Mortgage rates are a fundamental determinant of housing market activity, directly impacting affordability for prospective homebuyers and influencing refinancing decisions for current homeowners. After a period of significant volatility, rates in 2025 have settled into a range that, while still elevated compared to the historically low levels of the pandemic era, shows signs of potential future easing.

This article provides a detailed look at current mortgage rate trends, followed by an in-depth analysis of the factors expected to shape mortgage predictions for 2026 and 2027, drawing upon expert forecasts and prevailing economic indicators.

Mortgage Rates Predictions for Next 2 Years: 2026 and 2027

Current Mortgage Rates Trends in 2025 (Till Date)

The year 2025 has seen mortgage rates fluctuate, reflecting ongoing economic adjustments and policy responses. As of August 9, 2025, the average 30-year fixed mortgage rate stands at approximately 6.70%, according to data from Zillow. While notably lower than the multi-decade highs exceeding 8% seen in late 2023, these rates are a significant departure from the sub-4% environment prevalent just a few years prior.

Here's a snapshot of average national rates for key mortgage types as of early July 2025:

| Mortgage Type | National Average APR (Aug 9, 2025) | Weekly Change |

|---|---|---|

| 30-Year Fixed | 6.70% | -0.12% |

| 15-Year Fixed | 6.65% | +0.09% |

| 5-Year ARM | 7.35% | -0.19% |

Source: Zillow

Several key factors have driven these trends in 2025:

- Federal Reserve Monetary Policy: The actions of the U.S. Federal Reserve remain arguably the most significant influence. Following three interest rate cuts in 2024, which brought the federal funds rate down to a range of 4.25%-4.50% from 5.25%-5.5%, the Fed has paused its easing cycle through the early part of 2025. This pause, as noted by Forbes Advisor, is a result of the Fed's cautious stance, balancing progress on inflation (which has cooled to around 2.7% but remains above the 2% target) with a surprisingly robust labor market, evidenced by recent strong jobs reports.

- 10-Year Treasury Yield: Mortgage rates track closely with the yield on the 10-year U.S. Treasury note, which reflects market expectations about future interest rates and economic growth. As of late April 2025, the 10-year Treasury yield was around 4.37%. The spread between this benchmark yield and the average 30-year mortgage rate typically hovers around 1.5% to 2.0%; however, in 2025, this spread has been wider, sitting around 2.51% as of June, reflecting various market risk factors and the specific dynamics of the mortgage market.

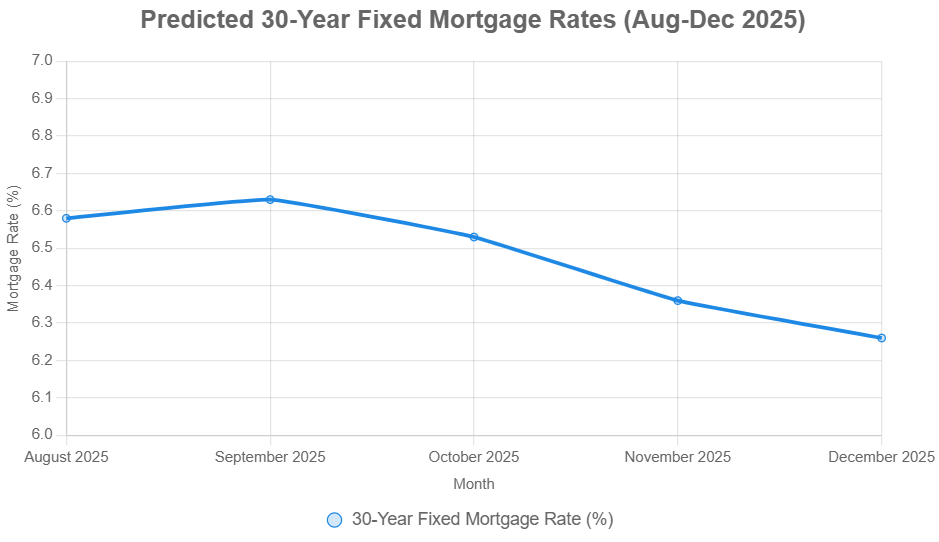

- Economic Sentiment and Volatility: The year has been marked by continued, albeit less extreme, volatility. Rates dipped into the mid-6% range in March before rising again in May, closing that month around 6.89%. This fluctuation is partly fueled by broader economic uncertainties, including potential global trade disruptions and tariff policies, which increase overall market volatility and can indirectly pressure rates.

In summary, 2025 has seen mortgage rates hovering in the upper 6% to lower 7% range, anchored by a Federal Reserve waiting patiently for more definitive signs on inflation and the labor market before resuming rate cuts, and influenced by a 10-year Treasury yield that reflects a mix of stable growth expectations tempered by ongoing uncertainties.

