It’s the question on everyone’s mind whenever they see news about interest rates going up or hear whispers of economic slowdown: Will the housing market crash in the next 10 years? After living through the wild ride of the last few years, it’s natural to wonder if we’re headed for another steep drop. No, the housing market is unlikely to experience a major crash in the next decade, according to most expert forecasts and current market conditions.

While modest corrections and regional variations are expected, the structural safeguards implemented after 2008, combined with persistent housing shortages and healthier lending standards, point toward gradual stabilization rather than a dramatic collapse. However, that doesn't mean it will be smooth sailing, and understanding why is key.

Will the US Housing Market Crash in the Next 10 Years?

Where Are We Standing Right Now?

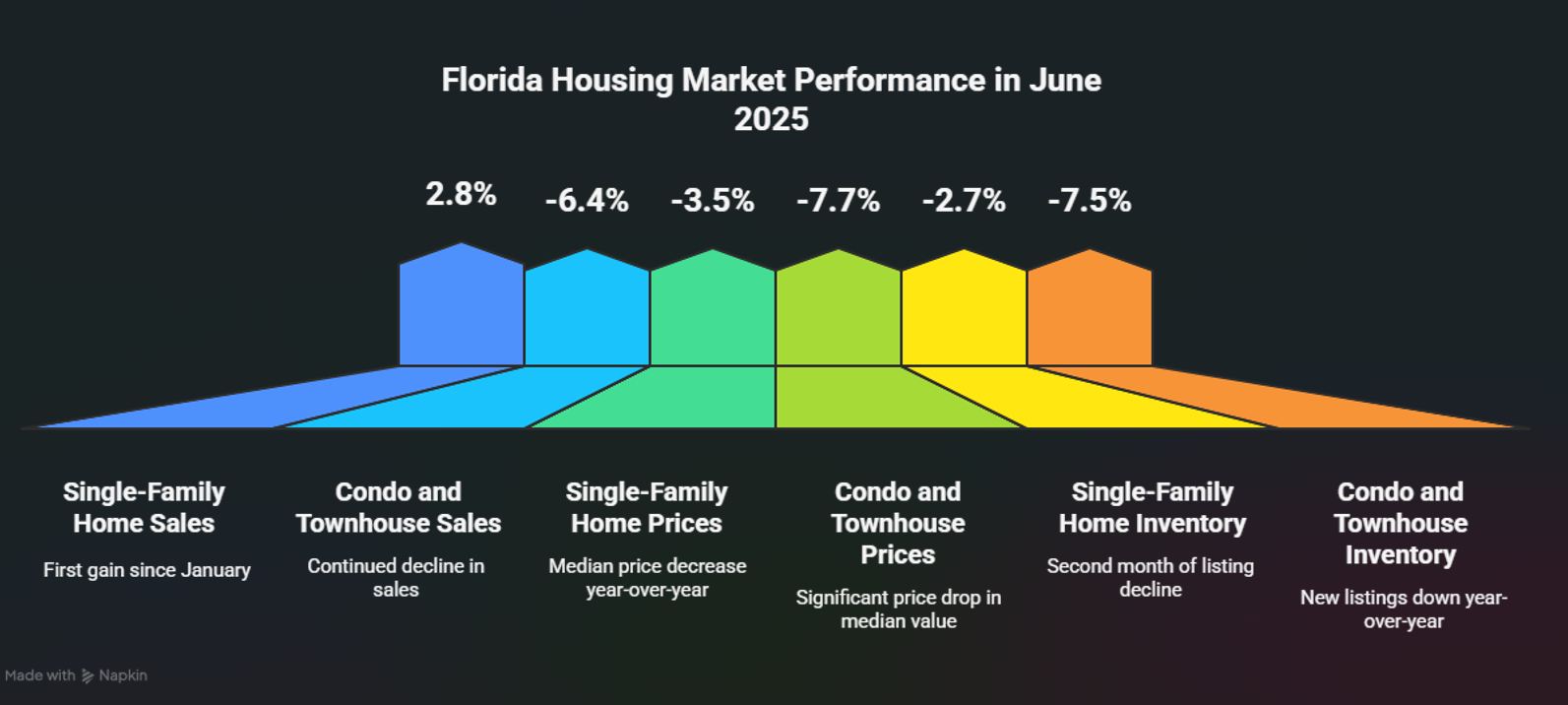

It feels like we've entered a phase the pros like Redfin are calling “The Great Housing Reset.” Gone are the days of house prices soaring by double digits every year like they did during the pandemic frenzy. Things are normalizing. As of late 2025, home prices have climbed about 2.2% year-over-year, with the median home sitting around $290,000. That's a much gentler climb, and honestly, it feels more sustainable for most people.

