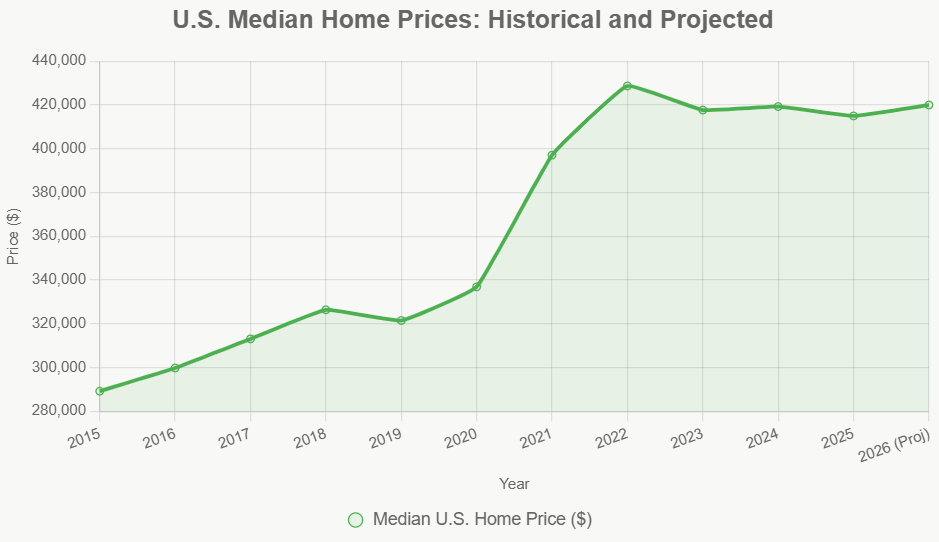

Let's dive into what might be the biggest topic on many minds right now: housing prices. If you're a homeowner, thinking about selling, or a hopeful buyer, listen up! The word on the street, from a top economist at the National Association of Home Builders (NAHB), is that we're likely to see home prices fall in many cities in 2026. This isn't just a feeling some people have; it's a prediction based on what builders are already doing to make their new homes more affordable.

This is a pretty big deal because, for years, it felt like home prices were only going one way: up. What the builders are telling us paints a picture of some needed adjustments. It boils down to this: if builders have been dropping their prices to sell homes, eventually, people selling their existing homes will have to do the same.

Home Prices Could Fall in 2026 as Builders Slash Prices

Why the Price Drop Prediction for 2026?

Robert Dietz, the chief economist for the NAHB, made waves at the International Builders Show (a major event for folks in the home-building industry) by sharing his outlook. He believes that in most areas, we'll see existing home prices come down. Why? To make things more affordable for buyers.

Here's the core of his argument, as I see it:

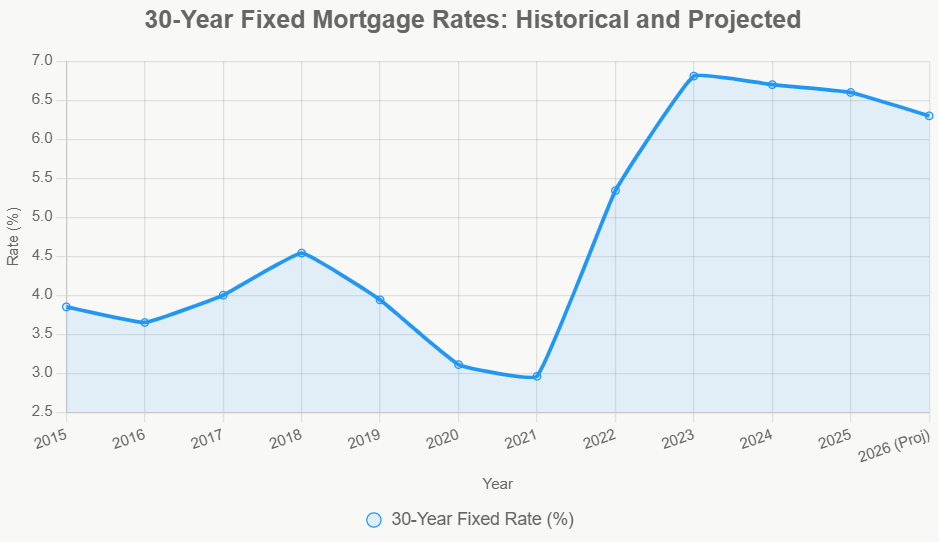

- Painful Price Discovery: Dietz put it well when he said existing homeowners are now faced with the “price discovery” that builders have been doing since 2022. Builders have had to get real about their pricing strategies to keep selling homes when affordability became a major hurdle. Individual sellers, however, have been slower to adjust their expectations.

