Big news for anyone thinking about buying a home or refinancing! The average 30-year fixed mortgage rate has fallen by a whopping 98 basis points over the past year, hitting its lowest point in more than three years. This is a significant shift that could make a real difference in your monthly payments and overall borrowing costs.

30-Year Fixed Mortgage Rate Drops Sharply by 98 Basis Points

A welcome fall in mortgage rates

As a long-time observer of the housing market, I can tell you that seeing mortgage rates move this much, this quickly, is quite exciting. According to *Freddie Mac's *latest data, the average rate for a 30-year fixed mortgage on January 15, 2026, now stands at a much more manageable 6.06%. That's a substantial drop from the 7.04% we saw in mid-January of last year.

This nearly full percentage point decrease is exactly what the market needed to kick things into higher gear. We're already seeing the positive effects, with people jumping into buying homes and those already on their mortgages looking to refinance. It feels like a real breath of fresh air for both aspiring homeowners and those looking to improve their current situation.

- Significant Decline: The current rate of 6.06% is the lowest level seen in more than three years, a major shift from recent highs.

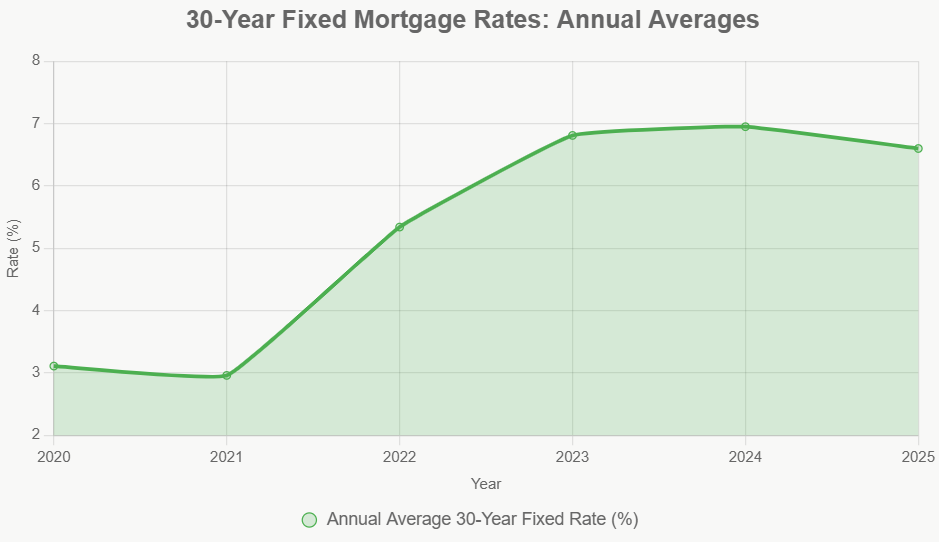

- Recent High: Rates peaked at around 8.03% in October 2023, meaning the decrease from that peak is even larger than 100 basis points.

- Market Impact: The recent decline has already led to a noticeable jump in weekly purchase applications and refinance activity, signaling an improving housing market ahead of the spring sales season.

What's driving this change?

It's natural to wonder what's causing such a dramatic dip. Several economic factors are at play. Recent actions by the Federal Reserve and signs that the labor market is cooling down have helped ease concerns about rising inflation. While rates in the 6% range are still higher than the record lows we saw during the pandemic (which dipped as low as 2.65% in January 2021), they're actually closer to the historical average of around 7.70% that we've seen for decades.

A significant boost came recently with President Trump's announcement of a new $200 billion mortgage-backed securities buyback plan. This kind of government intervention can directly influence the cost of borrowing. Beyond that, the general health of the economy, including how fast it's growing and the performance of 10-year Treasury yields, all play a crucial role in setting mortgage rates.

Mortgage Rate Movement: A Closer Look

To really understand the impact, let's break down how rates have moved. The numbers speak for themselves.

Yearly Rate Comparison:

| Mortgage Type | Average Rate (Jan 15, 2026) | Average Rate (Jan 15, 2025) | Change (Basis Points) |

|---|---|---|---|

| 30-Year Fixed | 6.06% | 7.04% | -98 bps |

| 15-Year Fixed | 5.38% | 6.27% | -89 bps |

This significant year-over-year drop is the headline news. It translates into potentially thousands of dollars saved over the life of a loan.

Recent Trends (Weekly & Monthly):

| Mortgage Type | Average Rate (Jan 15, 2026) | Last Week's Average | Last Month's Average |

|---|---|---|---|

| 30-Year Fixed | 6.06% | 6.16% | 6.14% |

| 15-Year Fixed | 5.38% | 5.46% | 5.45% |

As you can see from the weekly data, rates dipped even further just last week, reinforcing the downward trend.

What this means for you

This drop isn't just a number; it has tangible benefits for everyone involved in the housing market.

- For Buyers: This is a prime opportunity. Lower rates mean lower monthly mortgage payments. For the same monthly budget, you might be able to afford a more expensive home, or you can simply save money each month. The recent surge in purchase applications shows that many people are recognizing this advantage and are back in the market.

