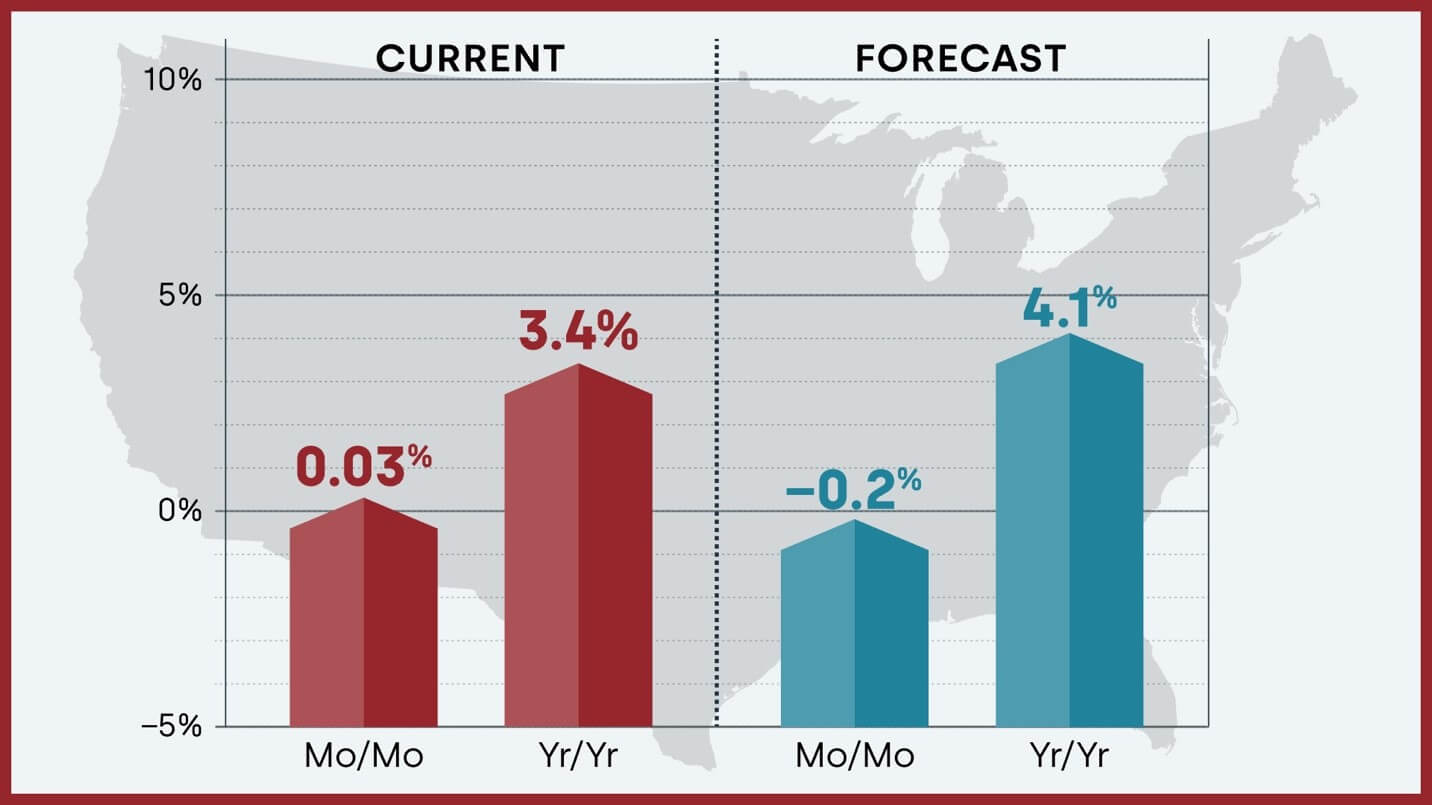

Are you trying to figure out what's going on with housing market prices in early 2025? You're not alone! The housing market can feel like a rollercoaster, and keeping up with the latest trends is crucial, whether you're buying, selling, or just keeping an eye on your investment. Here's the good news: Experts are predicting a 4.1% increase in home prices nationally by the end of 2025, compared to December 2024. Let’s take a deeper dive and see what's shaping the market right now and what we can expect in the months ahead.

Housing Market Forecast: CoreLogic Sees 4.1% Jump in Home Prices in 2025

A Look Back at 2024: Steady but Not Spectacular

2024 was a year of moderation in the housing market. We saw a bit more inventory than in the previous couple of years, which meant buyers had a few more options. However, demand remained somewhat soft due to factors like higher mortgage rates. As a result, home price growth was steady, but not as explosive as we saw during the peak of the pandemic.

According to CoreLogic, home prices nationwide, including distressed sales, increased by 3.4% year-over-year in December 2024. While that's a decent gain, it's a far cry from the double-digit appreciation we experienced just a few years ago. On a month-over-month basis, prices barely budged, increasing by only 0.03% in December.

Key Takeaways from 2024:

- Moderate Growth: Home price appreciation slowed compared to previous years.

- Inventory Improvement: Buyers had slightly more options available.

- Regional Differences: Some areas experienced stronger growth than others.

What's Fueling the Forecast for 2025?

So, what's behind the projection of a 4.1% increase in home prices by the end of 2025? Several factors are at play:

- The Spring Buying Season: The housing market tends to heat up in the spring, as families look to move before the new school year starts. This increased demand could put upward pressure on prices.

- Limited Inventory: While inventory improved in 2024, it's still below historical averages in many markets. A shortage of homes for sale can drive prices higher.

- Economic Factors: The overall health of the economy plays a role. If the economy remains stable or improves, it could boost consumer confidence and lead to more homebuying activity.

However, it's important to remember that these are just forecasts. Unforeseen events, like a sudden spike in interest rates or a major economic downturn, could certainly change the outlook.

Regional Variations: Where are Prices Headed?

The housing market is rarely uniform across the country. What's happening in one city or state can be very different from what's happening in another. In December 2024, we saw significant regional variations in home price growth:

- Northeast Strong: States like Connecticut (up 7.8%) and New Jersey (up 7.7%) experienced some of the strongest year-over-year gains. This is largely due to limited inventory in these areas.

- Hawaii and D.C. Lagging: On the other end of the spectrum, Hawaii and the District of Columbia saw home price declines of -1.1% and -0.7%, respectively.

- Southern Markets Adjusting: Some Southern markets are readjusting to higher inventories and increased variable mortgage costs.

- Mountain West Stabilizing: The Mountain West is trying to find stability after experiencing significant price swings in recent years.

Year-Over-Year Home Price Changes by State (December 2024)

| State | Change (%) |

|---|---|

| Connecticut | 7.8 |

| New Jersey | 7.7 |

| Hawaii | -1.1 |

| District of Columbia | -0.7 |

Major Metro Areas: Winners and Losers

Looking at specific metro areas, we also see a mixed bag of results.

- Chicago Leads the Pack: In December 2024, Chicago posted the highest year-over-year gain among the top 10 metros, at 5.6%.

- Other Strong Performers: Boston, Washington, and Miami also saw solid price appreciation.

- Phoenix Cooling Down: In contrast, Phoenix experienced more modest growth, reflecting the market's attempt to stabilize.

Year-Over-Year Home Price Changes by Select Metro Areas (December 2024)

| Metro Area | Change (%) |

|---|---|

| Chicago | 5.6 |

| Boston | 4.8 |

| Washington | 4.4 |

| Miami | 4.0 |

| Los Angeles | 4.1 |

| San Diego | 3.2 |

| Phoenix | 2.5 |

| Denver | 1.7 |

| Houston | 3.4 |

| Las Vegas | 5.0 |

Markets at Risk: Where Prices Could Fall

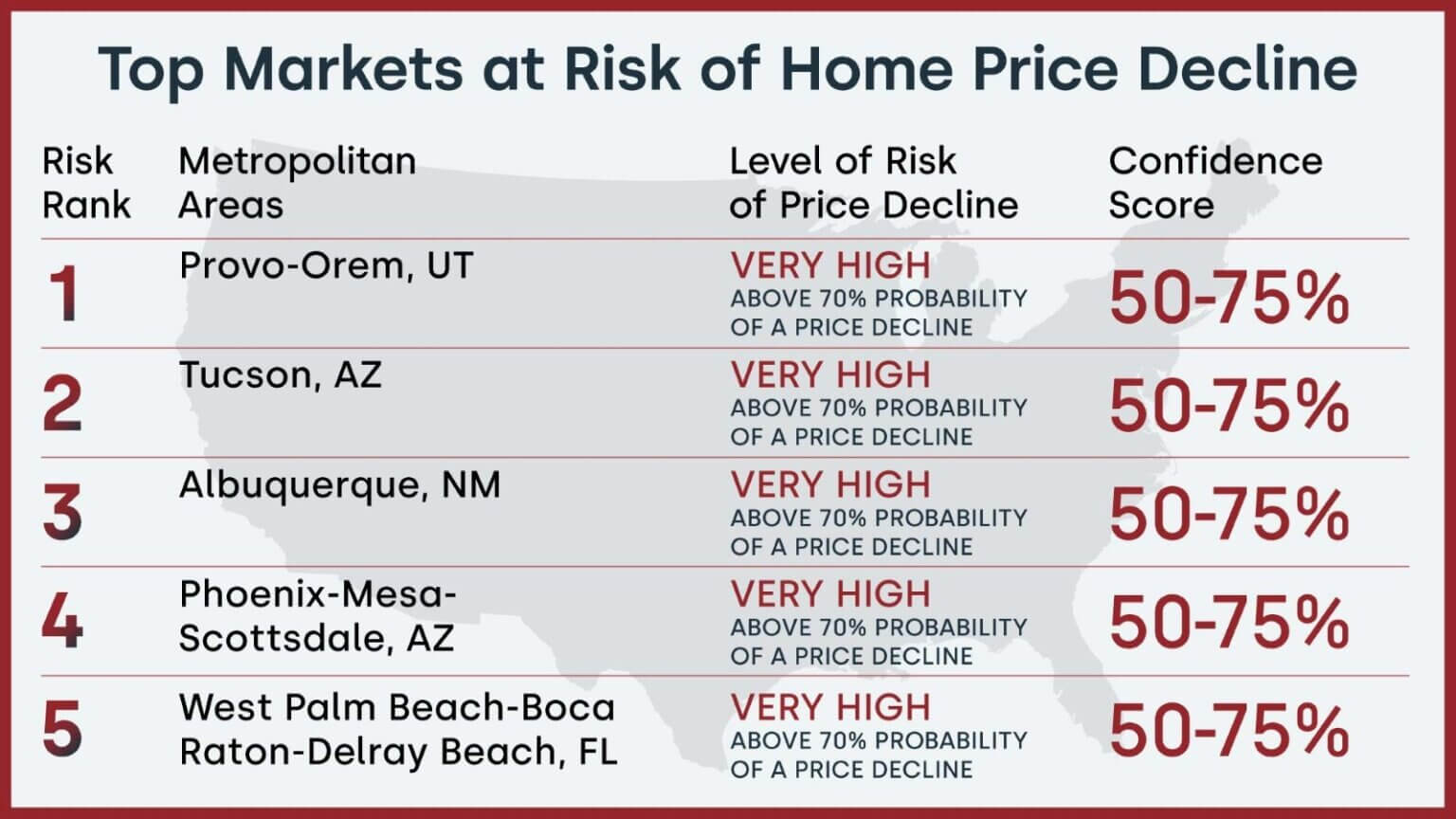

While most areas are expected to see price appreciation in 2025, some markets are considered to be at higher risk of a decline. CoreLogic's Market Risk Indicator (MRI) identifies areas where the housing market may be overheated or vulnerable to economic shocks.

According to the MRI, the following metro areas are at very high risk of home price declines over the next 12 months:

- Provo-Orem, UT: This area has a 70%-plus probability of a price decline.

- Tucson, AZ: Also at very high risk.

- Albuquerque, NM: Another market to watch carefully.

- Phoenix-Mesa-Scottsdale, AZ: Continuing its cooling trend.

- West Palm Beach-Boca Raton-Delray Beach, FL: A surprise entry on this list.

Top Five U.S. Markets at Risk of Annual Price Declines (December 2024)

| Rank | Metropolitan Area | Level of Risk of Price Decline | Confidence Score |

|---|---|---|---|

| 1 | Provo-Orem, UT | Very High (70%+) | 50-75% |

| 2 | Tucson, AZ | Very High (70%+) | 50-75% |

| 3 | Albuquerque, NM | Very High (70%+) | 50-75% |

| 4 | Phoenix-Mesa-Scottsdale, AZ | Very High (70%+) | 50-75% |

| 5 | West Palm Beach-Boca Raton-Delray Beach, FL | Very High (70%+) | 50-75% |

If you're considering buying or selling in one of these areas, it's especially important to do your research and consult with a local real estate professional.

Factors Beyond the Numbers: Wildfires and Tariffs

The numbers paint a general picture, but it's crucial to understand the real-world events that can influence the housing market. As CoreLogic's Chief Economist, Dr. Selma Hepp, points out, factors like proposed tariffs and natural disasters can have a significant impact.

- Tariffs: The possibility of new tariffs on imported building materials could drive up construction costs, which would inevitably be passed on to homebuyers.

- Wildfires: Events like the devastating wildfires in Los Angeles County in January 2025 can disrupt the supply chain, increase building material costs, and delay construction times.

These types of events highlight the interconnectedness of the housing market and the broader economy.

Recommended Read:

Weekly Housing Market Trends: What's Happening in 2025?

Expert Opinion and My Own Thoughts

Dr. Selma Hepp's analysis offers valuable context to the data. She emphasizes the ongoing bifurcation across markets, with the Northeast experiencing strong growth due to low inventory, while Southern markets adjust to higher inventory and rising mortgage costs. I agree with her assessment that the housing market is likely to see a smaller overall increase in prices in 2025 compared to previous years.

In my opinion, while the forecast of a 4.1% increase is reasonable, it's crucial to remain cautious. The housing market is sensitive to changes in interest rates, economic conditions, and consumer sentiment. It would be smart to keep a close eye on these factors in the coming months.

What Does This Mean for You?

Whether you're a buyer, seller, or homeowner, here's what the February 2025 housing market insights suggest:

- For Buyers: Be prepared for a potentially competitive spring buying season. Get pre-approved for a mortgage, work with a knowledgeable real estate agent, and be ready to act quickly when you find the right property.

- For Sellers: If you're considering selling, now might be a good time to list your home. Prices are expected to continue rising in most areas, but don't overprice your property.

- For Homeowners: Stay informed about local market conditions and be prepared to adjust your plans if necessary. Consider refinancing your mortgage if interest rates fall.

Final Thoughts

The housing market prices are complex, and it's vital to stay informed. While forecasts suggest a moderate increase in prices in 2025, it's essential to consider regional variations and potential risks. By understanding the factors that influence the market, you can make informed decisions about your real estate investments.

Work with Norada in 2025, Your Trusted Source for Investment

in the Top Housing Markets of the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Housing Market Forecast 2025: Affordability Crisis Will Continue

- Lower Mortgage Rates Will Reignite the Housing Demand in 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for the Next 4 Years: 2025 to 2028

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?