Are you wondering what's really going on with home sales right now? You're not alone! It feels like every time you turn on the news, there's another headline about the housing market, and it can be tough to make sense of it all. Here's the bottom line upfront: while the latest numbers show a bit of a dip in home sales from the previous month, it's definitely not all doom and gloom.

In fact, year-over-year, we're actually seeing more home sales happening. It's a bit of a mixed bag, and that's exactly what makes it interesting – and important to understand if you're thinking about buying or selling.

Let's dive into the recent data and break down what it really means for you, whether you're dreaming of your first home, considering a move, or just keeping an eye on the market. I'm going to share my take on these trends, not just as statistics, but as real-world shifts that impact all of us.

Home Sales Plunge Due to Soaring Home Prices and Mortgage Rates

The Latest Numbers: A Closer Look at Home Sales

The National Association of REALTORS® (NAR) just released their latest report, and it's packed with insights. Let's get into the key takeaways from January 2025:

- Month-over-Month Dip: Nationally, existing-home sales decreased by 4.9% in January compared to December. This means fewer houses were sold in January than in the previous month.

- Year-over-Year Growth: However, looking at the bigger picture, home sales were actually up 2.0% compared to January of last year. This marks the fourth consecutive month of year-over-year increases, which is a pretty positive sign!

- Median Home Price Continues to Climb: The median price of an existing home rose to $396,900 in January. That's a 4.8% increase from January 2024, and it's the 19th month in a row we've seen prices go up year-over-year. This tells us that even though sales dipped slightly month-to-month, home values are still appreciating.

- Inventory is on the Rise: There were 1.18 million unsold homes on the market at the end of January, a 3.5% increase from December and a significant 16.8% jump from January 2024. This is good news for buyers because it means there are more choices available.

- Months' Supply Increasing: The “months' supply” of homes, which estimates how long it would take to sell all the homes on the market at the current sales pace, is now at 3.5 months. This is up from 3.2 months in December and 3.0 months in January 2024. A balanced market usually has around a 5-6 month supply, so we're still leaning towards a seller's market, but inventory is definitely improving.

- Time on Market Lengthening: Homes are taking a little longer to sell. In January, properties typically stayed on the market for 41 days, up from 35 days in December and 36 days in January last year.

So, what does all this mean? On the surface, a monthly sales decrease might sound concerning, but when you dig deeper, you see a more nuanced picture. The year-over-year growth and rising inventory suggest a market that's adjusting and maybe even finding a bit more balance.

Why the Mixed Signals in Home Sales Data?

As someone who's been following the housing market closely for years, I've learned that it's rarely ever a straightforward story. There are always multiple factors at play, pushing and pulling the market in different directions. Here's what I think is contributing to these somewhat contradictory trends in home sales:

- Mortgage Rates Still Stubbornly High: This is probably the biggest elephant in the room. As NAR's Chief Economist, Lawrence Yun, rightly pointed out, mortgage rates haven't really budged despite some expectations and even slight interest rate cuts by the Federal Reserve. Rates hovering around 6.85% (as of late February 2025) are significantly higher than what we saw just a few years ago. This directly impacts affordability. For many potential buyers, these rates, combined with already high home prices, are making it challenging to enter the market.

- Home Prices Remain Elevated: While the rate of price growth might be slowing in some areas, prices are still going up overall. The nearly $400,000 median price tag is a hefty sum, and it prices many people out of the market, especially first-time buyers. This continued price appreciation, even if at a slower pace, keeps pressure on affordability.

- Inventory Slowly Rebounding: The good news is that more homes are becoming available. The significant year-over-year increase in inventory is a welcome change. For the past couple of years, we've been in a severe inventory shortage, which fueled bidding wars and rapid price increases. More inventory gives buyers more options and a bit more breathing room. However, we're still not at historical norms for inventory, so it's a gradual improvement.

- Seasonal Slowdown: January is typically a slower month for home sales anyway. Winter weather, holiday spending, and just general post-holiday sluggishness often contribute to a dip in sales activity. So, the month-over-month decline should be viewed in this context. The year-over-year comparison gives a better sense of the underlying trend.

