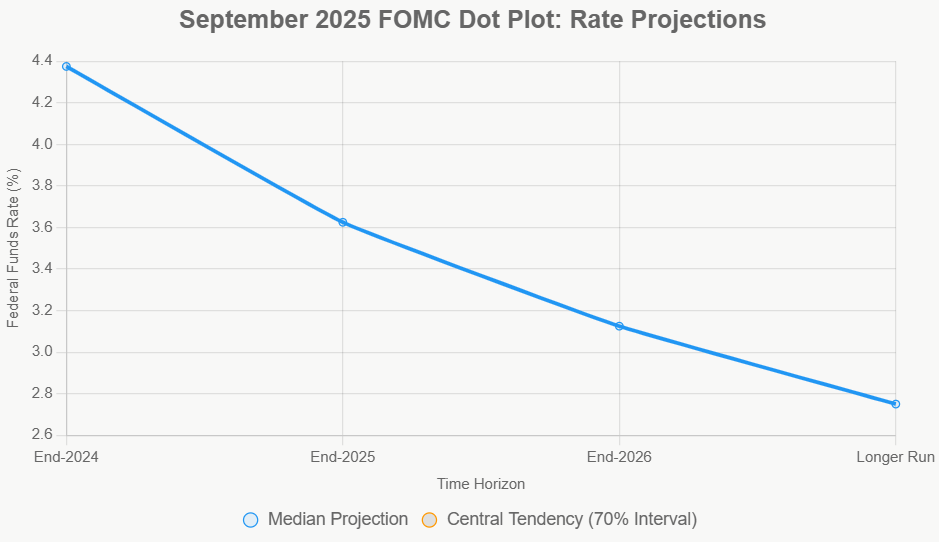

Let's talk about the big question on everyone's mind: what are the Federal Reserve's plans for interest rates in 2026? Based on their latest projections, it looks like they're aiming for just one more quarter-point interest rate cut by the end of 2026. This would bring the target for the federal funds rate down to the 3.25% to 3.5% range. But here's the thing, and I’ve seen this play out before in my years following the economy – these predictions are more like educated guesses than concrete plans. The economy is a wild horse, and we can't always predict its every move.

