If you're like me, you're probably glued to news about the housing market, especially if you're thinking about buying, selling, or just curious about where things are headed. So, let's dive right in! The housing market forecast for the next 2 years, 2025 to 2026, points towards a slow but steady recovery. Expect to see a gradual increase in home sales, modest price growth, and a bit of relief on mortgage rates, but don't hold your breath for a return to pre-pandemic days. Affordability will likely remain a challenge, particularly for those trying to buy their first home.

Housing Market Forecast for the Next 2 Years: 2025-2026

The last few years have been a wild ride for the housing market. We saw prices skyrocket, mortgage rates hit highs we hadn't seen in ages, and a serious shortage of homes. As of April 2025, things are still a bit bumpy. Prices are high, interest rates are up there, and it's tough for regular folks to afford a place to live. But, experts are cautiously optimistic that things will get a little better in the next couple of years.

Here's a Breakdown of What to Expect:

- Home Sales: Expect a slow and steady increase.

- Home Prices: Prices will likely rise, but not as much as they have been.

- Mortgage Rates: We might see a little bit of a drop, but don't expect them to plummet.

- Inventory: More houses are becoming available, which is good news for buyers.

Digging Deeper: The Key Forecasts and Trends

Let's break down these predictions in more detail. Keep in mind that these are forecasts, and things can change!

1. Home Sales: Slowly Climbing Back Up

After hitting a low point in 2024, the housing market is expected to see a gradual increase in sales. This isn't going to be a huge jump, but it's definitely a step in the right direction.

- Existing-Home Sales: The National Association of Realtors (NAR) is predicting about a 6% increase in 2025, reaching 4.3 million units. They expect an even bigger jump of 11% in 2026.

- New-Home Sales: These are expected to grow by about 10% in 2025 and another 5% in 2026. This is partly because builders are starting to construct more homes.

The key takeaway here is that while sales are improving, they're still below what they were before the pandemic. High mortgage rates are still holding some people back.

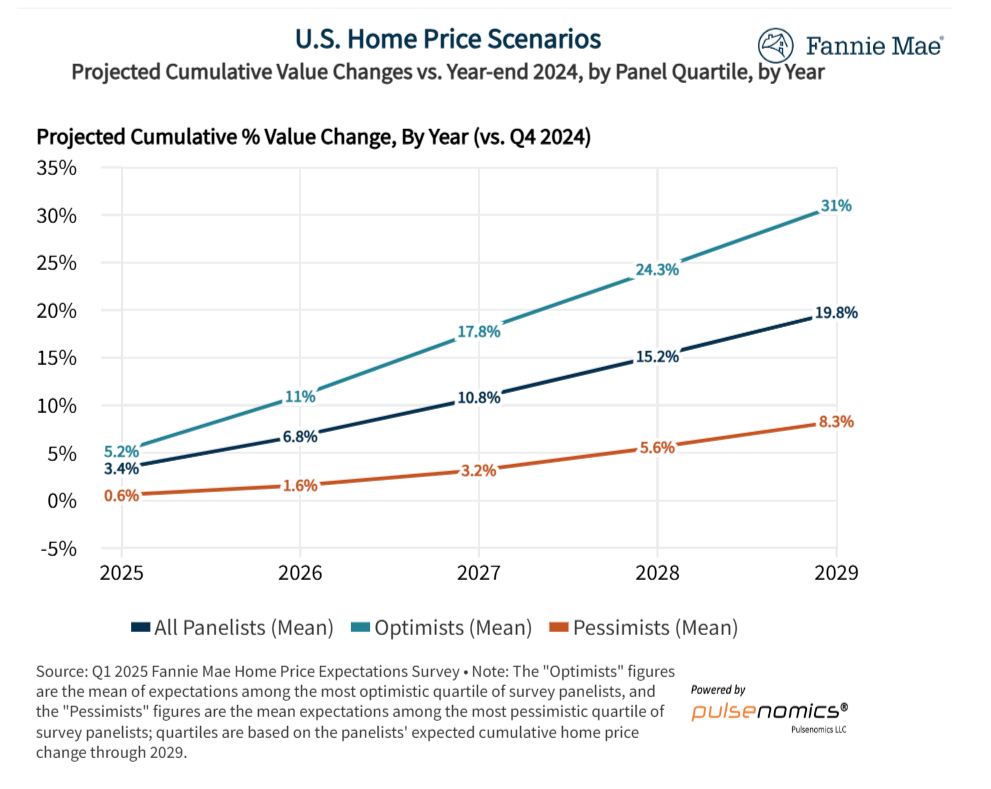

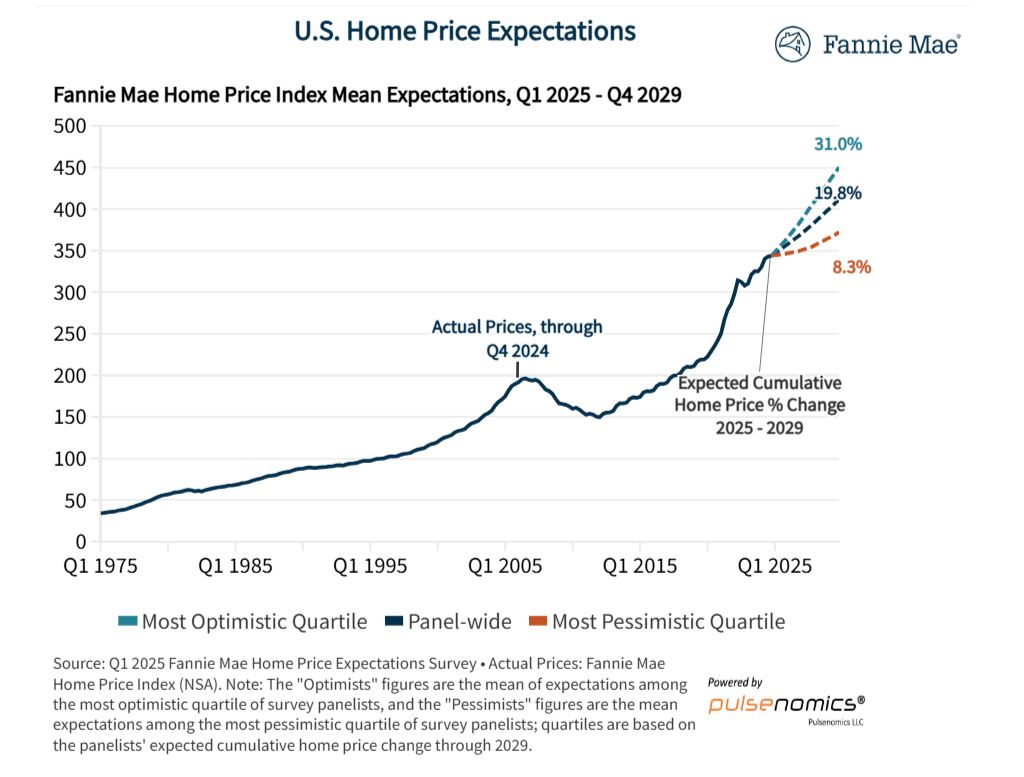

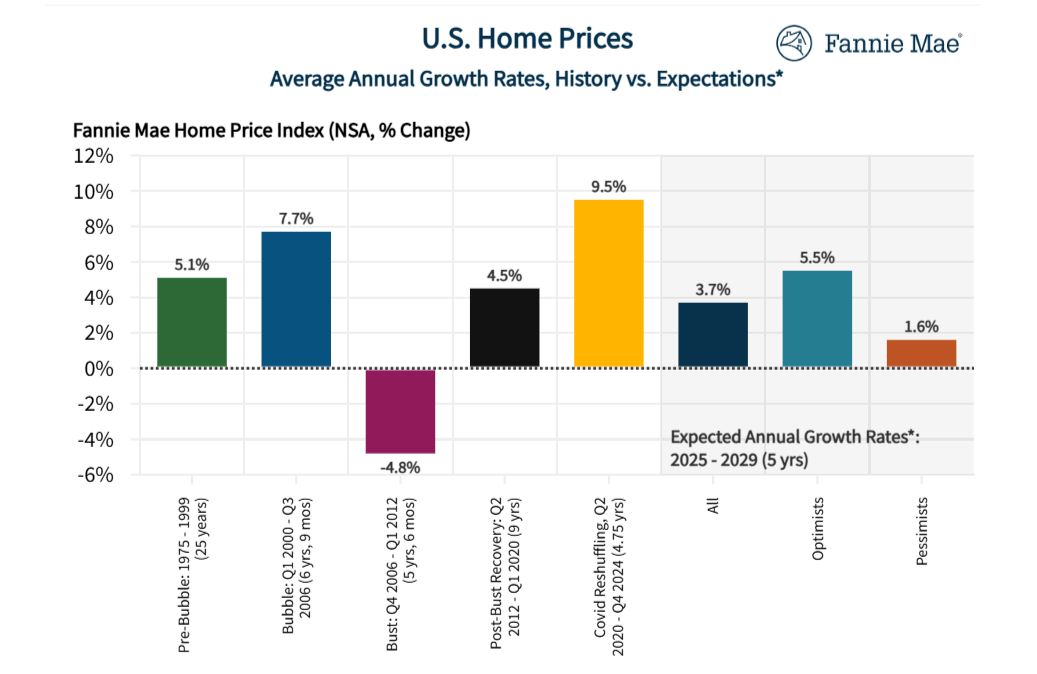

2. Home Prices: Moderate Growth is the Name of the Game

Remember the days when house prices seemed to go up every single day? Those days are likely over, at least for now. Experts are predicting more moderate growth in home prices over the next couple of years.

- NAR Projections: The NAR is predicting that home prices will increase by 2-3% annually. This would put the median home price at around $410,700 in 2025 and $420,000 in 2026.

- Fannie Mae Projections: Fannie Mae is a bit more optimistic, forecasting growth of 3.8% in 2025 and 3.6% in 2026.

Here's a quick comparison:

| Year | NAR Home Price Growth | Fannie Mae Home Price Growth | Median Home Price (NAR) |

|---|---|---|---|

| 2025 | 2-3% | 3.8% | $410,700 |

| 2026 | 2-4% | 3.6% | $420,000 |

Keep in mind that these are just averages. Some areas might see prices rise more quickly than others.

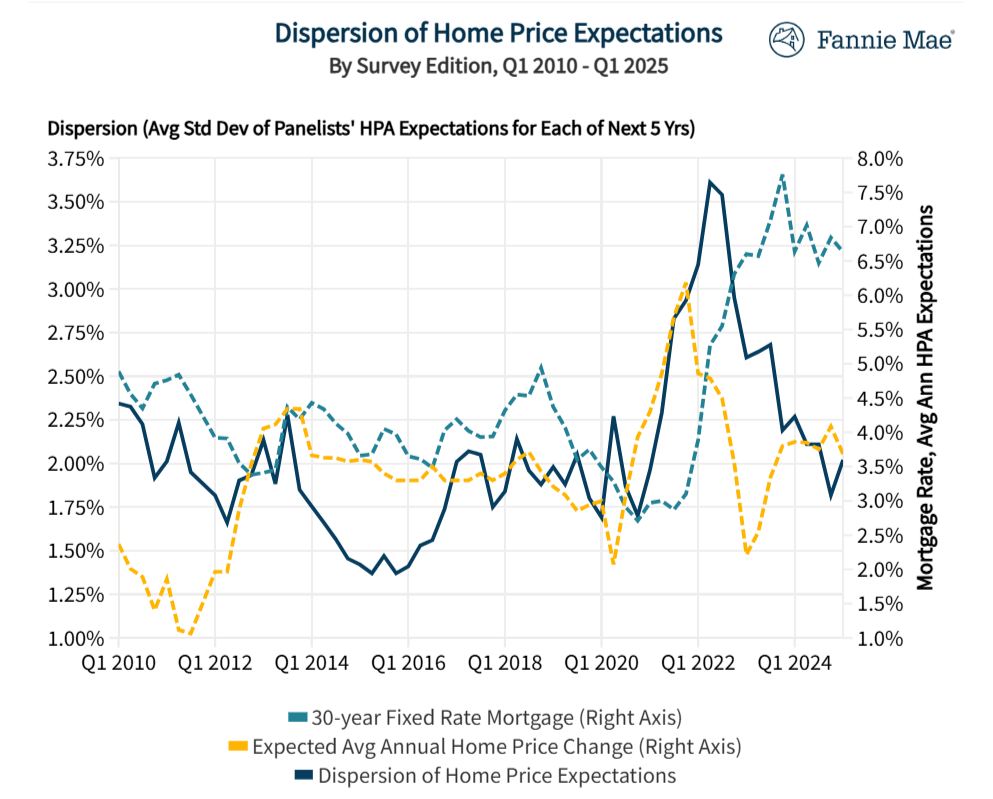

3. Mortgage Rates: A Little Relief, But Don't Get Too Excited

High mortgage rates have been a major headache for anyone trying to buy a home. The good news is that rates might come down a little bit, but don't expect a dramatic drop.

- Current Rates: As of now, the average 30-year fixed mortgage rate is around 6.4%.

- Forecasts: The NAR thinks rates could drop to around 6.1% by 2026. Fannie Mae is predicting a rate of 6.3% by the end of 2025.

The big question mark here is the Federal Reserve. They're trying to keep inflation under control, and that could limit how much they can lower interest rates.

4. Housing Inventory: More Options for Buyers

One of the biggest problems in recent years has been the lack of homes for sale. That's starting to change, with inventory up about 30% compared to last year. This gives buyers more choices and could help to cool down the market a bit.

- New Construction: Builders are starting to construct more homes, which will also help to increase inventory. However, there might be a slight dip in multifamily (apartment) construction in 2025 before it rebounds in 2026.

5. Regional Differences: Where You Live Matters

The housing market isn't the same everywhere. Some areas are doing better than others.

- High-Growth Areas: The South and Midwest are expected to be strong, thanks to relatively affordable prices and job growth.

- Challenged Markets: Coastal areas like the Northeast and West might see slower growth due to high prices and limited supply.

I believe that focusing on local market trends is extremely important. National averages are useful, but they don't always reflect what's happening in your specific area.

6. Policy Impacts: What the Government Does Can Matter

Government policies can have a big impact on the housing market.

- Tariffs: Proposed tariffs on building materials like lumber could increase construction costs.

- Immigration Policies: Changes to immigration policies could affect the availability of construction workers.

- Regulatory Reform: The National Association of Home Builders (NAHB) is pushing for reforms to reduce land and construction costs, which would help to make housing more affordable.

These are things to keep an eye on, as they could add uncertainty to the market.

7. Consumer Behavior: Who's Buying Homes?

The people buying homes are changing, too.

- First-Time Buyers: Affordability is still a big challenge for first-time buyers.

- All-Cash Buyers: More people are buying homes with cash, which means they're not as affected by mortgage rates.

- Multigenerational Households: More families are living together, which can change housing needs.

- Demographic Trends Millennials and Gen Z are entering the market.

My Thoughts and Predictions

I've been following the housing market closely for quite some time, and one thing I've learned is that predicting the future is never easy! However, based on what I'm seeing, I think the forecasts for a slow and steady recovery are reasonable.

Here are a few of my personal thoughts:

- Affordability is the biggest challenge: Even with modest price growth and slightly lower mortgage rates, many people will still struggle to afford a home. We need to find creative solutions to address this issue.

- Regional variations are key: Pay close attention to what's happening in your local market. National trends don't always tell the whole story.

- Be prepared for uncertainty: The housing market is affected by many factors, some of which are unpredictable. Be prepared to adjust your plans if things change.

The Bottom Line: What Does It All Mean?

So, what's the big picture? The housing market is expected to gradually recover in 2025 and 2026. We'll see a rise in home sales, moderate price growth, and a slight easing of mortgage rates. Existing-home sales are projected to reach 4.3 million in 2025 and increase by 11% in 2026. Home prices are likely to rise by 2-3% annually. However, affordability will remain a challenge, and regional variations will play a big role.

While the outlook isn't perfect, it's definitely better than what we've seen in recent years. If you're thinking about buying or selling a home, now is a good time to start doing your research and talking to a real estate professional.

Also Read:

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for the Next 4 Years: 2024 to 2028

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Real Estate Market Predictions 2025: What to Expect

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Housing Market Predictions for the Next 2 Years

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions 2024: Will Real Estate Crash?

- Trump vs Harris: Which Candidate Holds the Key to the Housing Market (Prediction)