Mortgage rates have also been a bit of a rollercoaster, but they’re hovering around 6.3% for a 30-year fixed loan, down a bit from earlier this year. The biggest change you’ll notice is in how many homes are actually for sale. Inventory growth has slowed way down, from a big jump of 33% a year ago to just 10% now. This tells me we're not out of the woods on supply issues, but it’s also not a situation where there are just way too many homes for sale, which is often a precursor to a crash.

What Do the Experts See Coming Soon?

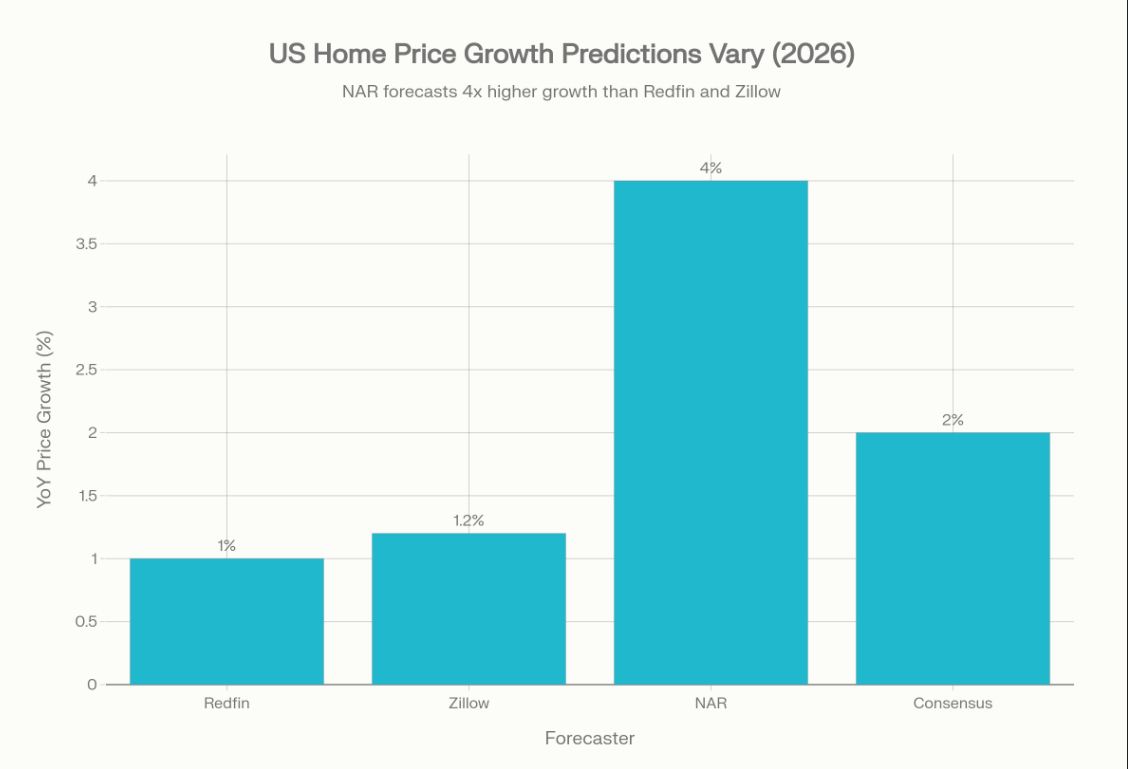

Looking just ahead, the crystal ball for the housing market seems pretty clear on one thing: continued, though much slower, growth.

Price Forecasts

Most analysts are predicting home prices to go up between 1% and 4% in 2026. Redfin thinks we'll see about a 1% rise, while Zillow is calling for 1.2%. The National Association of Realtors (NAR) is a bit more optimistic, forecasting a 4% increase. They believe strong job growth and the fact that we still don’t have enough homes available will keep prices nudging up.

Sales Volume

We're also expected to see more homes being sold. Zillow estimates about 4.26 million existing homes will change hands in 2026, a jump of 4.3%. Redfin predicts a 3% increase. NAR is even more enthusiastic, expecting a big 14% jump nationwide. This is likely due to a lot of people who put off buying during the high-interest-rate period now looking to get back into the market.

Mortgage Rates

Here’s where it gets interesting. Some financial experts, like those at Morgan Stanley, think mortgage rates could dip down to around 5.5% to 5.75% by mid-2026. That’s if things go as predicted with the big government bond yields. However, they also warn that rates might tick back up in the second half of 2026 and into 2027. So, while we might get a little breathing room on affordability, it might not last forever.

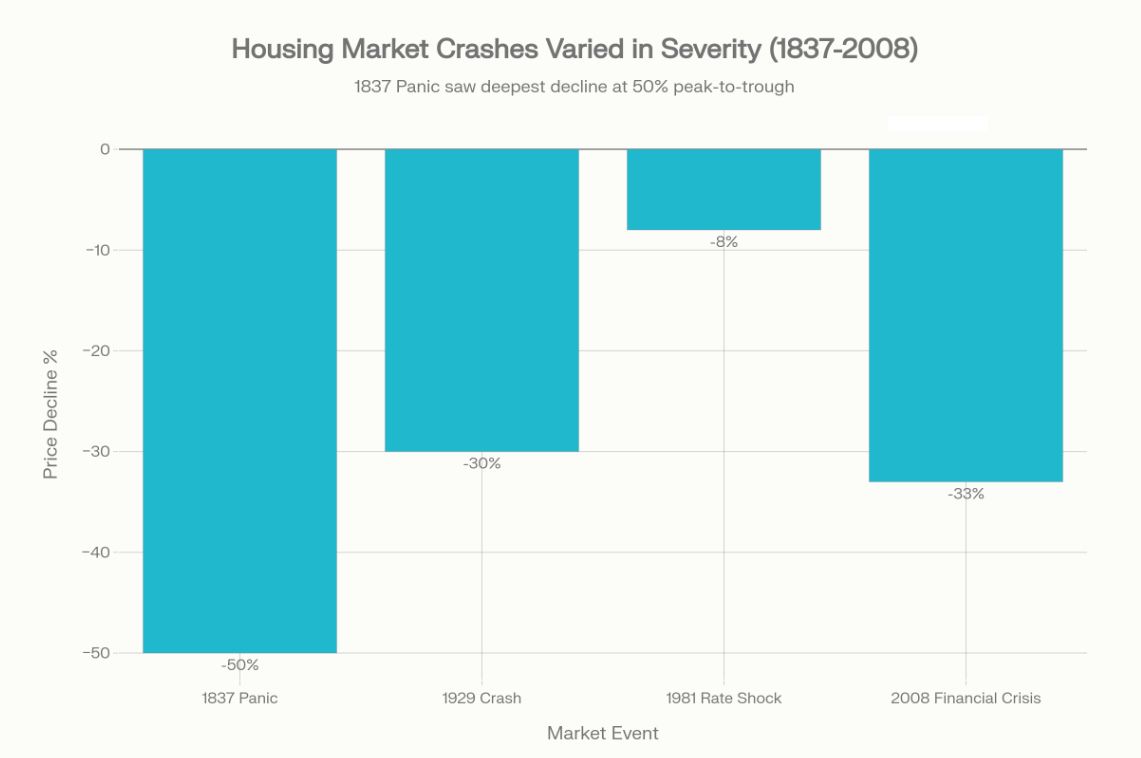

A Little History Lesson: What Past Crashes Teach Us

To understand if a crash is likely, it helps to look back at how we got here before. The US housing market has seen its share of downturns, and they were all for different reasons.

- 1837 Panic: This was all about crazy land deals and banks handing out loans like candy. It led to 40% of US banks failing and home values in places like New York dropping by 50%.

- 1929 Crash: The famous stock market crash also hit housing hard. By 1933, home values had fallen by 30% nationwide, fueled by tough credit conditions and widespread job losses.

- 1981 Downturn: High inflation meant the Federal Reserve jacked up interest rates. Mortgage rates hit a sky-high 18.45%, pushing home values down 8% across the country.

- 2008 Financial Crisis: This is the one most people remember. It was caused by risky lending practices (the subprime mortgage mess) and problems in the banking system. Home prices took a massive hit, falling 33% from their peak.

Each of these had unique triggers. Knowing them helps us see what warning signs to watch for today.

What to Keep an Eye On: Potential Risk Factors

Even though I’m not predicting a big crash, there are definitely things we need to monitor.

Economic Indicators

- Interest Rates: Like in 1981 and leading up to 2008, rapid spikes in interest rates can really hurt the housing market. If the Fed keeps raising rates aggressively and they go way above what people expect, it could make buying a home unaffordable for many.

- Unemployment: If lots of people lose their jobs, fewer people can afford to buy homes, and more people might fall behind on their mortgage payments. This puts downward pressure on prices.

