Are you dreaming of owning a home, but those mortgage rates are making you sweat? You're not alone. Everyone's wondering the same thing: Will mortgage rates go down in 2025? If you're looking for a straightforward answer right away, based on the latest insights from financial giant Morgan Stanley, then yes, there's a good chance mortgage rates could ease down in 2025.

However, don't expect a sudden plunge back to those ultra-low pandemic rates we saw a few years ago. It's more nuanced than that, and understanding the details is key to making smart home buying decisions. Let’s dive into what Morgan Stanley is predicting and what it really means for you and your homeownership dreams.

Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

The Wild Ride of Mortgage Rates: A Quick Recap

To really get where we're going, we need a quick look back at how we got here. Remember just a few years ago, during the peak of the pandemic? It felt like interest rates were practically giving money away! The Federal Reserve, or “the Fed” as they're commonly known, slashed interest rates to near zero to keep the economy afloat.

This sent 30-year mortgage rates tumbling to a historic low of around 2.65% in early 2021. It was a crazy time – everyone was refinancing, and the housing market went absolutely bonkers. If you blinked, houses were selling for way over asking price!

But, as you know, what goes down must come up. Inflation reared its ugly head, becoming a major economic headache. To combat rising prices, the Fed did a complete 180 and started aggressively raising interest rates.

Fast forward to October 2023, and we saw mortgage rates skyrocket to nearly 7.80%. Ouch! That's a massive jump, and it understandably threw a bucket of ice-cold water on the housing market. Suddenly, homes became significantly less affordable, and many would-be buyers were sidelined.

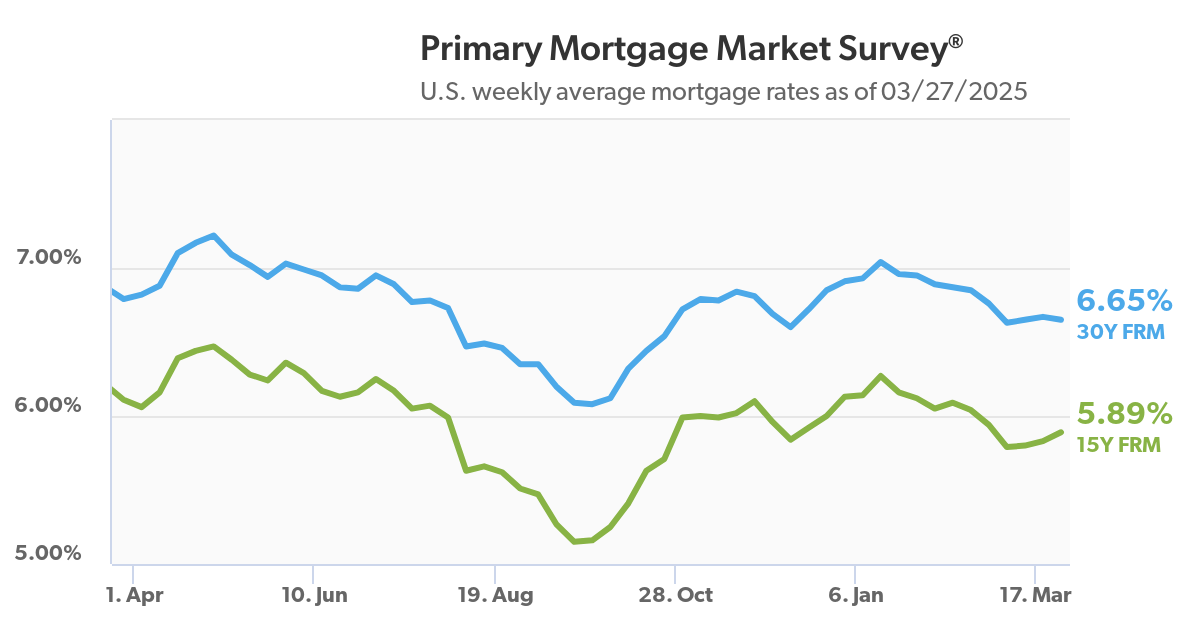

In 2024, we saw a bit of a breather. Inflation started to cool down, inching closer to the Fed’s target of 2%. The central bank even started to hint at potential rate cuts. While the Fed did reduce its benchmark rate by a full percentage point in 2024, those cuts didn't translate directly into a huge drop in mortgage rates.

