages can reduce the barrier to homeownership for households that might otherwise find it challenging to qualify for a conventional loan.

In Colorado Springs, the presence of VA loans, coupled with relatively lower home prices, means that the typical down payment needed is often significantly less than the national average. This advantage makes homeownership more attainable for more people, which in turn drives the housing market.

The Role of Flexible Work Arrangements

In the post-pandemic world, the ability to work remotely or in a hybrid model has drastically changed the dynamics of where people choose to live. I see it every day in my real estate practice. Colorado Springs has been fortunate enough to have a higher than average share of remote and hybrid job postings, which is attractive to people who don't necessarily have to be tethered to a specific location for their jobs.

The combination of affordability and a good quality of life, coupled with remote job opportunities, makes the city a great choice for those who wish to escape the hustle and bustle of larger metropolitan areas while still maintaining a fulfilling career.

Challenges and Considerations

While Colorado Springs presents a positive outlook for 2025 and beyond, potential buyers and investors should be aware of some challenges and considerations.

- Rising Interest Rates: Although mortgage rates have started to decline, they are still relatively high compared to the past few years. This can affect affordability, especially for buyers with tighter budgets.

- Inflation: Inflationary pressures can impact the cost of living and construction materials, potentially putting upward pressure on home prices.

- Competition: With Colorado Springs gaining popularity, competition among buyers can be high, which could make it challenging to secure a desired property.

- Limited Inventory in Certain Segments: Although inventory is recovering, certain segments of the market might still have limited supply, especially in the lower price ranges.

- Water Resources: Being in the West, water resources are a concern that should be considered when buying a home, especially when looking at properties in drier regions.

The Future of Colorado Springs Real Estate

In my opinion, the future of real estate in Colorado Springs looks bright. The factors that are driving the growth seem to be pretty solid. I anticipate that it will continue to be a magnet for buyers and investors, leading to healthy growth in the coming years.

The factors that make Colorado Springs attractive—the combination of affordability, great lifestyle, strong economy, outdoor recreation, and a significant military presence—appear to be durable characteristics. I personally believe that these will continue to drive demand in the years to come.

Tips for Buyers and Investors

- Get Pre-Approved for a Mortgage: Having a pre-approval letter in hand will demonstrate to sellers that you're a serious buyer and give you a head start.

- Work with a Local Real Estate Agent: A knowledgeable agent can provide valuable insights into the local market, assist in your search for suitable properties, and guide you through the buying process.

- Research Neighborhoods: Different neighborhoods in Colorado Springs have distinct characteristics, such as price points, school districts, and amenities. Do your homework to ensure the neighborhood aligns with your needs and preferences.

- Stay Informed About Market Trends: The real estate market is dynamic, so stay up-to-date on market trends and changes in interest rates.

- Be Prepared to Act Quickly: In a competitive market like Colorado Springs, you might need to act quickly to make an offer on a property.

- Consider New Construction: New construction can offer a variety of benefits, such as modern amenities, energy efficiency, and warranties.

- Look at Government-Backed Loans: Explore VA, FHA, and USDA loans if you're eligible. These loans can make it easier to afford a home.

I believe the combination of a strong local economy, attractive lifestyle, and government-backed loan programs positions Colorado Springs for continued real estate growth. If you're considering a move to the area, or are simply looking for a good investment opportunity, Colorado Springs is certainly worth a look.