- Regional Differences are Stark: The housing market isn't monolithic. What's happening in one part of the country might be very different from another. For example, sales declined in the Northeast, South, and West in January, but remained steady in the Midwest. Price growth also varies significantly by region, with the Northeast seeing the biggest jump in median price (9.5%) compared to the South (3.5%). We'll break down regional trends further in a bit.

The Affordability Squeeze: A Major Hurdle for Home Buyers

Let's talk more about affordability because, in my opinion, it's the central challenge in the current housing market. The combination of high home prices and elevated mortgage rates has created a real affordability crisis for many Americans.

Think about it: even a slight increase in mortgage rates can drastically change your monthly payment. And when you're already stretching to afford a home at today's prices, those rate hikes can be a dealbreaker.

This affordability squeeze is particularly hitting:

- First-Time Home Buyers: As the data shows, the share of first-time buyers dipped to 28% of sales in January. This is concerning because first-time buyers are the lifeblood of the housing market. They often have less saved for a down payment and are more sensitive to interest rate changes. NAR's own data shows that the annual share of first-time buyers in 2024 was the lowest ever recorded. This is a flashing red light.

- Buyers with Limited Budgets: For many people, especially those with average incomes or below, homeownership feels increasingly out of reach. The dream of owning a home, a cornerstone of the American dream, is becoming harder to achieve.

The fact that cash sales are still a significant portion of the market (29% in January) and that individual investors and second-home buyers are active (17% of purchases) suggests that a segment of the market is less affected by affordability constraints. These buyers are often less reliant on financing and can navigate the higher rate environment more easily. This can exacerbate the affordability challenges for regular homebuyers who need mortgages.

Regional Home Sales: A Patchwork Market Across the US

It's crucial to remember that “national” home sales data is really an average of many different local markets. And right now, those local markets are behaving quite differently. Here's a regional breakdown from the January report:

- Northeast:

- Sales: Down 5.7% month-over-month, but up 4.2% year-over-year.

- Median Price: $475,400, up a significant 9.5% year-over-year (the highest regional increase).

- My Take: The Northeast continues to be a competitive and expensive market. While sales dipped slightly in January, the strong year-over-year price growth suggests ongoing demand, especially in desirable metro areas. Limited inventory in many Northeast markets likely contributes to price pressures.

- Midwest:

- Sales: Unchanged from December, and up 5.3% year-over-year.

- Median Price: $290,400, up 7.2% year-over-year.

- My Take: The Midwest seems to be showing more resilience. Sales held steady month-over-month, and year-over-year growth was solid. The median price in the Midwest is still significantly lower than the national median, making it a more affordable region for many. This relative affordability may be supporting sales activity.

- South:

- Sales: Down 6.2% month-over-month, and unchanged year-over-year.

- Median Price: $356,300, up 3.5% year-over-year.

- My Take: The South saw a more pronounced monthly sales decline. The fact that year-over-year sales were flat suggests some cooling in this previously red-hot region. While prices are still rising, the pace of growth is more moderate than in other regions. Inventory in some Southern markets may be improving, giving buyers more leverage.

- West:

- Sales: Down 7.4% month-over-month, but up 1.4% year-over-year.

- Median Price: $614,200, up 7.4% year-over-year.

- My Take: The West experienced the steepest monthly sales drop. While year-over-year sales are still slightly up, the region is showing signs of slowing. The West remains the most expensive region in the country, and affordability challenges are particularly acute in many Western markets. High prices and interest rates may be dampening buyer demand more significantly in this region.

These regional differences underscore the importance of looking beyond national averages. If you're in the market, it's essential to understand what's happening in your specific local area. Talk to local real estate agents, track local data, and understand the dynamics unique to your market.