- The Affordability Crisis in Numbers: He pointed to a concerning statistic: the typical home price is now 4.9 times higher than the typical income. This is way above the historical average of around 3 times income and even beats the ratio seen during the housing bubble peak in 2005. When homes are this expensive relative to what people earn, it's incredibly tough for them to save up for a down payment, whether it's the 3.5% needed for an FHA loan or the 10% for a conventional one.

- Builders Are Already Doing It: The data supports Dietz's point. He noted that prices for newly built homes have actually been trending down for about three years. The typical new home is now about 15% cheaper than it was in the fall of 2022. This is happening because builders are slashing prices to overcome the affordability challenges that are hurting demand.

New Homes Are Cheaper Than Used? You Heard Me Right.

This is where things get really interesting, and it's something I've been watching closely. A recent analysis from Realtor.com® revealed something almost unheard of: new homes are now more likely than existing homes to have had their prices cut.

Let's break this down:

- Q4 2025 Data: In the last three months of 2025, 19.3% of new home listings had price reductions. For existing homes, that number was just 18%.

- Inverted Trend: Even more striking, since April 2025, the median price for a new home has actually been lower than the median price for an existing home. Think about it: it's like a car dealership charging more for a used car than a brand new one of the same make and model. It just doesn't happen traditionally, and it signals a major shift.

So, why are builders willing to drop prices so much?

- Smaller Homes: While some of the relief in new construction comes from somewhat smaller homes (floor plans are about 5% smaller than in 2022), the biggest chunk is due to direct price cuts and discounts.

- Market Pressure: Builders are in the business of selling homes. When buyers can't afford them due to high prices, builders have to adjust. They've been ahead of the curve in this “price discovery” process.

What Does This Mean for Existing Home Sellers?

Dietz's prediction is that individual home sellers will eventually have to catch up. They've been reluctant to let go of the high prices they might have achieved during the pandemic's buying frenzy. But as new homes become more competitively priced, sellers of existing homes will likely face increasing pressure to lower their asking prices to attract buyers.

The historical precedent of a 3-to-1 home price-to-income ratio, which was once a reliable indicator of affordability, is now a distant memory. When that ratio balloons to 5-to-1, it makes it incredibly difficult for many households, especially younger ones, to get a foot in the door.