Fed Interest Rate Predictions for 2026 Indicate Just One Rate Cut

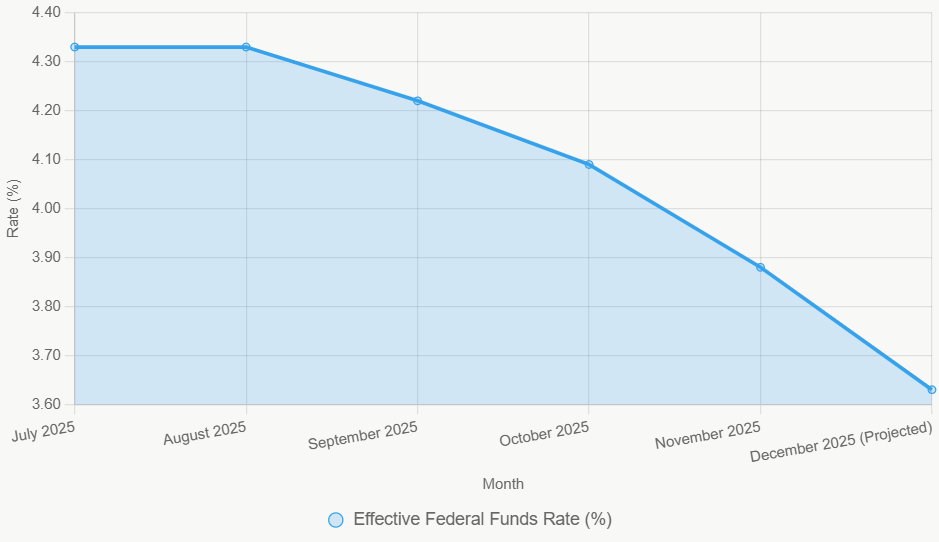

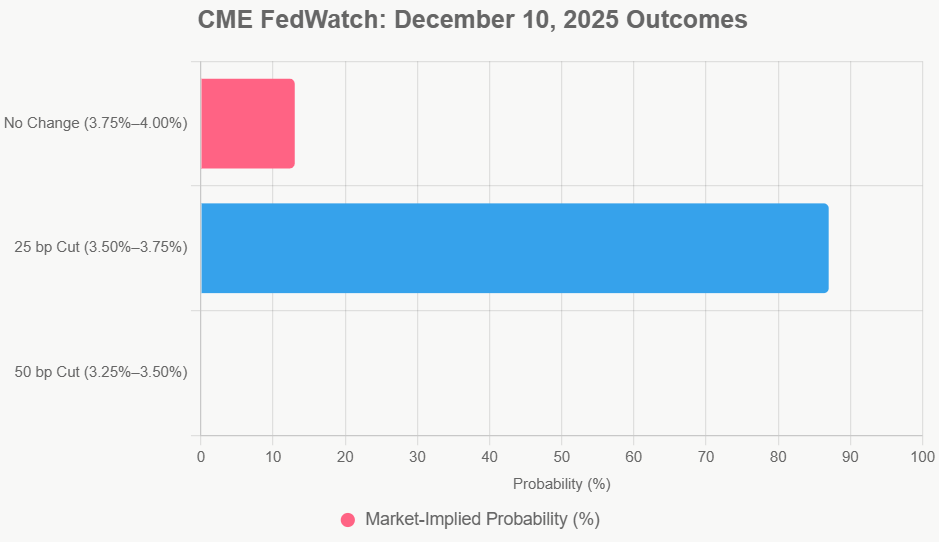

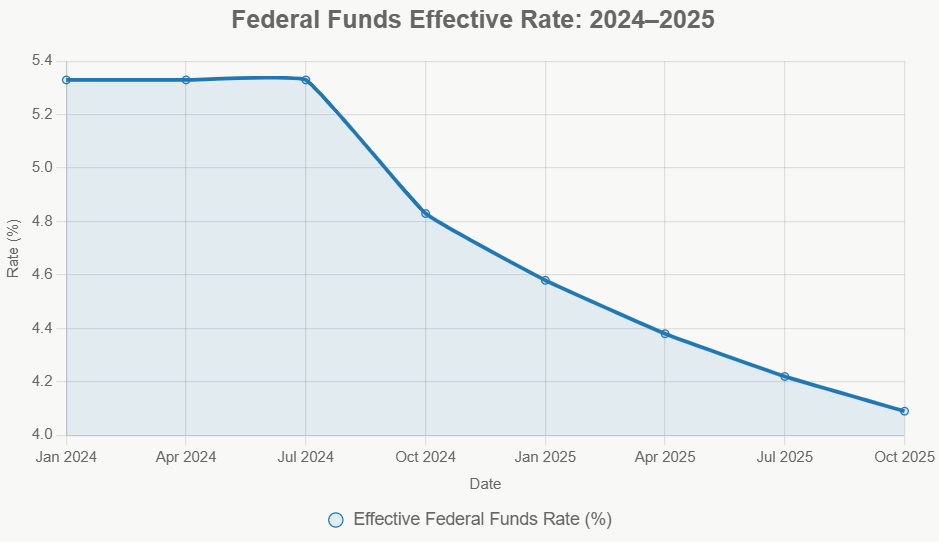

It's easy to get lost in the numbers and charts, but understanding what drives these decisions is key. The Fed, or the Federal Open Market Committee (FOMC) as they're formally known, just made another 0.25% cut on December 10th, 2025. This brought their main interest rate tool, the federal funds rate, to a target of 3.5% to 3.75%. This was their third cut of the year, signaling a shift from their earlier stance of keeping rates high to fight inflation.

Now, let's dive into what the folks at the Fed are thinking for 2026.

Peering into the Fed's Crystal Ball: The Official Forecasts

Every now and then, the FOMC releases what they call the Summary of Economic Projections (SEP). Think of it as their report card on where they see the economy going and what path their interest rate policy might take.

Here's a rundown of their key hopes for the end of 2026:

- Federal Funds Rate: The big prediction is a median forecast of 3.4%. This basically means they expect the rate to land somewhere between 3.25% and 3.50% by the close of 2026, which ties into that single cut.