Long-term yields, which influence mortgage rates, kept fluctuating. As we entered January 2025, the 30-year fixed mortgage rate was hovering just below 7%. Better than the peak, yes, but still a far cry from those sweet pre-pandemic days.

Morgan Stanley's Crystal Ball: What to Expect in 2025 and 2026

So, where do we go from here? This is where Morgan Stanley’s forecast comes into play. Their strategists, who spend their days analyzing economic trends and market movements, are predicting that mortgage rates could indeed go down in 2025. Their reasoning is tied to Treasury yields. Treasury yields are essentially the return you get on investments in US government debt, and they have a big influence on mortgage rates.

Morgan Stanley believes that these yields could fall, which, in turn, could pull mortgage rates down with them. They also anticipate a slight easing of home prices due to an increase in housing supply.

Now, it's important to manage expectations here. Morgan Stanley isn’t saying we’re going back to 3% mortgage rates anytime soon. The magnitude of the potential drop is still uncertain. Think of it as a gentle easing rather than a dramatic plunge.

Looking further ahead to 2026, Morgan Stanley suggests that a slowing in US economic growth (GDP growth) could further push Treasury yields lower. If the economy cools down, it often leads to lower interest rates across the board. This could mean mortgage rates might see further declines in 2026, potentially improving housing affordability even more.

Here's a quick summary of Morgan Stanley's forecast:

- 2025: Mortgage rates could fall along with Treasury yields. Home prices may see a slight decrease due to increased housing supply.

- 2026: Slower GDP growth could lead to further declines in Treasury yields and mortgage rates.

It's crucial to remember that these are forecasts, not guarantees. The economy is a complex beast, and many factors can influence interest rates. Geopolitical events, unexpected inflation spikes, and shifts in Fed policy can all throw a wrench into even the most well-thought-out predictions.

What Does a Rate Drop Really Mean for Your Wallet?

Let's talk real numbers. Even a small drop in mortgage rates can make a significant difference in your monthly payments and overall affordability. Morgan Stanley gives a great example:

Imagine a $1 million home.

- At a 7% mortgage rate, your estimated monthly payment (principal and interest) would be around $5,322.

- If the rate drops to 6.25%, that monthly payment comes down to approximately $4,925.

That’s a difference of roughly $397 per month! Over the life of a 30-year loan, that difference really adds up. It could be the difference between comfortably affording a home and feeling stretched too thin.

Here’s a simple table to illustrate the point further with varying home prices:

| Home Price | 7% Mortgage Rate (Approx. Monthly Payment) | 6.25% Mortgage Rate (Approx. Monthly Payment) | Monthly Savings |

|---|---|---|---|

| $500,000 | $2,661 | $2,463 | $198 |

| $750,000 | $3,991 | $3,694 | $297 |

| $1,000,000 | $5,322 | $4,925 | $397 |

| $1,500,000 | $7,982 | $7,388 | $594 |

These are estimates and do not include property taxes, insurance, and other potential housing costs.

As you can see, even a 0.75% drop in mortgage rates can translate to hundreds of dollars in savings each month. For many families, that's a game-changer.

Recommended Read:

Mortgage Refinance Applications Skyrocket as Rates Hit New Lows

Mortgage Rates Drop: Can You Finally Afford a $400,000 Home?

Home Prices: Will They Cool Down Too?

Mortgage rates are only one piece of the affordability puzzle. Home prices are the other big factor. And let's be honest, home prices have been on a tear for the past few years. Morgan Stanley points out that average home prices are up about 30% since early 2020! That million-dollar home in 2019 could easily be listed for $1.3 million today. It's tough out there for buyers.