But Not Everyone Agrees…

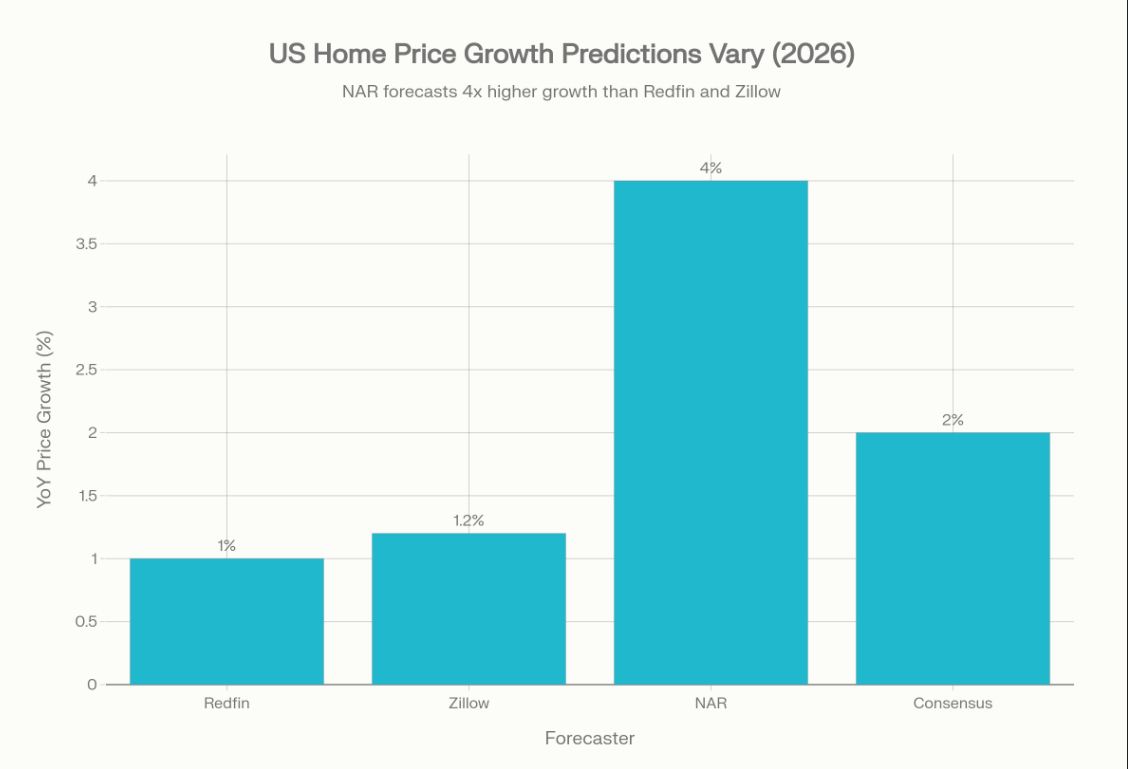

Now, it's important to note that not every expert shares this exact outlook. At the same International Builders Show, Danielle Hale, the chief economist for Realtor.com®, offered a slightly different perspective.

Hale expects modest price increases for homes in 2026. She pointed out that asking prices were pretty flat in January compared to the previous year, but actual sales prices edged up a bit. This indicates that the market, especially in areas like the Northeast and Midwest, remains competitive.

Here's her take:

- Seller Confidence: Hale noted that the percentage of listings with price reductions has actually gone down recently. She interprets this as sellers being more confident in their initial pricing from the start, aiming to avoid needing reductions as they move into 2026.

- Regional Differences: She also emphasized that the housing market is not a monolith. There's a lot of variation by region. While some areas, particularly in the South and West, might see softer prices, others in the Midwest and Northeast are still quite hot with rising prices. This “regional bifurcation” is more pronounced than usual.

She highlighted that the varying inventory levels across different markets are a major driver of these regional differences.

My Two Cents (Bringing Expertise to the Table)

From my years of following real estate trends, I can tell you that both perspectives have merit. Dietz's point about builders being the first movers in price adjustments makes perfect sense. They have overhead, construction loans, and inventory to manage, so they're often the first to blink when demand cools.

However, Hale's observation about regional variations is also crucial. Housing markets are incredibly local. What's happening in Chicago is very different from what's happening in Phoenix. Factors like local job growth, migration patterns, and the sheer amount of available housing stock (inventory) play a massive role.

I lean towards Dietz's prediction for many cities, particularly those that experienced the most significant price run-ups during the pandemic and where affordability is the most strained. The data from Realtor.com® on new vs. existing home price cuts is a strong signal that a correction is underway. Existing homeowners will eventually have to confront the new reality of pricing if they want to sell in a competitive market.

However, I also agree with Hale that some markets, especially those with strong job growth and limited inventory, might continue to see price stability or even modest increases. It's unlikely to be a nationwide cliff-dive, but rather a more nuanced shift with some areas experiencing notable price softness while others remain more resilient.

The key takeaway for anyone involved in the housing market is to stay informed about local conditions. Don't base your decisions on national headlines alone. Work with local real estate professionals who understand the pulse of your specific area. If you're a seller, be realistic about pricing. If you're a buyer, you might finally see some breathing room in 2026, but it's still wise to be prepared and act strategically.

Position Yourself Ahead With Smart Real Estate Investments

If 2026 truly becomes the year of the buyer's market, now’s the time to get ahead—before prices stabilize and competition heats up again. Strategic investors will use this window to build long-term cash flow and equity.

Work with Norada Real Estate to identify emerging markets and turnkey rental properties that offer stability, income, and growth potential—no matter how the market shifts.

THE BEST TIME TO INVEST IS BEFORE THE CROWD!

Speak to Our Investment Counselor Today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights:

- Will 2026 Finally Shift the Housing Market to Buyers?

- Housing Market: Booming vs. Shrinking Inventory Across America

- Housing Market Gains Supply But Buyers Hit Pause in 2025

- Mid-Atlantic Housing Market Heats Up as Mortgage Rates Go Down

- NAR Chief's Bold Predictions for the 2025 Housing Market

- Housing Market Update 2025: NAR Report Indicates Sluggish Trends

- 7 Buyer-Friendly Housing Markets in 2025 With Abundant Homes for Sale

- The $1 Trillion Club: America's Richest Housing Markets Revealed

- 4 States Dominate as the Riskiest Housing Markets in 2025

- Housing Market Predictions 2025 by Norada Real Estate

- Housing Market Predictions 2026: Will it Crash or Boom?

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Will Real Estate Rebound in 2025: Top Predictions by Experts