Is the Housing Crisis Over in America?

The housing crisis is not over in the U.S. There is a shortage, or housing underproduction, in all corners of the country. The major coastal cities are known for their exorbitant real estate prices, which are driven by zoning restrictions and a scarcity of available housing. According to a new study, these issues are increasingly plaguing once-affordable towns and cities across the United States.

According to an analysis by the housing policy group Up For Growth, more than half of the nation's metropolitan regions had a housing shortage in 2019, a significant increase from one-third of cities in 2012. The country is short 3.8 million homes to meet its housing needs, which is double the number from 2012.

In recent years, rising raw material costs have exacerbated builders' woes, particularly during the pandemic, when lumber prices increased by more than 150%. But, given the large cohort of Millennials entering the housing market, one of the most significant reasons for this shortfall has been the severe underbuilding of entry-level homes, where the majority of the demand exists. Given the significance of this factor, we go into more detail about the entry-level labor shortage below.

According to an analysis published by Freddie Mac, long-term single-family home development declines have caused the housing shortage. Starter homes have decreased much further, exacerbating that trend. Between 1976 and 1979, 418,000 entry-level single-family homes were built annually, accounting for 34% of all new homes built. Mortgage rates rose from 8.9% to 12.7% in the 1980s.

As mortgage rates rose, housing became less affordable, decreasing demand and supply. In the 1980s, the entry-level housing supply dropped by nearly 100,000 units to 314,000 per year. The entry-level percentage of new single-family homes remained at 33%, similar to the late 1970s, showing that entry-level supply fell by the same amount as the entire new construction market.

According to another report published on the housing shortage by Fannie Mae, every city in the country has a housing supply problem, but each city's housing supply problem is quite unique. The research conducted by the firm found out that while the US has a nationwide affordable housing deficit, each state and city's approach to solving it is different, and the tools and techniques utilized to build needed new housing supply must be adjusted.

Tools to increase housing supply are accessible, although less so. Many towns oppose hard choices and reforms to increase housing for low- and moderate-income homeowners and renters. However, without those choices, the economic and social benefits of adequate housing supply will be wasted and the issues caused by its scarcity will deepen.

The housing supply shortage has well-known causes. After the Great Recession, housing development plummeted. The last decade saw the fewest new residences created since the 1960s. 3.8 million housing units were needed in 2019. The pandemic-induced materials and labor scarcity worsened the tendency, as shown by the 2021 rent and home price increases.

Rising mortgage interest rates have already dampened housing demand, particularly for new homes, and an economic recession could reduce demand further. Prices and rentals may stabilize or fall in some markets. The supply crisis will persist, hurting low- and moderate-income families. Fannie Mae ensures affordable housing for low- and moderate-income families by providing mortgage funding.

From 2019 through 2021, Fannie Mae sponsored almost 575,000 affordable units, according to their analysis. Their loans on newly built single-family houses bought by moderate-to-low-income households, funding to preserve affordable multifamily rental housing, and investments in low-income housing tax credits make up the majority of that amount.

If the housing supply is there, we can finance more. Nope. Families everywhere will continue to suffer with high housing costs until communities take concrete action to construct and preserve affordable housing stock where and how it is needed most. Fannie Mae economists Kim Betancourt, Stephen Gardner, and Mark Palim have issued a study report.

The authors compared the housing supply of the 75 largest U.S. urban markets to the housing needs of their residents. The housing supply problem is national, but solving it is local. Most housing-cost-burdened households are not just in coastal metros with high housing expenses. Fresno, Charlotte, and Las Vegas have high housing-cost-burdened household rates. Even smaller cities like El Paso and McAllen, TX, lack affordable housing.

Housing shortages necessitate localized solutions. According to the research paper, affordable multifamily rental units in Dallas and Atlanta could boost housing affordability. Some markets need new single-family houses, while others need to preserve multifamily housing. This analysis, based on 2019 data (the last pre-pandemic year with accessible housing cost burden data), shows that supply and affordability issues have worsened.

Even if home price growth has slowed and inflation and rising interest rates have reduced demand, working people have suffered from the rise in rents and housing prices since 2019. The supply dilemma can only be solved by building more housing and preserving affordable housing. While the economic drivers of housing costs—materials and labor inflation, supply chain disruptions, etc.—may take years to fix, states and municipalities may work with investors, builders, and lenders to make more homes available.

In several of the most cost-burdened states, zoning reform to encourage higher density and multifamily housing near transit and job hubs are working. Another option is to reduce or streamline regulatory barriers that hinder new development, particularly for manufactured houses and smaller starter homes that have all but gone in many large metro areas and made it hard for millions to buy their first home.

Federal low-income housing tax credits have been one of the most successful capital-generating mechanisms for affordable housing production and maintenance for over three decades and should be expanded and reinforced. Helping first-time homeowners and low-income renters could encourage the construction of additional affordable housing in areas of high demand.

Fannie Mae and the thousands of mortgage lenders and investors they work with daily are ready to finance affordable homes. The US has a world-class housing finance system. It's time to equal the housing supply.

Will the Housing Crisis Worsen in 2023?

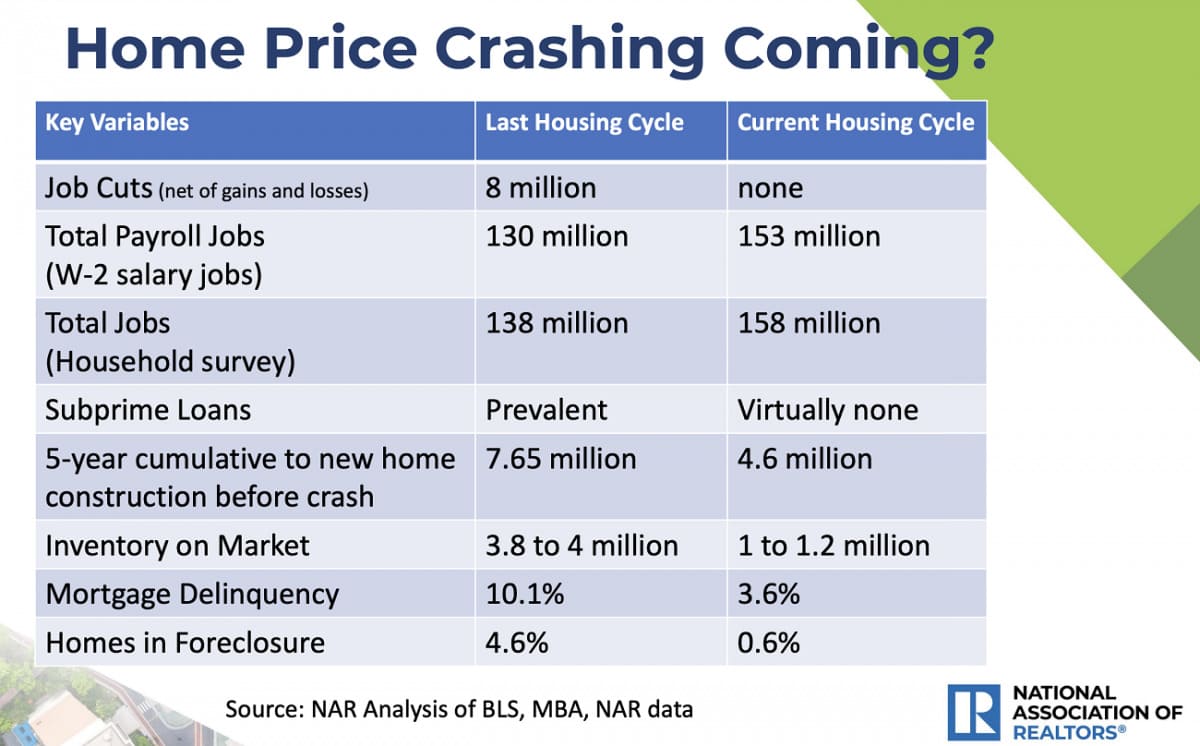

Many homeowners are still haunted by the 2008 housing market crash when property values plummeted and foreclosures increased dramatically. According to a new LendingTree survey, 41% of Americans now fear a housing crash in the next year, owing to the memory of a sudden disaster at a time when the real estate market was riding high. But NAR Chief Economist Lawrence Yun draws the distinctions between today’s real estate market and that of more than a decade ago.

- The labor market remains strong.

- Less risky loans.

- Underbuilding and inventory shortages.

- Delinquency lows.

- Ultra-low foreclosure rates.

At the virtual conference, where leading housing economists offered their 2023 forecast for the real estate market, Yun offered assurance that current dynamics are nothing like during the Great Recession. He pointed to several key indicators of how this market differs.

Homes in foreclosure reached a rate of 4.6% during the last housing crash as homeowners who saw their property values plunge walked away from their loans. Today, the percentage of homes in foreclosure is 0.6%—also at historical lows, Yun said. He predicted foreclosures to remain at historical lows in 2023.

Danushka Nanayakkara-Skillington, assistant vice president of forecasting and analysis at the National Association of Home Builders, said she expects housing starts to drop by double digits in 2023. Then, “as the economy improves in 2024, the housing market will gradually come out of this slump that is expected from the next year,” she added.

Builder confidence has fallen over the last 11 months as mortgage rates rose and buyer traffic slowed dramatically. Fifty-nine percent of builders have reported using incentives, like mortgage rate buydowns and price cuts, to try to win buyers back, Nanayakkara-Skillington said. Labor shortages combined with lot shortages, higher material costs, and lending issues for builders are all compounding factors preventing more construction.

And while lumber prices have eased from record highs, construction costs remain 14% higher due to shortages in other supplies, like gypsum and steel. “All of these issues will keep homebuilding down,” Nanayakkara-Skillington said. “We don’t see these issues being resolved in the near future either.”

Sources:

- https://www.freddiemac.com/research/insight/20210507-housing-supply

- https://www.cbsnews.com/news/real-estate-housing-shortage-crisis/

- https://www.fanniemae.com/research-and-insights/perspectives/us-housing-shortage

- https://www.nar.realtor/magazine/real-estate-news/2023-real-estate-forecast-market-to-regain-normalcy

As a general rule, 5 to 6 months of inventory is considered to be a normal or balanced market. Over 6 months of inventory and we have a buyer’s market. If it is less than 5 months and we have a seller’s market. The smaller the available inventory, the tighter the market is. Keep in mind that these are simply guidelines and will differ from market to market.

As a general rule, 5 to 6 months of inventory is considered to be a normal or balanced market. Over 6 months of inventory and we have a buyer’s market. If it is less than 5 months and we have a seller’s market. The smaller the available inventory, the tighter the market is. Keep in mind that these are simply guidelines and will differ from market to market. How To Become A Landlord

How To Become A Landlord