One of the reasons home prices have stayed stubbornly high, even with higher mortgage rates, is something called the “lock-in effect”. Think about it: millions of homeowners locked in super-low mortgage rates during the pandemic. Why would they sell and give up that amazing rate to buy another home at today's higher rates? This has significantly reduced the number of existing homes on the market, keeping supply low and prices elevated.

However, Morgan Stanley believes we could see some easing of home prices. They anticipate an increase in housing starts (new home construction) and new home sales in the coming years. More new homes being built and sold, along with potentially more turnover in existing homes, should gradually increase housing inventory. Increased inventory often puts downward pressure on prices, which could offer some relief to buyers.

It's not going to be a crash, though. Morgan Stanley is predicting a slight decrease in home prices, not a massive plunge. Don't expect to see 2019 prices again anytime soon. But any moderation in price growth would certainly be welcome.

Is Now the Right Time to Jump into the Market?

This is the million-dollar question, isn’t it? “Is now the right time to buy a home?” Honestly, there’s no one-size-fits-all answer. As Morgan Stanley rightly says, it’s both an economic and a personal decision.

Economically, waiting for mortgage rates to potentially come down further in 2025 and 2026 makes sense for many. If you can hold off and rates do ease, you could save significantly on your monthly payments and increase your buying power. And if home prices moderate slightly, that’s even better.

However, life isn’t always about perfect timing. Maybe you're a young couple starting a family and need to be in a specific school district now. Maybe you're a retiree ready to buy that dream vacation home and enjoy it while you can. These personal factors can outweigh the economic considerations.

Many buyers today are also banking on the idea of refinancing down the road. The hope is that mortgage rates will eventually fall further, allowing them to refinance their current mortgage at a lower rate and reduce their monthly payments. This strategy can make it easier to stomach a slightly higher rate now, knowing you might be able to improve your situation later.

Here are some things to consider when deciding if now is the right time for you to buy:

- Your Financial Situation: Are you financially ready to buy? Do you have a solid down payment, good credit, and comfortable debt-to-income ratio?

- Your Needs vs. Wants: Do you need to buy now due to life circumstances, or can you afford to wait?

- Long-Term Perspective: Are you planning to stay in the home for the long term? Real estate is generally a long-term investment.

- Rate and Price Forecasts: Consider the expert forecasts (like Morgan Stanley's), but remember they are not guarantees.

- Personal Comfort Level: Are you comfortable with current mortgage rates and home prices, even if they don't drop dramatically?

Personally, based on what I'm seeing, I think we're entering a period of more stability in the housing market, albeit at a higher plateau than we were used to pre-pandemic. The days of rock-bottom rates are likely behind us for now, but the extreme volatility we saw in the past few years might also be easing. If you find a home you love and it fits within your budget, and you’re in it for the long haul, then waiting for the absolute perfect moment might mean missing out.

Talk to the Experts

Navigating the housing market can be complex, especially with fluctuating mortgage rates and prices. This is where getting professional advice is crucial. Morgan Stanley suggests speaking with a financial advisor to understand your financing options and how current market conditions fit into your overall financial plan. They can help you evaluate different mortgage scenarios, assess your affordability, and make informed decisions tailored to your unique circumstances.

Don't go it alone! Reach out to a qualified financial advisor and mortgage professional. They can provide personalized guidance and help you navigate the path to homeownership with confidence.

In Conclusion:

Will mortgage rates go down in 2025? Morgan Stanley believes it's possible. They forecast a potential easing of rates alongside Treasury yields and a slight moderation in home prices due to increased housing supply. While a return to pre-pandemic affordability is unlikely, any decrease in mortgage rates would be a welcome relief for homebuyers. Ultimately, the decision to buy a home is a personal one, balancing economic factors with your individual needs and circumstances. Stay informed, do your research, and seek expert advice to make the best choices for your financial future.

Work With Norada, Your Trusted Source for

Real Estate Investments

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Read More:

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?