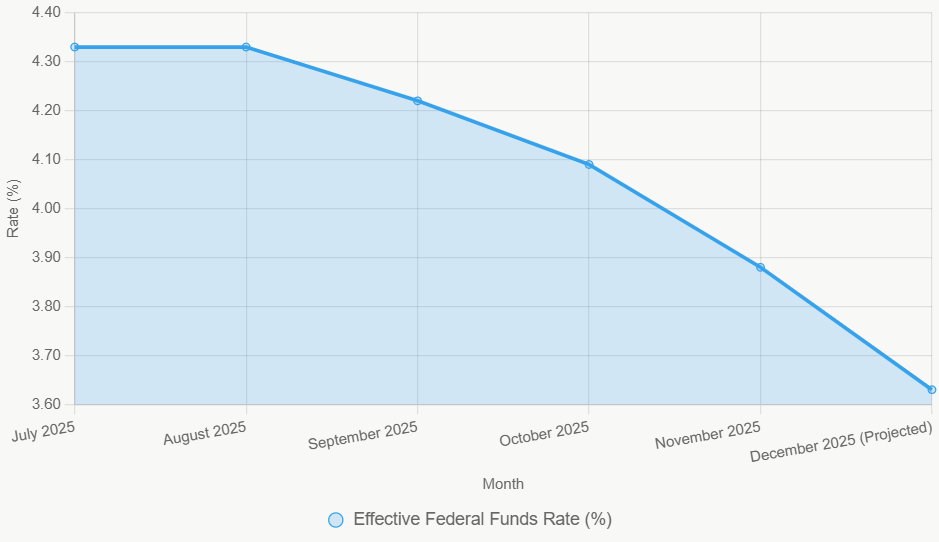

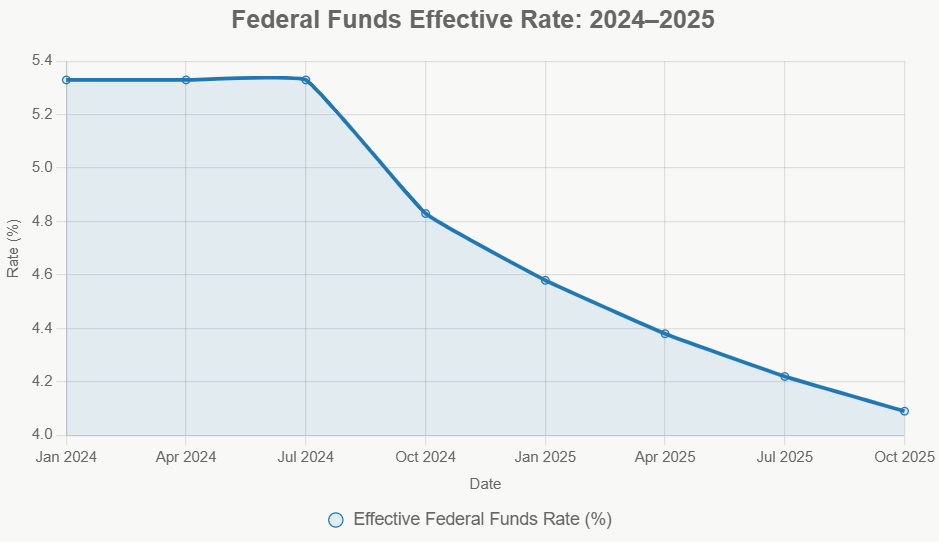

So, the Federal Reserve made a move, and you're likely wondering what that means for your hard-earned money. The recent quarter-point cut to the federal funds rate, bringing it to a target range of 3.50%-3.75%, is the third consecutive reduction, signaling a shift in economic strategy. This isn't just an abstract economic decision; it has very real, and often opposing, effects on your wallet. Simply put, borrowing just got a little cheaper, but your savings are likely to earn less.

How Does the Recent Fed Rate Cut Impact Your Personal Finances

It’s easy to get lost in the jargon, but understanding these fundamental shifts is crucial for making smart financial decisions. I've spent years watching how these moves ripple through everyday finances, and what I’ve learned is that while some people might cheer for lower loan payments, others might frown as their savings accounts offer a bit less. This is the dual nature of a Fed rate cut – it’s a two-sided coin, and you need to know how to play both sides to your advantage.

When Your Wallet Gets a Break: The Borrowing Side

One of the immediate effects of the Fed lowering its benchmark rate is that it generally makes it cheaper for banks to borrow money. This cost saving often gets passed on to consumers in the form of lower interest rates on various loans and credit products.