- For Refinancers: If you currently have a mortgage with a rate significantly higher than 6.06%, now might be the ideal time to refinance. You could potentially lower your monthly payments, reduce the total interest you pay over time, or even shorten the term of your loan. The increase in refinance activity indicates that homeowners are seizing this chance.

My Take: Why this matters

I've seen firsthand how much even small changes in mortgage rates can impact people's financial lives. When rates were high, many potential buyers were priced out, and existing homeowners were hesitant to move. This recent drop is like a wave of relief. It injects much-needed activity and optimism into the housing sector. From my perspective, this isn't just a temporary blip. The combination of economic adjustments and proactive policy measures seems to be creating a more stable and favorable borrowing environment.

Looking Ahead: What's the forecast?

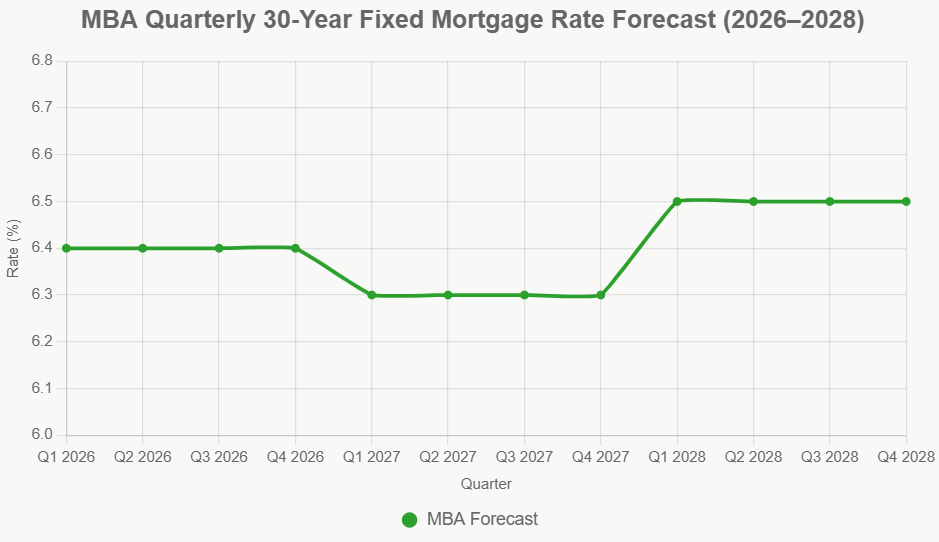

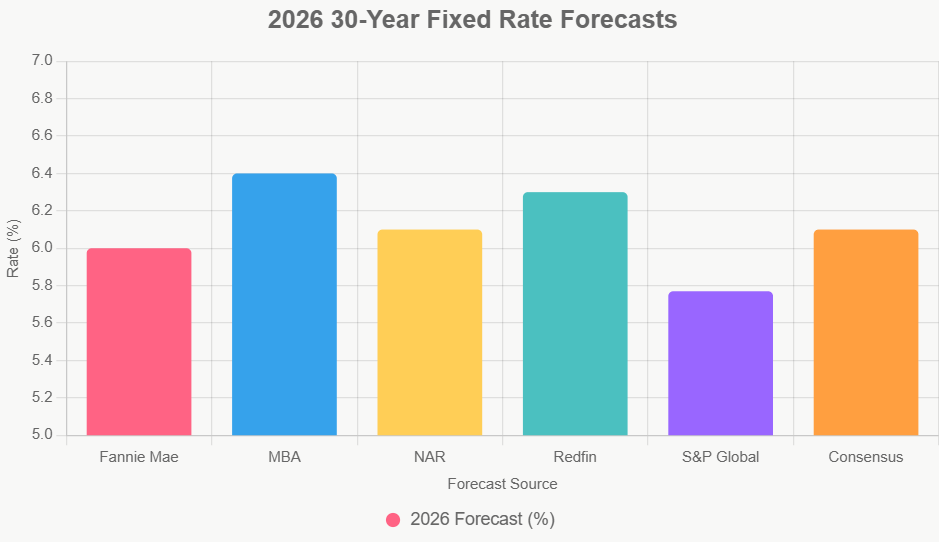

The crystal ball for interest rates is always a bit cloudy, but experts are offering some promising insights. Most forecasts suggest that rates will likely stay in the low 6% range throughout 2026. Some even predict they could dip below 6% by the end of the year. This provides a sense of stability for planning purposes, whether you're buying or refinancing.

However, it's crucial to remember that the national average is just that – an average. Rates can vary quite a bit from one lender to another. My best advice is always to shop around and compare offers from multiple lenders. You might be surprised at how much you can save by finding a lender who's willing to offer you a rate even lower than the national average.

The current housing market, with these lower mortgage rates, is presenting a fantastic opportunity. Don't miss out on the chance to make your homeownership dreams a reality or to optimize your current mortgage situation.

and

Florida’s A+ affordable rental vs Punta Gorda’s larger high‑yield property. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Also Read:

- What Leading Housing Experts Predict for Mortgage Rates in 2026

- Mortgage Rate Predictions for 2026: What Leading Forecasters Expect

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?