Recommended Read:

Fannie Mae Lowers Housing Market Forecast and Projections for 2025

Housing Market Forecast 2025 by JP Morgan Research

Housing Predictions 2025 by Warren Buffett's Berkshire Hathaway

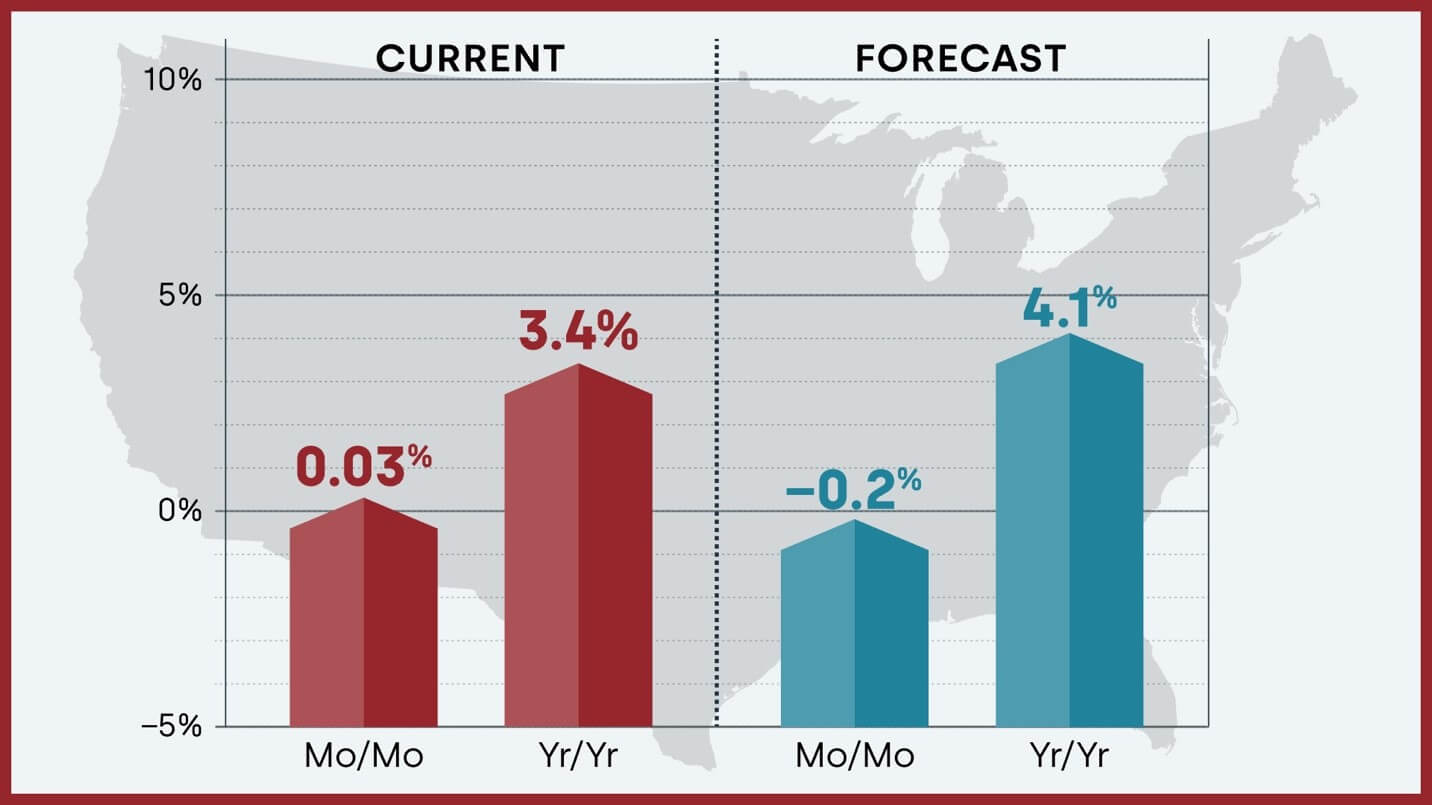

Housing Market Forecast: CoreLogic Sees 4.1% Jump in Home Prices in 2025

Inventory: A Glimmer of Hope for Buyers?

The increase in housing inventory is one of the most noteworthy aspects of the latest data. For years, the lack of homes for sale has been a major constraint on the market, driving up prices and creating intense competition.

The fact that we're seeing a significant year-over-year jump in inventory (nearly 17%) is potentially a positive shift, especially for buyers. More inventory means:

- More Choice: Buyers have more homes to choose from, reducing the feeling of desperation and the need to jump on the first available property.

- Less Competition: Increased inventory can ease bidding wars and reduce the pressure to make rushed decisions or overpay.

- More Negotiation Power: In a market with more inventory, buyers may have a bit more leverage to negotiate on price and terms.

- Slightly Longer Time to Decide: Homes staying on the market for a bit longer (41 days on average) gives buyers a little more time to consider their options and conduct due diligence.

However, it's important to keep this inventory increase in perspective. A 3.5-month supply is still considered relatively low. A truly balanced market would likely need to see inventory levels closer to 5-6 months. So, while the improvement is encouraging, we're not suddenly in a buyer's market across the board.

Furthermore, the type of inventory matters. Are we seeing more starter homes, more luxury homes, or a mix? Are the homes in desirable locations and in good condition? The quality and location of available inventory are just as important as the quantity.

Mortgage Rates: The Unpredictable Factor

Mortgage rates are the wildcard in the housing market equation. They have a profound impact on affordability and buyer demand. The fact that rates have remained stubbornly high, despite some expectations for them to decline, is a key factor shaping the current market.

What happens with mortgage rates going forward will be crucial. If rates were to come down significantly, even by a percentage point, it could inject a lot of energy into the market, bringing more buyers off the sidelines and potentially boosting sales.

However, predicting mortgage rate movements is notoriously difficult. They are influenced by a complex interplay of factors, including:

- Inflation: If inflation remains elevated, it could put upward pressure on rates.

- Federal Reserve Policy: The Fed's actions on interest rates have a direct impact on mortgage rates. Future Fed decisions will be critical.

- Economic Growth: The overall health of the economy can influence rates. Strong economic growth could lead to higher rates, while a recessionary environment might push rates down.

- Bond Market: Mortgage rates are closely tied to the bond market, particularly the 10-year Treasury yield.

For buyers and sellers alike, staying informed about mortgage rate trends and understanding the factors that influence them is essential for making informed decisions in the current market.

Looking Ahead: What to Expect in Home Sales

So, what can we expect for home sales in the coming months? Here are my thoughts:

- Continued Nuance and Regional Variation: The market will likely continue to be characterized by mixed signals and significant differences across regions and even local areas. There won't be a single national trend that applies everywhere.

- Inventory Growth to Persist (Slowly): I expect inventory to continue to improve gradually. New construction is picking up in some areas, and as the market cools slightly, homes may stay on the market longer, adding to the overall inventory. However, I don't anticipate a dramatic surge in inventory overnight.

- Affordability Will Remain a Key Constraint: Unless we see a significant drop in mortgage rates or a substantial correction in home prices (which seems unlikely in many areas), affordability will continue to be a major challenge, especially for first-time buyers and those with limited budgets.

- Market Will Adapt and Adjust: The housing market is dynamic and has a way of adjusting. Sellers may need to be more realistic about pricing, and buyers may need to be patient and persistent. We may see more creative financing options emerge as the market adapts to the higher rate environment.

- Importance of Local Expertise: Navigating this market will require local knowledge and expertise more than ever. Working with a knowledgeable and experienced real estate agent who understands your local market is crucial, whether you're buying or selling.

Final Thoughts: Navigating the Home Sales Market Today

The current home sales market is definitely interesting and a bit complex. It's not a screaming hot seller's market of the past few years, but it's also not a crashing buyer's market. It's somewhere in between, with pockets of strength and areas showing signs of moderation.

For buyers, it's a market that requires patience, preparation, and a realistic understanding of affordability. Take advantage of the increased inventory, shop around for the best mortgage rates, and be ready to negotiate.

For sellers, it's essential to price your home strategically, understand your local market dynamics, and work with a skilled agent to market your property effectively.

The key takeaway is to stay informed, be realistic, and seek expert guidance. The housing market is always changing, but understanding the underlying trends and dynamics can help you make smart decisions, whether you're looking to buy, sell, or simply stay informed.

Work with Norada in 2025, Your Trusted Source for Investment

in the Top Housing Markets of the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Read More:

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Housing Market Forecast 2025: Affordability Crisis Will Continue

- Lower Mortgage Rates Will Reignite the Housing Demand in 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for the Next 4 Years: 2025 to 2028

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?