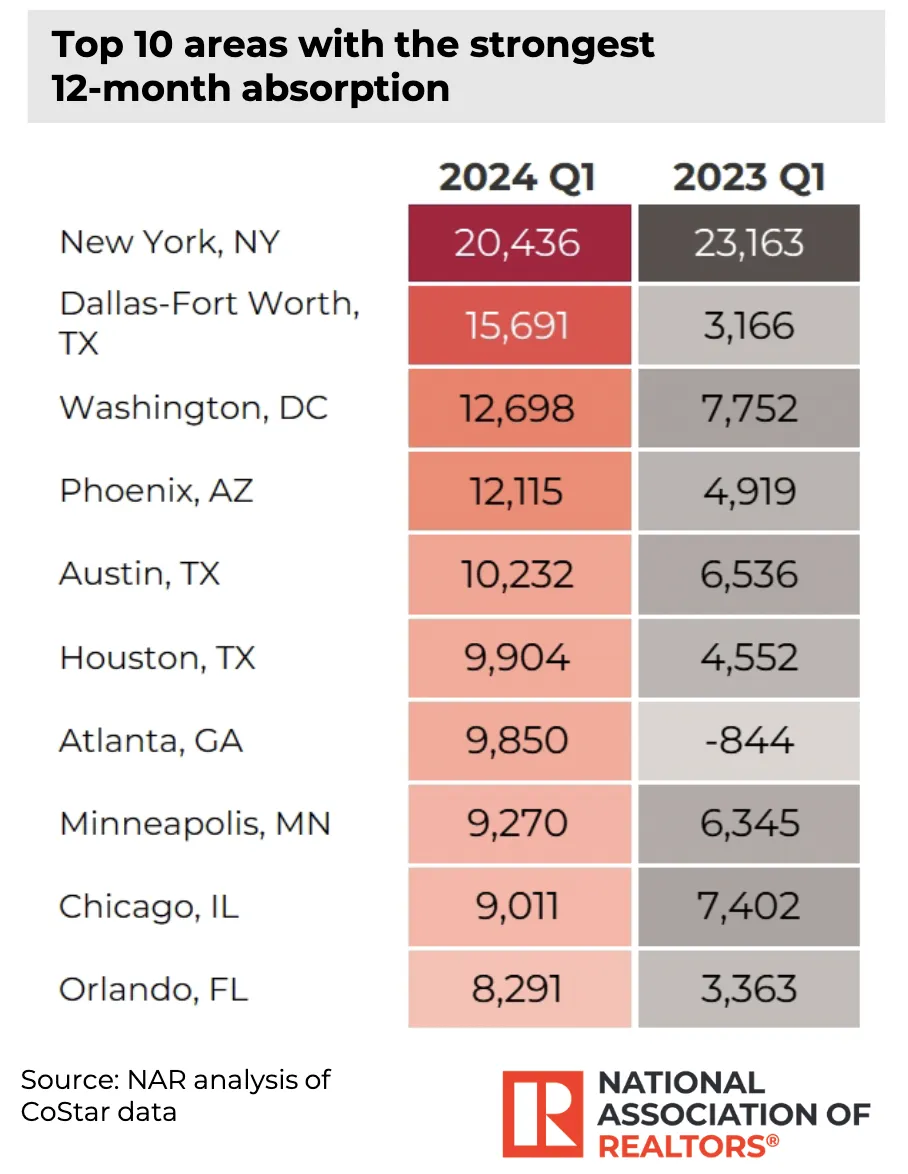

Realtor.com's 2025 Housing Forecast Top 10 Markets

| Rank | CBSA Title | 2025 Existing Home Sale Counts Year-over-Year | 2025 Existing Home Sale Counts vs 2017–19 Average | 2025 Existing Home Median Sale Price Year-over-Year | 2025 Existing Home Median Sale Price vs 2017–19 Average | Combined 2025 Existing Home Sales and Price Growth |

|---|---|---|---|---|---|---|

| 1 | Colorado Springs, Colo. | 27.1% | -5.6% | 12.7% | 88.9% | 39.8% |

| 2 | Miami-Fort Lauderdale-West Palm Beach, Fla. | 24.0% | -0.7% | 9.0% | 100.5% | 33.0% |

| 3 | Virginia Beach-Norfolk-Newport News, Va.-N.C. | 23.4% | 24.5% | 6.6% | 57.3% | 29.9% |

| 4 | El Paso, Texas | 19.3% | 1.3% | 8.4% | 71.1% | 27.8% |

| 5 | Richmond, Va. | 21.6% | 31.7% | 6.1% | 68.8% | 27.6% |

| 6 | Orlando-Kissimmee-Sanford, Fla. | 21.1% | 23.6% | 7.0% | 60.4% | 28.1% |

| 7 | McAllen-Edinburg-Mission, Texas | 17.4% | 23.6% | 7.0% | 60.4% | 24.4% |

| 8 | Phoenix-Mesa-Scottsdale, Ariz. | 18.0% | 8.5% | 7.2% | 76.2% | 25.2% |

| 9 | Atlanta-Sandy Springs-Roswell, Ga. | 19.6% | 23.6% | 5.3% | 59.0% | 24.9% |

| 10 | Greensboro-High Point, N.C. | 17.3% | 16.6% | 5.4% | 61.5% | 22.7% |

Partner with Norada, Your Trusted Source for Turnkey Investment Properties

Discover high-quality, ready-to-rent properties designed to deliver consistent returns. Contact us today to expand your real estate portfolio with confidence.

Reach out to our investment counselors:

(949) 218-6668 | (800) 611-3060

Recommended Read:

- Colorado Springs Housing Market Predictions 2025: Prices Will Drop

- Colorado Housing Market Predictions 2025: Will Prices Fall?

- Top 20 Hottest Housing Markets Predicted for the Next Year [2025]

- 10 Hottest Housing Markets Predicted for 2025: Sun Belt Boom

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Hottest Real Estate Markets in Maine: Top Locations for 2024

- Top 10 Hottest Real Estate Markets in the World

- 68 Housing Markets Where Prices Have Doubled the Fastest