Credit Cards: A Little Breathing Room

If you carry a balance on your credit cards, especially those with variable interest rates, you might see a small dip in the interest you’re charged. These rates are often tied to the prime rate, which closely follows the federal funds rate. While a quarter-point might not seem like a lot, over months of carrying a balance, it can add up to a noticeable difference, potentially reducing your minimum payment slightly and meaning less of your payment goes toward just interest.

Mortgages: A Chance to Refinance or Buy

Mortgage rates are a bit more complex, influenced not just by the Fed but also by the bond market's outlook on inflation and the economy. However, a Fed rate cut often sends a signal that the market might expect lower rates in the future, and this can gradually lead to lower mortgage rates.

For those with an adjustable-rate mortgage (ARM), your payments could decrease. And if you’re in the market for a new home, you might find slightly more favorable rates. More importantly, if you have a mortgage with a decent interest rate but not a stellar one, a rate cut can be the perfect trigger to consider refinancing. This could potentially save you thousands of dollars over the life of your loan. I’ve seen clients significantly improve their monthly cash flow by strategically refinancing after a series of Fed cuts.

Auto Loans and Personal Loans: Making Big Purchases More Accessible

The affordability of larger purchases also gets a boost. Rates on new auto loans, personal loans, and even home equity lines of credit (HELOCs) tend to become more attractive. This can make that new car, a necessary home renovation, or even consolidating higher-interest debt into a more manageable loan a more financially sensible decision.

When Your Savings Get Less Love: The Flip Side

Now, for the savers among us, the news isn’t as rosy. As the cost of borrowing decreases for banks, so does the rate they can earn on their own money. This typically leads them to lower the interest rates they offer on savings products.

High-Yield Savings Accounts (HYSAs) and Money Market Accounts: Returns Soften

These are often the first places to feel the pinch. The annual percentage yields (APYs) on your HYSAs and money market accounts tend to drop relatively quickly after a Fed rate cut. While these accounts are still designed to offer better returns than traditional savings, the gap might narrow. If the Fed continues its path of rate cuts, expect these APYs to keep nudging downwards.

Certificates of Deposit (CDs): Lock in or Look Ahead

The beauty of a CD is its fixed rate. If you already have a CD, your interest rate is locked in, and you won't see any immediate change. However, any new CDs being offered by banks after a rate cut will likely come with lower APYs. This presents a strategic decision: If you believe rates will continue to fall, now might be a good time to lock in the current, still relatively decent, fixed rate for a CD.

Traditional Savings Accounts: Minimal Impact

For those who stick with basic savings accounts at large, traditional banks, the impact of a rate cut is usually minimal. These accounts typically offer very low interest rates year-round, so even a Fed cut might only shave off a fraction of a percentage point, if anything at all.

My Take: Navigating the Current Environment

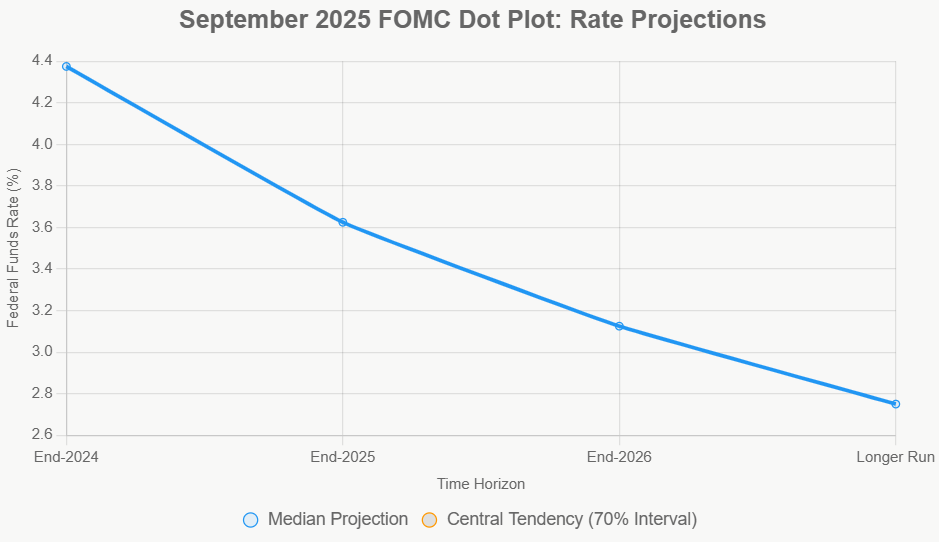

As I see it, this recent move by the Fed is a clear signal: the era of chasing exceptionally high yields on the safest of savings vehicles might be winding down, at least for now. The central bank is likely trying to stimulate economic activity by making it cheaper to borrow, which is a delicate balancing act.

