Mortgage rates for July 19, 2025, are here. As of today, mortgage rates have shown a slight decrease in average 30-year fixed mortgage rates to 6.88%, down 1 basis point. However, it is up from 6.84% the previous week. Meanwhile, refinance rates for 30-year fixed loans have decreased significantly to 7.01%, down 6 basis points from last week’s 7.07%. These subtle movements highlight a market in cautious flux, deeply influenced by Federal Reserve policies and economic signals.

Mortgage Rates Today July 19, 2025: 30-Year FRM Dips, Refinance Rates Tumble

Key Takeaways

- 30-year fixed mortgage rates rose slightly by 4 basis points to 6.88%.

- 15-year fixed mortgage rates ticked down marginally to 5.90%.

- 5-year ARM mortgage rates decreased to 7.75% from 7.80%.

- 30-year fixed refinance rates dropped 6 basis points, now averaging 7.01%.

- The Federal Reserve's current monetary policy aims to reduce rates gradually through 2025-2027.

- Economic factors such as tariffs, inflation, and labor market softness are influencing rate movements.

- Rate projections anticipate declines potentially to around 5% by 2028 given planned Fed cuts.

Current Mortgage Rates Overview

Mortgage rates have fluctuated in the past months as the economy reacts to Federal Reserve policies and external economic factors. As reported by Zillow, the average 30-year fixed mortgage rate currently stands at 6.88%, marking a slight increase from the prior week’s 6.84%.

Other mortgage types also saw subtle changes:

| Loan Type | Rate (%) | Weekly Change | APR (%) | Weekly APR Change |

|---|---|---|---|---|

| 30-Year Fixed | 6.88 | ↑ 0.04% | 7.31 | ↑ 0.01% |

| 20-Year Fixed | 6.53 | ↑ 0.05% | 6.99 | ↑ 0.08% |

| 15-Year Fixed | 5.90 | ↑ 0.01% | 6.18 | 0.00% |

| 10-Year Fixed | 6.03 | ↑ 0.25% | 6.12 | ↑ 0.14% |

| 7-Year ARM | 7.70 | ↑ 0.12% | 8.18 | ↑ 0.08% |

| 5-Year ARM | 7.75 | ↓ 0.13% | 8.03 | ↓ 0.11% |

The marginal increase in the 30-year fixed rate could affect homebuyers' monthly payments slightly, but rates remain below the highest levels seen in recent years.

Refinance Rates as of July 19, 2025

Refinancing remains an option for many homeowners looking to adjust their mortgage terms due to fluctuating interest rates. Unlike purchase mortgage rates, refinance rates have actually decreased recently:

| Refinance Loan Type | Rate (%) | Weekly Change |

|---|---|---|

| 30-Year Fixed | 7.01 | ↓ 0.12% |

| 15-Year Fixed | 5.88 | ↓ 0.08% |

| 5-Year ARM | 7.93 | ↓ 0.05% |

This decline in refinance rates is encouraging for owners who locked in higher rates earlier. A refinance at nearly seven percent might reduce monthly payments or allow a term shortening, depending on the borrower's goals.

Federal Reserve’s Role in Mortgage Rates as of Mid-2025

The Federal Reserve continues to significantly influence mortgage rates through its monetary policy decisions. After a period of aggressive rate hikes in prior years to combat inflation, the Fed has shifted toward easing monetary conditions.

Recent Fed Actions

- In late 2024, the Fed cut rates three times, lowering the federal funds rate by 1 percentage point to a target range of 4.25%–4.5%.

- In June 2025, the Fed announced intentions to cut rates further by the end of 2025, but the timing and magnitude of these cuts are debated among members.

- The “dot plot” median forecast predicts the federal funds rate could fall to 3.9% by the end of 2025, with further cuts into 2026 and 2027.

Economic Factors Affecting Fed Decisions

- Persistent tariffs contribute to inflationary pressure, although the impact on consumer prices has been slower than expected.

- A projected economic slowdown with GDP growth slowing to around 1.4% and rising unemployment near 4.5% could prompt more aggressive rate cuts.

- Political pressures exist to reduce borrowing costs, but the Fed emphasizes a data-conditioned approach to rate changes.