Mortgage Rates Predictions for 2026

Looking ahead to 2026, the consensus among leading housing market analysts points towards a modest, gradual decline in mortgage rates. This outlook is primarily predicated on the anticipated trajectory of Federal Reserve policy and evolving economic conditions.

- Expert Forecasts: Major institutions forecast rates to move slightly lower through 2026. Fannie Mae projects the 30-year fixed mortgage rate to end 2026 at 6.1%, a decrease from their 6.5% projection for the end of 2025. Similarly, the Mortgage Bankers Association (MBA) predicts rates stabilizing at 6.3% by the close of 2026, adjusting slightly upwards from previous, more optimistic forecasts but still indicating a downward trend from current levels. Other sources like U.S. News also project rates to settle in the mid-6% range.

| Source | 2025 Year-End Prediction | 2026 Year-End Prediction |

|---|---|---|

| Fannie Mae | 6.5% | 6.1% |

| MBA | 6.7% | 6.3% |

| U.S. News | 6.3% | Mid-6% range |

- Federal Reserve Policy: The primary driver of the expected decline is the anticipated easing of monetary policy by the Federal Reserve. The Fed's Summary of Economic Projections (SEP) from March 2025 indicates a projected median federal funds rate of 3.4% by the end of 2026, down from a projected 3.9% for the end of 2025. This expected series of rate cuts is designed to gently cool the economy and bring inflation fully back to target. Lower short-term rates reduce pressure on longer-term bond yields, including the 10-year Treasury, which in turn influences mortgage rates downward.

- Economic Factors: The economic backdrop is also expected to be generally supportive of slightly lower rates in 2026:

- Inflation: If inflation continues its path towards the Fed's 2% target, as some analyses like Deloitte Insights suggest it will, the Fed will gain confidence to implement the projected rate cuts, directly benefiting mortgage rates.

- Economic Growth: The Fed's projections anticipate a stable but perhaps slightly slower pace of economic growth in 2026 (2.1% real GDP growth projected for 2026 vs. 2.2% in 2025). A steady, non-accelerating economy typically allows interest rates to normalize lower.

- Housing Market: While the housing market is characterized by a persistent shortage of inventory, which can influence economic activity, the direct impact on national interest rates is secondary to the broader macroeconomic picture and Federal Reserve actions.

- Risks and Uncertainties: While the outlook for 2026 points towards some easing, risks remain.

- Persistent Inflation: Should inflation prove stickier than anticipated, or reaccelerate unexpectedly, the Fed could slow or pause its rate cuts, keeping the federal funds rate higher and consequently exerting upward pressure on mortgage rates.

- Economic Resilience: A stronger-than-expected economy could also lead the Fed to maintain a tighter stance for longer.

- Geopolitical and Trade Issues: Global events, including ongoing trade tensions, can inject uncertainty into financial markets, potentially increasing volatility in bond yields and mortgage rates.

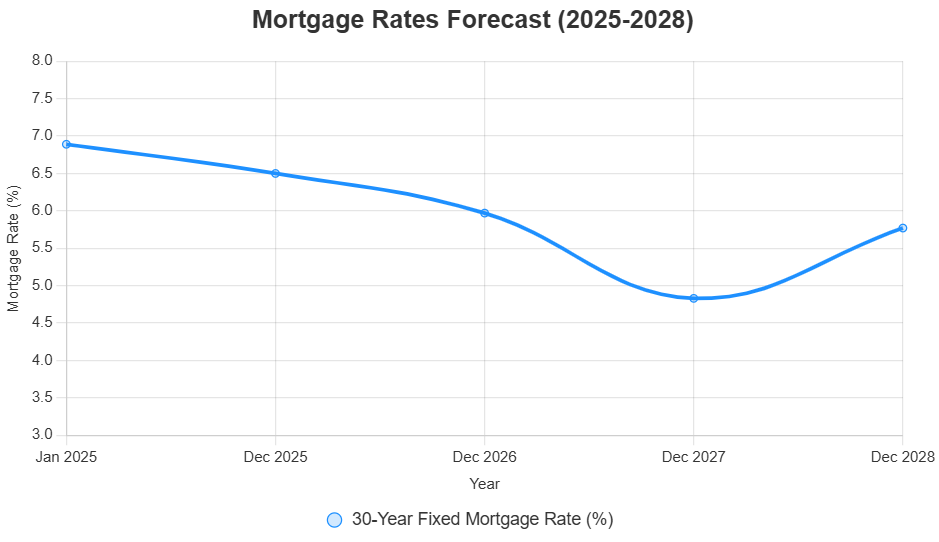

In essence, 2026 is expected to be a year where mortgage rates gradually decline, driven by the Federal Reserve's planned rate cuts as inflation moves closer to target, provided the economy remains stable. The 6.3% area appears to be a reasonable consensus target by the end of the year.