- Household Debt: Americans currently owe a record $18.585 trillion in debt as of late 2025. Mortgage debt makes up a big chunk of that, around $13.072 trillion. While mortgage payments are a smaller percentage of people's take-home pay (around 11.2%) than in the 2000s, a significant increase in job losses could make this debt harder to manage.

Supply and Demand

- New Listings: The biggest hurdle for a hot market is simply not enough homes for sale. In early 2026, new listings were still down 12.6% compared to the year before. To have a truly healthy market, we’d ideally see around 80,000 new homes listed each week during peak seasons. Without that kind of pickup, inventory will stay tight, and the number of sales might not reach historical highs.

- Homebuilding: The number of new homes being built is also important. While single-family home starts went up a bit in late 2025 (5%), the permits for future construction actually dipped slightly. This suggests builders might be a little hesitant, which could mean supply issues continue.

Market Sentiment

- How Long Homes Take to Sell: Right now, homes are taking about 91 days to sell on average. This is a good sign that things aren’t overheated.

- Price Cuts: About 34.7% of homes have seen price reductions, while only 2.4% have seen price increases. This indicates that sellers are being more realistic with their pricing, and buyers have more room to negotiate. It's a sign of a more balanced market, not a bubble.

Why a Big Crash Is Probably Not Happening

So, with all those potential risks, why am I leaning towards stability rather than a crash? A few big reasons stand out to me.

Better Rules of the Road

The biggest difference between now and 2008 is how banks lend money. Thanks to rules put in place after the last crisis, like the Dodd-Frank Act, lenders are much stricter. They do more thorough checks, and there's far less of that risky subprime lending. The average mortgage rate at 6.57% in late 2025 comes with much tougher requirements for borrowers. This means fewer people are taking on loans they can’t afford.

We Simply Don't Have Enough Houses

This is a huge one. For years, we haven’t built enough homes to keep up with the population. This structural housing shortage means that even if the economy hits a bump, there are still plenty of people looking for a place to live. This inherent demand acts like a safety net, preventing prices from free-falling nationwide. Builder sentiment shows some unsold inventory, but it’s more about a return to normal levels, not an oversupply that would force a crash.

Things Are Getting More Affordable (Slowly)

For the first time in a while, incomes are expected to grow faster than home prices. This gradual improvement in affordability is crucial. When housing costs take up a smaller portion of people's income, it reduces the risk of widespread mortgage defaults, which is exactly what happened in 2008. The current debt-to-income ratio of 11.2% is still manageable.

Not All Markets Are Created Equal

It’s really important to remember that the US housing market isn't one big, uniform thing. What happens in New York might be totally different from what happens in Phoenix.

- Regional Differences: Some areas are doing much better than others. For instance, the Middle Atlantic region saw prices jump 5.7% year-over-year, while the Pacific region saw a slight 0.1% dip.

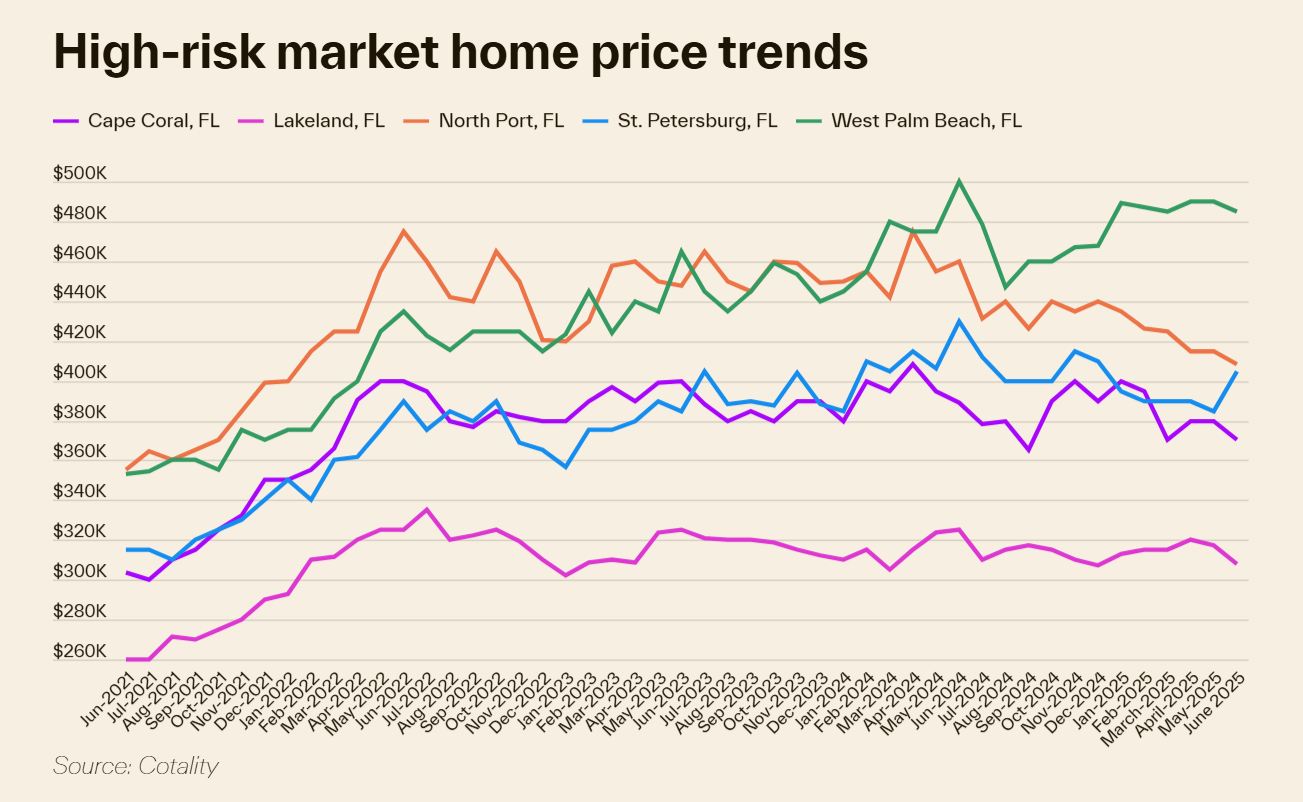

- Local Risks: Cities that have seen massive price jumps fueled by investors, or those that depend heavily on one industry that could crash, might be more vulnerable to local price corrections. Think about places like Las Vegas back in the day; when their market went down, it went down hard because so many mortgages were risky.

What Could Still Trigger a Downturn?

While a nationwide crash like 2008 seems unlikely, major economic shocks could still cause significant problems.

- A Deep Recession: If we fall into a really bad recession with long-term high unemployment, that would definitely hurt housing demand and could lead to foreclosures.

- Sky-High Mortgage Rates: If the Federal Reserve has to keep raising rates much higher than anyone expects, pushing 30-year mortgages above 8%, that would price out a huge number of potential buyers.

- Global Shocks: Major international crises, big bank failures, or sudden economic disasters similar to 2008 could shake the market.

- Rising Costs: If it becomes much more expensive to build homes (due to things like tariffs or labor shortages), supply could be squeezed even more, while demand might falter due to economic worries.

The Next 10 Years for the Housing Market: Stability with Bumps

Looking out towards 2035, I expect the US housing market to see cycles of ups and downs. We'll likely experience periods of modest growth, maybe some short, localized corrections, and definitely regional differences. But a full-blown, nationwide crash like the one that defined 2008? I don't think so.

Why? Two big forces are working in our favor:

- Demographics: A large generation, the Millennials, are entering their prime home-buying years. That’s a lot of demand.

- Supply Issues: That persistent shortage of homes isn't going away anytime soon.

These factors, combined with the stronger regulations, provide a solid foundation for prices.

However, no one should get complacent. We still need to be aware of those warning signs: rapid price run-ups without strong economic backing, lenders getting careless again, too many investors trying to flip homes quickly, and underlying economic weakness. Right now, the market doesn't show many of those extreme red flags, suggesting stability is the most likely outcome over the next decade, even if there are some bumps along the way.

In 2026, select U.S. cities are projected to see surging demand, rising rents, and appreciation—creating prime opportunities for investors seeking passive income and long‑term wealth.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

VS

Alabama’s newer A- rental vs Tennessee’s larger property with higher NOI. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to a Norada Investment Counselor (No Obligation):

(800) 611-3060

Also Read:

- Home Prices Stall Across 6 Major Metros After Years of Gains

- 10 Resilient Housing Markets Winning Against National Slowdown

- Will Lower Rates and Incentives Make New Construction Homes Affordable in 2026?

- Top 10 Most Popular Housing Markets of 2025 for Homebuyers

- Will Real Estate Rebound in 2026: Top Predictions by Experts

- Housing Market Predictions for the Next 4 Years: 2026, 2027, 2028, 2029

- Housing Market Predictions for 2026 Show a Modest Price Rise of 1.2%

- Housing Market Predictions 2026 for Buyers, Sellers, and Renters

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025