- GDP Growth: They're feeling a bit more optimistic about how much the economy will grow. They've bumped up their prediction to 2.3%, which is up from the 1.8% they thought back in September.

- Unemployment Rate: They generally expect the job market to stay pretty stable, forecasting the unemployment rate to be around 4.4%.

- Core PCE Inflation: This is the Fed's preferred measure of inflation, and they think it will cool down to 2.5% by the end of 2026. That’s a welcome drop from the 3.0% they were projecting for the end of 2025.

More Like a Crowd: Disagreements Among the Fed Officials

What really jumps out at me from these projections, and frankly, it always does, is how much the Fed officials themselves disagree. It’s not a monolith; it’s a bunch of smart people looking at the same data and coming to different conclusions.

While the average or median prediction is for just one cut, look deeper, and you see a wide spread. Some officials think rates should end up much lower – down to 2% or 2.25%. Others, however, believe rates should stay higher, or even tick up a little.

This is a crucial point because it contrasts with what the markets are expecting. Traders in the financial world often bet on two or even more rate cuts in 2026, pushing the rates down towards or even below the 3% mark. When the Fed's thinking and the market's expectations diverge this much, it can create a lot of uncertainty and volatility. I’ve seen this lead to surprising market moves when the Fed’s actions don’t quite match what everyone was betting on.

The Economic Tightrope Walk: Why the Cautious Approach?

Fed Chair Jerome Powell has explained that they're in a tough spot. They need to balance keeping inflation in check with supporting job growth. Inflation, while coming down, is still a bit higher than their long-term goal of 2%. At the same time, the job market, while strong, shows some signs of weakening.

Their current thinking – the optimism about faster growth and cooling inflation – is what's leading them to be cautious about aggressively cutting rates. They don’t want to cut too much and risk reigniting inflation, but they also don’t want to keep rates too high and choke off the economy.

What Could Derail the Fed's 2026 Rate Path?

Okay, so the Fed is projecting one cut. But let’s be real, predicting the future is a fool’s errand, especially when it comes to something as complex as the economy. I’ve learned to always have a few “what if” scenarios in mind. Here’s what could seriously throw a wrench into their current plans:

- Inflation Plays Hard to Get: The Fed's main job is keeping prices stable. If inflation, particularly that core PCE number they’re watching, stubbornly stays above their 2% target or, worse, starts creeping back up, they’ll have to hit the brakes on rate cuts. We could even see them consider raising rates again if things get out of hand. Think about unexpected global events or new supply chain problems – those can quickly inflate prices.

- The Job Market Stumbles: Right now, they’re betting the unemployment rate will stay around 4.4%. But if we see a sudden jump in people losing their jobs or fewer people looking for work, that’s a clear signal for the Fed to step in and cut rates more aggressively to try and keep the economy humming and people employed.

- The Economy Gets Too Hot: This sounds like a good problem to have, right? But if the economy starts growing much faster than their 2.3% prediction, fueled by, say, a massive tech boom or government spending, the Fed might worry about overheating. That means too much money chasing too few goods, which leads back to inflation. In this case, they might hold rates steady to cool things down.

- A New Boss with New Ideas: Jerome Powell's term as Chair ends in May 2026. The President will pick a new Chair and likely appoint new members to the Fed board. A new leader might have a completely different philosophy on monetary policy. Someone who’s really focused on growth might push for lower rates, while a staunch inflation hawk might be more reluctant. This change in leadership could significantly shift the committee's direction.

- Global Curveballs: The world economy is interconnected. A major international conflict, a trade war that flares up unexpectedly, or even domestic political gridlock could create massive uncertainty. These kinds of shocks can disrupt everything, forcing the Fed to react in ways they haven’t even considered today.

Tariffs: The Wild Card That Could Mess with Everything

Tariffs are a prime example of something that can seriously complicate the Fed’s plan. They’re like a tax on imported goods, and they tend to do two things: make prices go up and slow down economic growth. This creates a tough dilemma for the Fed, which has to juggle both inflation and employment.

How Tariffs Hit Inflation and the Economy

- Higher Prices for You and Me: When tariffs are put in place, businesses that import goods have to pay more. They usually pass that cost on to consumers in the form of higher prices. This effect doesn’t just disappear overnight; it can linger and impact prices well into 2026. Some economists believe tariffs could add a full percentage point to inflation.

- Prices Stay Higher: Even if the rate of inflation from tariffs slows down, the overall level of prices for certain goods will likely stay permanently higher than they would have been without the tariffs.

- Messing with Supply Chains and Trade: Tariffs can disrupt how businesses get their materials, raising their costs. Plus, other countries often retaliate with their own tariffs, which can hurt American exports and slow down our economy.

Tariffs and Fed Policy in 2026

The Fed’s current prediction of a single rate cut likely assumes that the impact of any existing tariffs will fade and that no major new ones will be announced. But if tariffs cause more trouble than expected, we could see some big changes:

- Slower Rate Cuts: If tariffs keep inflation higher than anticipated, the Fed will likely get more cautious. They might delay those planned rate cuts. Chair Powell has said they're trying to look past temporary, tariff-driven price hikes, but if they become a lasting problem, they’ll have to act.

- Potential for Rate Hikes: In a more extreme scenario, imagine new, significant tariffs being imposed. If these lead to a surge in inflation or higher expectations for future inflation, the Fed might be forced to consider raising interest rates, which would be a huge departure from their current outlook.

- The “Stagflation” Dilemma: Tariffs can create a nasty situation where you have higher inflation and slower economic growth (and potentially higher unemployment). This is what economists call stagflation. In such a scenario, the Fed might have to choose which goal to prioritize, making their policy moves unpredictable.

- More Uncertainty: When there’s uncertainty about trade policy, it makes it harder for businesses to plan and invest. This general economic fuzziness can lead to shaky markets, and the Fed might feel pressured to use its tools to calm things down.

So, while the Fed's projections give us a roadmap, it's crucial to remember that the journey can be unpredictable. Keep an eye on inflation data, the job market, and any surprising policy shifts – those are the real indicators of where interest rates are headed.

Invest in Real Estate While Rates Are Dropping — Build Wealth

The Federal Reserve’s last FOMC meeting of 2025 delivered a 25 basis point cut, lowering borrowing costs and signaling continued support for a cooling economy.

For investors, this move strengthens opportunities to lock in financing for turnkey rental properties—Norada Real Estate helps you capitalize on lower rates with cash-flowing deals in strong markets.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- FOMC Meeting Today Expected to Announce Third Fed Rate Cut of 2025

- Fed Interest Rate Decision Today: Latest News and Predictions

- Fed Meeting Today is Poised to Deliver the Third Interest Rate Cut of 2025

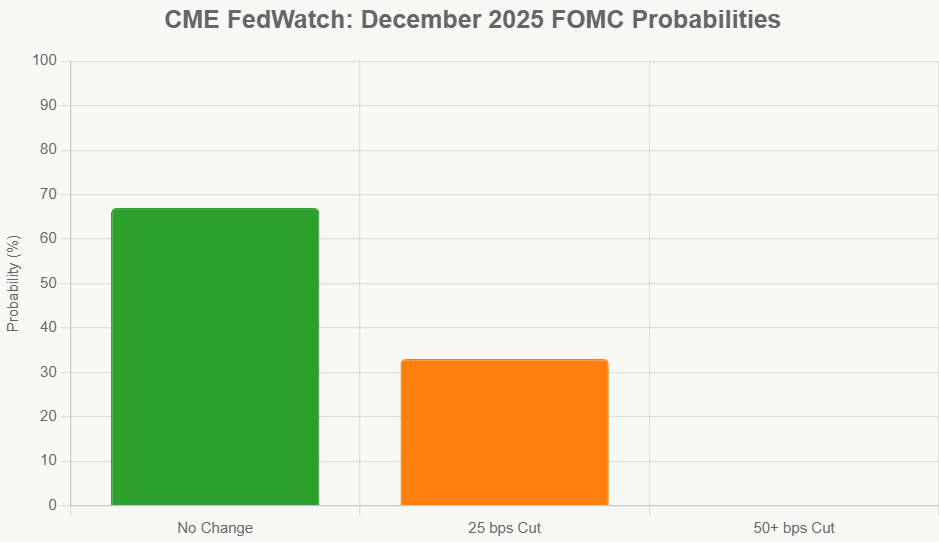

- Fed Interest Rate Predictions Signal 70% Chance of December 2025 Cut

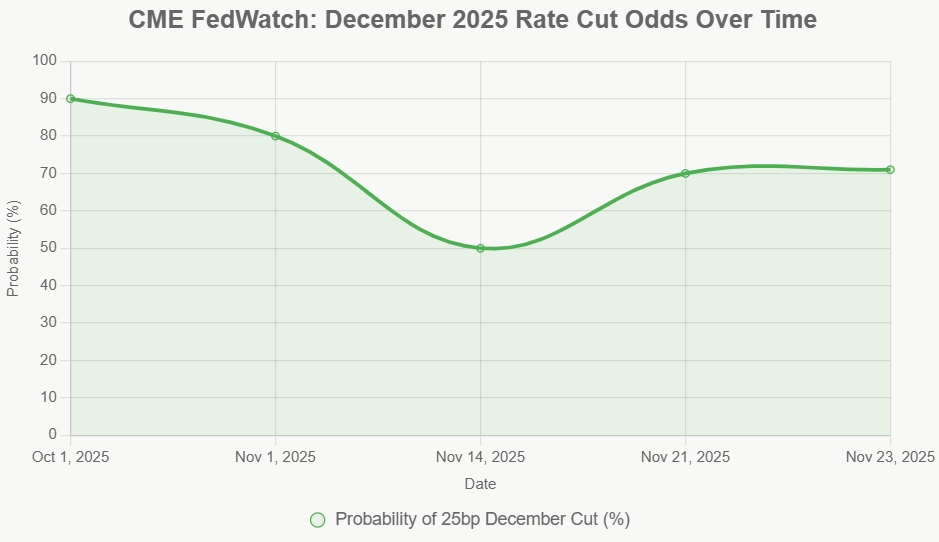

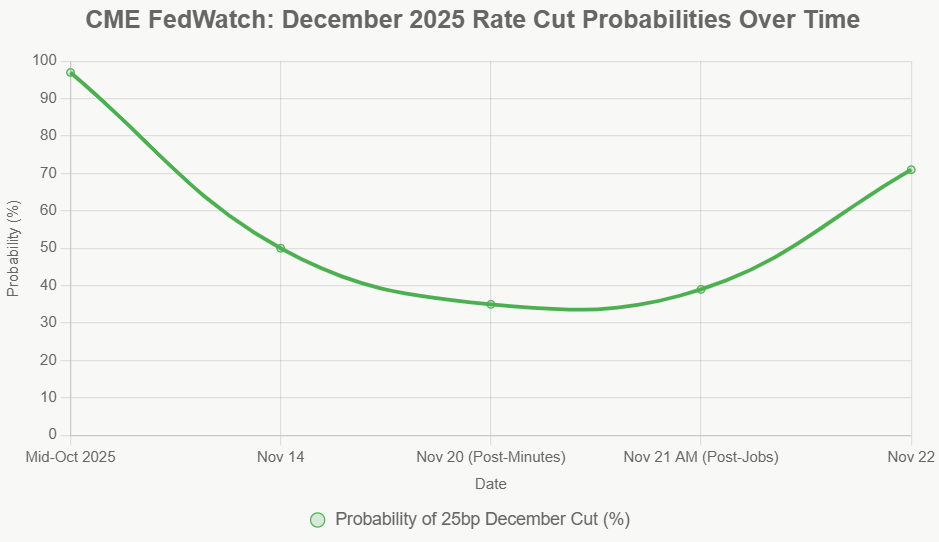

- Fed Meeting Minutes Expose Divide: Why December Rate Cut Odds Are Fading Fast

- Fed Interest Rate Predictions for the December 2025 Policy Meeting

- Fed Signals Growing Reluctance to Interest Rate Cut in December 2025

- Fed Cuts Interest Rate Today for the Second Time in 2025

- Fed Interest Rate Forecast for the Next 12 Months

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet