Renters should brace themselves for significant increases in rent prices as we enter the second half of the year. Despite the fact that New York City is swiftly adjusting to a new normal in the aftermath of the pandemic, the NYC rental housing market is hampered by historically low inventory levels. Because of the abnormally tight rental market conditions, rents are anticipated to rise more, at least until the seasonal decline in demand for rentals that occurs after the summer.

Despite continuously improving inventory, landlords are racing to reverse the pandemic discounts they provided, forcing rents to rise. Despite a large increase in the number of people leaving the city throughout the pandemic, the number of persons looking for rental homes has remained continuously high. The removal of rental incentives is yet another sign that landlords remain hopeful about demand. Because of the high rents in Manhattan, many people are eager to relocate to the more affordable neighborhoods of Brooklyn and Queens.

According to a report published by New York Post, the average rental price in Manhattan, Brooklyn, and Queens has risen to a new all-time high. Beginning last month, various factors contributed to the excessive rental market in New York, including a lack of availability, rising mortgage rates, peak season, and the Housing Stability Tenant Protection Act, which was enacted in 2019 and enacted expanded tenant eviction protections. Rising Fed interest rates have pushed would-be home purchasers into the rental market, making an already tight market even tighter.

“People who were thinking about moving somewhere else, let’s say in the suburbs, where mortgage rates are 3.1 percent at the end of December, now they are in fives; that is a significant increase,” Jonathan Miller of Miller Samuel who analyzed the findings told The Post. “So those people who were perhaps looking at that as an option might be sitting put. And sitting puts fewer apartments available. So the irony of this Fed move is while it’s cooling the purchase market, it is putting more pressure on the rental market.”

Douglas Elliman, a real estate agency in New York, has released a report analyzing the median rental pricing across the five boroughs, and it does not appear to be slowing down any time soon.

NYC Housing Market – Rental Report

Manhattan

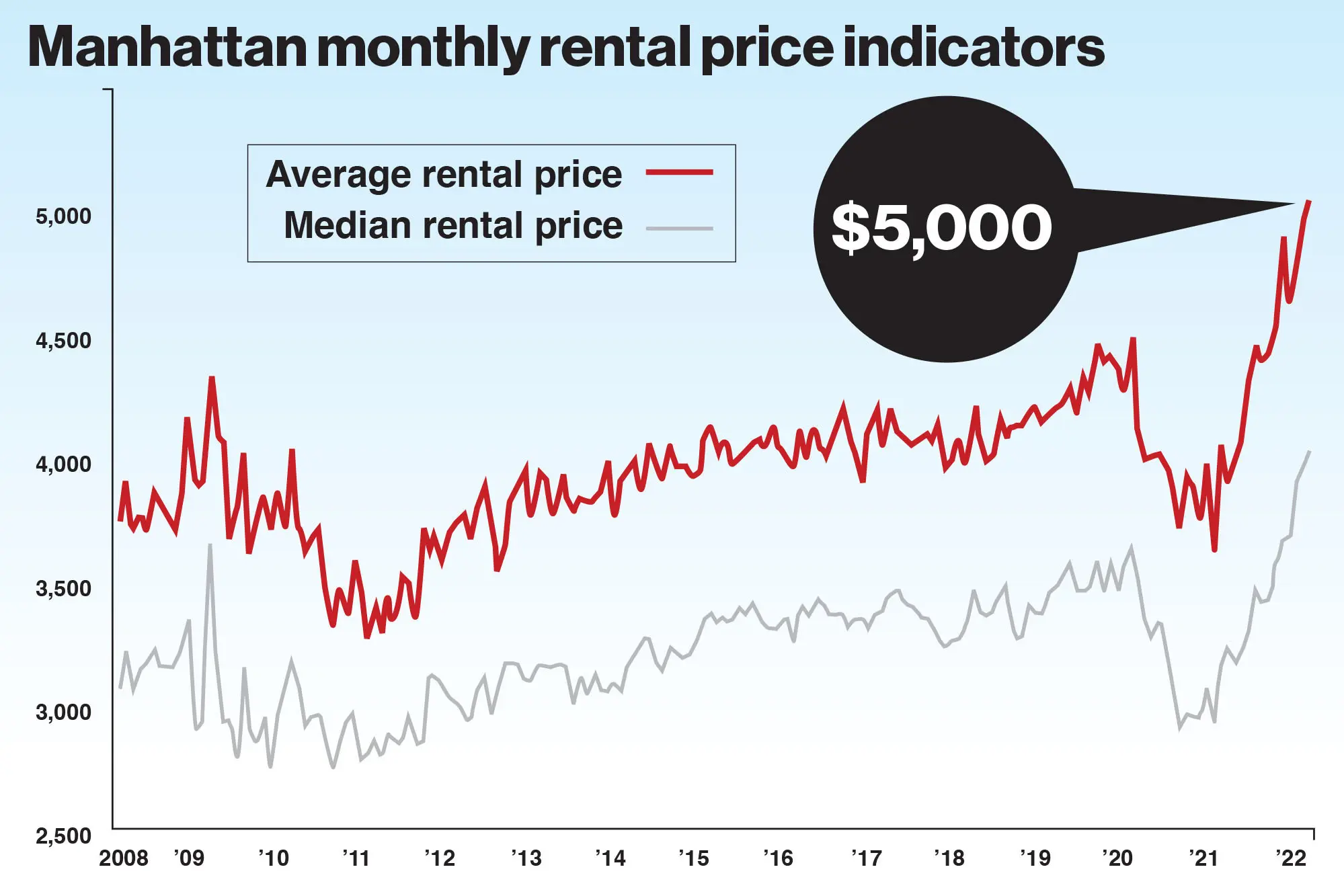

Average rental price: $5,058; Median: $4,050

The median rental price for Manhattan is now at an average of $4,050, which is $800 over what it was just a year ago, according to the eye-opening June market reports compiled by Douglas Elliman and Miller Samuel. Specifically, the average rental price in Manhattan has reached $5,000 for the first time in Big Apple History. The median rent is the mid-point value of the total price samples. Average rent is the sum of all rents divided by the number of the sample size.

The average rental price of $5,058 indicates that a tenant would spend roughly $61,000 annually on housing alone, as the median rent has set a record for the fifth consecutive month. The number of new leases increased for the fifth consecutive month, and the vacancy rate stayed below 2 percent for the seventh consecutive month. The average rent for a studio apartment is $3,145, while a one-bedroom apartment costs $4,278, and a two-bedroom apartment averages $5,722.

Brooklyn

Average rental price: $3,822; Median: $3,300

Average rental prices in Brooklyn reached $3,822 per month, up about $100 from last month’s average. That marks a new high for the borough for the second straight month. According to Elliman's report, the average monthly rent for a studio is now $2,284. A one-bedroom apartment rents for an average of $3,240, while a two-bedroom apartment costs $4,040.

Last year at this time, the median rent was approximately $500 less, or $2,700 per month. Last summer, studio apartments offered an 11.2% discount, one-bedroom apartments offered a 25.3% discount, and two-bedroom apartments offered a 26.8% discount. Since then, prices have increased between 20 and 50%.

Northwest Queens (Long Island City, Astoria, Sunnyside, Jackson Heights)

Average rental price: $3,352; Median: $2,973

Queens is still the most affordable option when it comes to renting, although prices have risen for the second consecutive month. Monthly rental costs averaged $3,352 with a median of $2,973. In comparison, the median rental price in the Northwest section of Queens was $2,700 at this time last year, roughly $300 less than it is today.

The average monthly rent for a studio is approximately $2,782, according to the most recent research by Elliman. A one-bedroom apartment averages slightly over $3,000 per month, while a two-bedroom apartment costs approximately $4,168 per month. For New Yorkers or those hoping to wait it out, you may have to wait a little longer. If rents hit an affordability barrier beyond which they cannot increase, this does not imply that they decrease; rather, it merely indicates that they do not increase.

Source: https://nypost.com/article/where-nyc-real-estate-rental-market-stands-right-now-housing-prices/