One way or another, Uncle Sam is going to get his cut. Count on it. And so will your state and local governments. That said, as you file taxes there are certain things you can do as a real estate investor to help manage your tax bill, and maximize your after-tax return on your investment.

One way or another, Uncle Sam is going to get his cut. Count on it. And so will your state and local governments. That said, as you file taxes there are certain things you can do as a real estate investor to help manage your tax bill, and maximize your after-tax return on your investment.

In order to do so, however, you need to understand the primary ways in which investment real estate portfolios get taxed. You must also have a general grasp of some abstract concepts like calculating your tax basis, as well as the depreciation of capital investments. Hey, if this stuff were easy, we’d all be CPAs, right?

Warning: This article will only arm you with enough information to be dangerous. You can click on any of the links for more detailed information directly from the Internal Revenue Service. This article won't make you an expert. But you can become conversant with the basic terminology, so you can be better prepared for a meeting with your tax advisor.

Sixty-five percent of U.S. housing markets are worse off today than they were four years ago according to the California-based real estate research firm RealtyTrac.

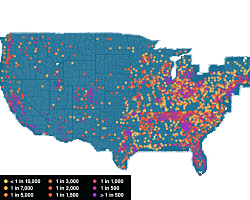

Sixty-five percent of U.S. housing markets are worse off today than they were four years ago according to the California-based real estate research firm RealtyTrac. We've all heard that the housing bubble's pop led to thousands of foreclosures, but its interactive maps like this that really show how prevalent the problem was — and still is. Part of a project on 30 election issues, the map below uses data from RealtyTrac to display foreclosure rates by county.

We've all heard that the housing bubble's pop led to thousands of foreclosures, but its interactive maps like this that really show how prevalent the problem was — and still is. Part of a project on 30 election issues, the map below uses data from RealtyTrac to display foreclosure rates by county.

After nine consecutive months of appreciation, August was the first month where home values decreased by 0.1% to $152,100, according to Zillow.

After nine consecutive months of appreciation, August was the first month where home values decreased by 0.1% to $152,100, according to Zillow.