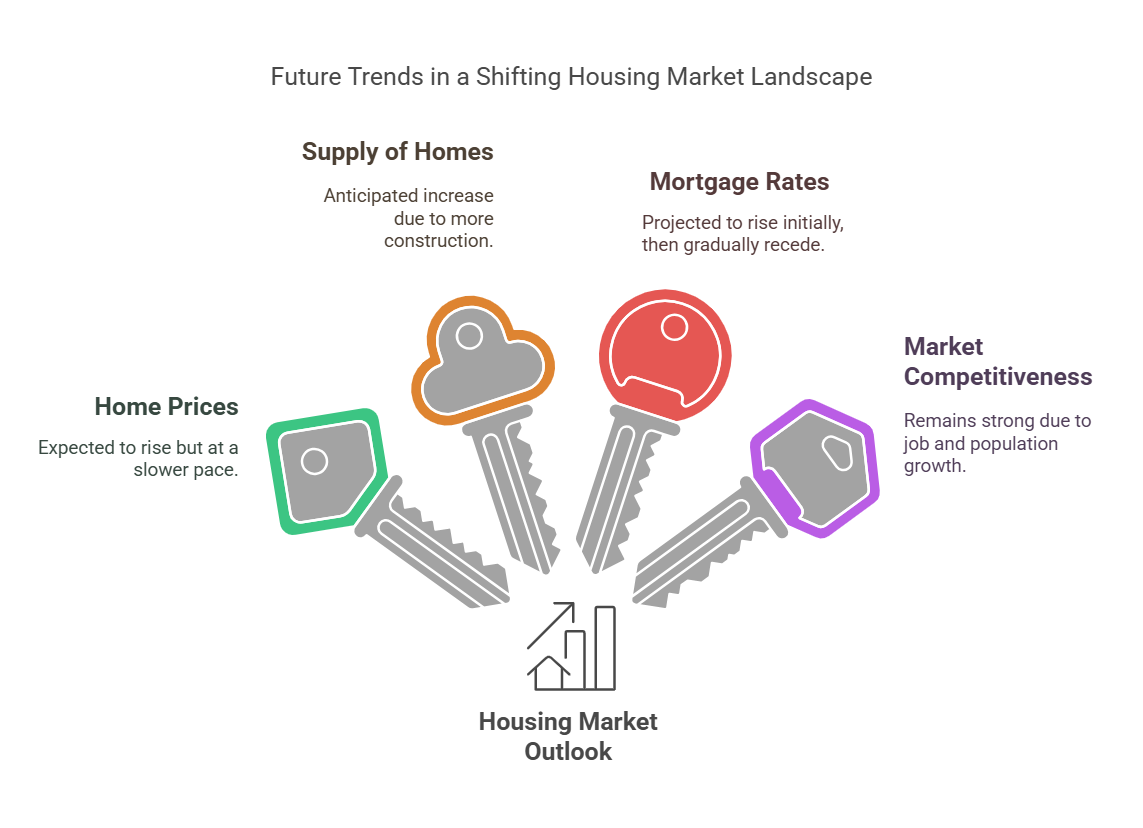

How Does This Impact Mortgage Rates?

Mortgage rates tend to follow bond market yields, which are sensitive to Fed policy and economic outlooks. The average 30-year mortgage rate in 2024 was around 6.7%, and it remains just under 7% in mid-2025. Analysts forecast mortgage rates may gradually decline towards 5% by 2028 if the Fed executes its planned cuts.

The current economic environment, including inflation pressures and global disruptions, means mortgage rates will likely stay somewhat elevated in the near term. However, the outlook is cautiously optimistic for lower borrowing costs in the coming years.

Detailed Comparison of Mortgage and Refinance Rates

To provide clearer insight, here is a side-by-side comparison showing current purchase mortgage rates alongside refinance rates as of July 19, 2025:

| Loan Type | Purchase Rate (%) | Purchase APR (%) | Refinance Rate (%) | Refinance Weekly Change (%) |

|---|---|---|---|---|

| 30-Year Fixed | 6.88 | 7.31 | 7.01 | ↓ 0.12 |

| 20-Year Fixed | 6.53 | 6.99 | — | — |

| 15-Year Fixed | 5.90 | 6.18 | 5.88 | ↓ 0.08 |

| 10-Year Fixed | 6.03 | 6.12 | — | — |

| 7-Year ARM | 7.70 | 8.18 | — | — |

| 5-Year ARM | 7.75 | 8.03 | 7.93 | ↓ 0.05 |

Example Calculation of Monthly Payments With Current Rates

To understand how these rates affect monthly payments, consider a $300,000 loan amount for a 30-year fixed mortgage at today's rate of 6.88%.

- Using a standard formula:

Monthly Payment = P × r(1 + r)^n / ((1 + r)^n – 1)

Where P = $300,000, r = monthly interest rate (6.88%/12 = 0.00573), n = 360 months.

Calculation:

Monthly Payment ≈ $300,000 × 0.00573 × (1.00573)^360 / ((1.00573)^360 – 1) ≈ $1,975

By comparison, a 15-year fixed mortgage at 5.90% would have a monthly payment of approximately $2,475 but with total interest savings over the shorter term. The lower refinance rates would slightly reduce monthly costs if a homeowner refinanced at 7.01% for a new 30-year term.

Related Topics:

Mortgage Rates Trends as of July 18, 2025

Mortgage Rates Predictions for the Next 30 Days: July 3-August 3

Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

Broader Market Context From Leading Sources

Data from recent market reports confirm that mortgage rates have largely stabilized after peaking higher earlier in the year. According to Freddie Mac and Zillow, the rates fluctuate slightly week to week but remain generally in the 6.7% – 6.9% range for the 30-year fixed product. Meanwhile, refinance rates have edged down, making refinancing somewhat more attractive despite still relatively high levels compared to pre-pandemic years.

Federal Reserve communications and economic data reinforce the notion that mortgage rates are tied tightly to monetary policy shifts expected this year and next. Pricing in future rate cuts shapes long-term bond yields and thus mortgage rates.

Personal Perspective and Market Outlook

Speaking from experience analyzing mortgage trends, such small weekly rate shifts—like the 4 basis point rise in purchase rates—may seem minor but can translate to hundreds of dollars over the life of a mortgage. Thus, monitoring market conditions closely is essential for borrowers planning major decisions.

Today's environment shows a mixed but cautiously improving scenario, where refinance options are becoming slightly better while purchase rates hover near 7%. The Fed's commitment to lowering short-term rates later this year suggests a potential easing down the road, but the pace may be gradual given persistent inflationary and geopolitical concerns.

Homeowners and buyers should acknowledge the current rates as reflective of a complex intersection of Fed policy, economic data, and global events.

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?