From my experience, people often react one of two ways: either they jump on the lower borrowing costs, or they fret about their savings. My advice? Don't just react; be deliberate. Understand both sides of the equation.

Strategic Moves for Savers in a Falling Rate World

When the Federal Reserve starts cutting rates, it's a cue for savers to become more proactive. Simply letting your money sit in a standard savings account means you’re likely losing purchasing power to inflation. Here’s what I’d be looking at:

Optimization for Short-Term Cash

- Hunt for High-Yields: Even with slight decreases, online HYSAs and money market accounts still offer far better rates than most brick-and-mortar bank savings accounts, which can be as low as 0.40%. Don't overlook the online options for your emergency fund or any cash you need quick access to.

- Stay Vigilant: These variable rates change. I make it a habit to periodically check the APY of my savings accounts and be ready to move my money if a competitor offers a significantly better rate. It’s a small effort for potentially a better return.

- CDs as Anchors: If you have a portion of your savings that you won’t need for a year or three, consider opening a CD now to lock in a competitive, fixed rate before they potentially drop further.

- CD Laddering: A smart play I often recommend is CD laddering. This means buying CDs with staggered maturity dates – say, one that matures each year for three years. This gives you periodic access to some funds while the bulk of your money is earning a higher, longer-term rate.

Revisiting Your Long-Term Investment Strategy

While safe havens might offer less, your longer-term goals might need a different approach.

- Goals and Time Horizons: If you need money in under three years, stick to safe, liquid options like HYSAs or Treasury bills (T-bills). For goals five years or more away, you might consider investments with higher growth potential, where you can weather short-term market ups and downs.

- Diversification is Key: In a lower-rate environment, earning decent returns often requires taking on a bit more risk or looking in different places. Consider diversifying into assets like stocks, real estate investment trusts (REITs), or dividend-paying stocks, which have historically performed well when interest rates are low.

- Bonds: As interest rates fall, the value of existing bonds that carry higher yields tends to increase. Short-term bond funds or high-quality corporate bonds can offer a blend of yield and stability, but always remember they carry more risk than a CD.

General Financial Housekeeping

This is also a good time to shore up your overall financial health.

- Employer Match: Never leave free money on the table. Contribute enough to your 401(k) or similar retirement plan to get the full employer match. This is one of the most straightforward ways to boost your savings significantly over time.

- Debt Reduction: With borrowing costs potentially falling, it's an opportune moment to tackle high-interest debt, especially if you have variable-rate loans. Consider using any extra cash to pay down credit card balances or explore consolidating debt at a lower, fixed rate.

The Bottom Line

The recent Federal Reserve rate cut isn't a simple event with a single outcome. It’s a financial nudge that presents both a challenge to savers and an opportunity for borrowers. By understanding its dual impact, staying informed, and adapting your financial strategies accordingly, you can navigate these shifts effectively and keep your finances on the right track.

Invest in Real Estate While Rates Are Dropping — Build Wealth

Lower borrowing costs would boost cash flow and enhance overall returns, especially for those positioned to act quickly

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- How Will Today's Fed Rate Cut Impact Mortgage and Refinance Rates