Mortgage Rates Predictions for 2027

Predicting mortgage rates for 2027 involves a higher degree of uncertainty, as forecasts extending this far out are subject to more potential deviations from the projected path. However, based on the expected trajectory of monetary policy and a normalization of economic conditions, a further decline in rates appears plausible.

- Longer-Term Outlook: The Federal Reserve's SEP from March 2025 projects the median federal funds rate to reach 3.1% by the end of 2027. This indicates an expectation of a continued, albeit potentially slower, pace of policy easing beyond 2026.

- 10-Year Treasury Yield Relationship: The relationship between the federal funds rate, the 10-year Treasury yield, and mortgage rates is key to the 2027 outlook. As the federal funds rate declines towards 3.1%, the 10-year Treasury yield would typically also move lower, although not in lockstep. Historical patterns and projections suggest a normalized 10-year Treasury yield could range between 3.5% and 4.0% under such conditions. Given the current mortgage-Treasury spread (around 2.51%), this would imply 30-year fixed mortgage rates potentially ranging from 5.5% to 6.0% by the end of 2027. This estimate is based on the logic derived from the Fed's projected policy rate and the current market spread environment.

- Potential Scenarios: While the 5.5%-6.0% range reflects a balance of probable factors, more optimistic scenarios exist. Some long-range forecast models, such as Long Forecast, predict rates as low as 4.7% by December 2027. Such a scenario would likely require more aggressive Fed rate cuts than currently projected, a significant narrowing of the mortgage-Treasury spread back towards historical averages (closer to 1.5%-2.0%), or a combination of both, perhaps driven by a faster economic slowdown or quicker-than-expected disinflation. Given the current economic signals and the Fed's cautious approach, the 5.5%-6.0% range appears more aligned with available projections.

- Risks and Considerations: The 2027 outlook is subject to several potential pitfalls:

- Inflation Surprises: If inflationary pressures persist unexpectedly, potentially due to supply chain issues, wage growth, or commodity prices, the Fed may be forced to keep rates higher for longer, pushing mortgage rates towards the upper end of, or even above, the projected range.

- Global Economic Climate: Trade policies, geopolitical conflicts, and the economic health of major global partners can all ripple through U.S. markets, influencing interest rates. Continued trade disputes, like those impacting U.S.-Canada trade, could increase economic friction and uncertainty.

- Housing Supply Dynamics: The ongoing structural shortage in housing supply, highlighted by sources like Mortgage Sandbox, could keep home prices elevated, potentially influencing overall economic activity and, indirectly, the interest rate environment, though this is less of a primary driver of national rates than monetary policy.

Read More About:

Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

Implications for Homebuyers

The anticipated gradual decline in mortgage rates over the next two years offers a degree of cautious optimism for prospective homebuyers. A potential drop from current levels around 6.88% to a range of 5.5%-6.0% by late 2027 could significantly improve affordability. For context, on a $400,000 mortgage, a rate reduction of 1% could lower the monthly principal and interest payment by approximately $250.

However, potential buyers should temper this optimism with other market realities. Home prices, while perhaps not appreciating at the rapid pace seen during the pandemic, are still expected to rise modestly (Fannie Mae forecasts a 3.5% increase in 2025 and 1.7% in 2026). These price increases can offset some of the affordability gains from lower rates.

Therefore, prospective homebuyers should consider the following:

- Stay Informed: Closely monitor economic data releases, particularly those related to inflation and employment, as well as statements and actions from the Federal Reserve.

- Shop Around: Rates vary between lenders. Comparing offers from multiple institutions is crucial (some lenders, like Tomo, were reportedly offering rates as low as 6.08% in early June 2025, demonstrating the potential for variation).

- Consider Rate Locks: If purchasing in the near term, be mindful of potential volatility. Locking in a rate when you find one you are comfortable with can provide certainty, even if rates fluctuate slightly afterwards.

Conclusion

As of mid-2025, mortgage rates hover around 6.88%, influenced primarily by the Federal Reserve's patient approach to rate cuts amidst cooling-but-not-yet-at-target inflation and a strong labor market, along with the dynamics of the 10-year Treasury yield.

Looking ahead, expert forecasts and Fed projections suggest a gradual downward trend. By the end of 2026, the consensus points towards rates stabilizing around 6.3%, driven by anticipated Fed rate reductions. For 2027, while uncertainty increases with the longer time horizon, a further decline appears likely, potentially bringing 30-year fixed rates into the 5.5% to 6.0% range, assuming the Fed continues its easing path and economic conditions remain stable.

However, this trajectory is not guaranteed. Unexpected shifts in inflation, the resilience of the economy, and global uncertainties could all influence the ultimate path of mortgage rates.

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated, it's more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?