Is this the moment you've been waiting for? Mortgage rates are taking a surprising plunge, and the housing market is starting to feel a whole lot friendlier. Today, August 6, 2024, the average 30-year fixed mortgage rate has dipped below the coveted 6% mark. This unexpected shift is sending ripples through the housing market, creating exciting opportunities for both prospective homebuyers and current homeowners looking to refinance. Let's dive into the details.

Mortgage and Refinance Rates Today, August 6, 2024, and Predictions

Current Mortgage Rates

Today’s mortgage rates reflect changes in the economic landscape and shifting Federal Reserve policies. According to Zillow, here are the national averages we're seeing:

| Mortgage Type | Rate (%) |

|---|---|

| 30-year fixed | 5.92 |

| 20-year fixed | 5.62 |

| 15-year fixed | 5.21 |

| 5/1 Adjustable Rate Mortgage (ARM) | 5.86 |

| 7/1 ARM | 5.77 |

| 30-year FHA loan | 5.41 |

| 15-year FHA loan | 4.82 |

| 5/1 FHA loan | 5.06 |

| 30-year VA loan | 5.20 |

| 15-year VA loan | 4.64 |

| 5/1 VA loan | 5.70 |

These rates are rounded to the nearest hundredth and serve as national averages, indicating that specific rates may vary based on location and lender.

Today’s Mortgage Refinance Rates

For homeowners considering refinancing, the rates also show some intriguing numbers. The current refinance rates, as provided by Zillow, are:

| Refinance Type | Rate (%) |

|---|---|

| 30-year fixed refinance | 6.63 |

| 20-year fixed refinance | 5.70 |

| 15-year fixed refinance | 5.63 |

| 5/1 ARM refinance | 6.03 |

| 7/1 ARM refinance | 5.69 |

| 30-year FHA refinance | 5.60 |

| 15-year FHA refinance | 4.83 |

| 5/1 FHA refinance | 5.13 |

| 30-year VA refinance | 5.33 |

| 15-year VA refinance | 4.43 |

| 5/1 VA refinance | 5.58 |

Typically, refinance rates trend slightly higher than purchase rates. The differences can affect your decision on whether to refinance now or wait for potentially better rates in the future.

Understanding Mortgage Types

When diving deeper into mortgages, it's essential to understand the types available:

30-Year vs. 15-Year Fixed Mortgages

- 30-Year Fixed: With a lower monthly payment but accumulated interest over a longer period.

- 15-Year Fixed: Higher monthly payments but significantly less interest paid over time.

For instance:

- A $400,000 mortgage at 5.92% over 30 years leads to monthly payments of approximately $2,378 and total interest of $455,960.

- Conversely, the same amount at 5.21% for 15 years results in monthly payments around $3,207 and a total interest of only $177,279 (Yahoo Finance).

This comparison illustrates the long-term savings of a 15-year mortgage, though it may push monthly payments beyond comfort for some buyers.

Fixed-Rate vs. Adjustable-Rate Mortgages

- Fixed-Rate Mortgages: Your rate is locked in for the entire term. Great for stable, predictable payments.

- Adjustable-Rate Mortgages (ARMs): Generally start lower but can change after an initial fixed period. In such cases, for example, a 7/1 ARM is fixed for the first 7 years, after which it may adjust annually based on market trends.

What’s Next? Future Mortgage Rate Predictions

Looking forward, several forecasts suggest a cautious outlook for mortgage rates. According to Fannie Mae’s Housing Forecast, analysts expect the 30-year fixed rate to end 2024 at 6.7% and drop to 6.2% in 2025. Similarly, the Mortgage Bankers Association anticipates a slightly lower 6.6% rate by the fourth quarter of 2024.

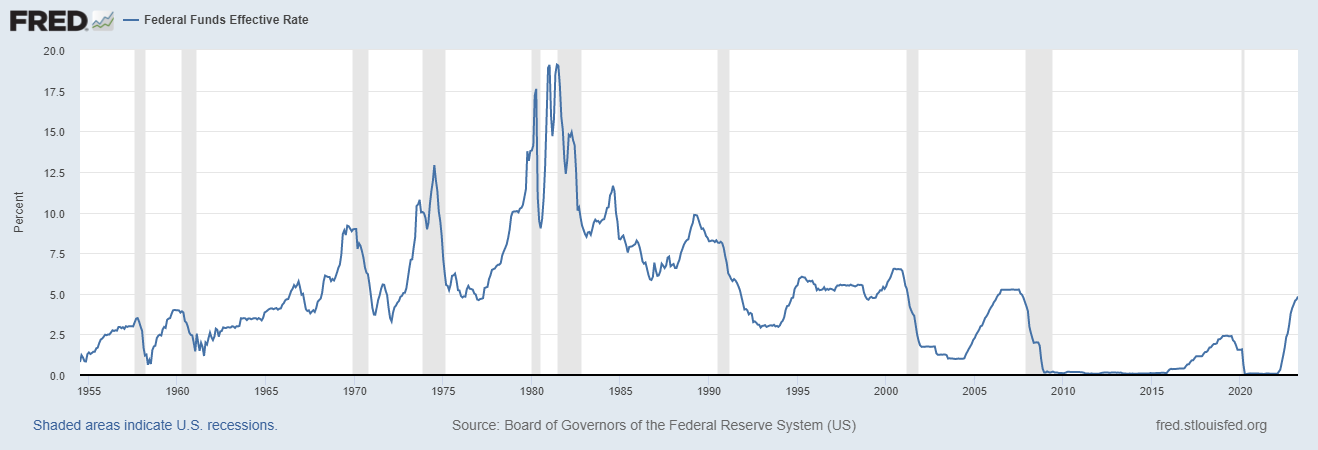

The trajectory of future mortgage rates hinges largely on the Federal Reserve's monetary policy decisions. As they monitor economic indicators, such as inflation and employment rates, any forthcoming rate cuts could lead to further decreases in mortgage rates. The next critical meeting of the Federal Reserve is on September 18.

Economic Indicators Impacting Rates

The latest reports indicate that the economy is beginning to cool down. The Bureau of Labor Statistics has recently released job statistics indicating a decrease in job creation. This could align with the Federal Reserve's goal of stabilizing inflation before selecting to cut the federal funds rate. The recent announcement from their meeting on July 30-31, 2024, confirmed that the Federal Reserve would maintain its current rate for the time being, indicating a wait-and-see approach towards economic recovery.

Final Thoughts: Is Now the Right Time to Buy or Refinance?

With mortgage rates dipping below 6%, now may be an appealing time for potential homebuyers. For those considering refinancing, the lower purchase rates could be beneficial, depending on personal financial situations and long-term goals.

Remember, these decisions are highly individual. Consider speaking with a financial advisor or mortgage professional who can provide tailored guidance based on your circumstances. Whether you're a first-time homebuyer or seeking to refinance, staying updated on rates is crucial for making informed decisions.

In conclusion, mortgage and refinance rates today, coupled with insightful predictions, offer good potential for both buyers and refinancers.

ALSO READ:

- Will Mortgage Rates Ever Be 4% Again?

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Summer 2024 Mortgage Rate Predictions for Home Buyers

- Mortgage Rate Predictions for 2025: Expert Forecast

- Prediction: Interest Rates Falling Below 6% Will Explode the Housing Market