- Fed Interest Rate Decision Today: Latest News and Predictions

- Fed Meeting Today is Poised to Deliver the Third Interest Rate Cut of 2025

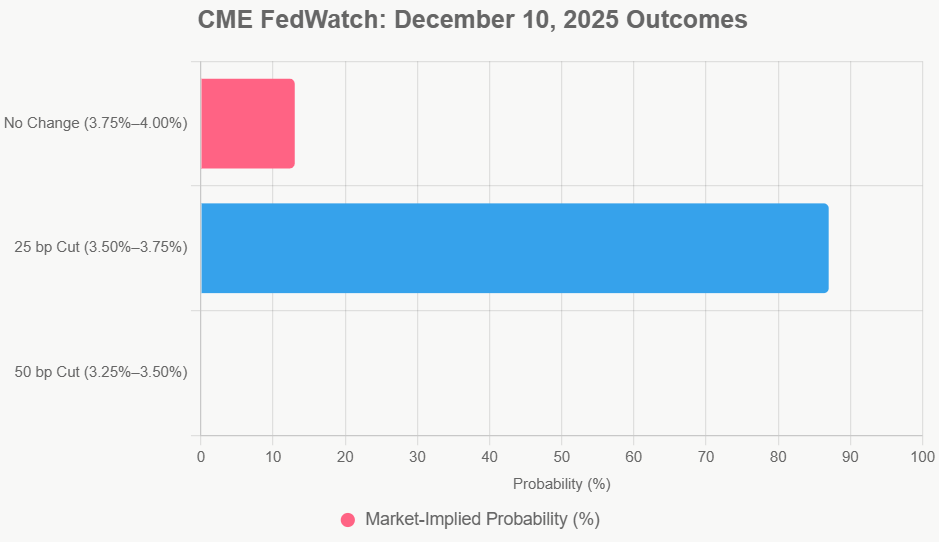

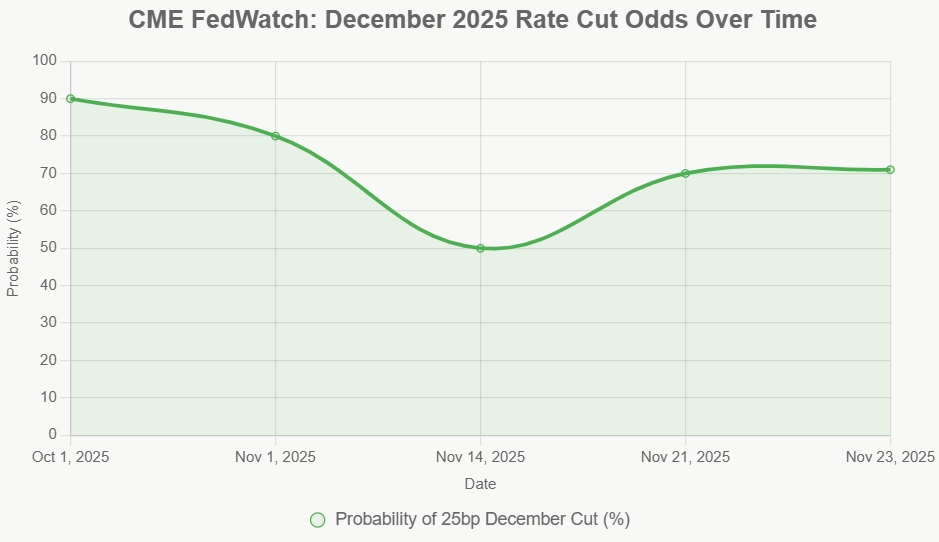

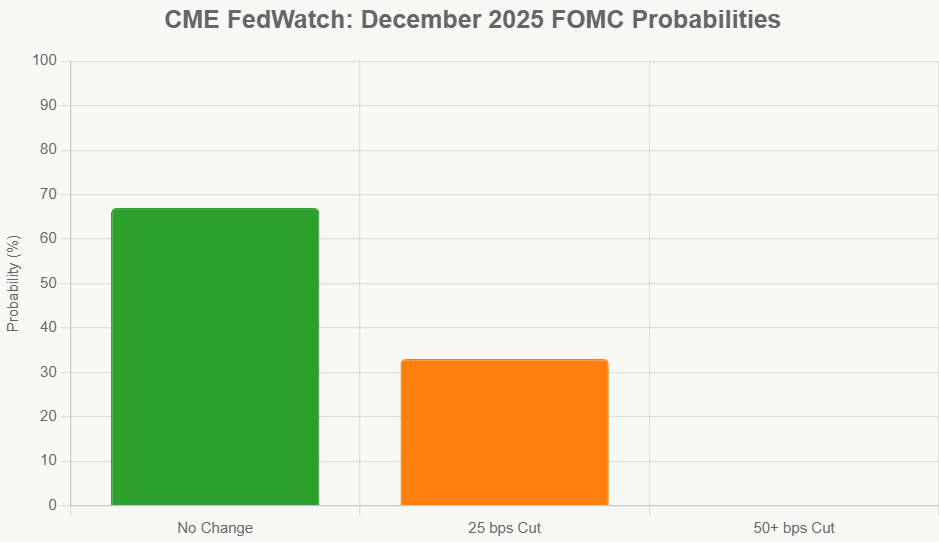

- Fed Interest Rate Predictions Signal 70% Chance of December 2025 Cut

- Fed Meeting Minutes Expose Divide: Why December Rate Cut Odds Are Fading Fast

- Fed Interest Rate Predictions for the December 2025 Policy Meeting

- Fed Signals Growing Reluctance to Interest Rate Cut in December 2025

- Fed Cuts Interest Rate Today for the Second Time in 2025

- Fed Interest Rate Forecast for the Next 12 Months

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet