The St. Petersburg housing market is currently in a hot state, with home prices rising at a rapid pace. There are several factors driving the hot housing market in St. Petersburg. St. Petersburg is one of the fastest-growing cities in the United States, and its population is expected to continue to grow in the coming years. This increase in demand for housing is driving up prices.

The supply of housing in St. Petersburg is limited. This is due to a number of factors, including the city's rapid growth and the fact that much of the land in the city is already developed. The limited supply of housing is also contributing to rising prices.

It is impossible to say for certain whether or not the St. Petersburg housing market will crash in 2024. However, there are a few factors that could lead to a crash. First, the interest rate environment could change. If interest rates rise, it will become more expensive to borrow money to buy a home. This could lead to a decrease in demand for housing and a decline in prices.

Second, the economy could weaken. If the economy enters a recession, it could lead to job losses and a decrease in incomes. This could also lead to a decrease in demand for housing and a decline in prices.

However, it is important to note that the St. Petersburg housing market has been very resilient in the past. The city has experienced a number of economic downturns, but the housing market has always recovered. This is because St. Petersburg is a desirable place to live, and there is always a strong demand for housing in the city.

St. Petersburg Housing Market Trends in 2024

In February 2024, the housing market in St. Petersburg, FL witnessed a steady rise in home prices, showcasing a **0% increase compared to the previous year. According to Redfin, the median price of homes soared to $410K, indicating a robust market performance. However, this upward trajectory was accompanied by a slight extension in the time homes spent on the market, with an average of 45 days, compared to 41 days in the preceding year. Despite this, the number of homes sold in February stood at 390, a marginal decrease from the 412 homes sold during the same period last year.

How is the Housing Market Doing Currently?

The current state of the housing market in St. Petersburg can be deemed as competitive, with homes typically selling within 33 days of being listed. This brisk pace suggests a heightened demand for housing in the area, with some properties even attracting multiple offers. On average, homes sell for approximately 3% below their listed price, indicating a balanced negotiation landscape between buyers and sellers. Moreover, certain properties, categorized as ‘hot homes,' are known to sell at or near the listed price within just 8 days of listing, further emphasizing the market's vigor and dynamism.

How Competitive is the St. Petersburg Housing Market?

The St. Petersburg housing market exudes a competitive edge, with homes swiftly making their way off the market within 33 days of listing. This rapid turnover underscores the fervent demand for housing in the area, compelling buyers to act swiftly to secure their desired properties. Additionally, the prevalence of multiple offers on some homes adds an extra layer of competition, further intensifying the market dynamics.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the robust demand for housing, the inventory levels in St. Petersburg appear to be relatively stable, with a consistent influx of available homes meeting the buyer's needs. However, the 40.3% increase in homes with price drops compared to the previous year signals a potential shift in the market dynamics, possibly indicating a slight imbalance between supply and demand. Nonetheless, the overall availability of homes seems to adequately cater to the prevailing buyer demand.

What is the Future Market Outlook?

Looking ahead, the future of the St. Petersburg housing market appears promising, with the current trends reflecting a resilient and adaptable ecosystem. While slight fluctuations may occur, the market is poised to maintain its stability and continue to attract both buyers and sellers alike. Moreover, the migration and relocation trends indicate a healthy interest in the St. Petersburg area, further bolstering the long-term outlook for the market.

Is It a Buyer's or Seller's Housing Market?

The current landscape of the St. Petersburg housing market leans towards a balanced environment, offering opportunities for both buyers and sellers to navigate the market with relative ease. While sellers may benefit from the competitive nature of the market, buyers can also find value in the available inventory and negotiation landscape. Ultimately, the market presents a symbiotic relationship between buyers and sellers, fostering a dynamic and inclusive environment for real estate transactions.

St. Petersburg Housing Market Forecast for 2024 and 2025

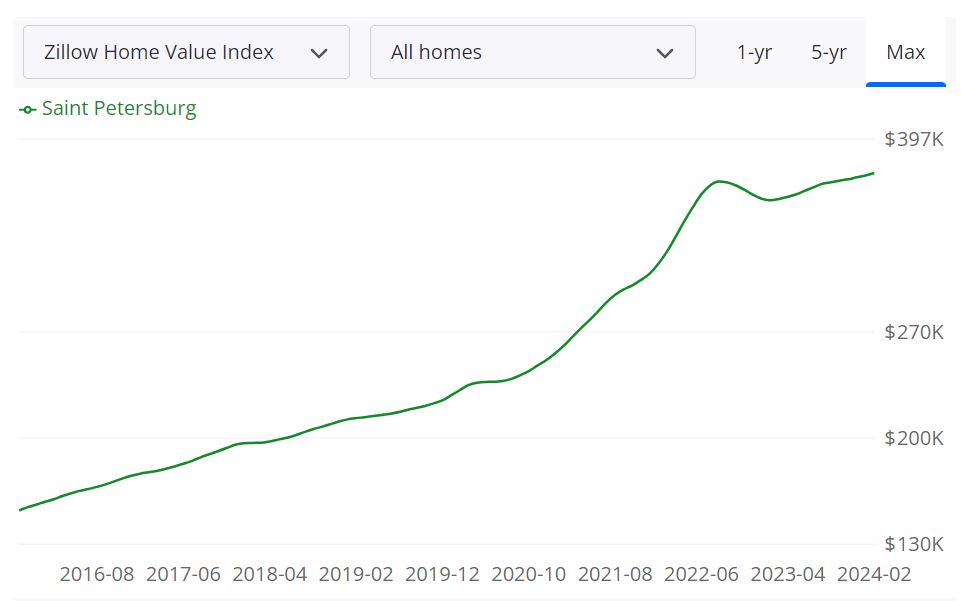

The key question on everyone's mind is whether the St. Petersburg housing market is susceptible to a crash. In the bustling city of St. Petersburg, the housing market continues to show resilience and promise. According to Zillow, the average home value stands at $375,013, reflecting a 5.0% increase over the past year. Understanding key metrics in this market can provide valuable insights for both buyers and sellers alike.

For Sale Inventory

The for sale inventory as of February 29, 2024, totals 2,000 properties. This metric illustrates the number of available homes on the market, indicating the level of supply relative to demand.

New Listings

As of the same date, there have been 576 new listings. This figure represents the influx of properties entering the market, providing prospective buyers with fresh options to consider.

Median Sale to List Ratio

The median sale to list ratio as of January 31, 2024, stands at 0.973. This ratio gauges the relationship between the final sale price of a property and its initial listing price. A ratio below 1 indicates that, on average, homes are selling for less than their listed prices.

Median Sale Price

As of January 31, 2024, the median sale price in St. Petersburg is $360,000. This figure represents the middle point of all home sale prices in the area, providing a benchmark for property values.

Median List Price

Contrastingly, the median list price as of February 29, 2024, stands slightly higher at $413,163. This metric indicates the average listing price of properties in the market, influencing sellers' expectations and buyers' negotiation strategies.

Percent of Sales Over and Under List Price

Analysis of data from January 31, 2024, reveals that 10.1% of sales were over list price, while 72.7% were under list price. These percentages shed light on the bargaining power of buyers and sellers, as well as the competitiveness of the market.

Are Home Prices Dropping in St. Petersburg?

While fluctuations in home prices are not uncommon, the data suggests stability rather than a significant drop. The median sale price and median list price provide insights into the pricing trends, with both figures indicating consistent values. However, localized factors and external influences can impact individual property prices.

Will the St. Petersburg Housing Market Crash?

Predicting a housing market crash requires a multifaceted analysis of various economic, social, and regulatory factors. While the St. Petersburg housing market exhibits healthy dynamics, unforeseen events or shifts in the broader economy could lead to fluctuations. However, there is currently no indication of an imminent market crash based on available data.

Is Now a Good Time to Buy a House in St. Petersburg?

Deciding whether now is the right time to buy a house depends on individual circumstances, financial readiness, and personal preferences. With a balanced market and relatively stable prices, buyers may find opportunities for favorable deals and negotiations. However, consulting with real estate professionals and conducting thorough research can help individuals make informed decisions tailored to their specific needs.

As with any investment, purchasing a home involves risks and uncertainties. While the current market conditions in St. Petersburg may present favorable opportunities, careful consideration and due diligence are advisable before making significant financial decisions.

Investing in the St. Petersburg Real Estate Market

1. Population Growth and Trends

St. Petersburg is currently experiencing population growth, positioning it as one of the fastest-growing cities in the United States. This surge in population contributes significantly to the demand for housing, creating a favorable environment for real estate investment.

2. Economy and Jobs

- Steady Economic Growth: The city's economy is on a steady upward trajectory, providing a stable foundation for real estate investment.

- Job Opportunities: The flourishing economy translates into increased job opportunities, further driving the demand for housing in St. Petersburg.

3. Livability and Other Factors

- Desirability: St. Petersburg is renowned for its high livability, making it an attractive destination for individuals and families seeking a quality living environment.

- Infrastructure Development: Ongoing and planned infrastructure developments enhance the city's appeal, positively impacting real estate values.

- Cultural Attractions: The city's cultural attractions contribute to its charm, making it a sought-after location for residents and potentially increasing property values.

4. Rental Property Market Size and Growth

The rental property market in St. Petersburg is substantial, presenting a lucrative opportunity for investors:

- Current Market Size: The rental property market is sizable, catering to a diverse tenant pool.

- Growth Potential: With the city's population growth and economic prosperity, the rental market is poised for further expansion, offering long-term investment potential.

5. Other Factors Related to Real Estate Investing

- Supply and Demand Dynamics: The limited supply of housing in St. Petersburg, coupled with robust demand, creates a favorable environment for property appreciation.

- Historical Market Resilience: St. Petersburg's housing market has shown resilience in the face of economic downturns, instilling confidence in investors regarding long-term stability.

Considering the city's population growth, thriving economy, high livability, and the potential for rental property market expansion, St. Petersburg emerges as a sound option for real estate investors. However, like any investment, thorough research, and a careful assessment of individual financial goals and risk tolerance are crucial before making investment decisions.

References:

- https://www.zillow.com/home-values/26922/saint-petersburg-fl/

- https://www.redfin.com/city/16164/FL/St-Petersburg/housing-market